Here in both the cases they are talking about secondary battery which even today every Vehicle requires.

This is good overview of LI-ION Battery

In case any violation of guideline of the forum let me know will delete.

@xvivek what they have stated is that every EV requires an lead acid battery as auxiliary power source in addition to Lithium-ion Batteries. However as per my checks, one with a 25+ years experience in mahindra’s production division and another with 10+ years experience in maruti service center, EV do not have lead acid battery as auxiliary power source.

Yes, EVs and Hybrids do require the lead acid battery as an auxiliary power source.

The only 2 exceptions are the Tesla Model S and Model X, who ditched the lead acid battery just last year. This was because they were getting too many complaints on battery discharging/ reliability in particularly these 2 models. Note that the Tesla Model 3 and Model Y still use the AGM lead acid battery.

Explaining this in short - it is the lead acid battery that provides primary power for low voltage systems used to wake the car, Bluetooth receiver, lights, Sentry Mode, door locks, windows, latches, actuators, etc. When car is awake and high voltage (HV) contactors are closed, 12v support is supplied by the HV battery pack. Only lead batteries hit all the cold cranking amps (CCA) performance necessary for starting, lighting, and ignition (SLI) applications. The lead acid battery is reliable and extremely cost efficient, and doesn’t require a BMS circuit board that a lithium ion low voltage battery would.

I understand that your original concern is about the terminal value of AREM’s legacy business. I honestly feel that the business should get a higher terminal value, because lead batteries should continue to be auxiliary power source for years to come. Now this technology is also going to move from Flooded Lead Acid Batteries to AGM (absorbed glass mat) or EFB (enhanced flooded batteries) to Lithium Ion 12V batteries over time.

The Clarios xEV Battery Portfolio illustrates the evolution we’ll see in this space -

So even though the main high voltage Li-on battery pack will see a lot of competition, here we have this niche, high margin business where operational leverage will continue to favour the incumbents clearly.

Plus now they have a wider export market, which is another big trigger for AREM. With Johnson Controls as a promoter-shareholder, they had restrictions over selling in many international markets, esp the western countries. AREM has a good foothold now in many SE Asian/ West Asian/ African markets, and the next big challenge is Europe and America. Industrial also continues to be a growing segment for them. AREM simply has to demonstrate that their terminal value should not be this discounted.

The way I see AREM is that this a long term play where we’re getting the legacy business cheap, plus the optionality of the new energy business, which makes it extremely attractive in this market. While it’s important to put a number to the terminal value of their legacy business, we have to understand that the potential upside will only come from the optionality, ie. what they can achieve in the new energy business.

“Over the next five years, India’s vehicle population is expected to experience exponential growth, with a projected count of approximately 252 million two-wheelers and over 96 million four-wheelers in India by 2028”

• AMARA RAJA market share – 30-35%

• OEM market share- 30%

• Telecom – 80+ %

• UPS – 40%

• 60% of the value of the battery is main raw material lead

• 85% of lead comes from recycled process

• Lead procurement – local ( As of NOW)

• 12- 14% export

• Amara Raja Batteries’ board has approved setting up a greenfield lead acid recycling plant with an estimated capacity of 1 lakh tonnes p.a at a total outlay of Rs 280 crores to be spent over the next 18 months. This will help the company comply with recycling standards whilst adopting advance technology in the most environmentally friendly manner

lead recycling plant in Cheyyar,Tamil Nadu,

• First phase of recycling plant with capacity of 1 lakh tonnes is expected to start by Q1 FY25. This would increase the inhouse recycled lead procurement for the company

• This plant will cater to 30% of their lead requirements

• Applications - catering to e-mobility and energy storage applications in India. Such as EV, UPS ( Industries and data centers), Telecom

• Automotive (volume of batteries)

- 19.2 Mn capacity – 4 wheeler

- 30 mn capacity in 2 whheler

• Industiral 2.3 Bn-A-H

• strive to increase the lead procurement Company intends to spend 300-400 cr. for lead acid expansion in FY24 and FY25 respectively

Current scenario.

