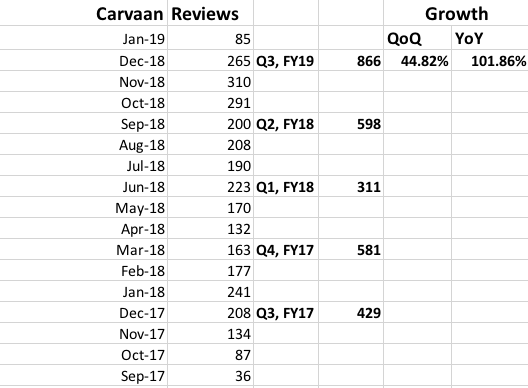

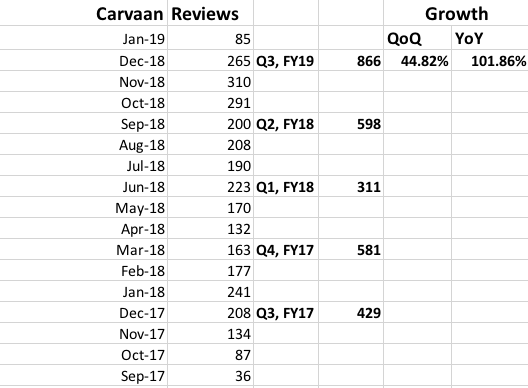

This is the data I gathered from Amazon for Carvaan. The number of reviews could give an idea of how much the topline can grow for this segment very roughly. Rupee depreciation during the quarter may play spoilsport with the margins though.

This is the data I gathered from Amazon for Carvaan. The number of reviews could give an idea of how much the topline can grow for this segment very roughly. Rupee depreciation during the quarter may play spoilsport with the margins though.