Good research report from ICICI securities …RBL_Bank_IC_Jun18.pdf (210.8 KB)

FY19 - Q1 Investor presentation:

RBL Bank under Tax Evasion

Hi

See the BSE update by RBL on this so called ‘issue’.

https://www.bseindia.com/xml-data/corpfiling/AttachLive/19e34c04-a355-481a-b9f8-07ef9da83a4c.pdf

I am actually not clear what the allegations are as such.

Charges are that they have been evading tax evasion for last 3 years. In the sense they are not paying up GST on the remittance fee charged by Business Correspondent or its agents but paying on the agreed commercial between BC and the bank.

BC regulations say this

Payment of commission/fee

The banks may pay reasonable commission/ fee to the BC, the rate and quantum of which may be reviewed periodically. The agreement with the BC should specifically prohibit them from charging any fee to the customers directly for services rendered by them on behalf of the bank. Commission structure or incentive mechanism should be devised in a manner that mere increase in the number of clients served or the transaction volume does not drive the commission. The remuneration should combine fixed and variable parts dependent, inter-alia, on some indication or measure of customer satisfaction. Some part of the variable remuneration could be deferred or clawed back in case of deficiency of service. The banks (and not BCs) are permitted to collect reasonable service charges from the customers in a transparent manner.

Also banks file this quarterly with RBI so I am unsure how this can be so called gamed. RBL says they haven’t even got a notice and the news channel says there are raids happening!

The model in which DMT (domestic transfer) works is a tad different from what is written by the regulators in my experience. The end pricing can be put at 1% say inclusive of GST but the agent charges more than that always due to the lack of understanding of the remitter. In locations say which are major DMT corridors example Kapashera there such things don’t happen to people who are remitting back home to UP/Bihar because people are more knowledgeable as to pricing. On books the pricing remains as 1% inclusive of taxes. So the BC agent earns from the customer (illegal and I guess untraceable) as well as the commission from the bank (legal). And by the way a BC can be for multiple banks not just one. These agents switch from one bank to another basis commercials and basis their prepaid balances.

I could share details on this but I have lost copyright to my paper on Domestic Remittance Business and how its done in India published 5 years back. But if you want to check it out its here Domestic Remittance: Money Transfer Anywhere and at Anytime in India | SpringerLink

p.s. I dont earn anything ![]()

Rgds

Deepak

RBL was asked by the exchange for clarification, Now from what I understand GST dept. might have sent demand notice, this will be properly appealed and challenged through process, I dont understand this vendetta media has, that in their infinite wisdom they’ve already labeled RBL as “chor” even without any judgement from competent authority. Even if tax is liable most probably it will be on the basis of some technicality. Doesn’t effect business. Pathetic.

Disc. Holding

Morgan Stanley slashes RBL target in 11 days after raising it; stock tanks 7%

Read more at:

//economictimes.indiatimes.com/articleshow/66325570.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

RBL Result for Q2 FY19

RBL Bank reports advances growth of 37% in Q2 FY19, Operating profit increase of 48% and Net Profit increase of 36% at ` 204.54 crore on a YoY basis

Key financial highlights:

Q2 FY19 Net Profit up by 36% to ` 204.54 crore

Advances (Net) at 45,872.66 and Deposits at 47,790.09 up by 37% and 31% respectively on Year on Year (YoY) basis

Net Interest Income (NII) up by 41% to ` 592.97 crore

Other Income up by 38% to ` 333.11 crore

Core fee income up by 60% to ` 325.24 crore

NIM improves to 4.08% up from 3.74% in Q2 FY18. Cost to income ratio is at 51.51%

Gross NPA ratio at 1.40% (1.44% in Q2 FY18); Net NPA ratio at 0.74% (0.78% in Q2 FY18); Provision coverage ratio increases to 61.45%

Return on Assets at 1.26 % up from 1.19% in Q2 FY18

Concall at 4:30 today.

Rgds

Concall Summary (source capital market):

- The bank has continues maintained strong growth momentum on all parameters in the quarter ended September 2018. The bank has exhibited acceleration in loan growth to 37% and deposits growth to 31% end September 2018 over September 2017. The CASA deposits ratio has further improved to 24.5% end September 2018.

- The revenue growth of the bank has remained robust rising 40% with NII showing jump of 41%, while core fee income also surged 60% in Q2FY2019.

