Hello Vpickr’s,

While i am not a deep value investor but this one is an exception in my portfolio.

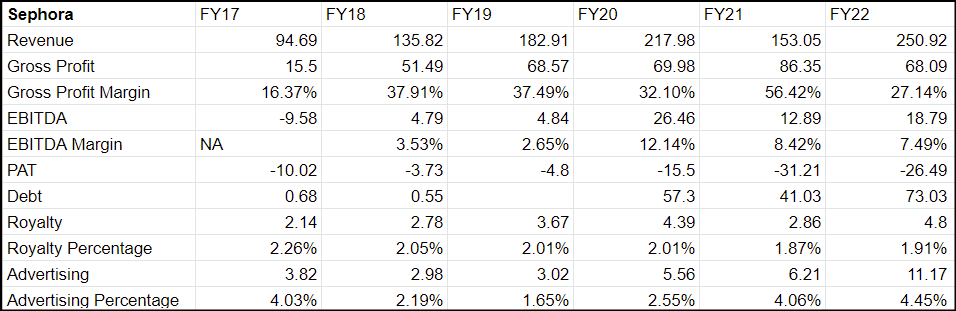

Arvind Fashion is a fashion retail chain with brands like U.S. Polo, Arrow, Calvin Klein, Tommy Hilfiger and Flying Machine. It also has the rights to operate Sephora premium beauty stores in India, it is worlds’ largest beauty retail operated by LVMH.

