Just like how taking out of 80:20 and allowing of gold metal loan facilities are good tailwind of thangamayil (for most jewellers), isn’t it possible that RBI may stop these two facilities if there is pressure on rupee again? Has someone thought of what could be the possibilities of RBI rolling back these two? Atleast any near forecast on indian current account impacting it??

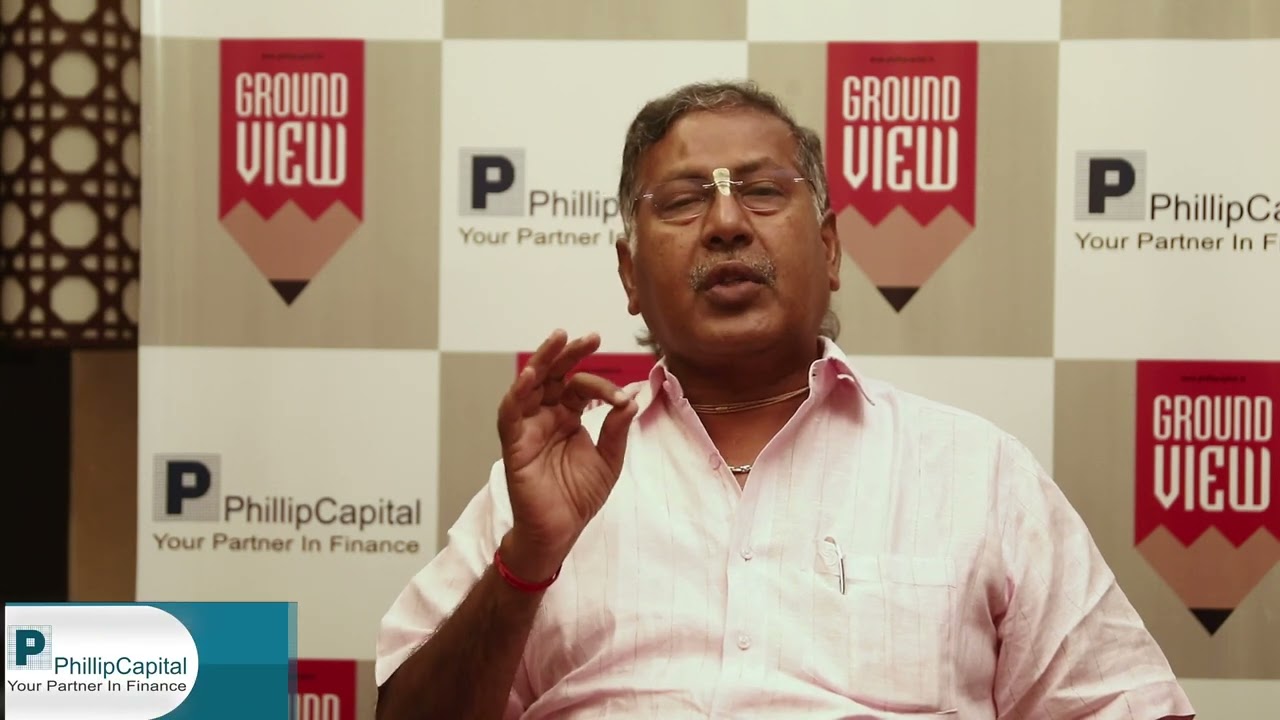

Management commentary

Immediate-term: TJL(Thngamayil Jewelry Limited) is targeting a revenue of Rs 17bn in FY21 (similar to FY20 levels

despite loss of sales for two months) driven by a c35% increase in gold rates (vs. FY20

average gold rates) and lower incidence of COVID-19 in Tier 2 / Tier 3 cities, where most

of its stores are located. Moreover, improvement in farmers’ incomes on better Rabi

crop harvest, normal monsoon, and higher allocation towards MNREGA should help.

Medium-term strategy: TJL sees healthy revenue run-rate continuing in the medium

term based on: (1) More focus on high-ticket-sized wedding jewellery, which is seeing

increasing prevalence. (2) Three large-format stores starting in FY22, which were earlier

meant to open in FY21. (3) Scaling up of low-capex small-sized format – TJML-Plus

stores – once they achieve internal profitability benchmarks. (4) Hallmarking regulations

likely to come into effect in FY22 (June,2021), which will lead to market-share gains. (5)

Healthy traction for high-margin value-added diamond-studded and fixed-rate silver

jewellery.

Intense focus on wedding jewellery to deliver results in the rest of FY21: Management

believes wedding jewellery demand will revive as: (1) most of the weddings have got

deferred to 2HFY21, and (2) families plan to increase their allocation towards jewellery,

given that the actual celebrations are likely to be low-key. These actions will also help

to drive to growth: (1) creation of separate marketing teams for pushing high-ticketsized wedding jewellery, which hadn’t been a focus area earlier; and (2) establishing links with marriage-hall owners, caterers, photographers, decorators, and choreographers, who it has incentivised based on leads generated. TJL provides smallticket gifts to wedding guests and specific decoration arrangements (balloons, flowers) at wedding venues, which acts as a draw for customers.

Got the following reply from Screener support yday explaning the TTM Profit growth.

…

Hi,

Thanks for writing to us.

TTM profit growth shows the profit growth of the last 4 quarters vs preceding 4 quarters

In the case of Thangamail Jewellery - the profit of the last four Quarters is 52.34+26.90+13.75+(-7.46) = 85.53

The profit of the preceding four quarters is 11.80+12.42+8.59+ (-6.40) = 26.41

Thus, the TTM profit growth of the company is 223.85%

I hope this helps.

…

This makes sense.

