The customs notification is here so ADD should take effect from here on.

Thanks to @saintsat for the find.

The customs notification is here so ADD should take effect from here on.

Thanks to @saintsat for the find.

Can someone help explain how much is the ADD on PAN imposed . I understand that the ADD is for 5 years but not sure how much is the ADD

ADD country wise.

Rate is written against each country.

It is varying from 40$ per MT to 140$ per MT

How can we track the Price of PAT and the spread between PAT and Oxy . Can someome help here ?

Also any idea on what is the current price of PAT

No free source for Indian Prices…can look at http://www.sunsirs.com/ for Chinese commodities prices…http://www.sunsirs.com/uk/prodetail-541.html for PA

Also from government import export data one can calculate prices with a lag…latest data is for July…https://tradestat.commerce.gov.in/meidb/comq.asp?ie=i

MA prices are at all time high levels, looks like supernormal profit there. Recent outperformance of Thirumalai over IG might be due to higher proportion of MA in revenues. Tracking PA/Ox spread will not give full picture considering MA/Ox spread is very high.

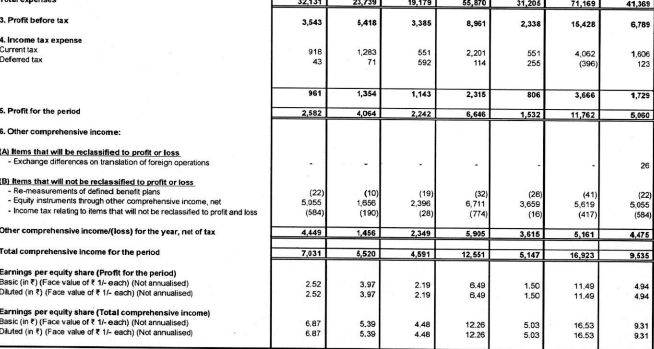

Q2 FY22 results.

Good results (Y-O-Y)

Revenue increased to Rs 481 Crs from Rs 268 Crs (Y-O-Y) and from Rs 399 Crs (Q-O-Q)

Net CFO increased from Rs 68Cr to Rs 237Crs

Cash & cash Equivalents increased from Rs 183 Crs to Rs 414 Crs.

Can anyone please explain why two different EPS have been shown in the result?

I had attended the AGM of Thirumalai Chemicals held today online. Some of the running notes of the AGM are given below (can be some discrepancy in notes as):

• Fortunate that we didn’t lose any of our employees but some of their relatives were impacted due to covid.

• Last 1.5 years we have done well. Largely result of action taken by our staff and management team.

• Some segment of our market like construction and auto were impacted during FY22.

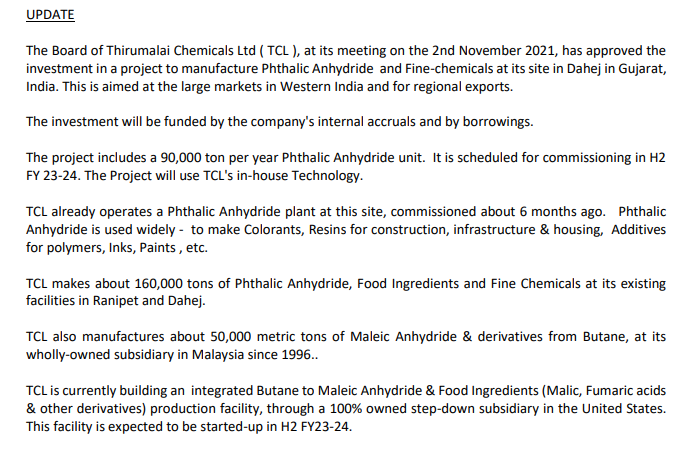

• FY22 we had our largest products, best sales, good profits, margins and cash flow. Our initiatives gave the best results. Our subsidiary in Malaysia had their best year. In previous year, we had set up subsidiary in Europe in Netherland. Started trading effectively and doing well in Europe. Even in US we have our team. These initiatives prepare ourself well for increased capacity in India and US. Our subsidiary in US has progressed well in petrochemicals and fine chemical plant that will make phthalic anhydride and food ingredients. Lost 6 months. Q1FY25 will start operations. Dahej project working. Started work in first phase – phthalic anhydride and fine chemicals. 20% addition due to phthalic anhydrite and fine chemicals due to debottlenecking will come by second half of FY24. Post expansion will expand geographically. Both projects are near RM procurement regions. During the last 3 years, board and management has worked very hard. In management, in operating team we are well versed with these challenges. Confident to work on multiple projects at the same time.