• Total raw material cost – 568.87 Cr

• Lead recycling FY 23- 69.53% FY 22 63.49% 10 % increase

• Batteries application

• Automotive 32%

• Industrial- 45%

• Total recycled waste- 27,823 MT FY 23

Future Plan of Action

• Development of NextGen Enhanced Flooded batteries for automotive application.

• Development of AUX product range for vehicle electric versions Development of market specific BCI product range Development of AGM product range for start stop application.

• Development of market specific product range of UPS Batteries with Advanced Plate Making Technology Development of robust battery for commercial vehicle applications.

• Study and Concept Evaluation of Advanced Plate making technology for Telecom Application.

• Evaluation of Chemistry Agnostic Solutions for Automotive and Industrial Applications Lead Optimization through Value Engineering Evaluation of different flame-retardant material grades to meet the global regulations/ directives

• New pasting additives to enhance the performance of 4W batteries Improve pasting process to enhance plate electrolyte availability Development of eco-friendly materials for bushing adhesive

• Throughput improvement of 2W negative plates curing process Evaluation & implementation of improved formation process for DIN batteries to reduce formation energy Advanced formation process validation for Flooded automotive batteries

• Develop and implement processes and controls to meet market specific requirements

• Develop & validate acid homogenization process for flooded batteries Screening of Lithium-Cell Technologies of different potential technology partners

• Development of 2170 NMC cylindrical cells with different compositions

• Develop 2/3 series LFP cylindrical cells.

Conclusion

• Amara raja seems to shift its complete focus towards raw material procurement for lead as 80% of it lead requirement has been fulfilled by recycled batteries which has became evident with its recent invsestment in lead recycling plant which expected to cover its 30% requirement of raw material and will benefit the company for longer run. Amara Raja aims for $3 billion revenue in lead acid batteries within 5-7 years

• Amara Raja aims for $3 billion revenue in lead acid batteries within 5-7 years

•

• Also company has been focused to increase its new energy business electric mobility and energy storage for which the energy requirement is mostly from li – ion battery based material. mostly based on batteries recycling.

• signed a Memorandum of Understanding (MoU) with the Government of Telangana to establish research and manufacturing facilities for lithium-ion cells and battery packs. The ‘Amara Raja Giga Corridor’ project, with an investment of approximately INR 9,500 crore in capital expenditure and new technology, aims to produce Lithium Cells and Battery Packs with capacities of up to 16GWh and 5GWh, respectively

• For this company has been investing heavily on its R&D centers. And trying to innovate new technologies in LI-ion battery segment which will cater future generation of transportation , may be its logistics or EV sector, two wheeler and 3, 4 wheeler. Targeting to increase its market share in India.

• In November 2022, established Amara Raja Advanced Cell Technologies (ARACT) to focus exclusively on expanding our lithium pack assembly operations as well as to channel our significant investment towards domestic lithium cell manufacturing. Phase 1 will consist of an R&D centre, a pack assembly facility, our commercial pilot line for cells, and 2 GWh of cell manufacturing. All of the required partners have been onboarded and approval processes are underway at the respective government bodies

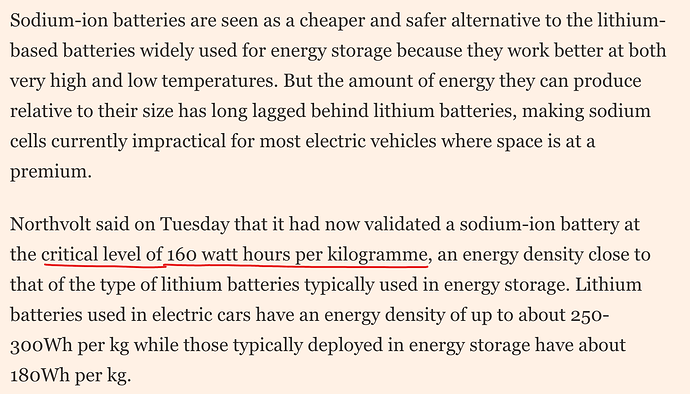

Northvolt has reported a breakthrough - Sodium iron battery Northvolt in new sodium-ion battery breakthrough (ft.com)

How do you foresee this playing out if this technology is viable and ends up achieving commercialization? Do you think that being an early entrant in Li-ion batteries could turn out to be a competitive disadvantage?