Thangamayil Jewellery AR2021 notes

- Manufacturing locations

Madurai (Showroom , Head Office and Manufacturing) , Coimbatore (Manufacturing) and Salem (Silver Manufacturing unit) - The year that went by started very badly for the entire nation more so to the companies that were forced into lockdown due to Covid 19 pandemic. Being in retail trade, due to complete lockdown the company could do a turnover of 12,589.04 lakhs in the first quarter with a reported loss before tax of 855.86 lakhs. However, things improved in the second quarter due to need to satisfy the pent-up demand for jewellery. Due to fear of non-performance of economy among all associated assets classes, a sudden increase in price of gold was seen in the second quarter that enabled us to report a turnover of 46,755.43 lakhs in the first half with a prfiot before tax (PBT) of 6,153.73 lakhs

- The year also witnessed a wide fluctuation in gold price(22ct) a low of 4,165 to high of `5,416 but settled in the lower range of 4,162 per gram. Therefore, with the normal profits that could have been earned but for this year ended in lesser realisation, the performance could have been better. Nevertheless better realisation of gold price in the larger part of the year has enabled the company to declare an all-time high profit before tax ( PBT) of 11,697.15 lakhs.

- It is unfortunate that the year 2021-22 started in a bad environment again affected by the Covid-19 Second Wave lockdown in the state of Tamil Nadu. The lock down continued still thereby significantly affecting operation in the current year 2021-22 both in May and June month.

- The First Quarter of any financial year is the Best for the industry as it carries more number of wedding days and akshaya tritiya function, as we see it from our internal reviews. So far the impact is only due to accompanied fear of the covid and not that of any economic set back. Once, the lock down is lifted, normalcy will be restored. We are confident that as in last year post lifting of complete lock down, pent up demand would re-emerge and there is every possibility that the lost turnover could be recouped in the rest of the year, provided widely expected re-appearance of covid third wave does not repeat

- All the ongoing retail outlets expansion are in place and only a marginal delay is expected in commencement planned as per schedule due to second wave impact.

- New marketing initiatives taken continues to show better “foot fall”and enquiries.

- The change in the “pricing formula” particularly in gold ornaments based on volume off take etc has improved our competitive strength.

- Supply chains and scale up of capacity.

We have developed a brand-based vendor management for ensuring “right in time” supply with the help of successful in-house software developed. Inventory holding cost has come down and a greater confirmation for what goes out is bought back as per merchandise plan is ensured. Our in-house capacity to produce common / traditional/ repetitive items increased that would ensure replacement of sold items from any retail outlets within 24 hours of sale so that more active and supportive inventory management could be strategized. - We are operating in south and western regions of the state of Tamil Nadu. This area is supposed to have larger cake in jewellery retail trade due to historical reasons. We had become a dominant player in a larger part of our retail outlets places. In a shrinking market size we are able to improve our volume effectively. It means that customers have a preference for our company among competitors for many reason including pricing, display, loyalty, varieties, ranges, and sentimental value

- Expanding product portfolio

The company has come a long way from a mere retailer of commercial grade jewellery into an emerging established reputational retail brand deliverer. Apart from normal range of gold ornaments of daily use and gifts, the company created a niche market for wedding ranges, exclusive facility for studded diamond items and a marketer for established other special allied brands. A supremacy is established in making and pricing at the lower end for silver payals, vessels and ornaments. It has also slowly promoted into other precious stones and unique value-added products. In the last 5 years share of other items in the overall turnover has improved from `,635.77 lakhs to currently 16,528.67 lakhs a registering growth of 91.40% and in terms of percentage in total sales increased from 6.65% to 9.09%. - Though a regional player our market share in the places we operate improved a lot steadily. In order to optimise the financial and non-financials resources at our command, the company needed to polarise the business in the areas we are already strong in, like south and western part of the state of Tamil Nadu. All synergies are in place like taste / preference/ ethnic demand/ loyalty/ brand visibility / outlets/services etc. It is imperative to scale up operations by carefully expanding deeper into these known and established territories. All our future expansion plans run around this objective so that operational efficiencies could be maximised.

- Becoming a retail brand instead of a jewellery retailer. By opting to market other brand jewellery the company started to harvest its brand loyalty and became a retail brand instead of jewellery retailer.

- The FY 21 ended in a positive note even though the second wave of Covid-19 pandemic started hitting some parts of the country from mid / late March 2021but this did not materially impact the Company’s performance. From the 2nd week of April 2021, one by one the State Governments have started announcing lockdowns to control the spread of the second wave of Covid-19 pandemic. There was no major impact to the sales in April and all the showrooms were opened following the Covid-19 protocols announced by the respective State Governments. But by early May 2021 almost all States Governments have imposed lockdowns of varying degrees to control the spread of the second wave of Covid-19. This complete closure does have an impact on the planned sales for the months of May and June 2021.

- The increased volume of Diamond sales & silver jewellery MRP items along with the existing silver articles incrementally contributed to better return on the working capital investment. The area of concern for growth remains with the gold ornaments. In recognition of this fact, your management has taken certain operational initiatives to improve the ROI on gold inventory in the days to come. Going forward, we may have to improve the stock rotation aspect with the help of new technology (goldratt platform) in the given pricing model either by contracting the size of the Balance Sheet or by profitability exploring avenues to build up outlets to increase the turnover and other related strategies for sustained growth

- The industry suffers from the introduction of sovereign gold bond and also by the penetration of “E-commerce” activity in the trade

- Inventories including company’s stock held with gold smiths are valued at lower of cost or net realizable value. The cost of raw material inventories is computed on a FIFO basis. The cost of nished goods and work in progress includes cost of conversion and other cost incurred in bringing the Inventories to their present location and condition.

