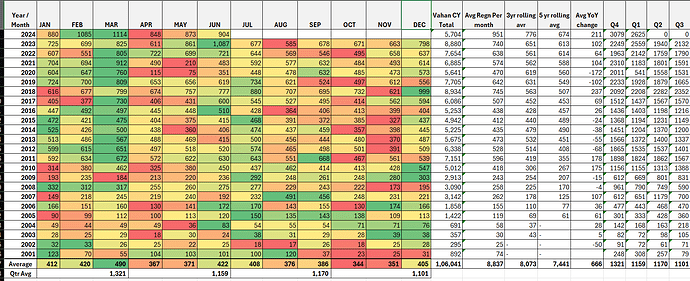

Updates for May Volumes in Vahan Registrations:

- 873 for May month

- Minor changes in VAHAN data for earlier months.

- Seasonal trend + Election related slowdown (MoM) was obvious in Apr & May. YoY the numbers are better.

- June will be crucial to see a pickup in volumes

As Mr Agarwal has previously iterated that Monsoon months are lean period for them however the traction in Infra if continues then numbers would be slightly higher as compared to same months in previous year but don’t expect a big jump. Post monsoon activities will pick up pace so does the numbers for ACE.

Disc: Invested from covid lows.

With the government’s focus back on the agriculture sector and good monsoons, can we expect ACE’s agri division to benefit?

+

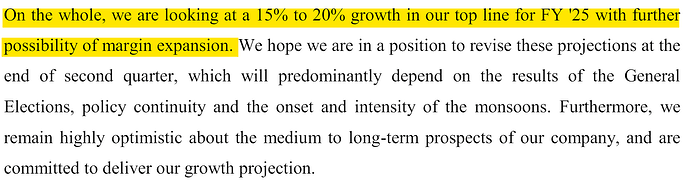

Conservative guidance debunked -

Q4FY23

Delivered - 35% growth in revenue and 103% growth in PAT.

Q4FY24

Deja vu? I believe the margins will shoot up by another 200 BPS easily, considering the fact that the capex on cranes and material handling is now complete there is no slowdown in the infra story of India whatsoever, and the CEV V norms.

While promoter selling stakes isn’t necessarily bad, for they can do so for myriad reasons just thought it is worth pointing. Took entry recently more as a technical bet coming out of a decent 3 month consolidation.

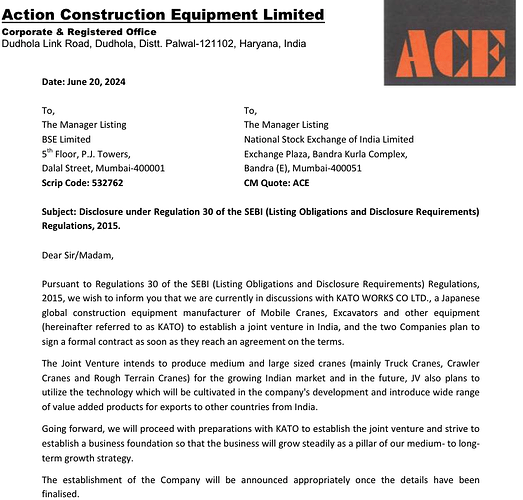

Finally it comes, although not finalized, but seems the market rumours on 18th June has triggered this Exchange filing. Seems going the Escorts way, (possibly not confirmed) JV with Japanese player first, then possible equity and then finally takeover. Incase of Escorts this took 5+ years from initial JV.

“Pursuant to Regulations 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, we wish to inform you that we are currently in discussions with KATO WORKS CO LTD., a Japanese global construction equipment manufacturer of Mobile Cranes, Excavators and other equipment (hereinafter referred to as KATO) to establish a joint venture in India, and the two Companies plan to sign a formal contract as soon as they reach an agreement on the terms.” Detailed Exchange Filing on JV Notification Link

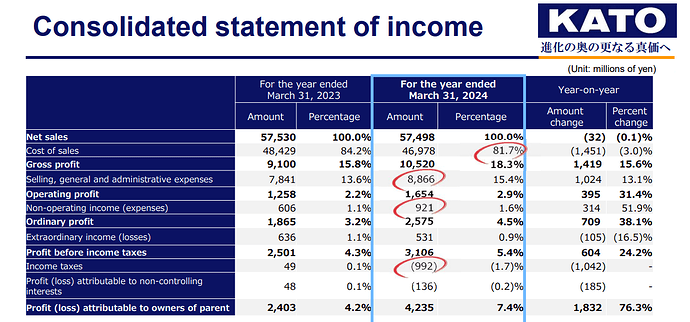

More details on KATO below. Note: 1 INR ~ 1.9 JPY

Business Profile: KATO WORKS CO., LTD.