I’m trying to get my head around this business, which is pretty conducive, however the equation of Li has added complications.

1.On 26.09.2022 announcement on sister concern and merger: Mangal industries Limited (MIL) is manufacturing of plastic components for battery such as containers, jars, covers, small plastic parts, handle etc. The transaction near to completion stage (Consider 15 -18 months from Oct 2022) and advantage of the transaction overall improvement on EBITDA by 0.75% -1%.

Current EBITDA - 12% -13%

- AREL has acquired engineering design firm Design Alpha (DFM Softech Pvt Ltd) , is a service provider and well recognized by the DSIR and focusing on developing & designing engg solutions and technologies to solve the complex challenges.

So apart from Li business… we are looking for another development on business, management guidance and more on execution timeline.

Amara Raja Energy & Mobility: A High Probability Wealth Creation Opportunity

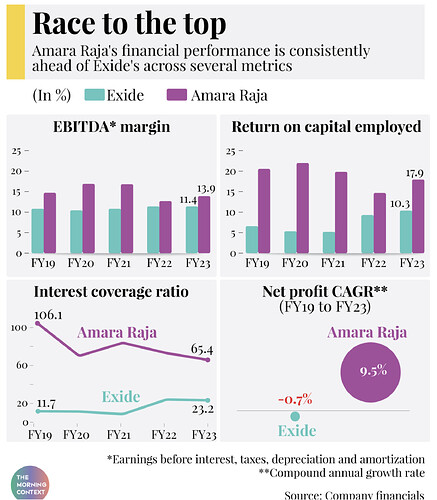

The world is trying to get better environmentally by reducing carbon emissions. In order to reduce carbon emissions, the world is trying to adopt Electric Vehicles (EVs) instead of Internal Combustion Engine Vehicles. When it comes to EVs, the main cost of the car is the battery that it has in the car.

Currently, in the battery space for EVs, there is one major player “Amara Raja Energy and Mobility”. It is the technology leader and is one of the largest manufacturers of lead-acid batteries for both industrial and automotive applications in the Indian storage battery industry. Under the automotive application, they are present in both markets that is OEMs and the After Market. In both segments, they have market share of around 30%-40%. Under the industrial application, they are present in two sectors that is Telecom & UPS. Under Telecom sector, they are the leaders with 80%+ market share. Under the UPS segment (Data centre Application), their market share is 40%.

In order to make a battery, the main raw material required is Lead which is 60% of the value of the battery. 85% of the lead comes from the recycled process as it is the easiest to recycle and have a very high efficiency in recycling. They currently procure lead locally for now. In order to carry out the recycling process internally, their board has approved setting up a Greenfield lead acid recycling plant with an estimated capacity of 1 lakh tonnes p.a at a total outlay of Rs. 280 crores to be spent over the next 18 months. This will help the company comply with recycling standards whilst adopting advance technology in the most environmentally friendly manner lead recycling plant in Cheyyar, Tamil Nadu. The first phase of the plant is expected to commission by Q1FY25 which would increase the in-house recycled lead procurement. Overall, the whole plant will cater to 30% of their lead requirements.

The company seems to shift its complete focus towards raw material procurement for lead as 80% of its lead requirements have been fulfilled by recycled batteries which has become evident with its recent investment in lead recycling plant which will benefit the company in the longer run. Revenue Growth to be expected from Lead Acid Battery Business at $3BN from current $1.2BN in the next 5-7 years.