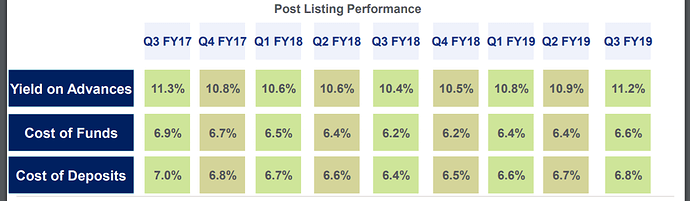

- The bank has further improved net interest margin to 4.08% in Q2FY2019 from 4.04% in Q1FY2019, as the bank has improved yield on loans to 10.91% supported by hike in MCLR rates.

- The cost of deposits has increased marginally to 6.65% in Q2FY2019 from 6.58% in Q1FY2019, while cost of funds increased to 6.44% in Q2FY2019 from 6.36% in Q1FY2019.

- The bank expects its cost of funds to increase further in Q3FY2019. Still, the bank expects to maintain margins around current level with better loan mix and funding mix as well as increase in MCLR.

- The cost of saving account deposits rose marginally to 6.3% end September 2018 from 6.2% end June 2018.

- The bank has witnessed the mark-to-market losses on investment book of Rs 11 crore in Q2FY2019, which have been fully provided in the current quarter itself.

- The bank has exhibited decline in cost-to-income ratio to 51.5% in Q2FY2019, while it expects cost-to-income ratio at 52% for FY2019 with investment program continuing.

- The bank has witnessed 19 bps increase in wholesale loan book yield in Q2FY2019, and expects further increase in yield support hike in MCLR.

- The bank has continued to strong growth momentum in cards business, while more than doubling the cards base to 1.2 million end September 2018 from 0.5 million end September 2017. The company is among the top 5 issuers in terms of spend and cards issuance. The fee income growth for cards business is in line with the growth in the cards issuance.

- The cards business fee income consist of four components such as interchange fees contributing 40% of overall card fees other three components like annual fees, processing fees and other fees contributes equally to overall cards fee income.

- The microfinance loan segment has continued to exhibit recovery which has posted strong 55% growth in the loan book. The bank has expanded its microfinance network to 19 States, while none of the state contributes more than 15% of the microfinance loan book.

- The GNPA of the microfinance loan segment has declined 1.7% end September 2018 from 2.45% end September 2018. As per the bank, demonetization impacted portfolio will be completely written off by year end, helping to reduce microfinance GNPA below 1% by end March 2019.

- New microfinance portfolio built post Jan 2017 has a strong collection performance, while the 90 day PAR stands at mere 0.33%. About 45-47% of microfinance loan sourcing is contributed by Swadhar.

- The bank expects to sustain loan growth in current year as well as in FY2020, while its on track to achieve RoA and RoE targets for FY2020.

- With regards to exposure to NBFCs, the bank does not have concern on its loan exposure to NBFC sector, while 85% of the exposure to the sector is high rated. The exposure to housing finance companies stands at Rs 700 crore.

- The exposure to IL&FS group stands at Rs 15 crore which is fully cash collateralized. There additional small derivative exposure to IL&FS group.

Hi

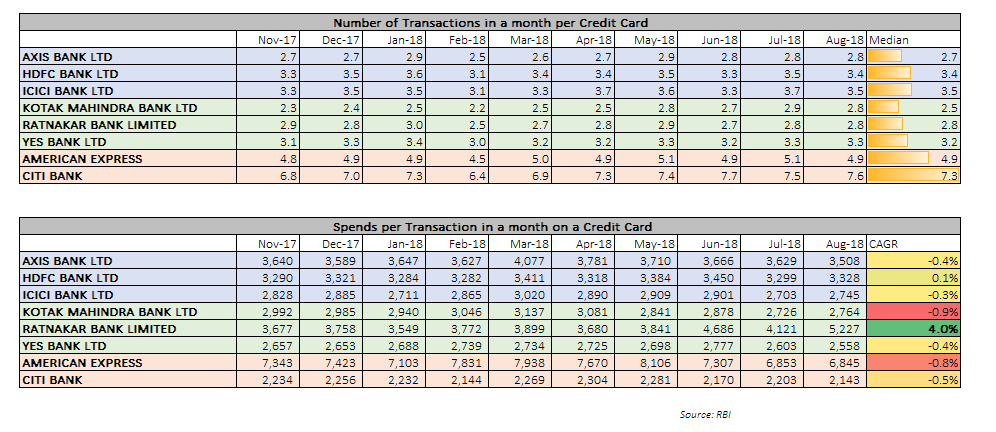

It was good to go through the results of RBL and also nice to see 2 slides on Credit Cards. I wanted to highlight some comparison of spends on an RBL issued card versus other banks and how the average spend is growing. Users of RBL Credit Card perhaps spend the most on their CCs. The growth rate of spends per card is also the fastest in the industry (atelast amongst the leaders in the card issuing world of private banks including Citibank).

