Hi All,

Starting thread on Amber Enterprise.

Amber basically manufactures RACs and components for eight out of the top 10 RAC brands in India.

IPO came @859 in Jan 2018 at PE = ~70

Current Price: 830, Current PE = 27 , as earning grew.

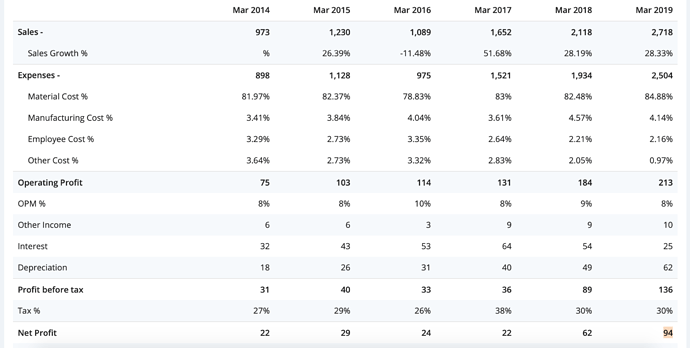

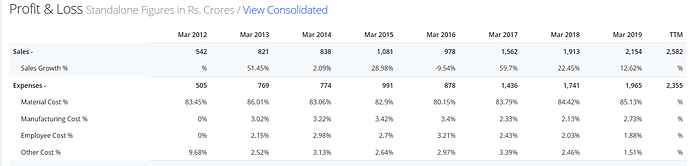

Market Cap: 2,554cr, sales: 2,718

WHO WE ARE

A ONE-STOP SHOP FOR AIR CONDITIONERS AND ITS COMPONENTS FOR CONSUMERS.

Amber Enterprises India Ltd is a prominent solution provider for Air conditioner OEM/ODM Industry in India. It has a dominant presence in RACs complete unit and deals in major RAC components with 10 manufacturing facilities across India focusing in on different product segments.

With expertise in components like heat exchangers, sheet metal components, injection molding components, and system tubing and motors, Amber is strongly positioned with its backward integration to derive the core deliverable’s in terms of quality, cost & delivery.

We offer higher energy efficiency and expertise in indoor, outdoor, split and window AC units. We deal in AC components as well as non-AC components.

We have a Diversified Product portfolio which includes:

RACs

WE DESIGN AND MANUFACTURE COMPLETE RACS INCLUDING WINDOW AIR CONDITIONERS(“WACS”) AND INDOOR UNITS (“IDUS”) AND OUTDOOR UNITS (“ODUS”) OF SPLIT AIR CONDITIONERS ("SAC"S) WITH SPECIFICATIONS RANGING FROM 0.75 TON TO 2 TONS, ACROSS ENERGY RATINGS AND TYPES OF REFRIGERANT.WE DESIGN AND MANUFACTURE INVERTER RACS TOO.

RAC Components:

WE MANUFACTURE RELIABLE FUNCTIONAL COMPONENTS OF RACS THAT INCLUDES HEAT EXCHANGERS, MOTORS AND MULTI-FLOW CONDENSERS WITH OTHER COMPONENTS SUCH AS SHEET METAL COMPONENTS, COPPER TUBING AND INCLUDING PLASTIC EXTRUSION, VACUUM FORMING AND INJECTION MOLDING PROCESSES TOO.

Non AC Components:

WE MANUFACTURE COMPONENTS OTHER DURABLES AND AUTOMOBILES SUCH AS CASE LINERS FOR REFRIGERATOR, PLASTIC EXTRUSION SHEETS, SHEET METAL COMPONENTS FOR MICROWAVE, WASHING MACHINE TUB ASSEMBLIES WITH OTHER SHEET METAL AND PLASTIC INJECTION MOLDING AND EXTRUSION COMPONENTS FOR AUTOMOBILES AND METAL CEILING INDUSTRIES.

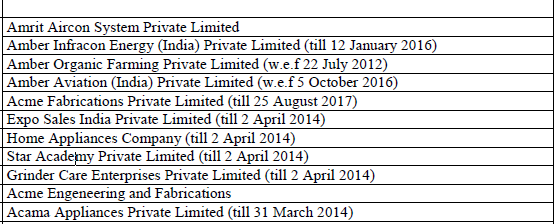

History:

Capex plans

In tandem with the growth in its order book, capex of Rs 75-80 crore was incurred in FY19 on R&D and an additional manufacturing line. Amber plans to set up a new manufacturing facility in south India. For this, the company will invest in land and building (worth Rs 30-40 crore) in FY20 and Rs 55-60 crore on a new assembly line in FY21.

Valuation:

Currently stock is valued at PEG Ratio: 0.79, Market Cap to Sales: 0.94, which looks reasonable for decently growing business.

Investment Rational:

-

Long Runway: The penetration of room ACs in Indian households is just 4%, hence long runway ahead, and AC is not luxury item anymore, at-least in north India its becoming necessity, and i don’t see any reason why the whole AC market wont grow in next 10 years, there might be temporary slowdowns, but not permanent one.

