Aarti Pharmalabs Q1 concall highlights -

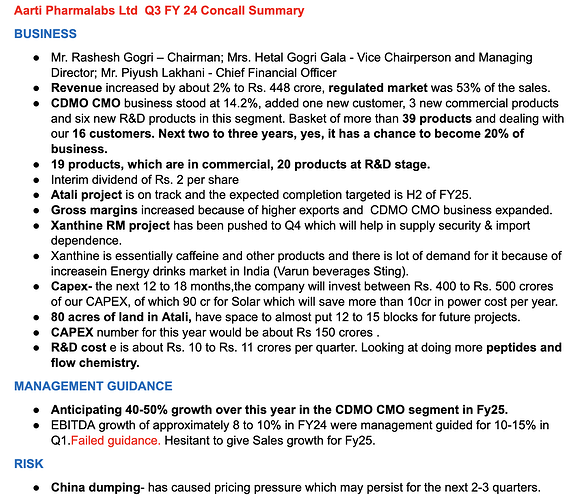

Sales - 458 vs 457 cr

EBITDA - 85 vs 86 cr ( margins flat at 19 pc )

PAT - 47 vs 52 cr (due higher depreciation and tax rate)

Manufacturing footprint -

Dombivali - Unit-1, APIs and Intermediates

Vapi - Unit-2, Api, intermediates, custom synthesis

Tarapur -

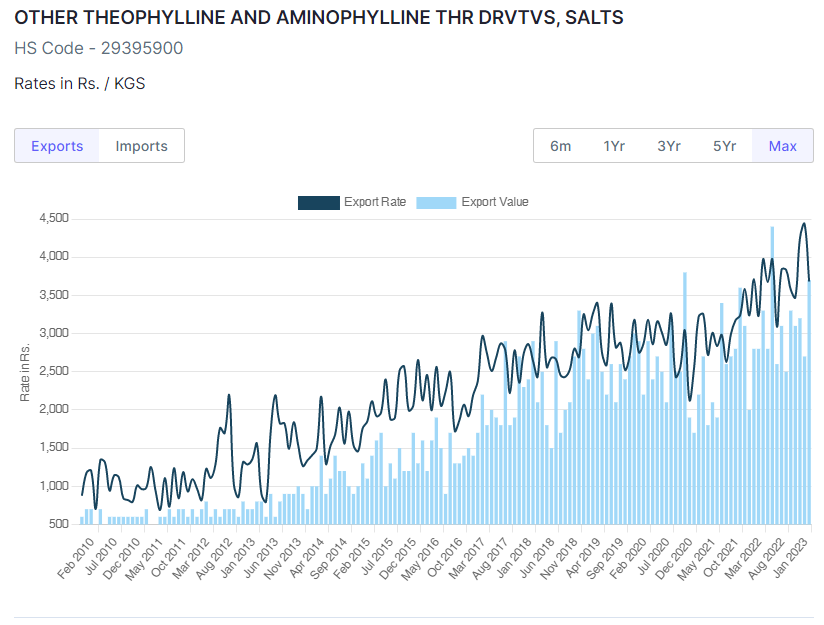

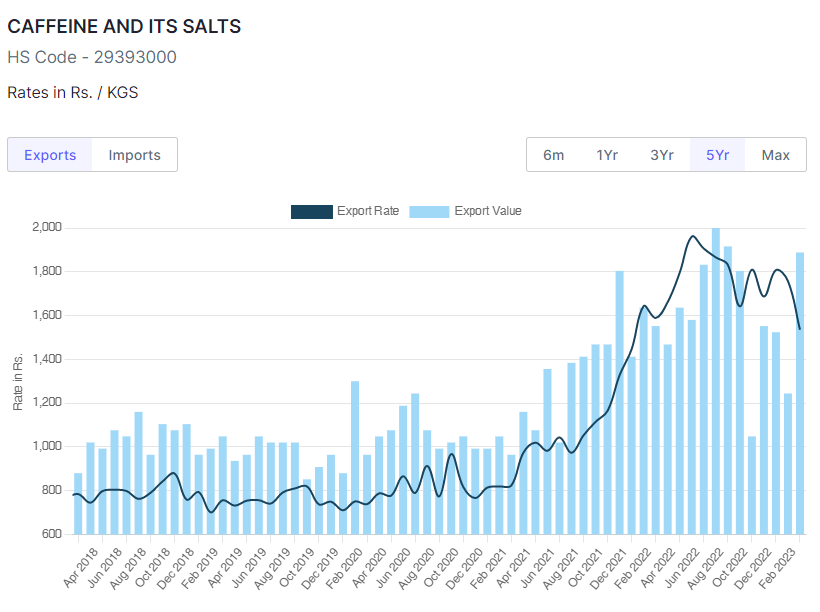

Unit 3- Xanthine derivatives

Unit 4- APIs

Unit-5 - Xanthine unit

Atali - New unit under construction

Vapi- R&D center

Sales breakup-

Xanthine -56 pc

API + Intermediates - 37 pc

CMO/CDMO - 7 pc

Total commercialised APIs - 50

Total APIs under development - 10

US DMF approvals - 40

CEP approvals - 20 - for sale to EU

Company is backward integrated with intermediates for most APIs

53 pc of exports to regulated mkts of US,Europe and Japan

Domestic:Export sales - 46:54

By end of FY 24, company to make one of the main RM used to make Xanthine in-house, currently imported from China

Expanded Xanthine capacity to 5kTons/ yr from 4kTons/yr in Q1

Greenfield project at Atali expected to go live in H2 FY 25

Likely to grow EBITDA by > 15 pc in FY 24

Company has done a capex of > 300 cr in last 2 yrs. Ramp up of these new facilities to take about 2 yrs from now. Asset turns to be between 1.5-2.0

API+Intermediate, CMO business has higher margins than Xanthine. Xanthine prices have been under pressure this yr

03 of company’s plants are US FDA approved

Previous 2-3 yrs were exceptionally good as Xanthine prices were high. Now they ve corrected. Hence the company has moderated its EBITDA growth guidance to 15-17 pc

Medium term EBITDA margin guidance of 20+/- 2 pc

Capex required for Atali Unit aprox 350 cr

Plus the company is likely to do another 150 cr brownfield capex in next 12-18 months

In CDMO space, 12 products are in pipeline ( phase- ii and iii ). Have commercialised 16 products till date. Margins here are better

In APIs, top 10 products contribute 60 pc of sales

Xanthine derivatives have applications in APIs, food and cosmetics. Biggest competition is from China. Company is by far the largest producer in India and caters to 80 pc of Indian demand

Hope that CMO/CDMO business scales up to 10 pc of business this yr

Business focus towards CMO/CDMO has increased in last 3-4 yrs. Atali expansion should further help scale up here

The 16 products commercialised by the company are in the scale up phase - can be a growth driver

More focussed on lifestyle disease APIs that are low volume higher margins. Focus continues to be the regulated mkts of EU, US

Atali capex will largely be used for intermediates & CMO/CDMO of intermediates

Most of big cola companies are customers of Aarti for finished Xanthine

Xanthine and derivates - 60 pc are exported, rest sold in India

Disc : not holding. Planing to take up a tracking position