Vertoz Advertising is a programmatic advertising company listed in NSE Emerge.

Digital advertising category is in a high growth phase due to strong penetration by Jio. Programmatic advertising is a category in it.

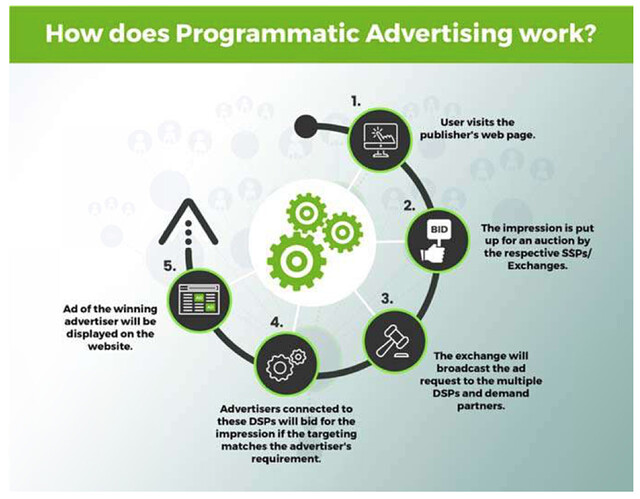

What is programmatic advertising? How does it work?

Programmatic advertising is buying digital advertising space automatically, with computers using data to decide which ads to buy and how much to pay for them.

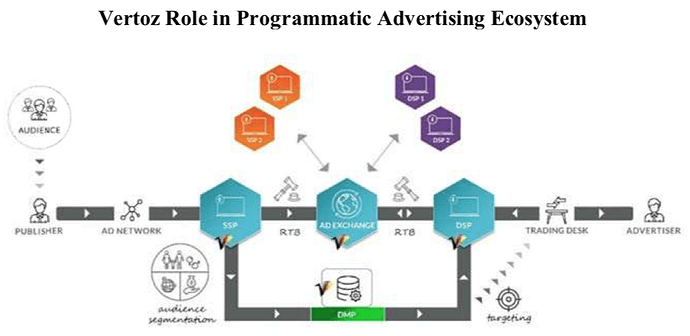

When a user enters a webpage, to create content in the ad space, his data is sent to the SSPs (supply side platforms), which is then sent to ad exchange and an auction is run on the bids allocated by various brands to the DSPs (demand side platforms).

What is DSP? SSP?

A DSP, or demand-side platform, allows advertisers to buy impressions from a wide range of publisher sites that are targeted to specific users based on things like location and previous browsing behaviours. A DSP ‘plugs in’ to an ad exchange, where publishers make their inventory available.

An SSP, or Supply-side platform, is used by online publishers to automate the selling of their advertising space, or inventory. It’s basically the same as a DSP but from the other side. While a DSP used by marketers to buy ad impressions from exchanges as cheaply as efficiently as possible, SSPs designed for publishers to maximise prices they sell impressions at. They’re both powered by similar kinds of technology.

What are the different kinds of programmatic advertising?

Real-Time Bidding (RTB) and Programmatic Direct.

RTB is like an open marketplace allowing businesses to serve ads on a wide variety of websites to only people that meet their buyer personas. Essentially, the software says to advertisers “This is what we know about the person visiting our page based on their browsing history, behaviour, device type, etc. What are you willing to pay to show your ad?”

Programmatic direct method is closer to traditional media buying method. This process allows advertisers to purchase a guaranteed number of impressions ahead of time. Often, publishers will often reserve their most premium placements - on home pages for example - for programmatic direct deals with top-tier advertisers. On the other side of things, advertisers who want to guarantee placements on a valuable publisher can do so in advance.

In the earlier days of programmatic advertising, RTB looked appealing to everyone. The benefits were plenty, and there seemed to be little downside to bidding for impressions across a wide variety of publishers. As an advertiser, as long as you were reaching who mattered, what did you care?

Well, you might care if your brand’s advertisements began showing up next to animations of domestic abuse, or if you were unintentionally funding terrorist organizations by awarding them chunks of your ad budget.

But programmatic direct isn’t ideal for all parties either. It’s transparent but this method has similar issues to traditional media buying:

- It’s slower. Programmatic deals are brokered ahead of time, which means impressions can’t be bought as readily as they can on the open marketplace.

- It’s more costly. Programmatic deals aren’t available directly through all publishers. Mostly, it’s premium publishers who sell their ad inventory this way, which means you’ll pay premium prices for placements.

- It’s not as targeted. If you purchase a set number of impressions on the homepage of the New York Times, you’re paying to show your ads to all visitors to the NYT homepage, not just the ones with the demographics of the target audience.

Self-Serve vs. Fully managed:

Running a self-serve digital advertising campaign allows advertisers to have direct access to their campaigns. Advertisers are able to keep real-time track of their campaigns from the jump, allowing for maximum control and the ability to make changes on the fly such as: Ad group adjustments & creative changes, Site list & target optimizations, budget & bid adjustments. One major benefit of running a programmatic campaign through a self-serve platform is the opportunity to execute everything in-house. The advertiser is within arm’s reach of everything and everyone they need in order to run a campaign, significantly cutting down on turnaround times. Also, the cost of running digital advertising campaigns is almost always more cost-effective than fully managed.

“Managed service” however is quite the opposite. In the case that digital advertising is fully managed by an outside source, be it an agency or otherwise, advertisers can adopt the “set it and forget it” type of mentality. Running a campaign through a fully-managed platform puts the campaign responsibilities in the hands of that platform’s media strategists. The media strategists are the ones who upload everything needed. This can be viewed as a more appealing option to those advertisers who don’t believe they have enough time or resources to run a programmatic campaign in-house through a self-serve advertising platform.

