How negative can SEBI’s stand against derivatives turn out on Angel One?? Because majority of business comes from derivatives.

I don’t think anything major will happen. Market seems to have already discounted this into Angel One’s stock. But yeh, the stock might consolidate for sometime now, until their wealth management business picks up.

It seems, with the new SEBI directive there would be a significant drop in the growth of the company. Does staying invested in this will be a value trap?

Thinking the same. I dont see a lot of downside from here but not sure if it will move up for some time.

Really confused! Any ideas from anyone.

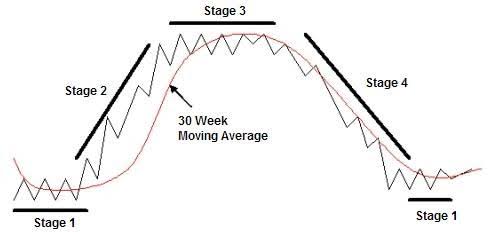

The stock has been in a downtrend. It’s forming lower highs, and is below 30 weekly ema. Today the volume of sell off was quite huge. Feels like the stock is in stage 4. I think one needs to wait for things to settle down before taking a call on investing.

What do you mean by stage 4?

Stage Analysis is a strategy for longer term trend trading. It was discussed in detail by Stan Weinstein in the book Secrets for Profiting in Bull and Bear Markets. Stage Analysis uses chart patterns to describe four distinct stages that a particular trade can be in.

Stage 1: Base Formation

Stage 2: Advancing/Uptrend

Stage 3: Consolidation/Topping

Stage 4: Decline

A link to read stage analysis: Trading With Stage Analysis

Soic has a video explaining the same: https://youtu.be/HHZBnmnFdjQ

**Angel One Q1 FY 25 Concall Highlights**

· If there are restrictions on No.of expiries for F&O it would have little impact as there are still Weekly and monthly expires and trading goes across the month.

· Regarding Impact if the lot size increases management said they can mitigate the impact by levering charges on other segments, Also a participant asked what if the lot size increased to 20-30 lakhs the management said they can manage that level and not sure after that

For most of the questions on regulator actions management said we need more time to analyze the situation until clear guidance from the regulators They also said they have enough levers( if possible they are also looking to charge on equity delivery orders) to offset those impacts and Due the size they have there are more efficient than other 4 major online brokers

· Management commented they are confident that EBITA margins will be at 47-48% after a few quarters

· Remaining most of the questions on MTF and Wealth management segment

· AMC licenses are getting delayed due to elections it is in the final and they said they got great response on wealth management side Domain Knowledge, tech, and Relationship managers are their 3 pillars in it

· There is 1-1.5% impact on operating profit due to new business

· MTF - Margin Trading Facility allows to buy a stock by 1/4 of the total transaction value. Angel One funds the balance amount. Interest rate is 18% per annum.

Industry size: 75000 Crores, Angle one share is 5% and the top one has 20%

· Mgmt said if charges on F&O increases then customers shift to MTF

Question by participant: Does 0 brokerage on equity indirectly drive MTF

Mgmt: We don’t believe charges on equity delivery impact MTF book

· Mgmt believe there will be no change in Life time value of the customer

Stock continues to fall, i am new to the markets but i really feel that the stock is at 17p/e and is correctly priced, but i won’t touch it till it offers a bit more margin of safety, because a lot of headshots might come from the government or the regulator which are already in the air, and the data that india is 80 percent of world’s fno volumes is simply mind boggling, this makes me feel that something bad is about to happen to the company.

Not invested.

May be may be not, we also need to understand and take it into perspective the Demographics of most of the world and where the demographic lives (T1,T2,T3) needs to be considered.

Yes, I agree that the Indian FnO markets are sought after the most by retail investors with <1 year(s) of experience in the markets, it is a problem. But Indirectly many more retail investors are picking up regular SIPs, which is good for the markets.

Can someone help me out with the view on Angel one. Valuations seem attractive . However , I am cautious about sustainability of earnings with the overhang of SEBI actions.

Definitely an attractive opportunity. However, keeping an eye on the chart pattern.

The last 7-8 months, the stock has been making lower tops and bottoms. Unless it goes to 13-14 PE, I personally will not buy it. However, I will be ready with the cash. Very high-quality company, transitioning to a stable AMC business.

However, you can buy if a further 10-15% drop does not bother you. Because I feel long-term (>3-5 years) will be good.

Stance: Quite biased. This is the highest allocation in my portfolio. Looking to invest more, if the trend reverses or stock becomes extremely cheap. Currently, 10% lower compared by average buying price

I think you should wait before you invest more in this stock. If the SEBI tantrums regarding options trading result in something meaningful, it will be very negative for broking companies as majority of their Revenues come from Options.

