@harsh.beria93, @zygo23554 - Below research report has mentioned huge cable aftermarket/replacement potential post GST. sharing this in case it may help in your analysis in other thread on Suprajit

Nice article from Marcellus on Suprajit

Suprajit to consider proposal to buyback shares and declare interim dividend during the Board meeting on 10th Feb 2021

Does anyone know why promoters and their trust sold 20 Cr worth of shares today?

It was part of Buy Back, they tendered their share back to the company,

| e to Person | Category of Person * | Securities held pre Transaction | Securities Acquired / Disposed | Securities held post Transaction | Period ## | Mode of Acquisition # | Trading in Derivatives | Reported to Exchange |

|---|---|---|---|---|---|---|---|---|

| Type of Securities ** | Number | Value | Transaction Type | Type of Contract | Buy Value | |||

| (Units~) | Sale Value | |||||||

| (Units~) | ||||||||

| AKHILESH RAI | Promoter & Director | 1207948 (0.86) | Equity Shares | 11688 | 3740160.00 | Disposal | 1196260 (0.86) | 06/05/2021 |

| 06/05/2021 | Buy Back | 11/05/2021 | ||||||

| KULA AJITH KUMAR RAI | Promoter & Director | 3816897 (2.73) | Equity Shares | 37492 | 11997440.00 | Disposal | 3779405 (2.73) | 06/05/2021 |

| 06/05/2021 | Buy Back | 11/05/2021 | ||||||

| ASHUTOSH RAI | Promoter | 1205000 (0.86) | Equity Shares | 11688 | 3740160.00 | Disposal | 1193312 (0.86) | 06/05/2021 |

| 06/05/2021 | Buy Back | 11/05/2021 | ||||||

| SUPRIYA AJITH RAI | Promoter & Director | 1757835 (1.26) | Equity Shares | 18325 | 5864000.00 | Disposal | 1739510 (1.26) | 06/05/2021 |

| 06/05/2021 | Buy Back | 11/05/2021 | ||||||

| AASHISH RAI | Promoter | 1200000 (0.86) | Equity Shares | 11688 | 3740160.00 | Disposal | 1188312 (0.86) | 06/05/2021 |

| 06/05/2021 | Buy Back | 11/05/2021 |

Just saw Suprajit Q4 results. Have one question, in case anyone knows the answer please let me know:

Why have they provided for impairment of goodwill of 16.6 Cr in Wescon, when in fact SENA division has performed well? Because in the press release they have said that the SENA division which includes Wescon has grown 7% and 38% in operating revenue and EBITDA respectively. Is it an indication that they had overpaid for Wescon in the first place?

Hi

I believe Sundram Clayton who is a top shareholder along with its parent TVS another top 10 shareholder sold their shares in bulk. Unifi cap was the buyer. Details are available on NSE.

Added: Got to know from Kedar that TVS group is doing restructuring.

Rgds

Old but good report to understand unit economics of phoenix lamp division

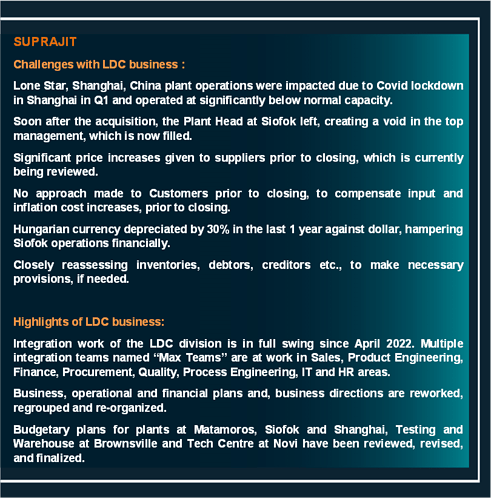

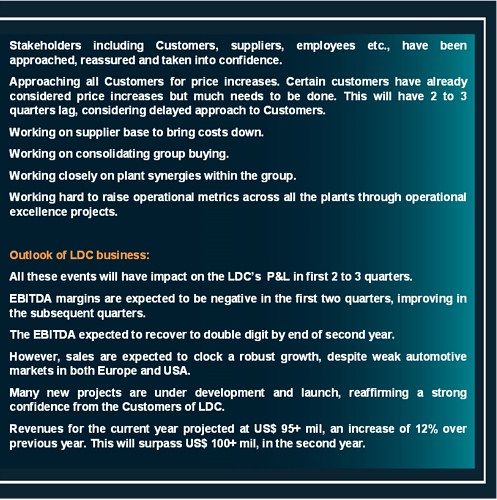

Here is a quick summary of the conference call the management held specifically on the acquisition of Light Duty Cable (LDC) business from Kongsberg Automotive, Norway. I have grouped all information into 3 categories - Business, Risk, and Management.

Business

- Acquisition cost Suprajit $42M or ~INR 311 cr. The company has reserves of INR 997 cr. Part of the acquisition is funded by debt

- This acquisiton provides Suprajit an entry into the US Automotive sector and production facilities across Mexico, Hungary, and China

- This distributed and local footprint will de-risk supply chain. Company used to have roughly 25% of thier inventory stuck in some port all the time

- The LDC division is expected to contribute ~INR 750 Cr to the top line in FY 23 at 10% EBITDA. Consolidated sales for Suprajit stood at INR 1,641 Cr for FY 2020-21

- Current capacity is about 100 million cables per annum, currently running @ 60% capacity. Once at full capacity, run rate revenue should be 70-80% higher than current figures

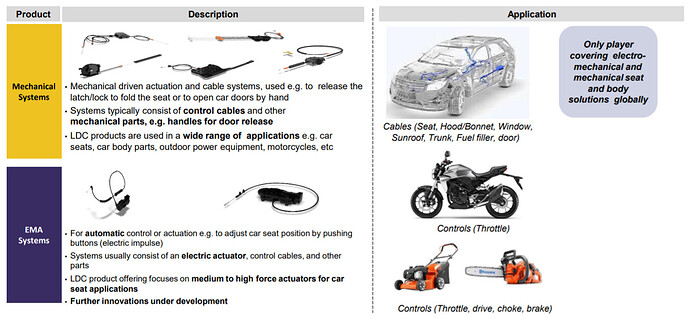

- The LDC business is 85% cables and 15% Electro-Mechanical Actuators (EMA). Attaching a picture from the investor presentation for a quick reference of applications

- The LDC division has a lot of EV customers, Tesla being a notable name

- LDC does more in the seat and seat related components and less in the door and body-related. Suprajit does the opposite, so now with this acquisition, they will be able to provide more content per car. Also lesser customer overlap. For common customers, applications are different

- Current EBITDA margins are at 10%, lower than the company average. Management feels this was mainly because this division of Kongsberg Automotive was a crying baby without proper attention and focus. They believe over the years they should be able to bring this up

Risk

- Smart motor systems within the EMA need semiconductor chips. But since the OEMs also don’t get enough chips to produce cars, the EMA business gets rather affected indirectly as volatility in demand

Management

- Kongsberg got this LDC division as part of a transaction that they did with Teleflex in 2007. Jim Ryan who was then serving as a President at Teleflex, joined Kongsberg Automotive. In both these previous companies he served for over 9 years each. He joined Suprajit in April 2021. Now, he is heading the Global operations for Controls and Cables division and is based out of the US. So he knows this industry and specifically this business like the back of his hand. This is a very shrewd appointment by the company and could really benefit from his experience and network

Tesla Mercedes Chrysler are customers.