Average number of transactions on an RBL CC is 2.8 per month which is not that superior when compared to the big private banks. This has to do with acceptance points where users pull out their cards, perhaps there are more lucrative offers on big private bank cards which is natural. Also this number will rise once the issuance base rises indirectly speaking.

The beautiful part is that when RBL CC users pull out their card they transact big. Quite big. The quality of spends is only slightly inferior to Amex in India! But I think more interest income would be generated on RBL issued cards than Amex cards. RBL CC spends is growing the fastest and leaving aside Amex it is better than all major CC players in India. This is a commendable job.

Please note that there is a concept of activation rate of cards portfolio which is not a publicly available data. Usually the banks I have listed below would have much superior activations compared to other banks. Citibank and Amex would be the leaders in activation.

Regards

Do we have the number of active credit cards per bank or the number of CC issued ?

Hi

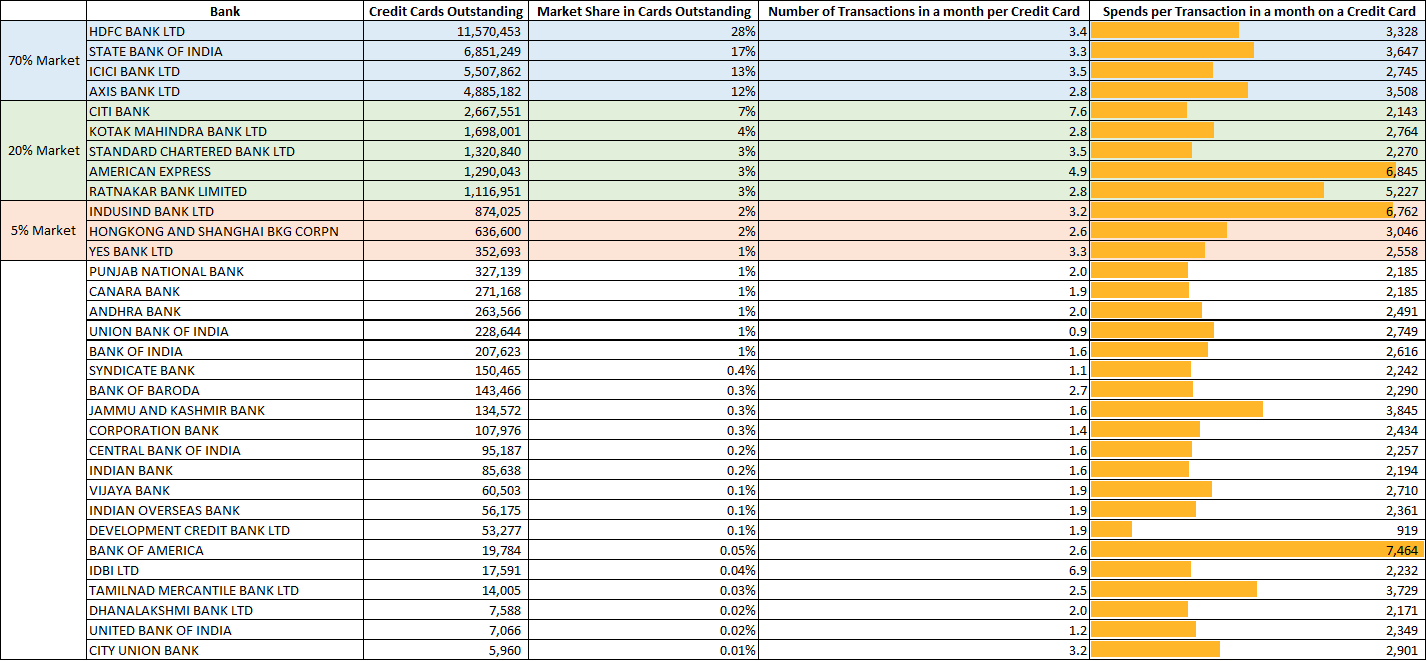

Activation rates are not published for each issuer. Here is the snapshot of the credit card data for August 2018.

