Hello

Apcotex is an interesting company with an established promoter…

I think future will depend on how artificial rubber is put to use

Hello

Apcotex is an interesting company with an established promoter…

I think future will depend on how artificial rubber is put to use

Srini,

On LC/BG, company imports a lot of raw material and ~20% of its sales is exported. So LC/BG are required for that. Since company is growing for last many years, these liabilities are also growing accordingly.

On increase in other expenses, ~2/3rd of total increase is coming from fuel and transport. The CPP they have in Valia is coal based, hence the increase. Also since freight rates went through the roof post COVID 2, these expenses also went up.

Hope this helps.

Rubber parts usage is highly intense in petrol and diesel engines

Our future vehiclular growth shall be in cng/ or flex engines using mixtures of petrol and ethanol

I believe this will curtail growth in auto related demand which is currently @30 pc of turnover

Industry specialists can throw more light on this

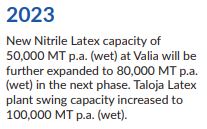

Expansion plant for manufacturing of Nitrile Latex at Company’s plant in Valia, Gujarat

has been commissioned ~ share up 10% today

Disclosure : Invested, not a reco, not a SEBI registered analyst

Hello Everyone , I have recently started studying this company . All due credits to @Worldlywiseinvestors .

I saw that no one in this space talked about the recent quarter concall which took place . So I have attached the link here : Apcotex Industries Limited Q3 FY23 Earnings Concall - YouTube

I had highlighted some notes by the management on the transcript itself , if you want you can simply go through the transcript i.e. attached below and side by side hear the con-call ( That’s what I do) as it was packed with info.

Q3Fy23 Apcotex Concall .pdf (983.4 KB)

Below I have attached some important snapshots which really helped me clear some doubts :

27th Jan Q3Fy23 concall , capex and it’s utilization and flow to topline by Abhiraj Choksey

So total 85000 tpa latex , making a 600-700Cr . ( quarterly 150-175Cr in addition)

The plant’s would be highly automated , playing a part in operating leverage .

The Capex was funded by 60% debt(120cr) , and 40%(80cr) internal accruals

Abhiraj Choksey as to how to how the 200 Cr Capex in Taloja and Valia plant can change the final topline of the company .

More clarification by Mr. Chokey as to why moving fromt the original plan .

The change in revenue mix over the years.

Export - 20% , roughly 180-220 Cr , Domestic - 80% , roughly 780-820 Cr

When asked about the competition and about there competitive advantage in the market.

Hope reading all of these would have cleared some of your doubts , as it really helped me a lot ![]()

Happy Weekend , cheers ![]()

6-7 years ago Revenue mix was:-

~ Footwear:- 30-40%

~ Paper:- 25-30%

~ Tyre:- 10-15%

~ Contrusction:- 10-15%

And for current scenario i.e, FY23 it is:-

~ Paper/ Paper board:- 15-20%

~ construction:- 15%

~ carpet/carpet textile:- 10-12%

~ tyre:- 10%

~ Nitrile latex:- 7-8%

~ Rest revenue mix goes to :- Rubber product which include Footwear, Automotive, agriculter etc.

No Industry has more than 20% revenue mix and once gloves market starts kickin then it may become larger chunk of its revenue, maybe 20% but others segment will grow aswell.

Why was it a loss making division? I know that this is cyclical, but couldnt understand why it is a loss making division.

I have started reading about this business. And have attached my notes here. As per my understanding, the management is decent and conservative, there can be some headwinds in near term but on long term basis it is highly likely that company will do well.

But when I am trying to model it, looks like growth for next couple of years is already factored in. Am I missing something here or have done some miscalculations here?

Apcotex Model.pdf (16.6 KB)

Apcotex Notes.pdf (1.7 MB)

Hi Pratik,

I went through your notes and model , I just had one doubt that the Apcobuild as a part of it’s revenue constitutes less than 4-5% of it’s revenue from what I am aware . If you could help with any source .

Secondly regarding the model -

Considering these the Share price for FY25E could be = 23.5(pe)* 27(eps) = 634

( I do agree that somewhat the growth has been factored in post the commission of the new plant ) The stock from 400 has gone to 540 . Mr. Market is supreme after all ![]()

I had worked with the other members of the soic team including @Mgkreddy and came up with the below model using ev/ebitda .

Assumptions taken were :

Disc : Interested but not invested ![]()

Your Apcotex Model, For FY 23 you have shown PAT of 59.2Cr. On FY23 9 months basis its 85 Crores. How did you calculated it as 59.2Cr for the whole year

Assuming 300cr EBITDA, the profits would be 200cr+ i.e. approximately double from current levels.

