Long track record with strong market position

AGI Greenpac, incorporated in February 1960 to introduce vitreous China ceramic sanitaryware in India later diversified into the manufacture of glass containers through the acquisition of Associated Glass Industries Limited (AGI) in 1981. AGI Greenpac holds a leading market share in all the business verticals of its presence. Post Demerger in 2019, AGI Greenpac was housing the entire packaging products division (PPD) and was also engaged in the manufacturing of buildings products for its group company; Hindware Ltd on a cost-plus basis. With the slump sale (with effect from closing of business hours of March 31, 2022), the building products division’s entire operating facilities of AGI Greenpac was transferred to Hindware Ltd, leaving apart some land parcels on which Hindware Ltd. Continues to pay lease rentals to AGI Greenpac.AGI Greenpac is one of the leading manufacturers of glass containers in India in the organised liquid packaging industry, catering marquee clients in the packaged beverages, food, beer, liquor, chemical and pharmaceutical industries.

Diversified product portfolio with long standing reputed client base

The company has over the years built a wide-ranging portfolio of packaging products for both glass and PET, along with synergic product business of security caps and closures. The company is positioned as one of the significant glass container manufacturers in the country, offering packaging solutions to multiple sectors. The company’s products cater to a large reputed diversified customer base (which includes names like Abott, Coca Cola, Bacardi, Carlsberg etc.) with a product range covering flint, amber and green containers. The company’s plants are equipped to manufacture 5 ml to 4,000 ml of glass bottles and 10 ml to 10 ltrs of PET bottles in various shapes, sizes and colours. The company is selling packaging products as a brand portfolio; under AGI Brand for Glass Containers, GP Brand for PET bottles and plastic products and AGI Clozures for security Caps and Closures.

Market Share

The Co. is the second-largest glass container company in India and accounts for ~20% market share of India’s organized glass packaging industry.

Brand Portfolio

1. AGI Glaspac: The Co. manufactures glass containers and specialty glass under this brand.

2. AGI Plastek: The Co. manufactures PET Bottles and products under this brand.

3. AGI Clozures: Under this brand, the Co. manufactures counterfeit resistant security caps and closures, with a primary focus on the alco-bev industry

Manufacturing Capabilities

The Co. has 7 state-of-the-art manufacturing units located across Telangana, Uttarakhand and Karnataka. It commenced trial production at its speciality glass including decorative glass manufacturing facility at Bhongir, set up at an investment of ~Rs. 270 crore. The facility has a manufacturing capacity of 154 tonnes per day, with five manufacturing lines spread across 15 acres. Total capacities under various brands are as follows -

AGI Glaspac - 1,754 tonnes per day

AGI Plastek - 10,256 tonnes per annum

AGI Clozures - 780 Mn pieces p.a. (Small caps); 132 Mn pieces p.a. (large caps) [[9]]

Marquee Clientele

The Co. has 500+ diversified institutional clients across industries such as - Abbott, Coca Cola, Glenmark, Bacardi, Carlsberg, Nestle, HUL, etc.

Foray into New Business

The Co. ventured into the cosmetic and perfumery segment, which is one of the most profitable market segments in the country

Risk Analysis

some of the Risk are

1.Availability of Raw Material Inability to obtain a consistent supply of raw materials at a reasonable price might have a negative impact on operations

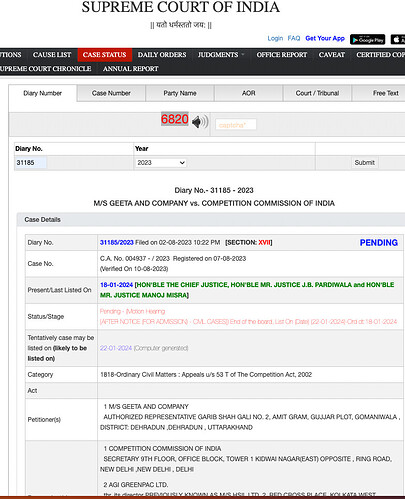

2.Acquisition of HNG not going through

3.Working Capital Management Short-term liquidity requirements can impact growth and profitability

Financials

YEAR Mar 2012 Mar 2013 Mar 2014 Mar 2015 Mar 2016 Mar 2017 Mar 2018 Mar 2019 Mar 2020 Mar 2021 Mar 2022 Mar 2023 TTM

| Sales | 1,312 | 1,538 | 1,708 | 1,817 | 1,959 | 2,072 | 2,250 | 1,605 | 1,859 | 1,260 | 1,430 | 2,281 | 2,318 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Expenses | 1,061 | 1,278 | 1,440 | 1,476 | 1,635 | 1,779 | 1,977 | 1,431 | 1,588 | 994 | 1,165 | 1,820 | 1,816 |

| Operating Profit | 251 | 260 | 268 | 342 | 324 | 292 | 273 | 174 | 271 | 266 | 265 | 462 | 503 |

| OPM % | 19% | 17% | 16% | 19% | 17% | 14% | 12% | 11% | 15% | 21% | 19% | 20% | 22% |

| Other Income + | 7 | 28 | 3 | 4 | 13 | 1 | 3 | 39 | 20 | -13 | 119 | 39 | 45 |

| Interest | 39 | 64 | 68 | 74 | 41 | 33 | 56 | 59 | 73 | 33 | 28 | 57 | 67 |

| Depreciation | 57 | 85 | 106 | 119 | 114 | 111 | 114 | 131 | 143 | 95 | 99 | 126 | 134 |

| Profit before tax | 163 | 139 | 98 | 152 | 182 | 150 | 106 | 22 | 75 | 126 | 256 | 317 | 347 |

| Tax % | 32% | 29% | 42% | 32% | 36% | 31% | 29% | 32% | 35% | 30% | 24% | 17% | |

| Net Profit + | 110 | 99 | 56 | 104 | 116 | 103 | 75 | 15 | 48 | 88 | 193 | 262 | 259 |

| EPS in Rs | 16.68 | 15.02 | 8.52 | 14.41 | 16.08 | 14.25 | 10.34 | 2.11 | 6.70 | 13.61 | 29.88 | 40.44 | 40.09 |

Acquisition:

- The HNG acquisition is still pending approval and is expected to be completed in Q3.

This acquisition has potential double its revenue.

Invested and biased