-

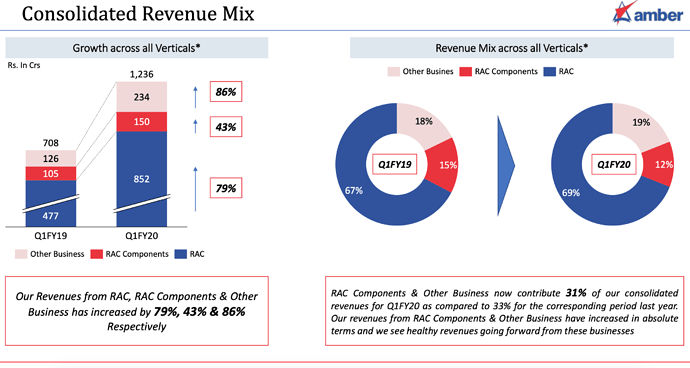

Decently growing company: In last 6 years sales has grown 3x where as profit has grown 4-5x.

-

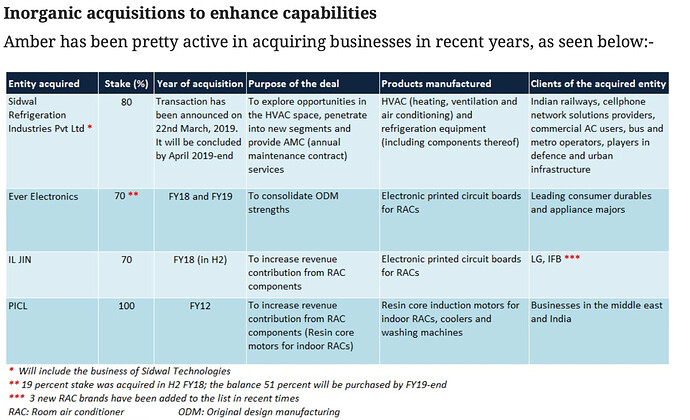

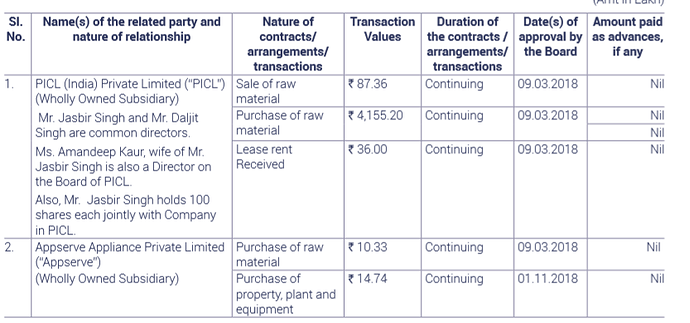

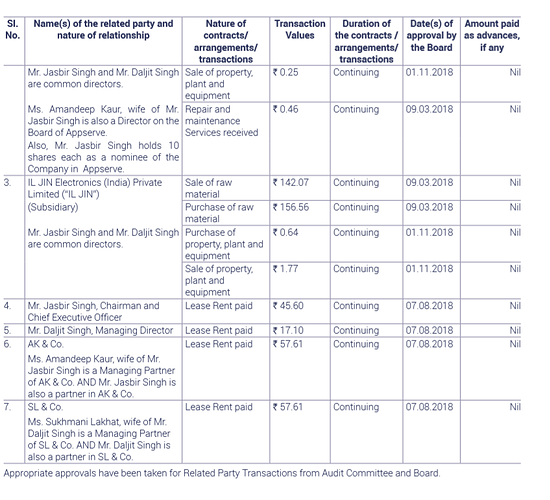

Consolidating market: Most of the AC brands are their customers, and some competition is going away as LEEL almost collapsed due to fraud, so Amber is able to consolidate market, they also acquired Sidwal (Market leader in Railway & Metro AC), IL Jin and Ever electronics(AC Parts maker) recently.

-

Focused approach: till date all the acquisition and expansion Amber did are majorly focused on AC market, which i think is good as manufacturing is game of scale & efficiency.

-

To promote ‘Make in India’ initiatives, the government has imposed steep custom duties on imported RACs and its components. This should help Amber bag new contracts.

-

Recently they added both Amazon India & Flipkart as there customers and decent growth from digital market.

Risks/Concerns:

-

Technological disruption in AC tech: although i think it’s low probability, still it can happen.

-

Customer Concentration: 75% of sales is from top 5 customer only, which is quite concentrated.

-

Stiff competition in the consumer durables business, RAC brands are forced to take price cuts in a bid to gain market share, This could put Amber’s margin under pressure since its contracts are B2B (business-to-business) in nature.

-

Demand slowdown: as in current scenario demand of even food products is effected, and of-course consumer discretionary items can experience bigger slowdown like auto’s.

-

Company looks aggressive in acquisitions as in last 2-3 years they acquired 3 companies, acquisitions are usually considered risky way for expanding business, one wrong acquisition can plague the company.

References:

http://www.ambergroupindia.com/docs/Investor%20Presentation/Investor%20Presentations/Investor%20Presentation%20Financial%20Results%20of%20Q1%20FY20.pdf

http://www.ambergroupindia.com/docs/Investor%20Presentation/Earnings%20Calls%20Transcripts/Q4FY19%20Earnings%20Call%20Transcript.pdf

http://www.ambergroupindia.com/docs/Investor%20Presentation/Earnings%20Calls%20Transcripts/Acquisition%20Update%20Call%20Transcript.pdf

Disc: Still Evaluating and its work in progress and have a initial position @ 825.

Appreciate members feedback, point of view on Amber business and Quality of Management as someone said, in India, Management is multiplicative factor if management is zero everything goes to Zero.