- Financials

- EBITDA margin increased by 38% to 8.21% as compared to 19-20. It is also partly due to better realisation of closing stock of earlier years.

- Revenue has improved by 7.48 % to 1,81,861.88 lakhs as compared to 19-20 in spite of Covid shut down for 92 days in 20-21. Improved product mix enhanced the company’s market share shrinking industry.

- Continuous better gold price realisation at the point of sales except in the last quarter.

- Due to corona we missed the “Akshaya Thirithiyai”sales along with lots of wedding days lost (muhurtham) that fell in rst quarter of both the years.

- The company has got a well-defined operative “Hedging” mechanism in place. The company availed more loan under “metal loan” category of finance from banks at concessional rate of interest besides ensuring a natural hedge on such procurement. It is 63% (previous year 73%) as against the internal set target of 75:25 due to stoppage of operation and relatively on lesser inventory level. Based on our experience and the current gold price movement trend we are of the opinion that the ratio at the most can go upto 75:25 in the overall operational interest of the company.

- During the year, we capitalized 561 Lakhs to our gross block comprising 479 lakhs for Plant & Machinery and Furniture & Fittings and other assets and balance of 82 lakhs for Computer Equipment including Software. The capital work in progress amount outstanding as on 31st March 2021is 228 lakhs (previous year `202 lakhs). This comprises interiors and other assets still to be put in use and are yet to be capitalised.

- Utilisation of own manufacturing facilities including on job work basis is around 96% as against 95% of the earlier years. The overall cost of production has come down due to attainment of scale of economics in the manufacturing facilities. It is expected to improve the own manufacturing capacity utilisation in forthcoming years. On a need basis, at short notice, handmade items capacity could be enlarged.

- Gold Metal Loan carries interest @ 1.90% to 3.25% p.a. Out of total loan of Rs. 305cr, Gold Metal loan is Rs. 138 cr.

- Advances from customers includes an amount of Rs.124.27 cr (As on 31st March 2020 Rs.186.97 cr) received towards sale of jewellery products under various sale initiatives / retail customer schemes.

Company has a Hedging Profit of Rs. 6.02 cr in FY21 against a Hedging Loss of Rs. 18.87 cr in FY20. hedging expenses represents Mark to Market (MTM ) difference for gold price hedging mechanism outstanding as on date as losses in accordance with generally applied the treatment for Hedging Accounting.

48th and 49th Branches opened in Nagerkoil,Kanyakumari & Surandai, Thenkasi on 15th Oct & 27 Oct 21

Disc: Invested

Though the company EPS went drastically YOY, from 38.15 in Sep 2020 to 19.47 in Sep 2021. Why price of this stock did not go down, any reasons behind it?

1.1 BACKGROUND AND COMPANY BRIEF :

Thangamayil (TML) is an organized jewelry chain based in the state of Tamil Nadu with a total store count of 47 as of Mar-21. It is a traditional and largely plain gold jeweler catering to tier 2/3 and rural markets in South and West Tamil Nadu. It is dominant in Madurai with a 15% share in the city as it began its operations there. Over time, it has steadily branched to other areas within the state and today has a presence in ~20 towns in TN. The company went public in 2010 when it had a store count of 7 with sales of Rs4.5bn. It closed FY21 with sales of 18bn, store count of 47 and it has a current market cap of Rs18bn.

It is a family-run business – the patriarch was late who started the business in 2000; today the company is being run by his three sons Balarama Govinda Das, NB Kumar, and BA Ramesh. Balarama is the Chairman and MD, and the other two brothers are joint MDs. Other family members are also involved in the business in the capacity of the CFO and other senior management. The company seems to score high on corporate governance and disclosures. Though they do not do calls, the annual report commentary is clear (read last 10 years), easy to understand, and explains the key moving parts well. All family members in the management seem conservatively compensated versus what we find at other small family-controlled businesses (the three brothers take Rs5.4mn each). The business has been conservatively managed – the jewelry business by nature needs some debt to fund its working capital and bouts of store addition but leverage has never been reckless and caused them trouble. There has been no equity dilution since their listing, and the promoter ownership has remained steady at ~67% and in fact, has inched up above 70% through the pandemic (added through Sep-20 quarter). SBI MF initiated a 6% position in June 2019 and has increased it to 7% over previous two quarters.

1.2 SECTOR LEADING BUSINESS ECONOMICS; SECOND ONLY TO TANISHQ

Thangamayil (TML) has business economics which is superior to Kalyan and second only to Tanishq in the listed organized Jewellers space. The two key metrics for any retailer are inventory turns and margins. Growth is the third vector but that is plausible (w/o leverage) only if the former two are sorted.

TML appeals to the small-town customer who traditionally buys plain gold jewelry as a long-term store of value. Typically, the TML customer set will come from those upgrading for the first time from their local/ unorganized jeweler to a branded player. Given this customer set and TML’s small-town positioning, gross margins for TML range from 8-12% due to lower making charges on their jewelry. These compare with 16-17% for Kalyan and 24-25% for Tanishq. Margins for TML are lower due to lower making charges as 1) designs are simpler with lower price points 2) pricing is competitive to convert new customers in tier 2/3 towns 3) studded share is much lower in high single digits versus 20-30% for players like Kalyan and Tanishq.

However, despite 600bps lower gross margins versus Kalyan, TML does similar or in fact slightly better EBIT margins of ~6% (Kalyan does about 5.5%). This is possible has TML is a very cost-focused, no-frills kind of operator. Their high density of stores also helps as they follow a cluster-based store expansion strategy. Such a clustering strategy reduces customer acquisition costs, lowers management oversight and inventory management costs. Lower rental costs in smaller towns also help a lot.