The company is also focusing to increase its revenue contribution from the New Energy Business which is catering to electric mobility and energy storage applications for which the energy requirement is mostly from li – ion battery material based on batteries recycling. For this company has been investing heavily in its R&D centres. They are trying to innovate new technologies in Li-ion battery segment which will cater to the future generation of transportation. They have signed a Memorandum of Understanding (MoU) with the Government of Telangana to establish research and manufacturing facilities for lithium-ion cells and battery packs. The ‘Amara Raja Giga Corridor’ project, with an investment of approximately INR 9,500 crore in capital expenditure and new technology, aims to produce Lithium Cells and Battery Packs with capacities of up to 16GWh and 5GWh, respectively

They also want to be present globally. So they have implemented a globalization strategy that is they want to increase market share in the existing geographies. They also want to tap western geographies. Europe and North America (especially for UPS Batteries).

This makes the case of Amara Raja very strong in the coming years based on the above facts. I am highly bullish on the company which is highly possible to do very well in terms of revenue and profitability.

Happy Investing!!!

That’s right !!! This is AMARA Transformational journey!! From FY25 onwards, many developments will be reflected in both Topline and bottomline ![]()

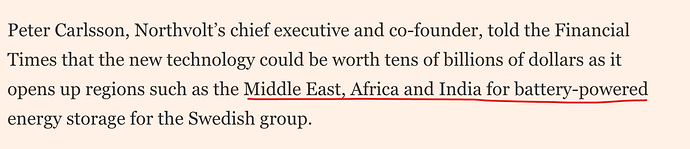

There was a very good recent article from Morning context on Amara Raja. I am sharing the key points below.

-

Galla’s political career: has been vocal in his opposition to the Narendra Modi-led government and has close connections with Andhra Pradesh opposition leader and TDP president N. Chandrababu Naidu. In July, The New Indian Express had reported that he now wants to quit active politics and will not contest in the general elections in 2024.

-

Amaron has managed to bag the top spot in the replacement battery

-

Next generation of business leaders came in (two nephews of Javadev Galla, Harshavardhana Gourineni and Vikramadithya Gourineni)

-

Harshavardhana, 35, has spent eight years at auto component maker Mangal Industries—he also served as the CEO of the group subsidiary.

-

Vikramadithya Gourineni, 32, has worked at Amara Raja Power Systems (power equipment and project developer) and Amara Raja Electronics (maker of power circuit boards). Tasked with “new energy” business. He has been allowed to take on more risks

-

International: Boost share of international sales from 13.3% in FY23 to 50% in next 5-7 years, plans to gain a foothold in the US and Latin America. Do contract manufacturing for Walmart and Amazon to manufacture private-label batteries for the US and other region

-

Investing Rs 400 crore to setup a recycling unit that will recover 150,000 tonnes of lead—this will help the company meet 30% of its requirement every year

One key financial highlight between Amara and Exide (Amara scores higher on each possible metric)

Disclosure: Invested (position size here, no transactions in last-30 days)

This looks like more of a storage / assembly unit . No manufacturing ?

Some Overview on Battery sector. Will delete it if sounds too basic for this thread

-

For batteries, the industry heavily relies on the automotive market, with 70-80% of battery sales in this segment. The remaining sales are in the stationary & industrial segment.

-

In the last FY, the auto industry grew by 12%,with companies like Exide and AmaRaja growing by 17-22% thanks to GST, organised share grew.

-

Exide’s share in the OEM segment has increased from 45-50% to 55-60%, and in the two-wheeler segment, Amaraja has recently secured orders from Honda.

-

Exide has approximately 95,000 dealers and sub-dealers, selling around 25 lakh units monthly.

-

Increased demand in the telecom market due to more mobile phones and the rollout of 5G, leading to higher battery demand for transmission towers and a shift from lead acid to lithium-ion batteries.

-

Demand projected to reach 150GWh by 2030, up from the current 50GWh. India primarily imports cells and assembles them, with cell manufacturing set to start by 2025 or 2026.