Company Overview

- Founded: 1895

- Established: 1935

- Headquarters: Shinagawa-ku, Tokyo, Japan

- CEO: Kimiyasu Kato

- Employees: 1,009 (as of March 2023)

- Industry: Manufacturing of mobile cranes, construction, and industrial equipment

Product Range

Kato Works Co., Ltd. specializes in the development, manufacturing, and sales of various heavy machinery and equipment, including:

-

Mobile Cranes

- Rough Terrain Cranes

- City Range Cranes

- All Terrain Cranes

- Truck Cranes

- Crawler Cranes

-

Construction Equipment

- Hydraulic Excavators

- Mini Excavators

- Earth Boring Rigs

- Crawler Carriers

-

Industrial Equipment

- Vacuum Trucks

- High-Speed Street Sweepers

- Snow Sweepers

- Compact Track Loaders

Financial Data (in Million JPY)

Kato Works’ financial performance over the past five years has shown variation in revenue and net income. Refer to (PitchBook) (Investing.com)…

Strategic Initiatives

Kato Works is committed to sustainability and has been focusing on developing and commercializing models aimed at achieving carbon neutrality. This focus aligns with the global emphasis on environmental considerations and positions Kato Works as a forward-thinking leader in the heavy machinery industry (Kato Works)…

For further detailed financial statements and company updates, you can visit Kato Works’ Investor Relations page (Kato Works).

Stock Performance Details

- Stock Symbol: 6390.T (Tokyo Stock Exchange)

- Current Stock Price: ¥1,297.0 (as of the latest trading day)

- Market Capitalization: ¥15.2 billion

- Shares Outstanding: 11,716,844

- 52-Week Range: ¥1,097.0 - ¥1,575.0

- Beta: 1.088 (a measure of stock volatility in relation to the market)

- Dividend Yield: High dividend yield indicating strong returns to shareholders (Financial Times) (Investing.com).

Price-to-Earnings (P/E) Ratio

- Current P/E Ratio: 4.65

Might make sense to buy KATO on Nikkei ![]() Revenue wise it is similar than ACE for this yr, but ACE might grow much much faster in next 3-5 years. Also ACE profitability is much higher. ACE should reverse merge

Revenue wise it is similar than ACE for this yr, but ACE might grow much much faster in next 3-5 years. Also ACE profitability is much higher. ACE should reverse merge ![]()

The numbers in their presentation are different. Can you please help regarding where these numbers were posted?

I’m trying to understand the rationale of this?

- do they get access to higher product catalogue?

- do they get to utilise Kato’s global distribution network for distributing their own range?

- what’s the strategic rationale for JV?

June End VAHAN Regn Numbers for ACE -

- 904 Regn in June till now, higher than May, Apr.

- 2625 Q1 FY25 versus 2559 in Q1 FY24 YoY, 3079 Q4 FY 24 for QoQ

- If similar number continues, we will see 10K for the year,

I can see the ACE cranes all over here in Hyderabad. This really gives me conviction of staying invested in ACE. I’ve been here since quite a while now and I can only see the construction activities growing like anything. Not just new buildings are erected but the old ones are moving into redevelopment as well. So the future seems bright for ACE.

Hello all. I had a question reg the shareholding at ACE. Clearly, the stock has done exceedingly well post March 2020 along with a solid increase in earnings. The story is pretty straightforward and part of the infra/capex theme that the market clearly loves right now. So the question then is, why is it that MF holding in ACE is only at 0.4%? This was near 2.9% in the Sept 2022 quarter which in itself was quite low. At a market cap of 17000 cr+ with a 34% free float, its a little surprising that MFs have such low exposure to such an obvious infra/capex name. While there is nothing wrong in this and there will always be exceptions, one of my filters for determining any unknown CG/quality issues is to see MF holding % which seems a little odd in this case. Similarly, there doesn’t seem to be much active sell side coverage for this name either considering its size and the sector it operates in (this is probably a function of the earlier mentioned issue itself i.e. lack of enthusiasm from MFs/DIIs towards this name).

Any thoughts?

Disc : Invested for several years

I think numbers aren’t going to remain the same, they will only improve as there was a demand slowdown due to elections.

Good numbers YoY during Election Year, Monsoon Season. Expect better peformance in coming qtrs. Awaiting concall for tomorrow. Might get update on KATO WORKS:

July End VAHAN Regn Numbers for ACE -

- 887 Regn in July’24 vs 677 in July’23 (+ >30%)

- Q2 is usually weaker vs Q1 due to monsoons. If we see Q2 numbers nearing Q1, then also the sales will be good. This will give an indicator of robust performance in coming Q3 and Q4

Action Construction Equipment Q1 FY25 Analysis: Key takeaways!!