Opex as % sales for TML is only 7% versus 12% for Kalyan and 13% for Titan. Note that this gap of ~500-600bps narrows by 150bps if we exclude A&P spends but TML has a superior opex cost structure by 400-500bps versus the other two. I would look upon TML as a low-cost sharply customer-focused value retailer in the jewelry market. The philosophy is loosely comparable to DMART or a VMART which works with lower gross margins but ends up with healthy EBIT margins on the back of high store throughputs and inventory turns.

However, the real secret, which also helps operating leverage on the P&L, is the far superior inventory turns of ~3x. TML can rotate its inventory more than 3 times in a year versus 2x for Kalyan and 2.5x for Titan.

There are several reasons why they can achieve this 1) stronghold of the localized markets in which they operate. They know the state and the local nuances well 2) competitive pricing with superior designs and transparent practices versus local players 3) strong inventory management – they use efficient back-end supply chain and work with vendors for lower lead times for replenishment.

Their capex per store at ~Rs20mn is about 40% of Kalyan. Similar EBIT margins to Kalyan but with higher inventory turns and lower capex per store translates into ROCE of 15-20% versus ~10% for Kalyan.

1.3 A BENEFICIARY OF RISING ORGANIZED SHARES IN JEWELRY RETAILING (AS HAS BEEN TITAN)

Note that TML has been benefitting from the sector tailwinds, like peers, and these will continue for years to come. The organized sector has benefited with accelerated share gains from local jewelers as 1) customer awareness on purity and transparency has improved 2) better tax compliance and monitoring, hallmarking requirements 3) funding squeeze for small and local players. 4) steadily rising share of studded jewelry (for TML, this has moved from 5% to 10% over the last five years).

1.4 SOUND HEDGING PRACTICES

TML was hit badly during FY14-15 when GML (Gold metal loans) was banned by the RBI (INR depreciation crisis) and gold prices dipped 15% over that period. Sitting on higher-cost inventory, TML saw almost zero margins for two years. Good thing is that experience has driven home the importance of being hedged to a large extent. Since then, every annual report stresses the importance of being adequately hedged.

TML has improved its hedging practices over the years which is comforting and means that they are reasonably hedged to adverse gold price movements. This is a major issue with smaller companies where sometimes they prefer to take calls on the underlying gold price and remain largely unhedged. This can lead to high earnings volatility and losses if gold prices retrace sharply. About 65-75% of the inventory is hedged via gold metal loans for banks. This is almost at par with large retailers like Kalyan although not as good as Titan which is nearly 100% hedged. However, the share of hedged inventory has steadily risen over the years and should continue as the BS becomes larger.

1.5 STORE ADDITION A KEY VALUE DRIVER; HAS PICKED UP THE PACE WITH THE DISCIPLINED EXPANSION

Store addition has picked up pace in recent years which is the most exciting part. The store addition journey of this company has broadly three legs. From FY09 to FY13, they added stores at a 35% CAGR and the store count increased from 9 to 31. This time also coincided with a sustained leg up gold prices which led to both strong sales growth and margins. The surplus was invested into store expansion. In fact, the main purpose of the IPO proceeds was to add new stores.

Then, multiple issues hit the sector – regulatory restrictions on gold availability and hedging (INR dep crisis) which hurt margins and sales over FY13-15, demonetization, GST, PAN requirements over FY15-18. While these things helped organized players, initially they impacted players like TML who had a very traditional rural clientele. Note that this also impacted Titan though not to the same extent given their deep pockets, ability to operate with nearly two-thirds of its stores under the franchising model, and BS strength to resort to hedging contracts outside of GML.

TML also underwent a store refresh exercise over FY13 - 18 to remodel/refresh its stores to stand up to new organized competition like Kalyan which entered small towns. Being conservative, management thought it prudent to put brakes on store addition until this was done. Over FY13-18, the store count was flat at 31-32.

However, store addition has again picked up starting FY19. Over FY18-21, TML added 15 new stores on a base of 32 (~14% CAGR) and annual report commentary suggests, store addition will continue ahead. While FY21 saw a pause, store addition has picked with 3 new stores added in 6mFY22 (remember 1Q was again impacted). One can reasonably expect them to keep adding 6-7 stores p.a. going ahead.

Remember, store addition is a key value driver for a ‘profitable’ retailer and is a key driver of the stock multiple as well. What I like is that they should be able to fund this with internal accruals and given their past financial discipline, don’t foresee them recklessly borrowing for the sake of growth (Kalyan has shown this trait in the past). A new store needs about Rs20mn in capex and Rs150mn in working capital including inventory and deposits etc. TML would generate FY22-24E cumulative EBIT of Rs5bn or a pre-WC OCF of Rs ~3.5bn. This should, theoretically, allow them to open 18-20 new stores without levering up more. Note that in this business capex is comprised of two-line items – increase in WC and increase in gross fixed assets. Hence, OCF pre-WC is the inherent core cash generation by the business which can be funneled for growth.

Also – the return on this store addition is more predictable as they will continue to go deeper in Tamil Nadu itself and not venture into unknown territory/ new state. Jewelry retailing, especially for tier 2/3 clientele is a business with high local nuances. Hence, I would imagine this store expansion should be value accretive and not value destructive. This is one of the main reasons why the stock has rerated sharply over the last couple of years.

1.6 FEW POTENTIAL RISKS WHICH CAN RENDER EARNINGS VOLATILE FROM YEAR TO YEAR

• Single state exposure to the state of Tamil Nadu. Any issue in the state caused by politics, poor monsoons, change in state regulations can impact TML. Madurai alone makes up 15% of sales. This has so far never been a major issue in the past (as is the case for some business-like MFIs). Headroom for growth remains large, as TML is heavily skewed to West and South TN.

