and these stock levels will never come soon!

Disclaimer: No recommendation!

and these stock levels will never come soon!

Disclaimer: No recommendation!

Not sure if this is discussed or confirmed anywhere:

But I found the Sales / Order value is pretty range bound for Angel One.

In last 8 quarters it is around 29 to 32 Rs/ Order. So I take this as a good metric to track this business.

And assuming same monthly orders as that of Jan & Feb avg, it is expected to be a poor Q4. Topline could be around 1010 to 1075 Cr. Happy to be wrong.

Disc. Invested

Why they have declared 2nd Interim dividend in such a hurry.

Hello Community,

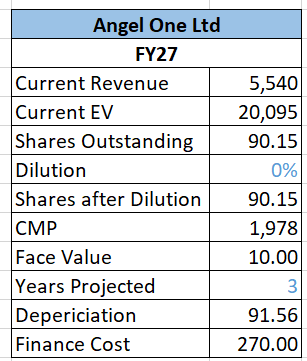

I’ve been tracking Angel One for some time but was always hesitant due to valuation concerns.

The business operates in a shallow cyclical industry, directly linked to equity markets. A decline in liquidity could negatively impact order volumes.

However, I am considering a contrarian bet on Angel One for the next three years, deploying capital in tranches. Given the increased spending on IPL advertisements and publicity, reduced orders, I anticipate a short-term impact on revenues & profit, making current valuations more attractive to accumulate.

If the company successfully controls its cost-to-income ratio, leverages cross-selling opportunities, and expands its non-broking revenue streams, the reliance on broking revenue could reduce from 68% to 60%. This shift would enhance resilience against fluctuations in F&O trading volumes and help offset potential revenue declines.

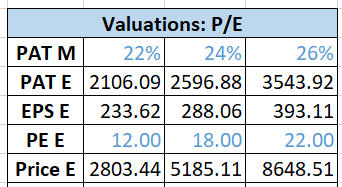

Based on moderate growth expectations for the next two years, my calculations indicate a potential upside of at least 25%.

However, I acknowledge the possibility of bias in my analysis due to limited industry knowledge.

Would love to hear counterarguments or any additional insights from the community!

Angel One has been growing sales and profits at unbelievable rates like 30-50% consistently over 3-5 years and is available at sub-15 P/E. Hiring of VP Tech of Google by an Indian company shows they are forward thinking - Company could expand to more geos also and lot of upside left. And it has a 2% dividend yield!

This is the Bajaj Finance of broking and available at dirt cheap P/E. I would say load the truck at these prices

I have recently got hooked on PEG as an important ratio. PEG of Angelone is .21. Which seems to indicate it is underpriced. Am I right?

This is very important as I have redone my portfolio recently based on this criteria, discarding those with high PEG, and buying stocks with low PEG.

I am looking for comments on this criterion

Disclaimer: Bought 200 today.

For cyclic business, most of the ratios are irrelevant as they are based on past data. Growth of Angel one is directly related with market activities which is currently down.

Disc: Tracking investment only.

While there will be cyclical ups and downs in the market.

If we are considering stock markets and investment theme, and betting on it’ll only grow and new people will find their way, then this stock is probably a direct play.

Obviously one can go for the exchanges, they are more certain & stable, but they won’t be available at trading platforms valuation, and I sense exchanges will always trade at a premium over trading platforms, due to monopolistic nature .

I have some NSE. Bought unlisted.

I was also considering buying CDSL before buying Angelone.

I somewhat agree with this. I overlaid both stocks on a chart, and while their patterns appeared quite similar, Angel One showed a notable spike in January 2024 which CDSL did not.

As of today, Angel One has surged 696.42%, whereas CDSL is up 379.74%. Additionally, the monthly RSI of CDSL is currently higher than that of Angel One, indicating a potential rally in both, may be faster in CDSL.

That said, with the growing market participation and increasing demat account openings, both stocks are likely to benefit.

Note: This is just my personal view, not a recommendation. I do not hold either of these stocks.

Hello Community,

I would like to add a few more key points:

a) Expected Credit Loss:

b) Collateral:

Instrument type: Margin trading facility. Primary collateral: Shares and securities.

The risk that the company may not be able to meet financial obligations as they become due. However, liquidity management appears strong:

Considering these figures, the company appears to be managing its capital efficiently.

Disclosure: Invested, first tranche deployed.. may be biased.

@babruvahana Nice insights.. Can you please share the source from where you plotted the graph?

@rishitdedhia13, It’s from Tijori [Asset Management Sector | Tijori Finance]

As expected, the number of orders has declined, which suggests that Q4 results could be weak. The implementation of true-to-label regulations and adjustments to the equity index derivative framework will have impact on net income by approximately 18%(as confirmed by management in the previous concall).

Management aiming for a flat fee brokerage model for cash delivery orders and introducing interest charges on non-cash collateral, evaluating price hikes in the F&O segment to have an OPM of 50%.

A price hike in the F&O segment may lead to client attrition, especially if competitors offer lower fees or zero-cost alternatives. Retaining customers will likely depend on the effectiveness of their AI-driven engagement and retention strategies.

Asset & Wealth Management revenues could offset broking losses in the short term. Over the long term, this diversification could reduce dependency on brokerage revenue, making the business model more stable.

Disclosure: Invested…maybe biased. Planning to add on dips.

Q4FY25 Results.

https://www.bseindia.com/xml-data/corpfiling/AttachLive/5a5def4a-74a2-42da-b087-b46a67e31209.pdf

The growth is negative in terms of revenue and profits both sequentially and YOY. Market surely won’t like this degrowth

Bad results are already priced in. However another 10 to 15% fall cannot be ruled out.

Disc: 1.5% of PF

We should focus on the long-term potential of the Indian stock market rather than getting distracted by short-term fluctuations in quarterly earnings.

When it comes to stock trading platforms, there’s still significant room for growth in India compared to global benchmarks — and Angel One stands out as a listed leader in this space.

Disclaimer: No buy/sell recommendation. Holding in family portfolio.

Angel One | Important Management Interview

Watch the interview