Market standing in India

- US Polo : # 1 Casual wear brand

- Arrow : Among top 5 leading formal brand

- Flying Machine: Among top 3 denim brands

- Tommy Hilfiger and Calvin Klein : #1 & #2 premium casual brand

- Sephora : #1 Prestige beauty retailer in india

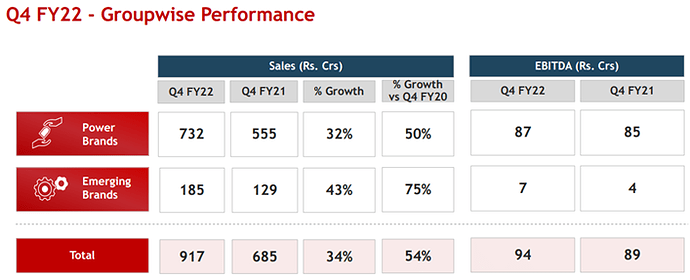

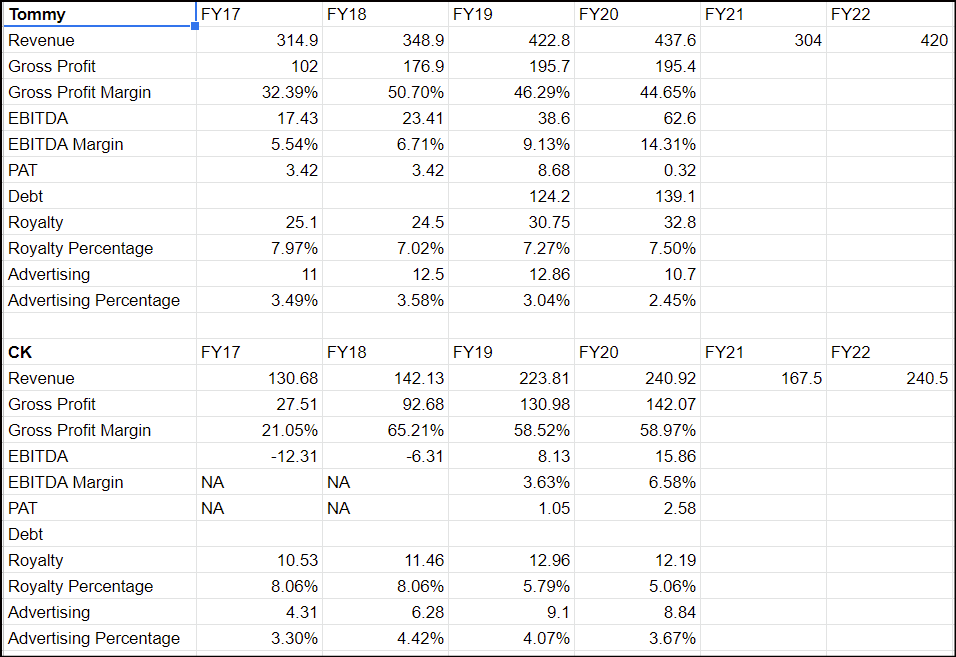

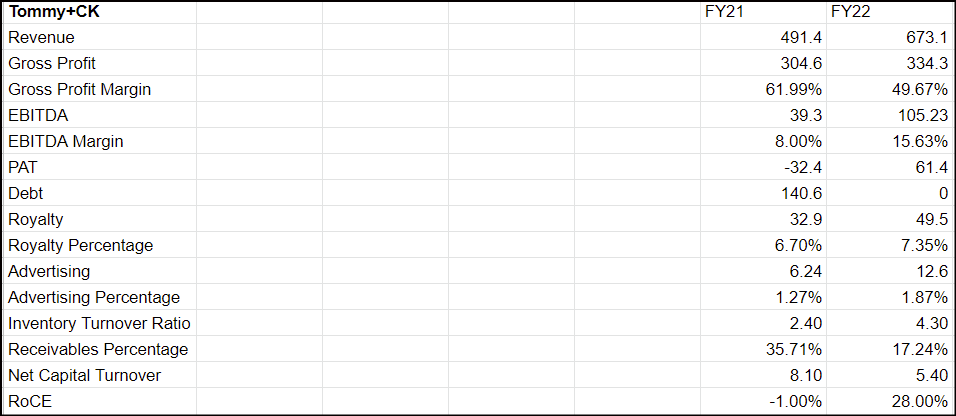

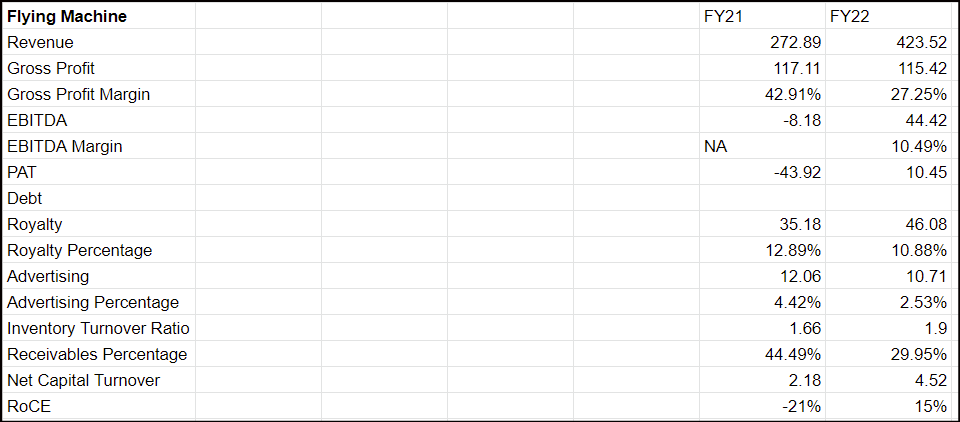

Below are some brand specific financial details:

| Brand | Revenue | CAGR | # of Stores |

|---|---|---|---|

| USPA | 1000 | 17% | 350+ |

| Tommy | 400 | 13% | 100+ |

| Calvin Klein | 250 | 25% | 70+ |

| Flying Machine | 400 | 18% | 250+ |

| Arrow | 500 | 8% | 200+ |

| Sephora | 200 | 72% | 24+ |

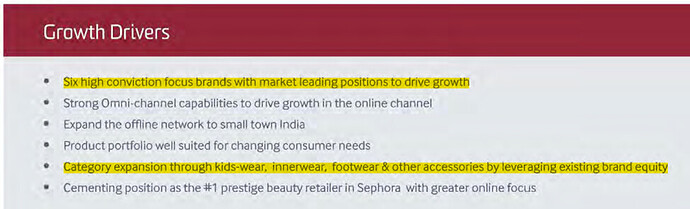

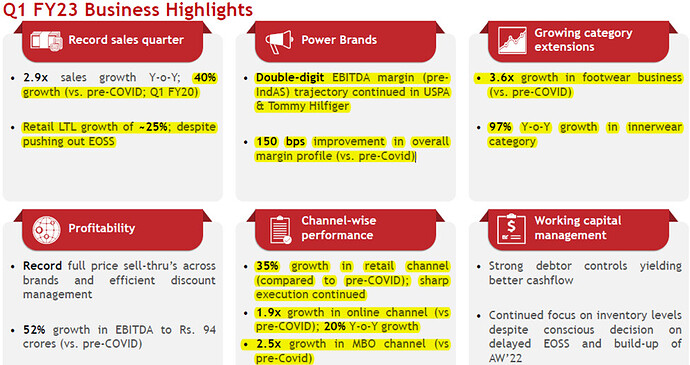

The company has leadership position across casual and denim category. The business has moved into adjacent categories of innerwear, footwear and kids wear where the growth is good. USPA has 300 Cr of sales through adjacent categories. Flying Machine is a digital first brand with strategic tieup with Flipkart. The company has an EBO footprint of 1200 stores and MBO and LFS of around 3000 stores. Innerwear is distributed through wholesale distribution channel as well.

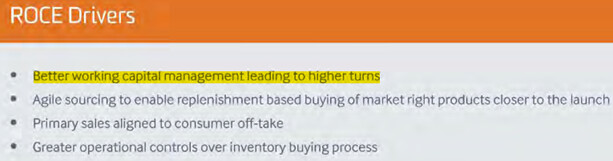

The company is building its own digital presence and more than 30% of online sales comes through D2C.The company has been focussing on Omni channel tech stack with inventory integrated across online and offline to drive better returns and reduce capital employed.

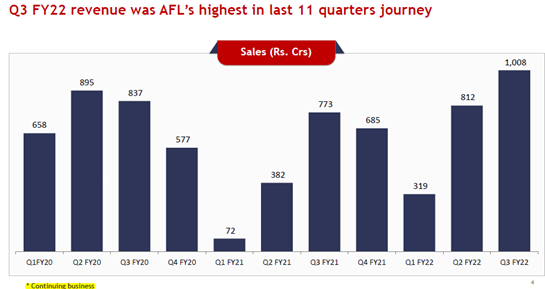

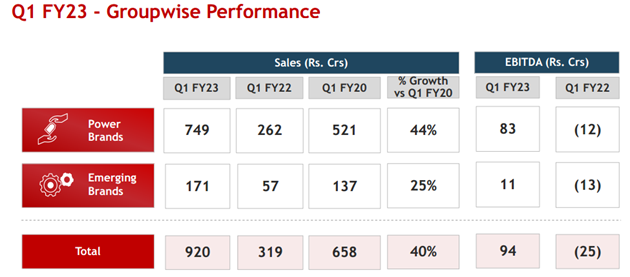

The company did 4600 Cr in sales in 2019 before Covid hit and currently trades at 3600 Cr market cap

The market is not wrong is pricing it that way, infact even before Covid hit, the company was in trouble and Covid just dealt it a big blow.

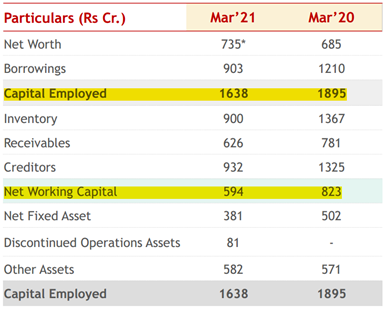

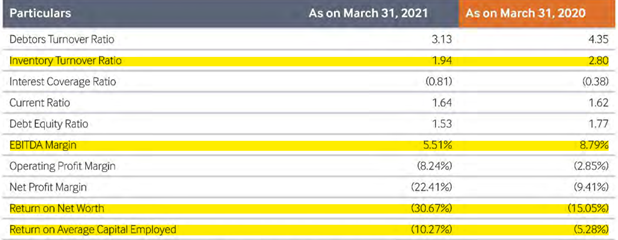

The company invested very aggressively in new brands and store format which bled its balance sheet. ‘Unlimited’ which is a value consious retail store was a cash drain. There were challenges related to forecasting which led to huge inventory and subsequent write-offs.