Adding another interesting data point wrt to Bajaj Fin Cards

| Credit Cards Oustanding | |

|---|---|

| RBL CC as a % of BAJFIN CC Portfolio | 4% |

| RBL BAJFIN CC as a % of RBL CC Portfolio | 56% |

| Growth in RBL BAJFIN CC from Sep18 to Apri19 | 51% |

Regards

I remain interested in RBL bank because it is a simple stock picking story where best private bank in each licensing wave has created immense wealth. But I am not convinced to make a case for investment yet -

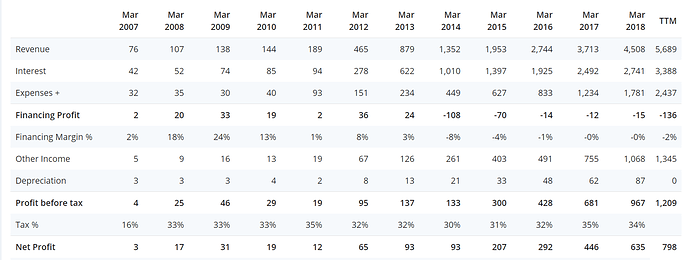

- Since FY14, for RBL bank PBT < Other Income. In screener parlance, this means they are reporting a financial loss i.e. the core banking business by itself is making losses. And this is despite very high NIM of 4%+.

If I am investing in a lending institutions, I would like the core lending operation to be profitable which validates management and business capability.

For a lot of banks like ICICI, Axis, Financing loss is due to higher provisioning on GNPA. But for RBL bank that is not the case. The financing loss seem to be from higher operating expenses.

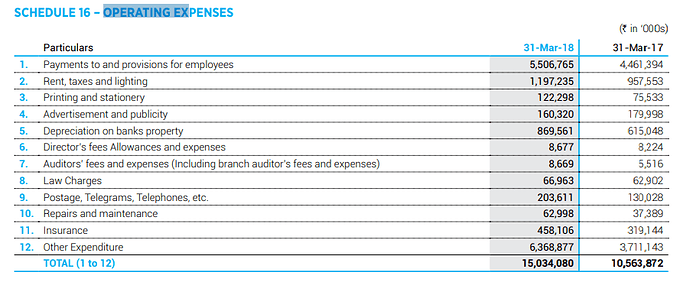

When I tried to find the breakdown of operating expenses, a large portion is towards employee expenses - which is okay as operating leverage will kick in business per branch and employee starts going up.

The real puzzle is other operating expenses for which AR18 provides no details.

It would still be okay to have higher other expenses if investments are made in branches or seeding newer higher quality lending businesses like retail housing finance or personal loans etc. but I don’t think that is the case based on conf calls. Also how much of these higher expenses are due to MFI piece also needs to be seen. In summary, far more details are needed on other operating expenses side.

- The NIM is higher at 4%+ but quality of NIM remains poor i.e. the kind of assets that are leading to these NIMs.

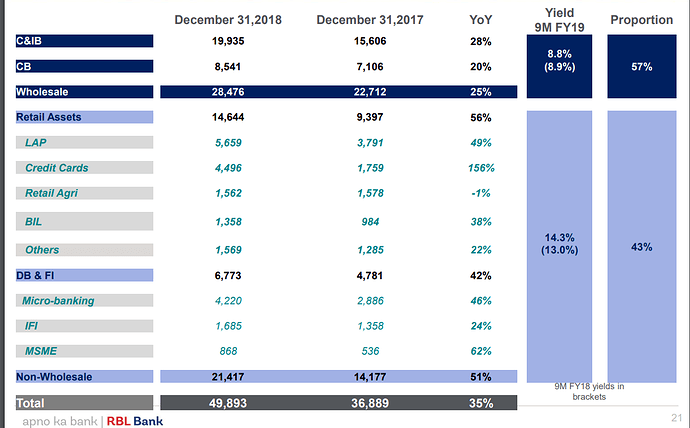

As one can see that yield on retail assets is 5%+ compared to wholesale assets. Out of the retail assets, only the credit card piece which I am comfortable/happy with. LAP + DB piece together forms 12,000Cr+ of retail assets. Although management claims LAP is against cash flows and GNPA ratios have remained low - I am still not comfortable with this. I would be interested to know the average duration of LAP loans and performance has to be looked across entire real estate cycle. There are far better opportunities if one really wanted to own the DB/MFI assets than RBL bank.