-

Assembling battery packs in India for export to countries with differential peak and non-peak electricity rates is commercially viable. This is due to the substantial price difference between Indian and developed countries’ battery packs. Developed countries have not seen significant drops in battery pack prices. For instance, Tesla’s power walls cost around $700-$800 per kilowatt hour, compared to India’s $200-$300, making India’s market more competitive.

-

Lead-Acid Batteries in Automotive Industry: Presently, 12-volt lead-acid batteries are the mainstay in IC engines in India, used for starting, lighting, and ignition. A shift to 48-volt systems, while beneficial in reducing wire thickness and heat, is hindered by high costs and the need for extensive redesigns. In contrast, electric vehicles are increasingly adopting 48-volt and higher systems, necessary for more power-intensive applications like cars and buses.

-

Two-Wheelers generally use 2 kilowatt chargers and most charging occurs at home. There isn’t a significant issue with charging infrastructure for two-wheelers. Even those living in societies manage to charge their vehicles by extending cords or removing the battery (weighing around 10-12 kgs) for charging at home. Battery swapping or standalone charging effectively meets their needs.

-

E-Rickshaws: Predominantly using lead-acid batteries, e-rickshaws in places like Delhi have developed informal charging stations. These vehicles are often parked and charged overnight for 10-12 hours and also charged during the day. The existing infrastructure adequately supports e-rickshaw charging.

- Autos with fixed batteries typically charge at home or at e-rickshaw charging stations. However, for autos that run on swap batteries, there is a growing need for dedicated charging infrastructure. Implementation is ongoing, with partnerships forming between auto companies and charger manufacturers. Typically, 10 kilowatt chargers, not classified as fast chargers, are used for these vehicles.

-

Telecom Sector Growth: Telecom sector is experiencing a surge due to the 5G rollout, requiring around five lakh lithium-ion batteries. This equates to 2.5 to 3 gigawatt-hours, valuing the market at about 2000 to 2500 crores. Telecom represents the largest growth area in the battery segment.

- there’s a shift towards standardizing battery specifications for various applications. A key development is the adoption of a 5-kilowatt hour battery pack as a standard module. This module’s size varies based on the number of companies sharing a telecom tower:

-

For a tower with 2operators, the battery requirement is about 14 kilowatt-hours.

-

If there are 3companies using the same tower, the requirement increases to around 28 kilowatt-hours.

- This modular approach allows flexibility in battery pack sizes, accommodating different needs based on the tower’s usage and the number of operators.

-

Data Center: India has around 130 to 140 data centers, predominantly using lead-acid batteries. These batteries are usually replaced every three years, creating a market size of about 150 crores. New data centers are emerging, but growth in this segment is gradual, expected to increase by 10-15%.

- Battery Requirements: Small to medium-sized data centers require 2.5 to 3.5 megawatt hour capacity, while large data centers need around 10 megawatt hour capacity. Lithium-ion batteries reduce these capacities by 30-40%.

-

Solar Segment: The solar industry in India is projected to grow significantly, aiming to reach around 280 gigawatt-hours by 2030. Despite this expansion, the growth in the battery energy storage systems doesn’t mirror this increase proportionally. Currently, only about 20% of solar installations have energy storage systems. The large-scale adoption of battery storage in solar is constrained by factors like uniform power rates and the high cost of batteries, with lithium-ion batteries priced around USD130-140 per kilowatt-hour and lead-acid batteries at USD60-80. The market for solar-related batteries is expected to experience a more pronounced growth once battery costs reduce to more economical levels, potentially around usd80-90 per kilowatt-hour, which could lead to a surge in demand around 2027-2028.

- Batteries are likely to be used in situations where there’s a real need, like providing power to remote villages or islands. In metro areas with fewer power outages, the necessity for battery packs is lower(at current prices).

-

Railways Segment: The railway sector is shifting towards lithium-ion batteries, especially for metros, to provide power backup during outages.

Amara raja vs Exide:

-

Lead-Acid Batteries: Amar Raja has traditionally been strong in the telecom sector with lead-acid batteries, while Exide was less prominent in this area.