• The customer set is mostly tier 2/3 and the incomes for this customer set are linked to agri and monsoons. So poor monsoons can impact volume offtake. The management spells out this risk in their annual reports as well, especially during muted performance years. For instance, in the monsoon deficit years of FY17 and FY19, tonnage declined 5-10%. The last two years (FY20 and FY21) have been sufficient, and tonnage has grown 4-13% (barring COVID impacted 1QFY21).

• Gold price still influences the P&L for a retailer to some extent even though he is largely hedged. Rising gold prices impact sales realization and drive operating leverage on other non-gold price-linked fixed costs (assuming volumes are not negatively impacted). Note that hedging protects gross margins, but EBIT margins can still swing basis sales realization. Besides 25% of the inventory is still unhedged. The last few years have seen a steady uptrend in gold prices and the P&L has not been stress tested for a falling gold price scenario. Note that gold price linkage, while matters, does not make it a commodity business like steel cos. This is a retailing business that earns making charges as margins irrespective of the direction of gold prices.

Company history

- Family business

- Father started as a proprietary company

- Father handed over the business to 3 sons(current promoters) in 1980, company was changed to partnership

- Changed company focus from traditional to modern/design focused

- Thangamayil jewellery private limited in 2001

- Public limited in 2007 and ipo in 2010

- Next generation are also now involved in the business

- 25 lakh happy customers

- 52 stores (39 Jewellery, 13 silver). All are in good operational status

- Business strategy changed over the timeperiod. Have to invest more currently to get returns.

Gold price

- Gold price didn’t increase, INR value eroded

Reason for ipo?

- Create value

- Has always focused more on value

Why Branches are mainly on tier 3 / tier 2 cities?

- Lot of scope to provide 916 hallmark and competitively priced jewellery in tier 2 / tier 3 cities, and the risk is low

- Business is a calculated risk. A showroom should break even in 1000 days (3 yrs), so that it doesn’t make a dent in the balance sheet.

When will you open a branch in Chennnai?

- Soon, in Gods grace. Balance sheet should be stronger. Brand name is established, there are chances to open showroom in many places. Only after a showroom is breakeven, profitable and then well established, we move on to next. Slow and steady wins the race. Can open upto 4 showrooms in a year beyond that we need to be very careful.

Two major incidents

1) Saw a funeral of a company boss. Lots of employees were there to show respect. This really moved him. Since then wanted to provide jobs to more than 1000 of people. Currently there are more than 1700 people working in Thangamayil

2) Meeting with Kenneth(PMS manager) from Old Bridge Capital. Kennet provided lot of info to unlock value

- Bottom line growth is important, to achieve that product mixing (diamond/silver) is important.

- Need to be a brand, so that selling different products is possible

- Business was transformed to next step after the meeting

- Small portion of shares was transferred to kenneth. This was the first time promoter has ever transferred his shares

Advice to young entrepreneurs

- See events from surrounding and convert them to experience and link them to business to grow

- Artificial intelligence, data science is used in Thangamayil

This covers the entire interview

Can some one please share a transcript in English if that is possible? Thanks.

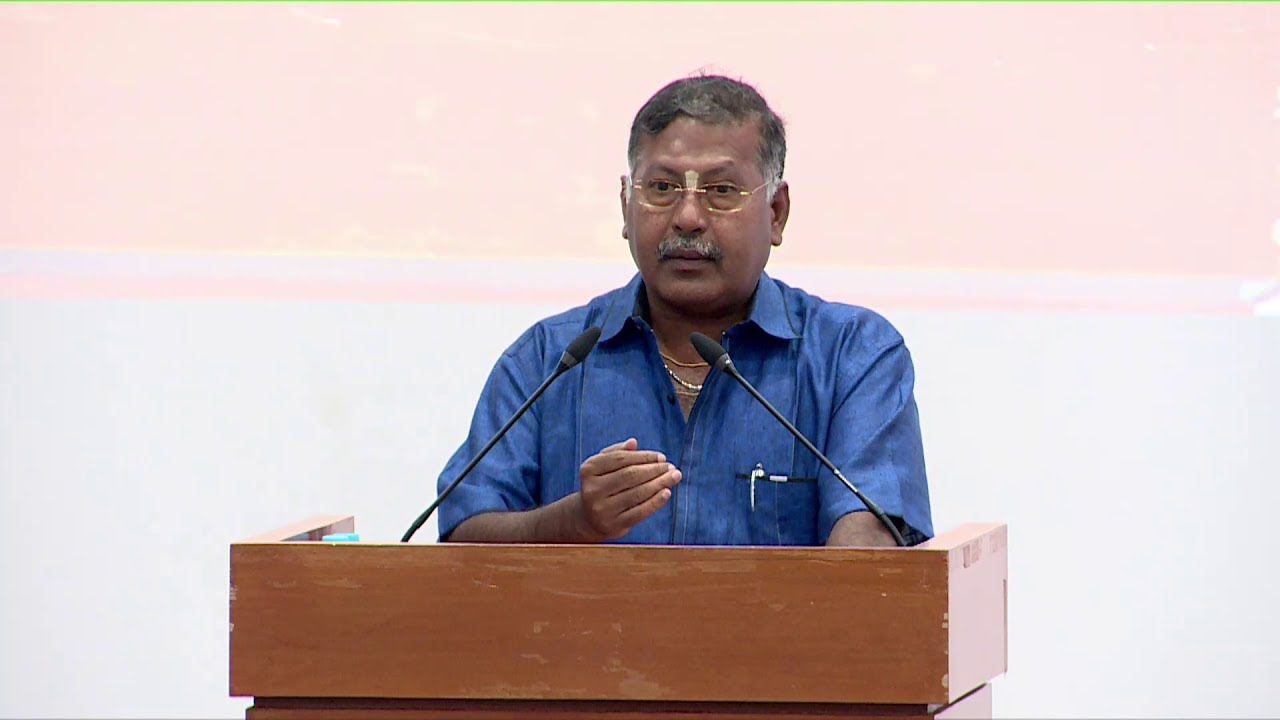

Transcript of the above success story.