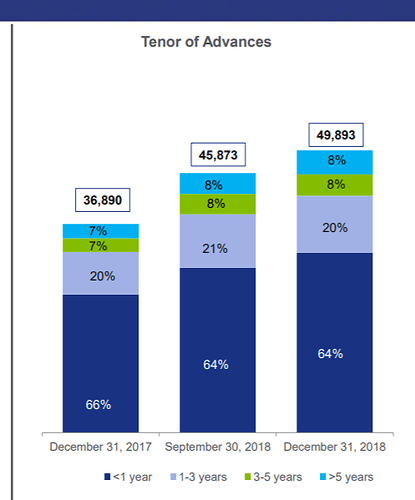

Further, 64% if the loan book has tenor of < 1 years which means majority of loans are working capital loans (which is good). But this also results in very limited pricing power for the bank and low yields on corporate side are a result of this.

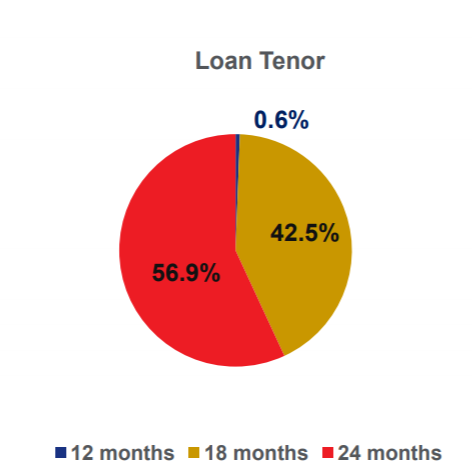

Further 55%+ MFI book has loan duration of 24 months - which is a little bit on higher side.

So overall, the asset side things are average and a lot needs to be done to consistently generate more RoA, more spreads.

- One of the things that provides “anti fragility” in financing businesses is - no requirement to raise capital frequently. This allows for business to be shielded from stock performance and ability to dilute at highest possible multiple. This ability is primarily provided by high RoA.

RBL has never crossed RoA of 1.3% in last many years and RoE remains poor at 10-12% despite high leverage. With such low RoE and high growth rate of 30-35%, capital is depleting quite fast and RBL has to go to markets for dilution. This is why - I think financial companies with RoA of 1% vs. 2% vs. 3% vs. 4% have to be treated very differently.

That being said, capability to dilute at higher and higher price is also an important factor and Ahujas definitely seem to have this capability.

On positive side, entire networth of Ahujas is in RBL bank, GNPA ratios have remained quite decent with no adverse remarks from RBI so far, ability to scale thing also exists.

So RBL remains an interesting story to track but I am unable to make case for investment yet (despite very good rally in stock price ![]() ).

).

Disc - No investments as of now. Have bought and sold shares in 6 months as I was studying the stock. No transactions in last 60 days. Not a buy/sell reco.

Very Good Profit Growth on back of NIM improvements

Based on Q4 results PPT, conf call, various research reports and newspaper articles, following are some points that I could gather ->

- The bank opened 36 branches in Q4 FY19 & plans to open 60-80 branches in FY20. The branches would be opened in existing areas so that density of branches go up & break-even reaches faster. There was no clarity on branch strategy prior to Q4 & it is good to see the focus back on branches.

- The bank has 17L credit cards & around 10L are in partnership with Bajaj Finance (BFL). The bank plans to double the number of cards with BFL to 20L in next 12-18 months. The “exclusive” partnership with Bajaj Finance is for 5 years & expiry date is in ~ Nov 2021. This is a major point of fragility in the entire credit card portfolio of the bank & how this develops need to be tracked.

- The RoA for credit card portfolio of RBL is between 2 to 2.5% - different number being reported by different sources. The industry RoA is 3-4% as per management & RBL RoA will reach this level over next 12-18 months.

- HDFC Bank has ~30% of all the credit cards outstanding & this might be one of the major contributor of 2% RoA for HDFC bank.