-

Lithium-Ion Batteries: Exide holds a competitive edge over Amar Raja in the lithium-ion battery segment. This advantage stems from Exide’s existing battery pack assembly unit in Paranthe, their in-house design team, and progress in cell manufacturing plants.

-

Market Share and Strategy:

-

It’s premature to accurately assess market shares for Amar Raja and Exide in the lithium-ion sector. Exide recently secured a significant order (around 150 crores) from Indus, while Amar Raja has not received similar orders yet.

-

Amar Raja is focusing on small battery packs for 5G applications, catering to the need for frequent tower installations (every 250-300 meters). Exide targets larger battery packs essential for running independent sites, covering a major portion of the market.

-

-

Amar Raja and Exide are major players in the telecom sector for battery installation, with other companies like Exicon and Narada also participating. Reliance has the highest number of cell towers equipped with lithium-ion batteries. The industry is shifting from older battery technologies to lithium-ion, specifically to LFP (Lithium Ferro Phosphate) due to its higher temperature tolerance.

-

Exide’s Lithium-Ion Cell Capacity: The demand for these batteries is expected to be strong, not just in stationary applications but also in the automotive sector, which constitutes 80% of the market demand. Currently importing cells and focusing on battery pack design and development. With a projected market growth to 150 GWh by 2030, Exide’s planned 6 GWh capacity is expected to be easily filled, and they are already taking advance orders.

-

lithium-ion battery market is dominated by several top Chinese firms, with S-Volts ranked around 7th or 8th. While the leading Chinese companies like BYD and CATL are not focusing on the Indian market due to its nascent stage and low cost, Excide choice of S-Volts as a partner may have been their best option available

-

Top Chinese firms might consider the Indian market once it scales beyond a certain size. For instance, CATL has indicated interest in markets exceeding 10 GwH, a benchmark India is yet to reach. Indian companies, therefore, have to navigate a limited pool of potential partners, with a preference for non-Chinese companies offering technologies like NMC, given the limited scope and relevance of others like LTO in the Indian context.

On EPR Guidelines

-

Extended Producer Responsibility guidelines, now applied to lithium-ion batteries as with lead-acid batteries, require manufacturers and importers to collect and recycle used batteries, shifting recycling responsibility from government to private sectors. Previously, only about 20% of lead from lead-acid batteries was recycled, with the rest going to the unorganized sector. Ineffective recycling of lithium-ion batteries risks losing valuable elements like cobalt, nickel, and magnesium. EPR ensures manufacturers and importers are responsible for material recovery, promoting recycling and waste reduction.

-

Companies like Excide, which have their own recycling units, are facing a disparity between the demand and their recycling capacity; for instance, when the demand is at 100, the capacity is only at 20. Historically, the industry’s focus has primarily been on the sale of new batteries rather than on reverse logistics. This trend has been due to the high costs involved in reverse logistics, the challenges in collection, However, with the introduction of new regulations, there is an anticipated increase in the market share of organized players. These regulations are expected to establish proper pricing mechanisms, making it significantly easier for companies engaged in recycling to source and procure materials. This change is particularly important considering that lead constitutes about 90% of the cost of a lead-acid battery. Improved access to recycled materials is likely to reduce the costs of raw materials significantly.

MF data for last 3 months as under :

Month : Shares held

1.Sep, 2023 : 8,771,773

2.Oct, 2023 : 8,922,802

3. Nov,2023 :9,591,632

What is this data source ? Is it available on monthly basis ?

Yes, available at /trendlyne.com/

VinFast, the Vietnamese electric vehicle manufacturer a key competitor of Tesla and BYD, is preparing to inaugurate its inaugural production site in India, specifically in Tamil Nadu’s southern region. The facility is touted to be primarily dedicated to producing batteries for electric vehicles (EVs). Notably, this venture in the city of Thoothukudi stands distinct from VinFast’s earlier intentions to assemble vehicles using parts imported from Vietnam.

How does the above news impact Amara Raja? @RealVishal ?

Assuming Only Electric is the future might be ignoring on-ground reality. ICE cars are here to stay.