AB Capital Q4 and FY 23 concall highlights -

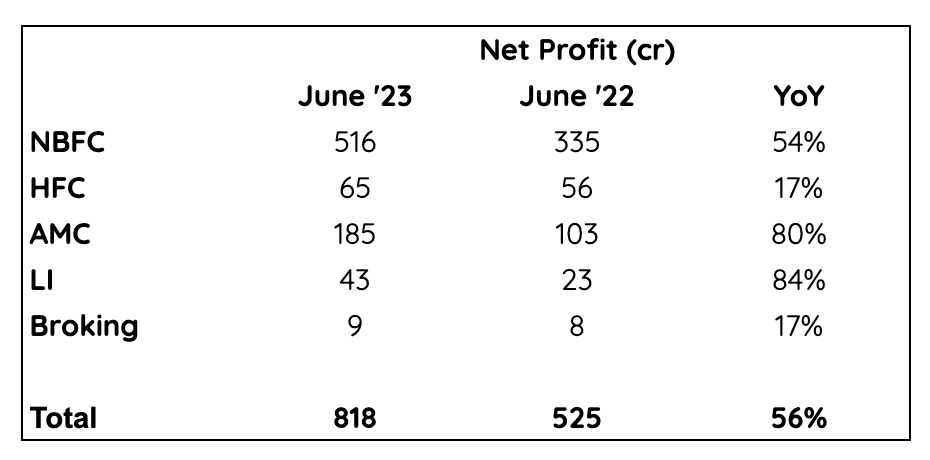

Full yr highlights-

NBFC loan book @ 80k cr, up 46 pc yoy

NIMs @ 6.84, up 60 bps yoy

PBT- 2090 cr, up 41 pc (despite doubling NBFC branches)

HFC loan book @ 13.8k cr, up 14 pc yoy

NIMs @ 5.08, up 76 bps yoy

PBT - 309 cr, up 22 pc

AMC’s AUM @ 2.86 lakh cr, down 4 pc yoy

PBT - 794 cr, down 11 pc yoy

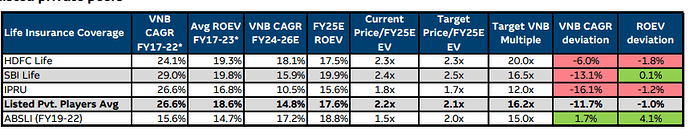

Life Insurance Individual first yr premium up 37 pc yoy

Net VNB margins at 23%, up 800 bps yoy

PBT- 196 cr, up 12 pc yoy

Other businesses ( broking - insurance and stocks, ARC )- PBT at 236 vs 176 cr, up 34 pc

Health Insurance - Gross premium up 57 pc yoy

Combined ratio at 110 pc vs 127 pc LY

PBT- (-) 218 vs (-) 310 cr

Asset quality -

NBFC -

87 pc loans to customers with CIBIL score> 700

Stage 2+3 book at 5.86 pc vs 8.98 pc yoy

PCR of 46 vs 39 pc for stage 2+3 book

HFC -

94 pc loans to customers with CIBIL score > 700

Stage 2+3 loans at 4.99 pc vs 8.75 pc yoy

Stage 2+3 PCR at 33 pc vs 31 pc yoy

AMC -

SIP book at 1003 cr vs 895 cr yoy

Total SIPs at 33 vs 32 lakh yoy

Count of SIPs -

Over 10 yrs old - 82 pc

Over 5 yrs old - 91 pc

Life insurance -

Total premium collected at 15.07 k cr, up 24 pc yoy

Growth at 2X of Industry

Third fastest growing life insurer in FY 23

Persistency ratios -

61M @ 54 vs 52 pc

37M @ 67 vs 67 pc

25M @ 72 vs 73 pc

13M @ 87 vs 82 pc

AUM@ 70k vs 60k cr (24:76 pc Debt:Equity)

Health Insurance -

GWP @ 2717 cr, up 57 pc yoy. Industry growth @ 26 pc

Mkt share @ 10.4 pc, up 208 bps ( SAHI )

Fastest growing health insurance player

Other Fin services ( insurance and stock broking ) -

Revenue @ 1100 cr, up 2 pc

PBT @ 238 cr, up 26 pc

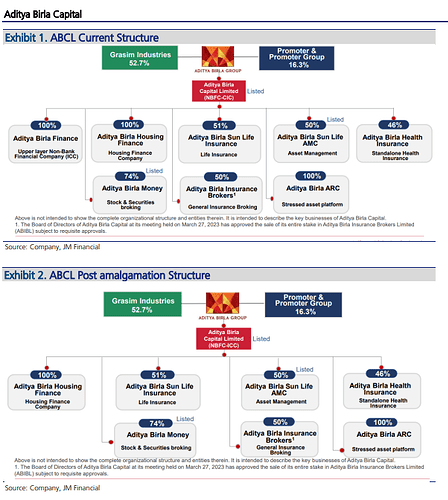

Management commentary -

Added 75 AB Capital branches in Q4. Total branches now at 1295

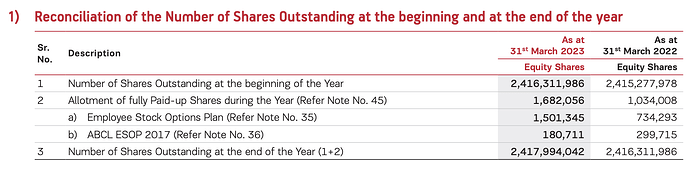

Company announced board of directors approval to raise 3000 cr for business expansion

Loans to Retail, SME, MSME, HNI constitutes 69 pc of loan book

Company focusing on granualisation of loan book

Avg ticket size in HFC business @ 25-30 lakh. HFC branches at 128

Health insurance claim settlement ratio at 96 pc (one of the highest in the Industry )

Capital raise in expectation of pick up of growth in Indian Economy

To be used for growth of both lending and protection businesses

A heavy chunk of company’s lending business comes from Fintech partners like Paytm. However, company has a direct connect with the customers while disbursing and collecting EMIs, also has access to their data etc

This was a concern that I also had. I think the management’s clarification on the same was satisfactory

Has launched a lending app - Udyog plus to capture micro SMEs. Company believe that this may be a big growth engine in the future

70 pc of NBFC book is secured

Management continues to be cautious wrt credit quality despite very high growth rates. Most lending happening to customers with credit score > 700

Company will target various Aditya Birla group employees, SME and MSME vendors for additional growth

Avg tenure of unsecured loans at 15-18 months for consumer loans, 18-24 months for SME loans

40+ pc customers are repeat customers in unsecured business

Keep proactively monitoring customer data on a monthly and weekly basis for any stress in the system

Despite rapid branch expansion, company continues to maintain healthy return ratios. Intend to continue on this path going ahead

Breakup of individual life insurance wrt Traditional vs ULIPs at 81 vs 19 pc

Disc: hold a small tracking position