Hello All ,

This is my first post with respect to Stock discussion Topic.

Abbott has always intrigued me, and i am trying to understand what makes Abbott the CASH MINTING MACHINE it is.

Topics like Products Leadership, Sales Growth and Consistent Operating Profit margin are well covered in this thread, i want to add another perspective from Cash Position (which should be taken with heavy dose of Salt)

The Calculation is rough and primary glance and not based on deep diving

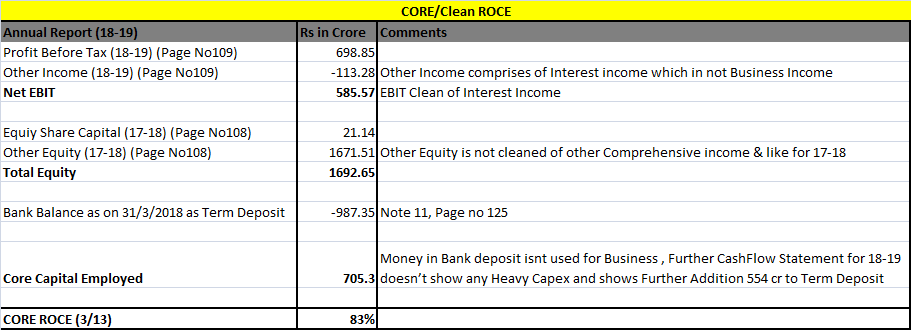

The Core ROCE is 83% and should be higher for current FY !!!

Can we infer that Abbott India is being Financed by Creditor’s and whole of PAT is free of any requirement of being Invested back in Business ?

Few Obervation:

Cash forms 52% of Asset side of Balance Sheet and 77% if Net Assets/Owner’s Equity.

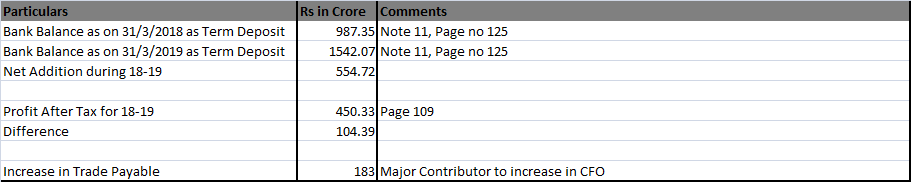

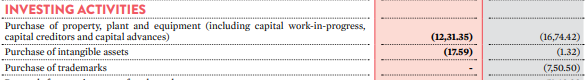

Require’s little reinvestment of Cash = 12 Cr in FY 18-19 and 24 Cr in 2017-2018

The Stock has Embedded Term Deposit of 725 RS (based on 31/03/2019 figures) which seems to be increasing by the day .

Overall The (Liquid) Balance Sheet and High ROCE and Sales Growth and Consistent Operating Profit Margin and Profit being Converted in to Cash makes investor’s Dream Financial Statement.

Please correct me if any of my interpretation/understanding/calculation is wrong/illogical/doesnt make sense. The Calculation are rough and Back of Envelope kind.

Disc: Abbott form >20% of my Portfolio and havent added in last 3 months

Thanks

Harsh