How was traditional digital advertising done before?

Before programmatic marketing, ad space was bought and sold by humans. The process was slow and inefficient, taking RFPs, meetings, and negotiations before an advertisement could be manually published. Online, it worked like this between two parties: publishers and advertisers. Publishers could promise advertisers a set number of impressions to a target audience, and advertisers would purchase that ad space if the target audience was one of their buyer personas.

Lots of online resources agree that programmatic advertising is the future in the digital advertising space. In western countries, 80% of digital advertising is programmatic while it is just 32% in India.

Vertoz Summary:

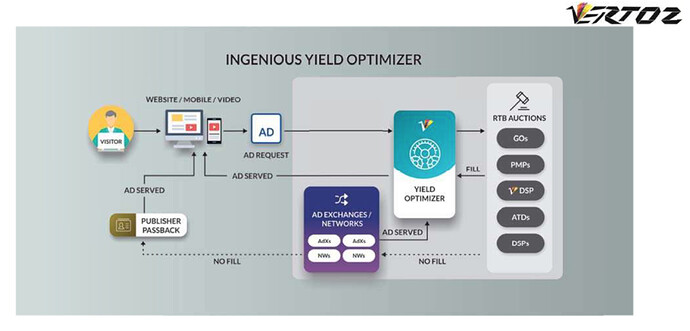

So with programmatic advertising set to boom, this company seems to be a good beneficiary. Vertoz operates in the RTB part of programmatic advertising which is more popular compared to programmatic direct.

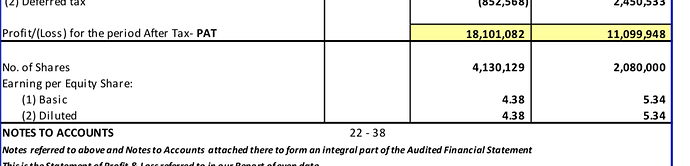

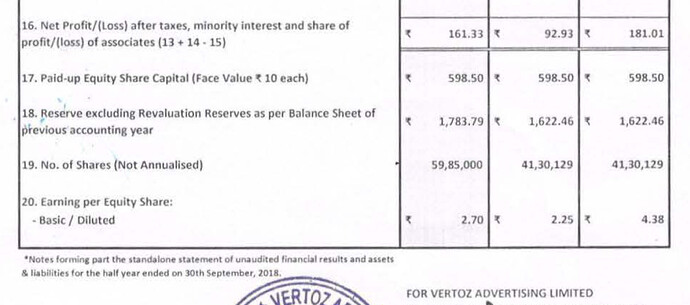

Their consolidated revenues are growing have grown from 11.86 crores to 36.83 crores in from 2016 to 2018 and profits from 36 lakhs to 5.73 crores. This high growth company is currently available at a P/E < 15 with price around 180 and consolidated EPS around 14.

The company also has subsidiaries in US, UK and UAE. It recently setup two step-down subsidiaries in New York, AdZurite and AdMozart.

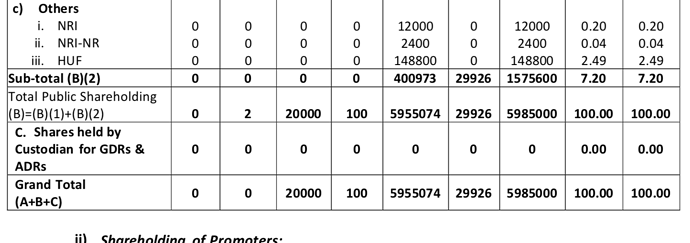

Promoter group holding is high 70%+.

Vertoz deals with both advertisers and publishers creating an online marketplace. It offers self-serve DSP and SSP to advertisers and publishers respectively, which seems to be the future of programmatic advertising as it offers more transparency and control to brands.

Revenue recognition info from IPO filings:

“We generate revenue from advertisers and publishers who use our solution for the purchase and sale of advertising inventory respectively. We maintain separate arrangements with advertisers and publishers in the form of master service agreements, which set out the terms of the relationship and access to our solution, or insertion orders which specify price and other terms. We recognize revenue upon the completion of a transaction, which is when an advertisement impression has been delivered to the consumer viewing a website or application, subject to satisfying all other revenue recognition criteria. We are responsible for the completion of the transaction. We invoice and collect the full purchase price of impressions from advertisers. In some cases, we generate revenue directly from publishers who maintain the primary relationship with advertisers and utilize our solution to transact and optimize their activities.”

Business Risks:

Technological disruption - Ad Tech is a fast moving space. Companies should always keep running.

Competition - An attractive and booming space can invite lots of players.

Need to understand the competitive landscape further yet, but kicking off the thread with some initial research.

Further questions:

How is the relationship with its partners?

Who are the competitors and how do they fare when compared with Vertoz?

What is bargaining power with Brands, Publishers and other partners?

Resources to learn further - Most of the above info is just taken and compiled from these:

https://www.bannerconnect.net/what-is-a-dsp-ssp-and-ad-exchange/

https://choozle.com/managed-service-vs-self-service-advertising/

https://vertoz.com/investor/Prospectus_Vertoz_Advertising_Ltd.pdf

https://www.vertoz.com/wp-content/uploads/2018/08/Annual-Report-2017-2018.pdf

Disclosure:

No holdings yet. Need to understand more.

Not a SEBI registered analyst.

Not a buy / sell recommendation.