Before I (B. Ramesh) would start about the business, I want to talk about it from a different subject.

I will tell you about me and our family.

Our father gave the shop to us in 1980, just 6 months after we joined the shop.

Normally in a family business the elders will not handover the business to the younger ones easily.

That too in a jewelry business there are No1 and No2 transactions which they would not want to reveal, since we would not handle it the right way.

But our dad gave it to us within 6 months and on giving it he held a family union and explained us the struggle and the work which has gone into it. On that day it was 10 feet by 10 feet store, and a sale of about 7-10 lakhs. On that day it was a substantial amount and there were bigger players in the market also. He wanted us to not lose the working capital on any circumstances, he emphasized that we are doing it for our family.

Later, everyday me and my brothers would discuss every thing about the business and the incidents which happened during the day, we would pull each other’s legs, even to the extent of ridiculing the customers, in free speech, later we realized that its SWAT analysis which we had done unknowingly in very deep depth.

When we started, it was license raj in 80’s. Volumes were less but we had profit even in that though situation. We would deeply analyze the business as to how it’s growing and the direction, we should take it.

In 1991 the liberation happened (India), in 2000 globalization and in 2007 VAT was introduced.

From 1979 until 2007 it was like the bamboo tree story, we had deep rooted our business experience and all the expectations and the urge to grow, opened in front of our eyes.

We changed the business accounts totally to bill sales only. This change brought in a dramatic change in our attitude towards the business we introduced systems and technology into it.

In 2017 GST was introduces and we were well prepared for it. We had not taken out our profits we left it in the business for it to grow. We concentrated what the bankers would expect, what collateral they expect what stock ratio they require, and created properties in company’s name.

In 2008 we planned for IPO but because of GFC we had to delay and we went public in 2010.

We have to relate our life experiences with our business in a way to grow it. I will explain a real-life incidence, when my son was 4-5 yrs old we walked into a shop which sells sweets, the shop keeper was very happy and he showed all the stuff he had in his store my son asked him for a chocolate that he had seen through an advertisement (importance of advertisements). The shop keeper didn’t have it, we left that store and went into another store, and that store had the stuff which my son needed. We took 2 of it and I handed the shop owner a ₹100 note, the store owner said its cost in only 25 paise altogether. Immediately the store keeper showed other sweets whih he had and the total cost came up to ₹ 75. This incidence shook me a lot, what I realized was just because a store didn’t have the stuff the customer needed, he lost ₹ 75 worth sales.

Those years our average bill value was ₹ 2000, if a store lost a sale because of not having a 0.25 worth product. What would be the amount of choice & service that we will have to provide to our customers to materialize a ₹2000 worth sale.

We always wanted our product to be of good quality.

I will share 2 incidents which made us realise it.

In 1991, we started export business and we went to Dubai, thinking I am going to do business with an Arabic person. There what I saw was all the shop owners are Sindhi’s and Gujaratis and all customers were Indians. The designs are Indian but still if customers are buying it here meant that the product sells because of the quality. Then we started making 916 jewelry.

Another incidence is I had a customer who wanted the chain which I was wearing, to that I responded by telling him this was Singapore quality and the price which I have quoted to you is not that. For that he said if you give me what I ask for I will pay its cost. I realized if we give what the customer asks, they are willing to pay its cost.

Another incidence, myself and my assistant were travelling by car and we had crossed a school where the kids were walking out, I asked my assistant what thoughts come to you when you see this, he said it’s a school zone and many kids are leaving it after the school. In a short distance away another school and the same scenario I again asked my assistant the same question and his reply was also the same. In a span of 10-12 mins we had crossed 4-5 schools and every time I asked the same question and by the 5th time my assistant got a little annoyed and asked “what brother we are travelling since morning and you are unyielding for my answers.

“What thoughts are in your mind please tell me”

I said, if all these kids grow up, they will come to my shop for purchase, will my store size fit all these people, I have to sell them jewelry, there is a huge opportunity. I will have to expand and also increase my store size.

I had been to a store in Chennai “Pothy’s” (A mega multi garment store) the store was filled with customers. I stood for a second and thought what’s attracting the customers to this shop, the hospitality here and there they served Kesari bath. I realized we will have to give something for our customers also to eat at our store, and we started serving our customers with round peanut chikkies & butter milk. About 50-60 ppl are getting employed in that segment.

We would enjoy our business, we adored it at every situation the thrill and satisfaction it gave, this cannot be experienced in a normal job. This is only for businesses. We had a huge exchange of culture by bringing the designs which are in Mumbai and Bangalore here. Our first priority was customer and their satisfaction. Second are our employees, we have about 1500 ppl working. And their satisfaction is also very important. We have not employed them we have empowered them; We have given them the liberty to think and bring in changes which helps us improve our business.

We are sellers of gold jewelry which is one product, besides that we are consumers of a 1000 different products and services. We encourage our staff to think in practical terms of how a customer will think to get satisfaction in his purchase. My staff have improved a lot and their performance has improved tremendously. After we introduced incentives, one of my staff came up to me and gave a suggestion. He said allocate your incentives budget as employee share of profit. That changed the perspective of my staff they run the stores as their own and bring in changes. Sales are happening all by itself.

