Looks like Price movement is telling the story that deal is off

We are fast approaching IPO prices. As even a retail investor don’t want to sell his holding on IPO prices, I find it tough that promoters / big stake holders will do so.

For me the deal is OFF… with crossed fingers ![]() …will wait for news to follow

…will wait for news to follow

PNB housing is sliding continuously.Today even Repco’s, Gruh slide halted but this counter continued. Valuations are back to couple of years to IPO prices.I think to market even the stake sale looks uncertain in current conditions so getting more bashed. The way canfin has cracked after stake sell off and current NBFC massacre looks scary.

Though PNB is much better placed then Canfin in terms of growth shown and ALM.but current market any news of stake sell off will trigger another round of sell off. Stake Sell on will trigger Up side. So stock is evenly poised.

Interesting views from BM.

No talks on PNB Housing any more by BM.

Here’s an excerpt from BM interview in Aug 2017

“If you have zeroed down on financials, then you see the cost of deposits, the cost of borrowings and whether they can issue debentures, whether it is an NHB finance loan. So, there are two ways to attack it. One is because you cannot charge more to anyone because nobody is going to take a car from you if you charge 1% just because you have served him a cup of cold coffee. So you have to look at a company which can keep its costs under control which is the opex and which borrows cheap and borrows well.

A company which we own – PNB Housing Finance – somebody should just go and see that balance sheet. Again, it is not a recommendation. When interest rates were high, they borrowed short. They said in one year we are going to see an interest rate fall and that is then we are going to go and borrow long. Most textbooks advise asset liability match so your assets and liabilities have to match but money is made by doing an asset liability mismatch. What it means is in short term, rates are lower and long term rates are always higher. So obviously you borrow short and you lend long that is the way to make money. When I visited Repco three years back, they has a one year, two years, three years, five years asset liability match. At that time I got impressed but now I realise money is made when your asset liability does not match because then you borrow short, you borrow at lower rates and you lend long, at higher rates. There are too many things to look at about it but basically that is how we go about it.”

I think Ultimately in Financial services, GREED is the sin that most directly correlates to risk. Some companies chose to be conservative and in turn get moderate stock price movements in good and bad times. The more greedy ones tend to have wider swings and once in a while, some succumb.

Source - Basant Maheshwari: Basant Maheshwari on how to invest in HFCs - The Economic Times

Till last month everyone had different opinion about HFCs, now old opinions need to be seen in today’s context.

As per Basant Maheswari top quality NBFCs (Top 20%) will bounce back and perform even better in the existing condition but low quality NBFCs should be sold immediately whatever be the loss.

I had sold some PNB housing and purchased some DHFL thinking that it was even cheaper, selling at book value. But BM advises to book losses in low quality NBFCs immediately. Hence I sold my DHFL, since I believe that over the long run, companies with good corporate governance will outperform poor ones, though not priced so cheaply. If PNBHF reaches the IPO price of low 800s it should bounce back, since there will be no sellers, all non promoters having purchased the stock during IPO. BM does not have a good opinion of canfin and repco in his latest interview.

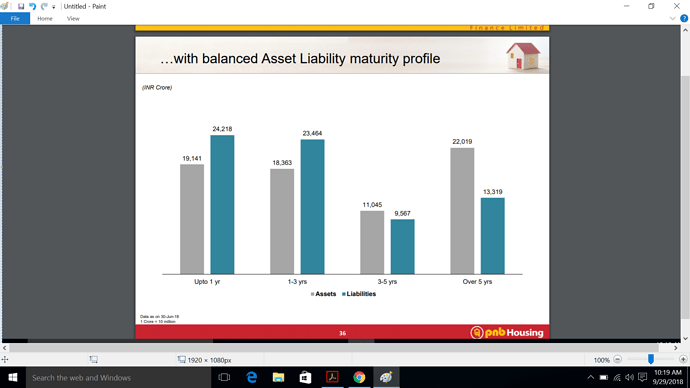

This is from the latest August 2018 investor PPT of PNB Housing.Can any one explain how ALM will impact them and how they are poised compared to others.It doesn’t look very bad from the details in the slide.

Financial companies take money from one side like FD (marked as liability ) and provide loans (marked as asset ). So, for simplicity let us in next 12 months, 100 RS of FDs maturing but on asset side only 80 RS available as there is a mismatch between tenure of lending n tenure of FD, then, these mismatch needed to be addressed by raising fresh liability I. In banking this is called ALM risk. Here, you can see , difference between asset n liability which comes approx 20% of liability maturing within a year don’t ve adequate asset side support n they will need to arrange for it . Now question is if they ve created assets at lower rate n if end up raising liability at higher rate , it can impact profitability but how much impact depends on many things like ability to raise liability at lower rate, share of asset in terms of fixed vs floating, ability to increase rates etc etc.

I would suggest everyone to evaluate by 10-14th Oct. Rates will be back to normal and good quality HFCs/NBFCs will back on their feet but smaller ones will continue to see tightening and they won’t be able to compete with PSU banks in the home loan segment. The govt. will do whatever it takes to avoid any blowups in a pre-election year.

Disc: No holding here

Just curious to understand ,how you have arrived at 10-14th Oct dates ?

Any event that’s scheduled where this s expected to be addressed/sorted out ?

Or it’s guesstimate considering the build up that’s happening ?

Thanks

Half yearly/quarterly tax outgo has tightened the liquidity which should ease by 2nd week of Oct. is what I understand talking to folks and confirmed by fund managers on TV. Govt. gets money and flows back to the system through banks and govt. payments/refunds.

Got it …Thanks. some additional perspective from Prabodh Agarwal of IIFL

Key monitoring parameters will be

Growth

NIM outlook for Q3 onwards

NPA especially LAP

Lastly clarity on stake sell

My Repco holding taught me about Management stance importance for Investor in case of a Crisis as if go they conservative then it’s good for company but not investor which flee the company due to Opportunity cost

Disc : Invested

LIC, SBI, Orix to subscribe to Rs 4500 crore IL&FS rights issue https://www.livemint.com/Companies/Y93giAJ3JA4ScqvNZSYNvK/ILFS-crisis-LIC-SBI-Orix-to-subscribe-to-Rs-4500-crore.html

Here co. came out with detailed ‘Liquidity Update’ as on 1st Oct.

Seems tobe comfortable…

Disc. Invested 2% of Portfolio.

Punjab National Bank to turn profitable in FY’19; Nirav Modi scam a bygone: Sunil Mehta

Perhaps PNB wouldn’t be pressurised to do the stake sale of PNB housing at throwaway prices.

Or Perhaps they Are factoring in the stack sale gains while making the statement ,as bids are already submitted.

Let’s see how things shapes up

We are aware that only Blackstone made all-cash offer for PNB Housing Finance but not sure if deal value is finalised … main concern is sharp decline in market cap & I am suspicious about stake sale process getting through.