IIT madras management…good priducts, exposure to growth market but last 15 years price is stagnant between 50 to 70. What ever they are cooking market is not buying it. If some one is invested in the company they need to ask what is missing for the to be Infosys and what can make them Satyam.

A bit more information shared on vcard. Management is spending as much time as they spend on hospital business. It will be a game changer at Industry level as per the call.

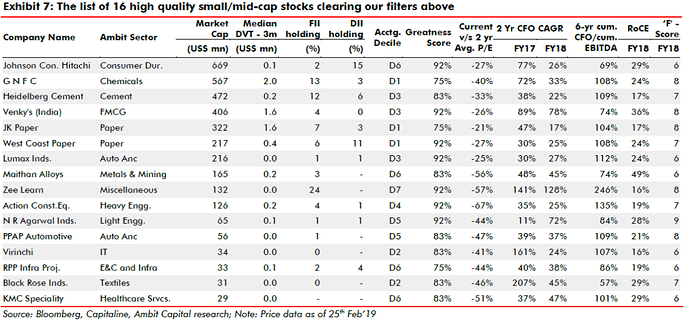

Ambit Capital has selected Virinchi as one of 16 high quality mid cap / small cap stocks with sound fundamentals and attractive valuations. Below is the full list:

Don’t have access to the report but Moneycontrol has summarized it here: Here are 16 fundamental midcap picks by Ambit Capital available at cheap valuation

What a joke of a list!

Paper companies, companies with dodgy governance , Cyclicals,

I dont understand what credibility this gives Virinchi. Being in a list with companies like Venky’s, West coast paper etc:

If anything Ambit has said the the above companies are as mediocre as Venky’s.

I wonder who makes these lists. A portfolio of the above stocks in equal weights would destroy wealth in a few years.

I think virinchi could do well but being in a list like this prepared by Ambit says something negative if it says anything at all!

Virinchi looks very cheap however. Investors can do well I think. All the best.

Yes agreed that many of the names on the list don’t warrant further analysis.

The list is not a buy/sell recommendation but merely a list of stocks clearing a set of parameters. As with any of these lists, they should only be used as a starting point for digging deeper.

Still worth highlighting for those following the company because Virinchi is rarely picked up by equity research analysts.

Promoters have converted 480,000 warrants @ Rs. 100 per share - translating to approx. 1.50% increase in shareholding.

In the recent 8 Lakh share warrants issued on 21st may 2019 to the KMP, it is mentioned that they need to pay 25% upfront and rest can be paid in coming 18 months.

Is this how warrants are generally issued with a deferred payment option? Just trying to understand from the senior boarders.

Source: https://www.bseindia.com/xml-data/corpfiling/AttachHis/3aff7397-3c50-411e-bc08-6f6a03cd0b3e.pdf

Yes this is standard practice for preferential warrants.

Virinchi Q4 and Annual result

Good numbers in healthcare & software product segments and improvements in balance sheet as well.

| INR lakh | FY 2019 | FY 2018 | YoY |

|---|---|---|---|

| Revenue | 41,112 | 34,250 | 20.0% |

| EBITDA | 12,418 | 9,693 | 28.1% |

| PAT | 5,892 | 3,302 | 78.4% |

| Dil EPS | 17 | 11 | 61.1% |

| Net Worth | 31,727 | 25,529 | |

| Net Debt | 15,317 | 14,756 | |

| ROE | 18.6% | 12.9% | |

| ROCE | 20.5% | 16.8% | |

| D/E | 0.48 | 0.58 | |

| Trading multiples as on 30 May 2019 | |||

| P/E | 4.87 | ||

| EV/EBITDA | 3.54 | ||

| P/B | 0.90 |

Great results… Looks undervalued on the holding companys parameters also

Any opinion of the group on the stock at current levels?

These stocks are multibagger in every bull market then goes through hibernation for 10 years or so -

Management had said in Q3 19 that it will come up with a dividend policy in Q4 19. But then they stopped conducting concalls, got rid of their investor relations department.

That’s because from 2008 to 2014 net profit was stagnant.

And suddenly people starts believing in Hospital story in previous bull market. who made money in Hospitals ?

I keep asking Mr. Ravindranath Tagore about any exchange filings and he promptly responds on time.

A company generating 80-90 Cr cash is available at 155 Cr. One of the advantages of bargain sale that happens during down period.

They service around 10 Cr towards debt payments in a year.

Future triggers can be : a) Roping in PE investor for Hospital expansion and b) eventual demerger of hospital division.

Disclosure: Invested.

Hi All,

I am looking to meet the management tomorrow. Please let me know if you happen to have any questions that you want asked. I can ask and share the response.

regards

Few questions from my end:

- What has been the use of funds received from Promoter on warrant conversion?

- What is the status of the PE transaction they had mentioned in the health vertical for which the business reorganization was done?

- Why no announcement on V card last quarter as guided?

- Why was no investor call held this quarter?

- Reason for sale of shares by Satyajeet Prasad? Is he exiting?

- How is debt servicing going and why haven’t they been able to improve the credit rating still? This has been work in progress for over a year now…

- Promoter & KMP have bought shares / ESOPs at 90 - 100 levels. Is there any appetite to support stock which is currently available at 2.4 PE and 0.5 P/B

- Any big picture guidance on short and medium term growth plan would be helpful.

Hi Naruto,

Few questions from my side:

- Why did they stopped Concalls post quarterly results? It provided one of the platforms for regular investors to interact with management and have more details regarding business.

- They mentioned that VCard is taking same bandwidth management as hospital business. Are there any early indicators of traction with Vcard business?Metrics around users or spend would be useful.

- What happened to Dividend policy which was to be announced by Q4-FY19.

- What is the strategy in regards to Hospital expansion. Current capacity of Hyderabd hospital, Plan for further hospital set up etc.

- Minor quip about consultation fees to Chairman. Not the most shareholder friendly decision. Would have been better if they would share the profit with Majority/Minority shareholders equitably.

- How are the Free cash flows used currently: expansion/debt reduction?

Thanks in advance.

When are they publishing the Annual Report.