Hi All,

I’ve been a (near silent) reader here for quite some time, and thought it’s finally time to start sharing my thoughts and learning journey.

I plan to write about how I think about investments, analyze opportunities, and most importantly - what I keep learning along the way.

First, a bit about me - I’ve worn different hats in my career. Started as an industry analyst and business consultant, then tried my hand at entrepreneurship (including a failed food-tech startup that was conceptually similar to Zomato/Swiggy). Later, I advised startups on fundraising, which gave me an interesting outsider’s view of the startup investing world. These experiences have shaped how I look at businesses and investments today.

Let me be upfront about a few things. I’m fortunate to be financially free, and this privilege allows me to think about investing differently.

I’m not chasing aggressive returns or looking for the next multibagger - honestly, I don’t think I have the skills or temperament for that.

Instead, I’m aiming for steady returns that modestly beat the market over 10-15 years.

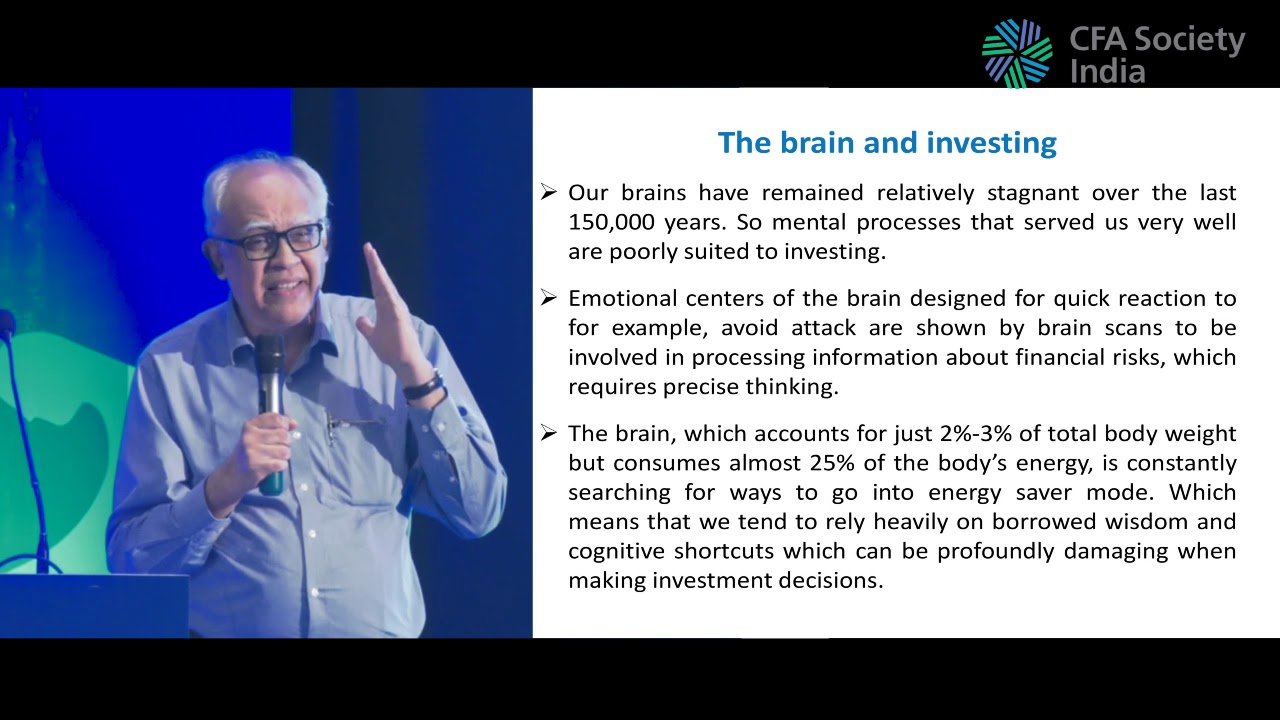

Something I’ve learned the hard way: in investing, temperament matters way more than judgment. I’d say it’s 85-90% temperament and 10-15% judgment. Most experienced investors actually get the analysis part right - it’s the emotional discipline that makes the difference.

I have two painful personal examples: I sold SRF and Persistent Systems simply because their stock prices weren’t moving quickly enough for my liking. The analysis was right, the businesses were executing well, but I lacked the patience to let the story unfold. Looking at their stock prices today makes me wince, but it’s a powerful reminder that great investments often test your patience before rewarding it.

Here’s what you can expect from my posts (I’ll try to write 2-4 times a month):

- Learnings about industries/sectors

- How I analyze businesses within their value chains

- Mistakes I’ve made and what they taught me

- General musings about investing and life

My approach might seem overly cautious to some. I maintain a high level of skepticism, especially about promoter actions.

My investing strategy has evolved after mistakes I’ve made over the last 14 years. Now, I would love to find great companies that keep growing profits without compromising their balance sheet quality, while their stock prices stay flat or even decline - makes my job of finding new ideas easier!

I do have a confession - I invest a small portion (about 5%) in momentum stocks. Here’s the brutal truth: most humans have an inherent gambling streak, and I’m no different.

This small allocation is my way of acknowledging and managing that gambling itch. I don’t believe in momentum investing as a philosophy - in fact, I think it’s quite the opposite of sensible investing. But I’m also honest enough to admit that I haven’t yet developed the temperament to completely ignore high-flying stocks that everyone’s talking about. Rather than fight this human weakness, I’ve chosen to contain it within strict limits. This 5% exposure satisfies that craving while preventing it from affecting my core portfolio.

I don’t pretend to be an expert here - we have many brilliant minds on VP for momentum plays. As Nomad wisely put it,

“This is momentum investing and is the mechanism by which expensive shares become very expensive, just as cheap shares may become very cheap.”

In this age of information overload, I’ve found immense value in Anand Sridharan’s “Rushmore Yardstick” - the idea of identifying a select few thinkers who truly understand the first principles of their domain. These are the rare individuals who, as Anand puts it, see through the Maya to understand “the nature of the beast.”

My Mount Rushmore includes Anand himself and colleague Pulak Prasad (Nalanda), Nassim Taleb for his insights on uncertainty and antifragility, Howard Marks for his understanding of market cycles, Michael Mauboussin (for analyzing businesses), and Daniel Kahneman for illuminating how our minds actually work (versus how we think they work).

I obsessively study their thinking. I’m quite selective about adding new voices to this list - there’s too much noise out there in the financial world (and I’m probably adding to it now!).

One thing I’ve learned to be wary of is advice from people without skin in the game. This includes most market commentators and financial sh**fluencers. Instead, I focus on learning from practitioners who eat their own cooking.

I try to find anti-fragile companies run by good managers. My focus isn’t necessarily on businesses chasing large TAMs - instead, I look for companies that dominate their niches. The first step in my analysis is always forensic checks - this is non-negotiable. If a business fails these checks, I don’t analyze it any further, no matter how promising the opportunity ahead might look. In analyzing businesses, I place more emphasis on balance sheets and cash flow statements than EPS (P&L). After all, it’s the financial structure and cash generation that help companies not just survive stress but potentially get stronger through different market cycles.

Looking forward to engaging with all of you. Please feel free to disagree, challenge, or share your own perspectives - that’s how we all learn and grow.