In India Holdco discounts are much steeper. The following linked article states that HDFC has the least Holdco discount and that too at 25%.

Great article! Thanks. They make a good case for HoldCo discounts being too high in India and what constitutes a good HoldCo vs a bad one.

I think in AB Cap’s case, whichever way you dice it: Increase the HoldCo discount above 20% or increase the underlying business multiples, it does seem undervalued. We should not penalise it twice by assuming the worst of peer multiples and by assuming a very high HoldCo discount too.

Aditya Birla Capital’s CEO Ajay Srinivasan’s account of the how the company coped up with the pandemic.

Part 1

Part 2

Part 3

Interesting theme playing out in Aditya Birla Capital. Was reviewing the June 2020 results as well as the Investor presentation for Management commentary. I understand that currently, the profitable businesses are the lending business (NBFC + Housing Finance, Broking as well as AMC). Life insurance and health insurance continue to show traction on the topline and increased underwriting. However, claims % are also fairly high making these businesses marginally loss-making.

But an interesting thing to note is the steep discount on the profitable businesses being AMC and lending businesses. Comparable businesses in the AMC such as HDFC AMC (AUM of 3.6 trillion), Nippon (AUM of 2.7 trillion), etc. the competitors are valued at > 30-40 times its earnings. If one were to look at Market Cap to AUM ratio, those Companies are in the range of 7% - 12% depending on market share and sizes.

NBFCs and Housing Finance companies given the COVID scenario have taken a huge hit given possibilities of lower collection efficiencies and higher credit costs, so typically trade at 1-1.5 times book value.

Now going to the marginally loss making businesses of Life and health insurance. It would not make sense to look at the CY PE but look at a forward PE. Solvency ratio is 186% which is marginally lower than industry competitors. The trend for insurance in India both life and health has tremendous opportunities given the low levels of penetration of the industry. Insurance to GDP ratios of the Country stands at a meagre 3.7% as compared to over 19% in the Hongkong and Taiwan. The ratio is about 12% in the US. Now undoubtedly a large chunk of this growth will go to LIC but historically, there has been no business which is controlled by the Government which has created and maintained wealth over longer periods of time.

I am willing to bet that inefficiencies and lack of technology adoption will likely slowdown the Goliath (LIC) which will enable private players to claw into the market share. The current market cap of Aditya Birla Capital is about the same as Nippon Asset (similar AUMs). There is effectively no value given to the lending business (which as per the Investor Presentation has no ALM risks (no asset-liability mismatches)) and has a healthy book. There is again no value given to the Insurance businesses (health insurance has seen tremendous growth in the last 1-2 years of over 5x premiums written). There is again no value given to the broking businesses as well. All these businesses are profitable businesses (ex-insurance) and an important thing to note is that the Company has an AUM of over 3.5 trillion (including AMC AUMs).

Could this be an opportunity? Time will certainly tell.

PS: The listing happened at ~ Rs. 250 per share, the CMP is Rs. 61.

What is being observed is just so very obvious. There is nothing that is written what anyone else don’t know.

So the correct way is to understand is WHY Is this so ?.

- Holding co, so trades at a discount,

- Management takes hefty salaries but never bother to share a penny in profit with shareholders.

- AMC stake is only 50% so do maths accordingly.

- Insurance is consuming cash.

- Consolidated ROE of business is less then 10-15%

- Even when banks/financials were booming still it was a value destroyer.

- Birla listed it at Rs 250 / MCAP of 50k crore and they themselves brought preference shares at 90-100 odd Rs.

All I am saying is market seldom is wrong unless an individual knows what other don’t know or time horizon is longer (Is this an opportunity cost or opportunity one has to decide)

Not saying anything conclusive but my understanding why it would be a TOP pick when opportunity are plenty. Go and do the valuation of SBI on similar parameters and you will have an answer.

Anyways Market is supreme. This analysis is on hindsight basis and as things changes we change too.

Aditya Birla Sun Life Mutual Fund, among India’s top five asset managers, is in exploratory talks to raise up to Rs 2,500 crore in an initial public offer. The fund house, a joint venture between the Aditya Birla Capital and Sun Life, has met about half a dozen local and global investment banks that are currently pursuing feasibility study of the proposed share sale, multiple sources with knowledge of the matter told ET.

Can you please explain how the propsed IPO of AB sunlife will impact the existing AB capital shareholders? Will the AB capital shareholder get a chance to apply for IPO at reduced price?

Well this doesn’t seem as great an advantage as it sounds because any outsider could buy AB capital shares before its AMC IPO & then apply for IPO (with discounted price for holding co. owners).