Due to liquidity crunch post ILFS crisis there was huge challenge in MBO and wholesale market which impacted even larges cos. like Page. And to top it up Covid came and aggrevated the situation. The company was in loss in FY20 & FY21 with debt in excess of 1000 Cr.

So why should one study it and consider it investment worthy. While the company is not out of the woods but it has taken a lot many actions to set it on the right path which if implemented as planned can take the stock price to multiple times of where it is currently.

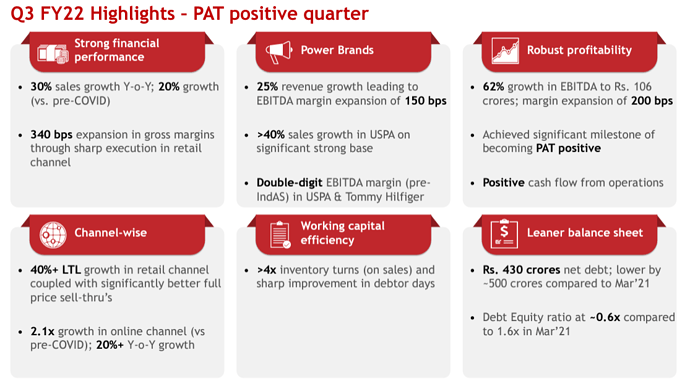

Action Taken

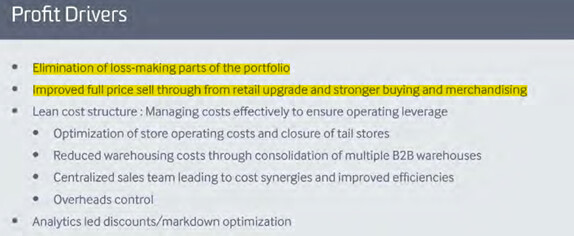

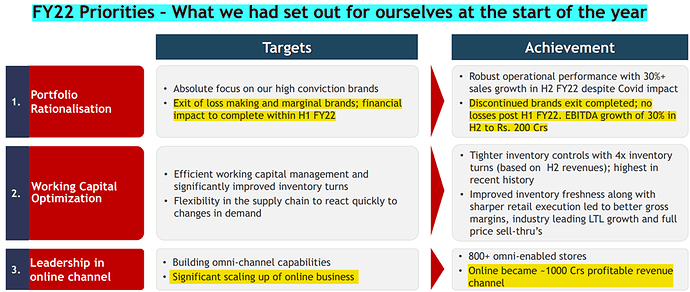

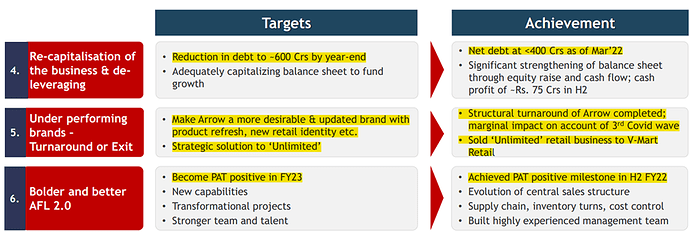

- Portfolio Rationalization : Exited loss making brands like Nautica, Hanes, Gant, Elle, Izod and Gap which freed up 170 Cr capital. It also sold Unlimited stores to Vmart for 150 Cr.