Believe me, I have been waiting for this stock to correct for a very long time, but given the regulatory uncertainty, I am not super confident about Investing right now. The valuations are cheap, but one needs to determine the reasons behind this. If shrinking Revenues and Profits due to Regulatory risk is a possibility, then this stock may be accurately priced.

I am in a similar boat. The average price is 5% higher than the current market price. The current valuation looks really attractive, I am waiting for the budget tomorrow and next quarter’s results.

Its transition to AMC will bring stability, they have also started giving loans and planning to add more financial products in their suite. It looks like a very attractive company for long run with a business model that is here to stay.

Disclosure: Biased and invested

I agree that they are expanding into new business segments.

If we consider the AMC business, it will take a lot of time to have any impact on the bottomline. HDFC AMC has an AUM of more than 4Lakh Crore and after this AUM, their bottomline is close to 2000cr. Imagine how long it will take for the AMC business to be meaningful for Angel. Also, they are mostly interested in Index Funds with lower commissions. So I am not really sure how this business segment is going to mature for this company.

Secondly, if the broking business is so strong or basically on steroids in India, why enter lending or any other business? Are they also expecting some regulatory pressure from SEBI and hence diversifying their product base?

I just feel the regulatory environment is very uncertain and in such scenarios it is better to wait out any developments.

Is anyone aware of the next steps after the consultation paper from SEBI on F&O? Basically, want to understand how long this overhang will last.

To understand the potential corrections in Angel One’s stock price, we should consider the following factors:

- Demat and Trading Accounts Comparison: We need to evaluate the number of demat and trading accounts in India compared to the U.S. This will provide insight into market participation and potential future trends.

- Stock Valuation: The stock’s current Price-to-Earnings (P/E) ratio is 16.4, which is below the median P/E ratio of 20.6. This indicates that the stock may be undervalued relative to its historical performance.

- Price Decline: The stock has already declined by 47% from its all-time high. This significant drop suggests that the stock has experienced a substantial correction.

- Potential Future Corrections: Despite the recent decline, further corrections could occur, with potential price levels around 1950 and 1635. However, this does not mean the stock should be overlooked.

In summary, while Angel One’s stock may experience further corrections, its current valuation and the number of trading accounts suggest it could still be a valuable investment opportunity.

FY24 AGM Notes of Angel One. (Aug’24)

Comprehensive Summary:

-

Company Overview and Performance:

- Angel One held its 28th Annual General Meeting virtually

- FY24 marked another year of robust growth for the company

- Total client base expanded to 22.2 million, representing 14.7% of India’s demat accounts

- Added a record 8.8 million new clients in FY24, with over 89% from beyond metros and tier 1 cities

- NSE active clients grew 42.7% year-over-year to 6.1 million

- Total orders increased by 52.2% to 1.4 billion

- Average daily turnover surged 143.5% to 33.2 trillion rupees

- Revenue grew 41.7% year-over-year to 42.8 billion rupees

- Operating profit reached 15.6 billion rupees

- Profit after tax from continuing operations hit a record 11.3 billion rupees

- Cash and cash equivalents increased to 98.4 billion rupees

- Net worth rose to 30.4 billion rupees

- Return on average net worth stood at 43.3% for FY24

-

Market Share and Operational Highlights:

- Achieved lifetime high market share of 58.1% in the commodity segment

- Experienced growth across all segments including derivatives, commodity, and cash

- Successfully handled 86.5% growth in average daily orders between Q1 and Q4 of FY24

- Peak daily orders surpassed 10 million during the year

-

Strategic Initiatives and Expansions:

- Transitioned from traditional brokerage to a digital-first business model

- Expanded capabilities of the super app

- Scaled up mutual fund distribution

- Commenced beta testing for credit and fixed income product distribution

- Incubated new asset management and wealth management businesses

- Focused on assisted business to serve underrepresented markets in tier 2+ cities

- Incorporated wealth management subsidiary in second half of FY24

- Assembled high-caliber team for wealth management with over six decades of combined experience

- Entered into a five-year associate partner sponsorship for the Indian Premier League (IPL) starting 2024

- Raised 15 billion rupees through Qualified Institutional Placement (QIP)

Key Forward-Looking Statements:

-

Product Expansion and Diversification:

- Continuing mutual fund distribution growth

- Advancing beta testing and eventual launch of credit and fixed income products

- Further developing asset management business with focus on passive products, primarily through SIP plans for index funds and ETFs

- Expanding wealth management offerings, initially targeting ultra-high net worth and high net worth individuals

- Plans to introduce insurance products in the future

- Aim to provide a comprehensive range of financial solutions throughout clients’ lifetimes

-

Technology and Innovation Focus:

- Ongoing investment in super app development and enhancement

- Continued investment in robust tech infrastructure, including new data center and disaster recovery center

- Leveraging AI and machine learning for:

a) Developing predictive models to analyze client behavior

b) Enhancing personalized experiences

c) Reinforcing security protocols and mitigating fraud risks - Using data analytics for swift adaptation to market shifts

-

Market Expansion and Client Acquisition:

- Targeting deeper penetration in tier 2, tier 3, and beyond cities

- Focus on acquiring younger demographics (48% of new clients under 25 in FY24)

- Expanding network through new partnerships

- Aim to democratize financial services across underserved regions

-

Wealth Management Strategy:

- Initial focus on ultra-high net worth and high net worth individuals

- Plans to expand digitally to serve affluent and emerging HNI segments

- Goal to optimize costs while achieving rapid scale-up

- Aspiration to grow business through both direct and assisted business units

-

Brand Building and Marketing:

- Leveraging 5-year IPL sponsorship for unparalleled brand exposure across on-ground, digital, and TV platforms

- Creating bite-sized educational videos, often in vernacular languages, to educate clients

-

Capital Allocation and Financial Strategy:

- Allocated recent 15 billion rupee QIP raise towards:

a) Margin monies with Clearing Corporation

b) Growing margin trading funding book - Focus on effective resource management and maintaining financial stability

- Allocated recent 15 billion rupee QIP raise towards:

-

Regulatory Engagement and Compliance:

- Commitment to work closely with regulators to enhance investor protection measures

- Active engagement in formulating and implementing regulations for capital markets

- Focus on promoting transparency, integrity, and investor protection

-

Long-term Vision and Growth Targets:

- Aspiration to reach and empower a billion lives through financial services

- Commitment to innovation and delivering superior client experiences

- Focus on fostering sustainable business practices

- Aim to expand team, client base, and technology to enhance client experience

- Goal to achieve long-term growth and profitability

-

Operational Excellence and Business Restructuring:

- Proposed post-restructuring of the business to augment market share

- Focus on sustaining growth across key metrics

- Emphasis on operational excellence to unlock value for stakeholders

-

Market Outlook and Industry Trends:

- Optimistic about the future potential of continued growth in Indian capital markets

- Anticipation of expanding investor and trader base in India

- Recognition of the need for appropriate safeguards to protect retail investors and traders

This summary provides a comprehensive view of Angel One’s current position, recent achievements, and future strategic direction. The company appears to be positioning itself as a leader in the digital financial services space in India, with a strong focus on technology, product diversification, and market expansion. However, as with all forward-looking statements, actual results may vary based on market conditions, regulatory changes, and other factors.

This summary has been prepared using automatically generated YT transcript and using Claude.ai

Disclosure: Invested

Based on the AGM transcript, the tone of Angel One’s management appears to be:

-

Confident and Optimistic:

- The management frequently highlights strong growth numbers and achievements.

- There’s a clear sense of optimism about future growth potential and the company’s ability to capitalize on market opportunities.

-

Forward-thinking and Innovative:

- The focus on technology, AI, and data analytics shows a commitment to innovation.

- Management seems eager to expand into new product areas and markets.

-

Strategic and Visionary:

- There’s a clear long-term vision to reach and empower “a billion lives” through financial services.

- The management outlines a comprehensive strategy covering product diversification, market expansion, and technological advancement.

-

Customer-centric:

- There’s emphasis on improving client experiences and tailoring products to different customer segments.

- The focus on educational content and vernacular offerings shows attention to customer needs.

-

Ambitious:

- The management sets high goals, such as becoming a comprehensive fintech player and expanding rapidly in underserved markets.

-

Proactive:

- The company appears to be actively anticipating market trends and regulatory changes.

- There’s a focus on building partnerships and exploring new business areas.

-

Proud of Achievements:

- The management frequently highlights record-breaking numbers and market share gains.

-

Transparent:

- The Chairman provides detailed information about the company’s performance and future plans.

-

Shareholder-friendly:

- There’s attention to shareholder returns, as evidenced by the dividend payments and discussion of potential buybacks.

-

Regulatory-conscious:

- The management expresses commitment to working with regulators and emphasizes the importance of investor protection.

-

Adaptable:

- There’s recognition of the need to be agile in a dynamic market environment.

Overall, the management’s tone comes across as confident, ambitious, and forward-looking, with a clear strategic vision for the company’s future growth and development. They seem to be balancing optimism about growth opportunities with awareness of market challenges and regulatory responsibilities.

This summary has been prepared using automatically generated YT transcript and using Claude.ai

Disclosure: Invested

did they mention any targets or numbers for the upcoming quarters/years regarding what they are targeting to achieve, like sales growth cagr?