What to expect from the market?

I don’t know what will happen in the short term. When we invest in equities, we should assume that we will get i) a 10% fall every year, ii) a 15%-20% fall every 2-3 years and iii) a 30-40% fall every 5-8 years. If you are not comfortable with such variations in your holdings, then the stock market is unlikely to suit you.

An important point to remember is that if you keep waiting for the market to correct when things are going well, you will not be able to buy when things take an ugly turn.

Today, the broader markets, especially the mid and small-cap space, took a significant beating. If your instinct was to sell and run away today then how would you be able to buy when there is gloom and doom all around?

There have been multiple studies in the past that staying in the market through its ups and downs is what makes the difference to the long-term portfolio.

Below is the monthly chart of the Nifty 500. You will see that the index has trended upwards even with sharp corrections in between.

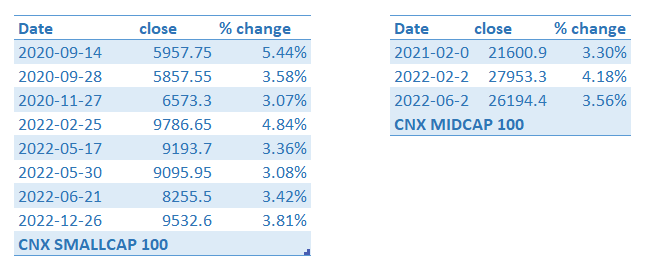

Also, I have attached the number of times the midcap and small-cap indices have taken a sharp cut in the last 3 years (post-Covid).

Fig: Nifty 500 weekly chart

Fig: Fall greater than 3% in CNX Smallcap 100 and CNX Midcap 100 in the last 3 years

What should be done on such days?

Now, on a day like today, when we saw broad-based selling, there are many questions that come to mind. But the main variations are:

- what do I do if I am already fully invested?

- what do I do if I have some cash in hand to deploy?

I don’t have a good answer to any of these questions. I will just say what I do.

When I get into an investment, I have a stop loss in place. The stop loss varies based on many factors but one of the main factors is the duration of expected holding. If I am buying something for the long term, my stop losses (or trailing stops) are much larger than if I am taking an opportunistic bet.

So, on a day like today, I don’t do anything.

In bull markets, there are multiple instances when we see very sharp counter moves for between 1 to 3 days. So, in general, I will not react unless a stop loss is hit. If it is, I will get out.

If I am holding a large percentage in cash, I may even deploy small quantities. The main idea is to ensure that the main trend of the market is not broken before I buy more. And that usually cannot be ascertained in one day.

The actual buy-sell decision will have to be taken over the next 2-3 days.

If I have to buy, I will stagger and buy over the next few weeks. I would also re-evaluate the portfolio to see if any switch needs to be made.

I continue to be very bullish about the Indian markets over the next 3+ years perspective. As such, these falls are opportunities to add cash to our portfolios.