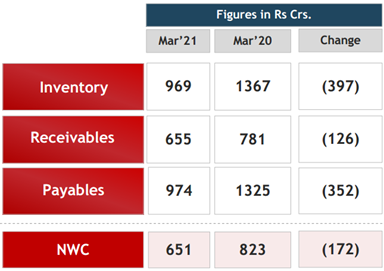

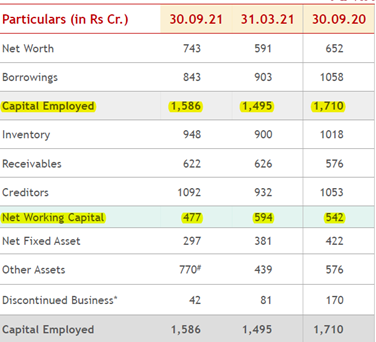

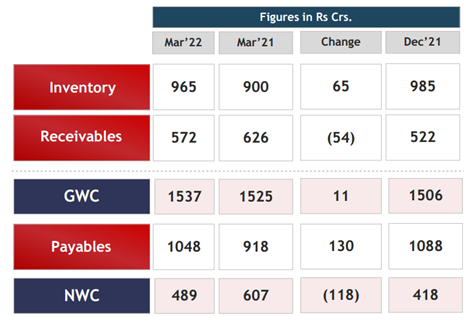

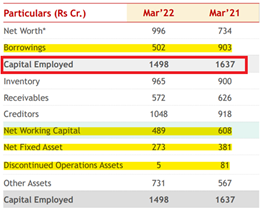

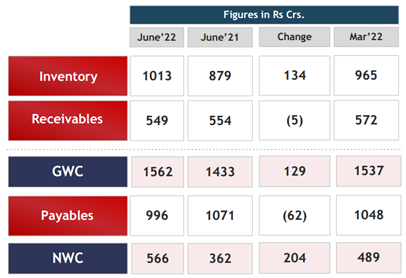

- Working Capital Optimization : Improvement in forecasting by deploying technology led to reduction in inventory by 400 Cr

- Cost Control : Cost optimization led to saving of 100 Cr/annum

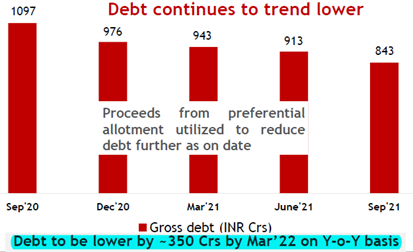

- Recapitalization: Raised 860 Cr through rights issue and strategic partnership with flipkart which led to debt reduction by 300 Cr

