one more piece of Bad news for PCJ

-

How sure about the trust worthiness of this news that it was recorded in recent days ?

-

No mention of Karol Bagh anywhere.

Hi Mani,

Possibly this video was recorded earlier but it was uploaded today.

Do you suspect A Bear cartel in Action ?

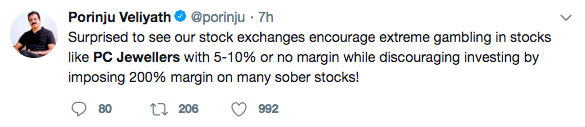

For the past few days the scrip is completely driven by operators. It’s almost like a casino. Not sure why SEBI is still sleeping.

The top ten shareholders are reputed mutual funds.Who are the operators here?

Check the delivery % … it is very low. So the operators are uncommitted players who enter and exit intraday. A look at the bulk/block deals for PCJ will give you clues as to who could be representing the operators …

Pls. refer to the Porinju’s tweet yesterday, It’s shared in this Forum. This is operator Play leading to unexpected Swings in prices.

That Said, the Swing was more yesterday, it’s visibly less today .

Porinju, At least never misguides about the ideas of Value investing the rationale and why it is important. I still like to hear him talk about how he picks regardless of the Size for e.g. Large/Mid/ Small caps.

As far as their performance is concerned,

90% of ALL the value picks, (i.e. Companies with High potential) have under-performed Since Jan, 2018.

Last thing, Let’s constrain our discussion to PCJ, If you don’t like Porinju there are other places where we can rant about him.

Titan and PCJ as top two leaders of this segment were my choice of investment. I did not ride the bull wave from 300 levels to 600 levels but entered at 300 levels when the Vakranghee fiasco happened. The logic was that whatever Vakranghee did had no impact on the PCJ business model. And it was available for a 50% discount from the peak.

However, since then, the stock crashed to below 100. And then rose as quickly to 260-270 levels. And all the while the company business mode has not changed a lot. A lot of rumours and confusion and thanks to social media high level of noise on PCJ.

I am invested in Titan and have exited PCJ as I feel that there are red flags behind so much volatility. PCJ may continue to be a trading stock, but not my core portfolio.

I have still not found any evidence of any wrongdoing by PCJ in any electric or print media… It will good if any boarder shares the hard evidence/facts. Just because the price is going down it does not become a suspect stock and vice versa. We all now that one of the FIIs sold a huge number which was equivalent to the total holding by public. The short sellers took the advantage and pushed the price further down. - this is a part of their business. Later they had to cover their shorts which led to sharp fluctuation in prices - this is also a part of their legitimate business. How does all this result in PCJ being a bad business. Have other MF/FII also sold heavily against delivery - we do not know.

Agree, I am also of the same opinion that just because there is allegation does not mean it is true. I added on to PCJ during this down fall.

Some hard concerns I have are:

- Why would fidelity exit at a huge loss in this manner? There will be a very good reason.

- With several fund houses holding and recommending this stock at twice the price, why would others not buy? Which would have put a floor.

- The receivables and days outstanding are way too high. This could be a fundamental concern.

None the less I feel, unless there is a case of fraud which we are unaware of, the current CMP makes a good entry point. They have come a long way by adding so many stores and plan to take the number to 200 which should provide good growth for next few years. I do not intend to tender shares in buy back, but the capitalize on this entry and let it grow for next few years when all this is forgotten.

The way I look at that is, just because satyam and few other IT companies ran a scam, we need not paint all IT companies with same brush. So even though Gitanjali ran a fraud, to a great extent Titan and PCJ are immune to that particular fraud.

I feel, these trades of shares by different entities doesn’t impact their underlying business. While I myself am not a customer of Jewellery, as long as the numbers and stores show growth, I feel we can hold on.

One thing i have difficulty in digesting is how Mr Balram garg starts operating one store in 2005 and then goes on rapid expansions.The other problem is the way in which compulsarily convertible preference shares and debentures are allotted.Not to mention it had taken in a good amount of money by ipo.Out of the 3000 crore general reserve,almost 1200 crore is ccp and ccd +ipo money.The way the company is in constant need of cash puts me off.

There are other red flags as well.For example the company gave 299 crore loan to one of its subsidiaries.Why would you give such loans to a private company?What would the shareholders of pc jewellers get from that?I would say Mind you that the company in question is not even 6 years old

Again,this is my personal belief,I may turn out to be proven wrong.But for me this is looks like a cash guzzler.I have not looked deep into the books,but only pointed out the issues that stick out on the surface

Disclosure:

Not invested.

I think, PCJ is highly volatile because of bulk deals. today less volatile because today less no. of bulk deals. I do not think, management introducing volatile.

https://www.nseindia.com/products/content/equities/equities/bulk.htm , here I checked bulk deals. some deals are too big above 1 crore shares.

Disclosure:

Invested.

CBI is doing search at Nagpur store

could you please provide source

please see Moneycontrol

@drravindra_2005 - This was news from last week. Given the volatility of the stock and the rumor mongering, i would suggest we exercise caution and refrain from such posts. The link to the article you are quoting is below and in the later half of the article, it summarizes events from last week of which you have later posted a screenshot. Your post seems to be misleading based on the article you are quoting.

Exited completely ,will take a call post meeting