The Macro Bull Case

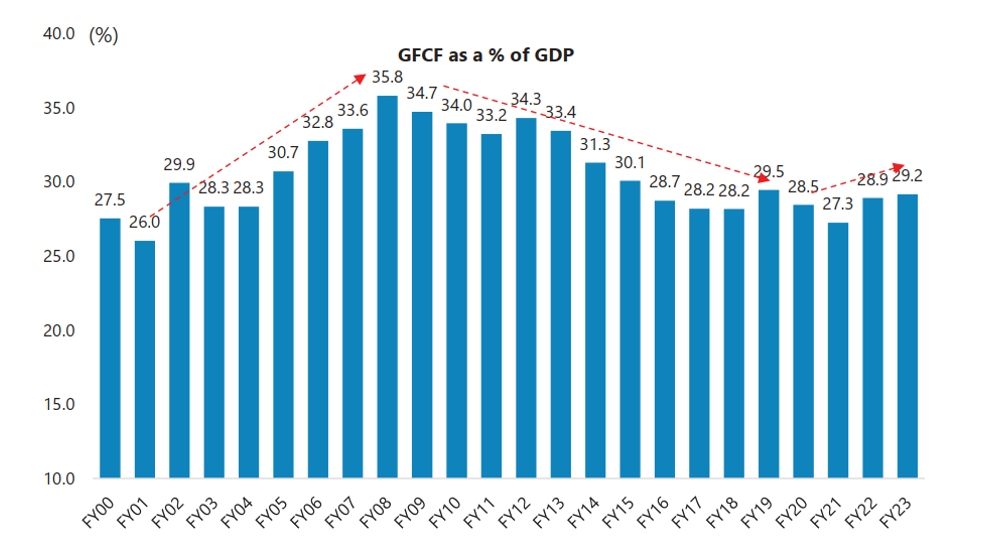

- GFCF (investments) are rising as a % of GDP

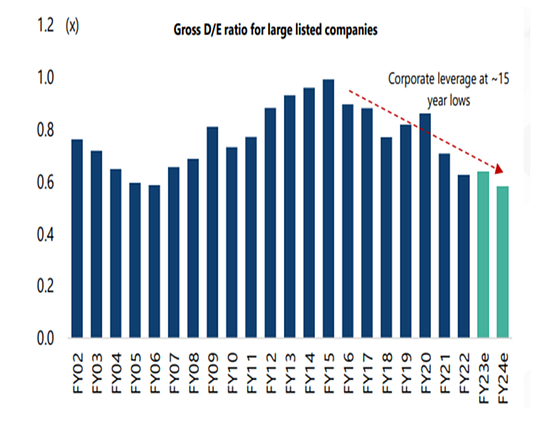

- Bank balance sheets have improved consistently over the last few years

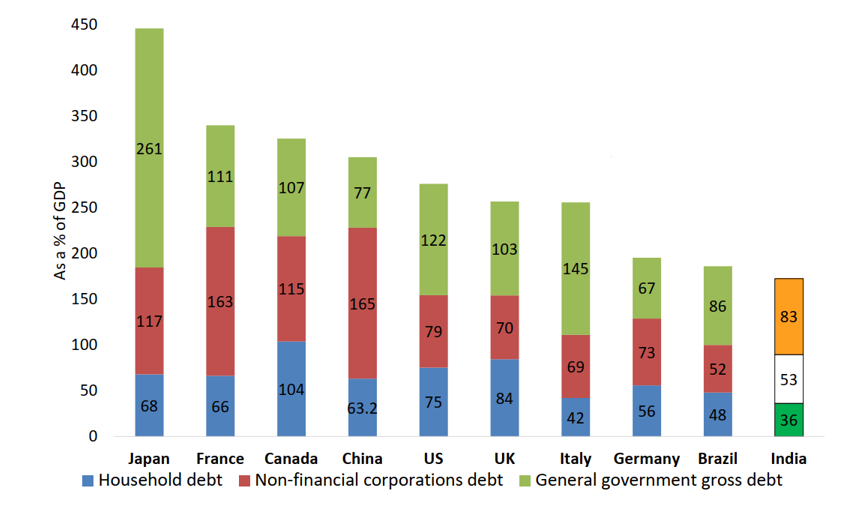

- India has one of the lowest debt as a country giving RBI more manoeuvrability in monetary policy

The Macro Bear Case

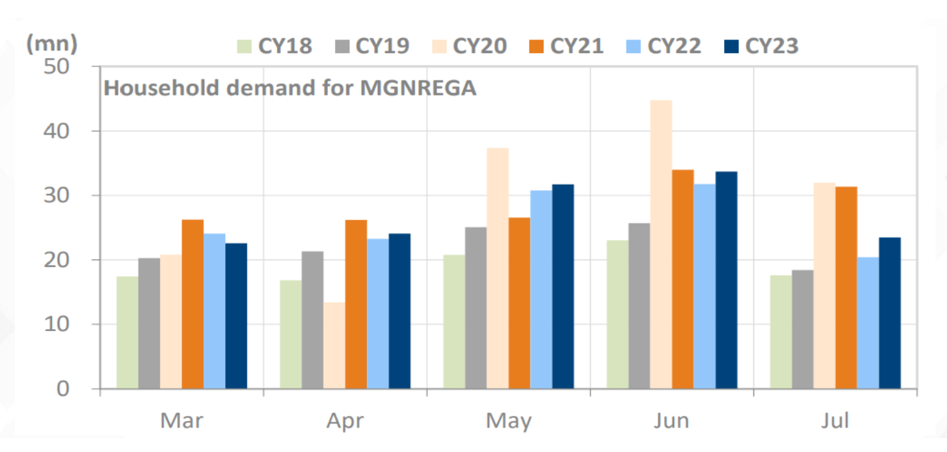

- MNREGA demand uptick signifies a poor rural economy

Crude is inching higher once again and could be headed to $100/bl

In Summary

- Do nothing for now.

- If you have cash, deploy slowly. Once the trend is clear, deploy aggressively.

- Be mentally prepared to book profits or losses if the market worsens quickly.