Action Construction Equipment (ACE) demonstrated strong performance in Q1 FY25, achieving its best-ever Q1 results despite the impact of general elections. The company reported a 12.82% year-on-year revenue growth to INR734 crores, with EBITDA margin expanding by 212 basis points to 17.11%. This resilient performance indicates a positive outlook for the company, supported by government infrastructure spending and growing demand across segments.

Strategic Initiatives:

-

Joint Venture with Kato Works: ACE has reached an in-principle agreement with Japanese manufacturer Kato Works to establish a 50-50 joint venture in India. This partnership aims to produce medium and large-sized cranes, including truck cranes, crawler cranes, and rough terrain cranes, for both domestic and export markets.

-

Expansion into Higher Tonnage Cranes: The company is focusing on expanding its product range to include higher tonnage cranes, addressing the growing demand for larger capacity equipment in infrastructure and construction projects.

-

Electric Crane Development: ACE has developed electric cranes and is awaiting government approvals for commercialization, positioning itself for the transition to cleaner energy solutions in the construction equipment sector.

Trends and Themes:

-

Shift towards higher tonnage cranes: The market is gradually moving from 15-ton to 20-25 ton cranes, with expectations of 30-35 ton cranes becoming more popular in the coming years.

-

Increasing adoption of new generation cranes: The market share of new generation cranes has grown from 5-10% to about 35% in recent years, indicating a shift towards more advanced and safer equipment.

-

Growing demand for tower cranes: The tower crane market is booming, particularly in the real estate sector, with ACE expecting a 20-30% increase in tower crane production this year.

Industry Tailwinds:

-

Government infrastructure push: The central government’s continued focus on infrastructure development, with a capex budget of INR11.11 lakh crores, is driving demand for construction equipment.

-

Pre-buying ahead of emission norms change: The upcoming transition from BS IV to BS V emission norms is expected to drive pre-buying in Q3, potentially boosting sales.

-

Revival of private capex: Increasing private sector investment in infrastructure and construction projects is creating additional demand for cranes and construction equipment.

Industry Headwinds:

-

Seasonal slowdown due to monsoons: The construction equipment industry typically experiences a slowdown during the monsoon season, affecting short-term demand.

-

Intense competition in certain segments: The presence of Chinese players in the truck crane and crawler crane segments has intensified competition and pricing pressure.

Analyst Concerns and Management Response:

Concern: Impact of elections and monsoons on Q1 performance.

Response: Management highlighted that despite these challenges, the company achieved its best-ever Q1 performance and expects momentum to improve post-August 15th.

Concern: Margins in the agri division.

Response: Management expects demand to improve with the advancement of monsoons, better liquidity, and consumer credit availability.

Competitive Landscape:

ACE maintains a strong position in the pick and carry crane segment and is a leader in tower cranes. The joint venture with Kato Works is expected to strengthen its position in the higher tonnage crane market, where Chinese players currently dominate.

Guidance and Outlook:

The company has reiterated its guidance of 15-20% growth on a consolidated basis with sustained margins for FY25. Management expressed optimism about potentially revising these projections upward by the end of Q2 or early Q3.

Capital Allocation Strategy:

ACE has acquired 82 acres of land for capacity expansion, with plans to start development on 22 acres as early as Q4 FY25. This indicates a focus on organic growth and capacity enhancement to meet increasing demand.

Opportunities & Risks:

Opportunities:

- Growing infrastructure investment in India

- Expansion into higher tonnage cranes through the Kato Works joint venture

- Potential for increased exports leveraging the Kato network

Riskemphasized texts:

- Dependence on government infrastructure spending

- Cyclicality in the construction and real estate sectors

- Intense competition in certain product segments

Regulatory Environment:

The transition to BS V emission norms for construction equipment is a key regulatory change that could impact the industry. ACE is positioning itself to benefit from pre-buying ahead of this transition.

Customer Sentiment:

Management indicated strong interest from major construction companies in their new products, particularly in electric cranes and multi-activity cranes (NX series).

Top 3 Takeaways:

- ACE’s strategic joint venture with Kato Works positions it for growth in the higher tonnage crane segment and potential export opportunities.

- The company’s focus on new generation cranes and innovative products like electric cranes and multi-activity cranes demonstrates its commitment to technological advancement.

- Strong government infrastructure spending and the revival of private capex provide a favorable demand environment for ACE’s products in the medium to long term.