Quality, Choice, perfection, price and buy back were our moto. This changed our business different from our competitors. In our concern there will be no changes to what we say and what we do. Since everything has been brought under the system, we are able to do sales of ₹10-15 hundred crores, very soon we will reach 10-15 thousand crores, we have market and setup ready for it.

We went public because we wanted funds to grow, for that we had decided to become a trustee structure. We will only stress more on the valuation of the company at the end of the year. We realized valuation is the biggest asset and I always stress on that.

In the 1970’s I went to Mumbai, my father asked me to visit Tribhovandas Bhimji Zaveri stores, that was the biggest stores in India those days. There was a bank also inside their store, I spent 2 days in their store and dreamt of growing my business to that scale. We went public in 2010 even before Tribhovandas did,

There are 4 types of profit when a jewelry business goes public, Profit because you are in business because we are selling products, profit because of creating our own products in higher volumes, selling in taxed bill itself there is a profit, there is input credit for our purchases & capex which other sellers don’t get because it’s sold for cash and the tax is not claimed. In share market we are trading our shares itself that also gives us a profit.

We should have a dream a big dream and associate ourselves with people who will make us achieve that dream into a reality. Business will throw a lot of situations which will test your patience, we should enjoy all those situations by innovating solutions to overcome those. We should see what opportunity we get through the troubles we encounter.

Q&A

Q. Are your jewelry designs made in house or do you outsource?

View your business from yourself first (How will you sell it to yourself) don’t look at it from a customer’s view, there are some basics of jewelry designs and most of the designs are based on that a few patterns will change, adopt it. Apart from that there are people who have specialized in that field we have such people also as our staff. One third of the jewelry are made in house, one third is out sourced and one third is purchased from others.

Q. How are you controlling pilferage?

We have to believe our employees; “my employees will never do a mistake” (huge applause from the audience) . Unknowingly an employee will do a mistake, but if you believe in your staff and give him the responsibility they will not cheat. After all these there are pilferage’s a little bit of it is provisioned for in 50-50 ratio (Our profit and their incentive)

Q. Visibility of the stores has improved, I was told you give discount to your customer if they produce bus ticket which they had used to come to your stores. Your brand equity has grown high in visibility angle.

And do you refine your gold jewelry? Yes, we refine it. 30-40% are old gold he have our own refinery unit.

There is another angle to your question, my stores are present in tier 2-3 cities only and as such the customers who come are not well off. For that reason, I fully reimburse their bus ticket cost along with a discount.

Q Wastage and making charge is not prevalent in North India please explain it?

We fix our rate on 92% purity, in north India they base their price on 98% purity some places in Kolkata even take it to 99% purity. The wastage cost will get recovered in that. Hence, they don’t charge it separately. The volumes are more in the south, total market for gold jewelry in India is 4 lakh crores out of that 25% sale happens in Tamil Nadu alone.

Q. You are very calculative and never compromise on your profits?

Check our balance sheet, we are unable to reach 2% PAT margins. We are only concentrating on our expenses and how to reduce it.

Q. Do you think or believe the next generation will carry forward the same values that you and your brothers uphold?

In 2001 my elder brothers son came into our business, I studied him for 6-7 years and after that only I decided to expand the business and went for IPO. They are very dedicated and grow the business.

I had attended the AGM of Thangamayil Jewellers Ltd held on 4th August. Key highlights of the AGM that I noted are given below (might have some discrepancy as had quickly noted it down especially for nos):

• Akshaytritya benefits this year after 2 years. Well placed to perform better in FY23 for following reason: 1. Normal business restoration after 2 years. 2. Higher agricultural income due to rise in price. 3. New outlets 4. Better stock turn. 5. Product mix. 10 more branches to be upgraded. Our core objective to grow sales will help. Objective of opening new stores will help in growth further this. Diamond sales increasing. Good contribution from diamond sales. May not have any difficulty in future expansion. TN enough room for growth. Pent up demand – Aadi Perukku – sizeable turnover achieved in one day as it happened for Akshay Tritya. All our working capital requirements are tied up with banks. Margin limits available through internal accruals. In terms of dividend distribution policy, company paid interim dividend of 10 each. Final dividend of 5 per share. Existing scenario and efforts by management to improve bottom line and achieve reasonable profit in the current year. Confident of achieving 15 – 20% topline growth in FY23. Branding, borrowing from banks and customers and our own internal accruals will result in proper debt equity ratio.

• Aadi Perukku – 62.76 crore turnover – 47% jump in one day turnover compared to last year. Akshay Tritya we did 80 something crore. FY20 – 30 crore sales during Aadi Perukku. More than 100% jump. It is very good number of bills – 5407 in FY20 vs 6020 in FY22 – 8060 bills this year. Weight per bill is also higher. Silver also doing well. 4 tonnes vs 3 tonnes last year sold during Aadi Perukku. Aadi Perukku is over and now Awani - wedding season will start. Q2 will also be very good.

• Expanding brownfield – expand 10 existing stores. Work is already done. Yesterday business was good. Total brownfield – expand – 4464 sq feet expansion in 10 stores. 26,295 sq feet post expansion retail year. Opening of new branches – 2 this year. Erode in October and January 1st or 2nd week – Kumbakonam. Good financial background. Our own internal accruals and banker support. Business growth is very good. Q2 should be very good. This year also our business – 20 – 25% topline growth is possible to achieve this year.

• Erode and Kumbakonam – January and October to be opened. 10 browfield expansion – 4 completed – Madurai – month end and others by Q3 and Q4.

• 4% net profit margin? Already done 2 – 3% margins in Q1. Working on 4%. With present scenario after two years and pandemic – Q2 is also going to be wonderful. Aadi Perukku did well – 112 kg vs 140 kg in Akshay Tritya. We will do well this year.