- RBL has refrained from issuing lifetime free credit cards as spends see to be lower compared to cards which incur fees. I believe HDFC Bank also follow similar strategy. RBL has also become largest provider of POS terminals in the country. How this helps credit card portfolio further is unclear to me as “acquirer” bank does not earn much in entire chain.

Adding some of interview links based on Q4 results:

Interesting perspectives from Rajeev Ahuja in discussion with Matrix Partners on fintech

Dear All,

Please see below my analysis on RBL Bank, would be glad to have your feedback.

Background:-

RBL bank was transformed from an age old private regional bank to professionally run, pan India fastest growing new age Bank under the leadership of Vishwavir Ahuja. Between FY10 until now under his leadership Bank grown almost 40 times and recently at CAGR of 35~40% the Bank is well poised to achieve its FY2020 vision of Advance growth of 30-35%, CASA ratio – 0.75-1% increase in every year, Other Income – 1/3rd of Total Income, Cost to Income ratio – 51~52% and Return ratio – 1.5% ROA.

Vision:- Banks vision is clearly articulated in terms of key metrics stated above. Additionally, all these are being done with strong focus on asset quality evident by both Gross and Net NPA being well within 1.3% and 0.7% respectively.

Moat:- Bank’s unique strategy being leverage technology such as Digital savings accounts, Fintech and partnership with leading consumer facing organization for credit cards such as Bajaj Finance, Book my show etc. It’s card business one of the fastest growing in the industry from 0.6m in Dec 2017 to 1.71m in Mar 2019 which contributes significantly towards fee income (45% of Fee Income) and ROA. Healthy conversion of cards spend into Consumer loans provides stability and stickiness to portfolio.

Bank is also able to leverage analytics to enhance cross sell and customer targeting. Bank enhances distribution through a combination of owned branches and Business correspondences which minimizes overall fixed cost and also adopts cluster based strategy for Branch expansion which helps in attracting customers, brand awareness at minimal incremental cost.

Profitability:- NII grew at ~40% YoY to 2539cr in FY 2019, NIM grown from 3.8% in FY18 to 4.1% in FY19 in spite of tight liquidity scenario in industry led by lower cost of funds at 6.8% and stable yields on Advances at 11.8%, Other Income grown at ~40% to 1442cr and 1/3rd of total revenue stand. Cost to Income ratio at ~ 51% and ROA at 1.3% and ROE 12.2%. Bank aim to achieve 1.5% on the bank of growth in fee income particularly card business.

Balance Sheet: - Advance and Deposit grew at ~35%, Advance mix is well diversified into Wholesale, Retail (LAP, Credit Cards etc.), Micro Banking and MSME business.FY19 growth in Deposit was led by 37% CASA deposits. Currently CASA stands at 25% of deposit Term Deposit is well diversified into borrowing streams .Loan portfolio too well diversified into category, sectors etc. The Bank is well capitalized to support growth though there has been Equity dilution.

Network/Distribution:-The Bank has growing distribution network into Metro, Urban and Rural and has strong presence in Maharashtra and Gujrat (Set up operation in GIFT city) and now looking into clustered based expansion into Easter and North Eastern states.

Shareholding is diversified even though promoter does not hold significant stake. This is one of the area of concern. Bank received many awards for the best private and small Bank.

Management quality: – MD and CEO Vishwavir Ahuja has rich experience as CEO of Bank of America for Indian subcontinent and spearheaded growth. All other management personnel are professionally qualified.

Risk management:– Bank has strong risk management practices led by analytics, CIBIL etc. which is evident by change in strategy to respond to external environment example :- currently, Bank adopts restrained approach to grow Micro banking and Agri business on the back of GST, Demonetization and election.

Risk Factors:– Partnership with Bajaj Finance for card business is one of the fragility given that it’s for 3-4 years and there’s a non-competing clause.

To support growth Bank resorts to Capital infusion due to which it never achieved high ROE (more than 11~12%) and ROA ( more than 1.3%) even though their recent focus is growing card business which’ll help ROE

Any changes in regulation for credit card fee by RBI could impact Bank significantly due to over reliance on credit card business

Valuation:– At per share price of 670/- Bank is trading at price to book of 3.7 for FY 19 but given the growth trajectory it’s justified to command premium. The only area of concern is it’s return ratio is tad lower from the likes of HDFC bank and Bajaj Finance of ( ROE of ~18%) but then these banks are traded at far more premium valuation as well.