• Q1FY23 was a good quarter – able to meet our target. Rest of the year started to see some headwinds due to recessions – this will affect our results. May have downward pressure on margins due to this. Will handle the issue capably.

• We are largely in commodity business but have some fine chemicals and food business. Commodity business is highly volatile. We are seeing headwinds in last one month. If there are variations its on account of pricing being decided by the markets. Customers import internationally or buy from us. Producers from other countries sell in India where margins and prices can be lower. That is why margins are volatile. We cant control it. However, we do control costs and whatever is in our hand.

• Dahej investment is between 500 – 600 crore funded partly by debt and partly by equity. US investment is USD 100 – 150 million and mixed through debt and internal accruals.

• Our challenge is to reduce bad nos during worse times and maximize profits during good times. Focus on cash flows

• Existing capacity – 150,000 MT capacity in Ranipet and 20,000 MT in Dahej – grow 20% in Ranipet. Dahej adding 100,000 MT capacity. US adding 45,000 MT pthalic anhydride capacity being added. Demand is good – its still growing fast in pthalic anhydride – demand being met through imports.

• Malic Anhydride spreads and opportunity size? Capacity in Malaysia? Debottlenecking there?

• Malic acid – recovery by waste way?

• Malaysia and India have done well. Malic Anhydride made in Malaysia. Used to produce coatings, special paints, used in FRP – reinforced polymers, polyester resins and plastics, food ingredients, pharmaceutical products. Very wide use – pesticides. Lot of downstream products go into automotive products.

• Phthalic anhydride is used to make paints, pigments – blue and green etc. Fine chemicals and food ingredients – squashes, processed foods – idli, dosa, beverages etc – thousand used. Oil and drilling industry. Malic acid largely used in food and beverage industry.

• Markets doing? Markets doing well. Largely sold out and will continue to be sold out this year and next year also. We hardly carry any inventory. Strong activity by the government due to inflation and due to Ukraine war there is decrease in demand which is expected to take place like construction, food, infrastructure etc. This will impact China and whole globe will start slowing down. We are going to see compression in GDP globally. We sell our products to paint industry for construction and automotive industry. All these industry won’t be isolated from the slowdown. We will also have softening of prices of our product. We will run at full capacity. Capacity utilization currently is 95% in India and Malaysia.

• Cannot say we will be flat for this year. We expect to be flat for next 2 months. Things change and recover fast.

• Enough space for us in domestic markets.

• We strengthened our team and bought a new CEO, new head in Ranipet and even in Dahej. We are strengthening our team

• Fumaric acid is made from waste in phthalic anhydride plant. Chemicals extracted from it is used to make fumaric acid. Similarly, we will be doing lot of fumaric acid in Dahej as well.

• Cannot talk about how much we will borrow and how much will be internal accruals. But we are conservative. We are not being extreme in our borrowing. We are funding the capital.

• We don’t want to go to BDO and plasticizers. BDO has become a commodity. Our intention is not to increase commodity side. BDO went through terrible times few years back. 95% capacity utilization in Malaysia.

• Speed of execution – we need to get approvals first – take 6 month to 12 months. Project execution time is 3 years – 30 months atleast. Trying our best to do things fasters. ADD continues in phthalic anhydride. Will bring new capacities online as soon as possible.

• Net cash of around 280 crore as on March 31, 2022.

(Disclosure: Invested with 1 share to attend AGM)

Just wanted to renew interest in Thirumalai due to falling stock price. It has been a good long term performer with good balance sheet.

even the promotor has picked up stake as another measure of confidence.

The chart is looking good, anyone tracking the story and prices of products?

Margins can reverse back to mean.

Fixed Asset can go to 1500 post CAPEX and Asset turn is 3x so sales will be 4500cr. so Peak Market Cap around 9000-11000 cr.

The problem with such type of businesses is that they don’t do Concalls, so we retail investors unable to identify what is happening inside the company.The only way to get the inside is scuttlebuts.

Thirumalai Chemicals is at the bottom of the downcycle. Even margins are at the bottom, mostly margins also gets bottom near 4%-7%. Prices of P.A & O-xylene are now much stable. So, i feel things should look good by next 1/2 quarters.

Sir can you please substantiate the below data (written by you) with any proof, if you are speculating then why in this forum,

Chinese dumping was also expected to stop by Q3FY24.

I think I read it in one of the Concalls of I.G petro or rating report by Fitch.

Could not find any where, please provide link or copy, paste the report.

Speculation, mis information can not be part of a research.

Investors get influenced by content in this platform, utmost care and validation required before posting anything here.

Underlying thought process is you are wrong if you are quoting some one they’re also wrong, the rating agency credibility diminish when such matters high lighted, and I will do that if you provide the evidence.

Thank you.