• Concalls – We are also aware – planning for that. Now we will start doing it very soon.

• QIP – 30 – 40 branches – documentation is going on – board is yet to take decision on what price to sell – merchant bankers and lawyers appointed – we will do very soon. 200 crore.

• Profitability – this year Akshay Tritya – business doing well. One day before collapse in margins. July is good. Changing our business profit ratio. This quarter we will improve margins.

• 4 stores opened last year – period of operation – 3 in Q3FY22, Q1FY23 Trichy. Sales in volume of gold, silver and diamond is above pre covid levels now.

• How many stores diamond is sold? Trying to increase the number of stores – 29 now have 39 large format stores – will sell in them as well.

• GM in silver and diamond? 20% GM in silver and diamond. Trying to increase it to 10 – 12% of sales. Diamond segment more

• Infrastructure across TN – pace of 4 – 5 stores to remain? Will open 4 – 5 stores every year for next 3 – 5 years

• Substantial improvement in inventory turnover? Special software with Goldrat. Achieved 3.13 times turnover in FY22. Current financial year – it will further improve in Fy23. Q1 achieved 4 times stock turnover.

• Ad spend and normal spends? Due to expansion of 5 showrooms, we had higher ad budget in FY22. Depending on expansion, we will determine ad spends. 5 new showrooms have achieved break even.

• Working capital tied up? 5 new stores opened in FY22 and Q1FY23. Tied up for its working capital.

• Profit margins? Price reduction exercise was taken to maintain market share last year and in Q1.

• Next 3 – 5 years company reaching GM of 11 – 12%? Putting all efforts to increase GM going ahead – product improvement in mix. Will achieve it if everything goes well.

• Competition? Reduction in price etc? We have done reduction in price to maintain our market share and able to compete with our competitors.

• Mandatory hall marking? Beneficial to organized sector vs unorganized sector. 2001 onwards started doing it. We are always beneficial and large format and organized sector will benefit from it.

• Goldrat appointed for increasing inventory items. Now this year we are selling costly item also. Same store sales doing well and that is why we are doing brownfield expansion.

• Bar sales will be very little – 3 to 5%. Low value addition items – 40% chains moving items. Chains – more than 40 – 42% of sales. Value addition is less. Design is not much. Fancy items etc are costlier. Chain items margins are 4 to 5% GM and rest items have GM of 10 – 12%.

• First we should concentrate on top line growth – geographical expansion also – every year 20 – 25% growth. Margin some reduction, advertisement spends also there. Trichy – April 14th opened – now its 4 times turnover – 100 kg store. First concentrate on top line and then margins will come.

• Hallmarking – implementation by Government not stringent. Not many new unorganized stores came up in last 2 – 3 years but old stores there. 100% implementation not there. Government implementation is very slow. Future is that organized players will do well – customers want 100% transparency, good service etc. If government implementation is stringent, topline growth will be 30 – 40%.

• Inventory at large and small stores? 60 kg in large stores – 20 – 30 kg in small stores

• Trichy store – 100 – 120 kg inventory available.

• 10 stores – brownfield expansion and new stores opening? We are opening 2 new branches – October – Erode and January – Kumbakodam.

• Inventory turnover planning for 4 times this year. Goldrat other software are very useful. We are using it.

(Disclosure: Invested from lower levels)

Thangamayil Jewellery Ltd has broken out of its previous All time high of 1516 which it created back in Nov 2021 and stayed above it.

Fundamentally as per the latest Annual Report

- The business is doing well as the quarter has begun with good sales during Akshay Tritiya ( 108 crores against 79 crores previous year).

- Demand for gold that was deferred would fructify after a gap of 2 to 3 years in the rural areas where company operates.

- Ten (small & medium sized) branches would be relaunched in 23-24 augurs well for incremental sales growth.

- All the outlets are EBITDA positive

- Retail volume - led growth by 27.75% over 2021-22.

- Company could sustain the gross profit margin at 9.43% on the significantly increased sales in a price sensitive environment.

- Top line growth increased on a five-year period as a compounded annual growth rate (CAGR) of 18.82%. It could have been better but for the disturbance caused by Covid pandemic.

- Bonus issue 1:1

- AGM on July 05

Disclosure : Invested.

The promoter’s shareholding has increased from 66.66% in December 2022 to 67.16% in March 2023 but I am not able to find any disclosures about the same. Does anyone know how that could be possible?

How time changes everything! At one time, we could talk of Geetanjali in the same breath as Thangmayil or Kalyan

Thangamayil Jewellery Q1 Fy24 result highlights/updates:

- Highest ever quarterly revenue of ₹959 crore and Net profit of 58.57 crs.

- Better price realizations and rally in gold prices during the quarter led to strong earnings. (Gold prices have inched up since June after a brief correction.)

- Growth in sales across retail product categories.

- YOY Retail grew by 27%(930 crs vs 731crs), wholesale de-grew by 70%(29crs vs 90crs).

- YOY Volume of Diamond products grew by 48% (volume in carats 3401 vs 2304)

- Total number of retail outlets stand at 54.

Overall management has guided for a better performance over Fy23 in the latest Annual report and Q1 results reflect the same. If the five year historical top line growth is maintained on the gross margin guidance by the management, Fy24 will be good.

Disclosure : Invested.

https://www.screener.in/company/compare/?codes=3409,1273512

Currently Radhka Jeweltech operates in Rajkot with a single 2500 sq. ft. outlet, with more than 30 employees. The retail outlets stock a wide range of jewelry designs for both men and women. The company also provides value-added service of manufacturing custom-made products.

So, it is really small. I am looking at it to see if it has the potential to grow.