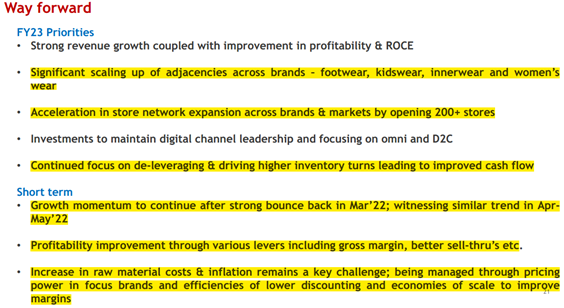

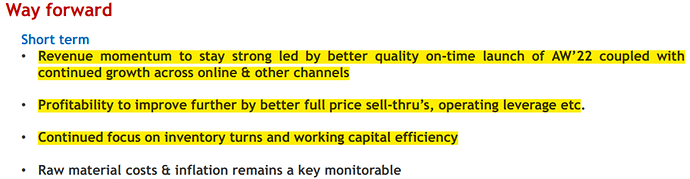

Way Ahead

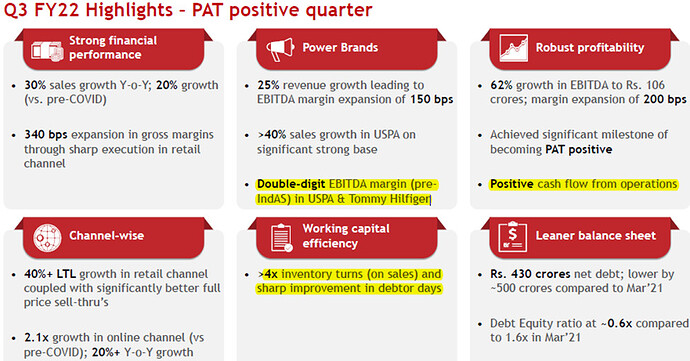

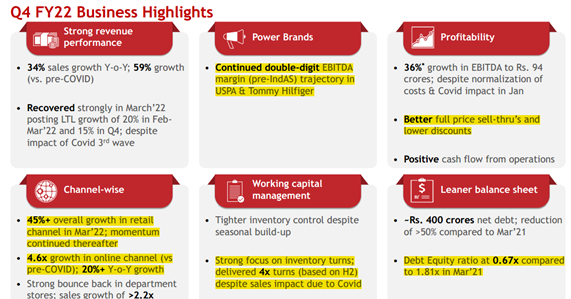

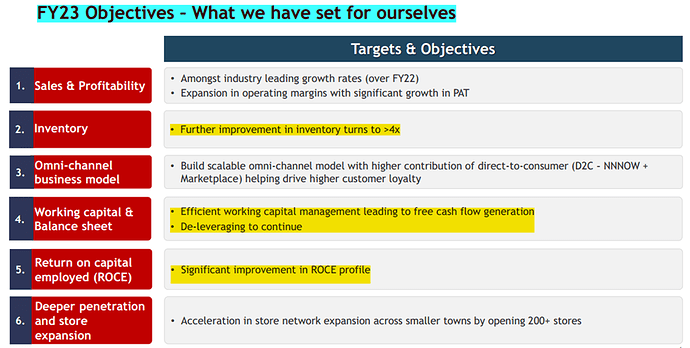

The company has invested in omnichannel strategy and is confident of achieving 15% topline growth CAGR with double digit portfolio level EBITDA and ROCE of >20%

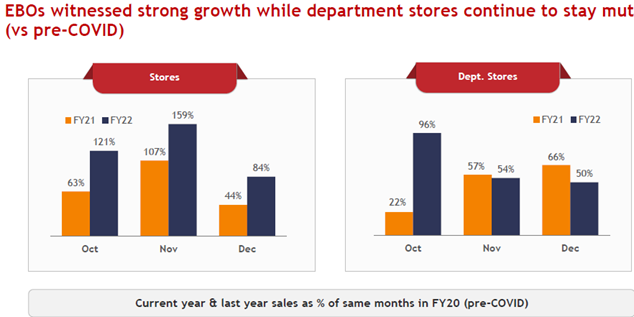

The digital push for company is quite evident and they expect to generate 1000 Cr revenue through digital for FY22 which is a 3X growth in last 3 years, ofcourse a large part is also driven by Covid related lockdowns. Digital contributes nearly 30% of revenue and >10% of onlines sales is fulfilled from stores, example of omni channel strategy in action.

The management team is highly experienced and most of them have experience in fashion, apparel, consumer industry.

The board is formidable and has marquee independent director like Nilesh Shah (Kotak), Vallabh Bhansali, Achal Bakeri and Vani Kola.

Ashish Dhawan, one of the best value investor in India holds 5% of the company.

Investment Thesis

This is one of the company which reminds me of Mohnish Pabrai’s quote that an investment idea should hit you like a 2X4 in the head, essentially meaning it should appear no-brainer and one should not need an excel to figure out if it is investment worthy, but there is a huge gap between Mohnish and mere mortal like me, so i pulled out an excel sheet

Basis guidance i expect the company to do 4500 Cr in sales by FY25 with around 550 Cr in EBITDA. There are no direct competitors to benchmark valuations, the nearest listed ones are Aditya Birla Fashion and TCNS.

Both trade between 35-50 times on normalized EBITDA and 4 to 6 times sales. Even if i consider 25 times EBITDA and around 3.4 to 4X sales, potential market cap can be close to 14000 Cr by FY25 against current market cap of 3600 Cr which is nearly a potential of 4X in 3 years beyond which it can compound at earnings growth rate if all goes well.

I started buying it around 1900 Cr and my average buy is at 2400 Cr.

Risk

- Biggest risk is reoccurence of Covid and any further lockdowns

- Failure of restructuring initiatives and push back from channel partners

- Competitive pressure leading to price discounting

- Conflict of interest led troubles between 3rd party Ecom sites and own ecom site

Disclosure - Invested