Yes, if existing shareholders were to get AB MF shares for free… then that will be a positive impact…

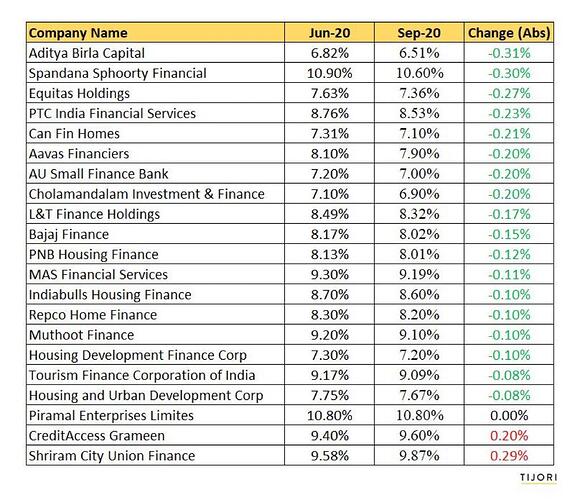

How is it that ABCapital has lower cost of capital than HDFC ?

this is the average cost… HDFC has a very large deposit base and retail Time Deposit have a higher interest rate compared to institutional money…but it is more stable…

this could be the reason of higher cost of capital for them…

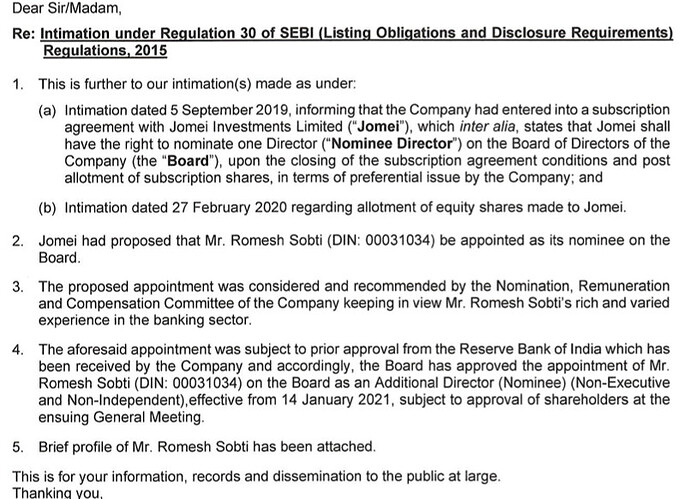

AB Capital looks best positioned among the large NBFCs to acquire a banking license should RBI decide to accept the working committee’s recommendations.

Looks like they are building talent-pool in case bank license is granted.

How much its possible to get a bank licenses with 51% stake in life insurance and health insurance and aum business,GI broking.If bank license is target not only talent pool couple of stable business needs to be listed first.Dont know what KM Birla and Ajay Srini is thniking.

Not directly related to this discussion.

The results are decent. Does anyone know Embedded Value of Life Insurance business ?

Invested in the stock for long run, betting on insurance business of this company than others.

Insurance busniess is valued at 20000 cr, AMC busniess at 25000 cr, NBFC and Housing at minimum 10000 cr, if demerged than it will go 60000 cr market cap.

EV was 5,727 cr as of Sep 30, 2020.

Whilst it’s good to look sum of parts valuation, I would like to recall the unwinding or merger of Aditya Birla nuvo into Grasim.

The minority investors lost heavily as for no reason the 100% owned subsidiary of Aditya Birla Nuvo - Aditya Birla Capital (ABC) , ownership was first forcefully merged into Grasim (by way of some preference shares and some other instruments) thus giving only (if memory serves right) less than 40% of ABC. In effect promoter family increased their ownership into ABC at the cost of minorities.

While previously when Aditya Birla Nuvo demerged Aditya Birla Fashion, the effective ownership mirrored that of Aditya Birla Nuvo, hence neither any reward or cheating the minorities happened in Aditya Birla Fashion demerger.

Thus one need not think that ABC ownership of all it’s subsidiary and their gains would be rightfully shared with minorities.

Yes, this is precisely my concern as well. Wanted to invest at 44 levels but waited till 200 day EMA was crossed to invest. Not impressed with results in NBFC division. Both Life and Health insurance are doing well in terms of revenue. I liked the website, how the health insurance products were sold to me. They have a strong pact with Axis Bank and have done nearly 100 crore in sales through them alone. If they are able to replicate that with HDFC bank as well and maintain a healthy claim ratio in Health Insurance then I feel its worthy to hold AB capital rather to wait for listing of Aditya Birla Life Insurance.