The current valuations are not stretched by any means so it would be fair to assume the stock doubling in 3-4 years purely based on profit growth + any valuation re-rating would be icing on the cake.

The risks that I see are :

Dumping from other countries

RM price fluctuations

Forex risk as the exports increase

The key thing to track here will be the capacity utilization and geographical expansion. The next 1-2 quarters can be soft and that can give opportunities to enter.

Disclosure : Not invested but definitely interested

About ApcoBuild, I could not find finer details in the concalls as well as in the presentations.

Regarding PE, I had taken the average of “max” but as highlighted by @Mgkreddy , I should have taken the average PE of last 5 years or so, because business dynamics actually changed post the acquisition of Omnova solutions.

I usually try to build very conservative scenario and if I find MoS in that case as well, then it helps me build even bigger position with higher conviction.

The latex prices have been on rise recently and thus it could be one of the reasons behind the quick run up in the stock.

Disc: Tracking closely.

I have taken 10% EBITDA margins, which I know, are way lower than current margins and that’s the reason you are seeing a different number. However you can ignore current numbers because we are trying to build the case for future.

Apcotex Q4FY23 Concall

-Margins were impacted due to lower demand for Nitrile Latex. And Indian Business reverted back to normal

-For the quarter: volumes are flat, most of the revenue generation is due to product mix changes & realisations. Volumes have grown by 8% this year.

-High cost RM has been exhausted. NBR margins have normalised in Q3 & Q4.

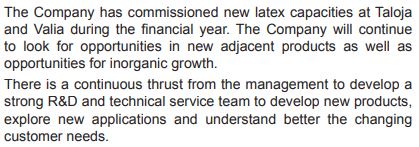

-Nitrile Latex market is weak as excess supply in Glove markets. Margins are even lower than pre covid. Post new plant- cost structure will go down. Demand should pick up and go back to Pre covid level.

-In the long term, we are bullish about the business. One of the handful manufacturers who can manufacture this product.

-Apcobuild has done really well. Entered new markets and new spaces. 25%-30% was the YOY growth. Total contribution to sales isn’t much.

-Seeing higher competitive intensity in NBR, very less competitive intensity in Synthetic latex. 2 companies have 80% market share in India. Main place, margins have been impacted is Nitrile Latex.

-Export growth of 28% in volumes for this Quarter, and export growth of 15% in volumes.

-NBR project: detailed engineering we have done and might announce depending upon the markets.

-End markets: paper, carpet, textiles etc are doing well. Only problem has been nitrile latex where demand is slow.

-Hope to get into Full capacity utilisation within 2 years for the incremental capex which can lead to 600-700 crores.

-200-250 crore of additional topline is possible this year from the new plants.

-14-15% will be the base margins, once nitrile stabilises. Aiming at 17-18% EBITDA Margins in the long run once things normalise.

-Completely exited the emulsion business for paints business.

-Competitive intensity in current industries isn’t that high. Barriers to entry are also higher.

-1700-1800 Crores we will be at FY26. We have other plans to grow as well- hinting to acquisition.

-Not seeing any slowdown in NBR. For last 6 months, if you remove NITRILE Latex. EBITDA Margins would have been higher by 100bps.

-Nitrile Latex next year will 15-20% of the entire sales.

-Taloja- 100% capacity utilisation will be sometime in FY25. Will reach 3000tonnes per month in FY25.

Disc: no reco.

There might be headwinds in short term.

Sold my entire position. Perked that money into Confidence Petroleum.

| 2608 | Apcotex | ||

|---|---|---|---|

| 1080 | Bear | Base | Bull |

| Growth | 14 | 16 | 18 |

| FY26 Sales | 1600 | 1686 | 1774 |

| PAT % | 10% | 11% | 12% |

| PAT | 160.006752 | 185.4344448 | 212.9369472 |

| P/E | 18 | 22 | 28 |

| Market Cap | 2880.121536 | 4079.557786 | 5962.234522 |

| CAGR | 3.36% | 16.08% | 31.73% |

My estimation at current 2600 Cr Mcap.

Disc: Waiting for it to either come 10-20% lower, or time correction, or some new +ve info to emerge to make a position.

as company is aiming for 17 to 18% margin i think it is a good buy at current market cap,plz share your view

https://www.bseindia.com/xml-data/corpfiling/AttachLive/35f8bb58-816e-4696-b4e4-73f3f0b424b8.pdf

AR - Apcotex

Some interesting points:

Disclaimer: No position currently

This can increase global demand for Nitrile Latex for gloves…