A few updates over last 2 months. Though some updates are a month older, I thought to put them here, so those who don’t track this remain aware.

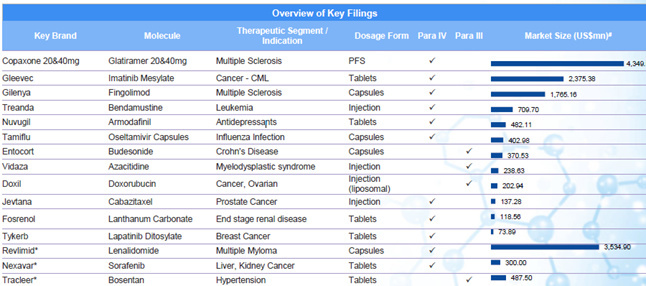

Update 1, Dec 12, 2016: Natco Launches the First Generic equivalent of Tamiflu® Capsules in the USA Market.

Link: http://corporates.bseindia.com/xml-data/corpfiling/AttachHis/D99B51DA_DB09_43E0_A6FF_3B19846081F2_103856.pdf

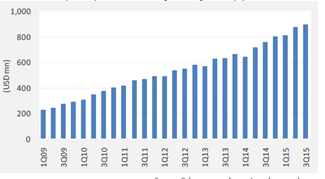

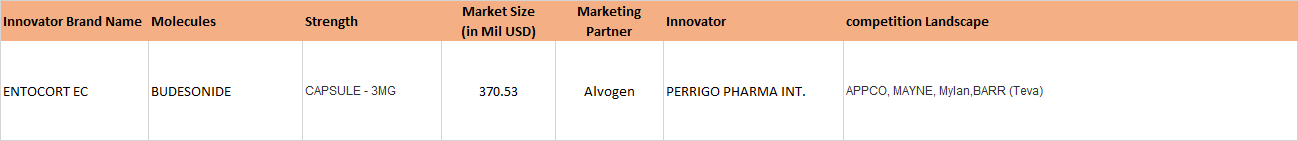

Natco’s partner Alvogen launched the first generic equivalent of Tamiflu in the US. The peak season for Flu in the US is from December to March, with the peak being in February. The following is a chart from the CDC website, showing Flu activity in the US

https://www.cdc.gov/flu/about/season/flu-season.htm

Depending on how Alvogen markets it in the US, there will be a reasonable share in the Tamiflu market. A small amount may reflect in the Q3 earnings and major amount will reflect in Q4 earnings. Needless to say, there are only two players for Tamiflu in the US market and this should definitely reflect in the earnings.

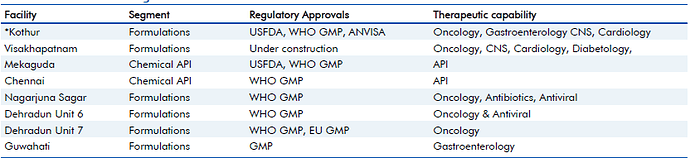

Update 2, January 25, 2017: Updates on USFDA inspection at its Kothur Formulation Facility.

Natco informed that it received 6 observations, all of which are correctable and procedural, and which the company believes, are minor in nature. They have been officially declared here, on BSE site:

http://corporates.bseindia.com/xml-data/corpfiling/AttachHis/1FA6837B_BF13_4406_83EF_505F1A5AB49C_100154.pdf

I did read the observations, and they clearly look minor, like Natco is claiming. US FDA observations recently have been affecting many pharma companies (For eg. Divis Labs). I would appreciate Natco management here, for immediately having shared the six observations transparently with all; and for not having used manipulative words in declaring the same (See Divis Labs announcement on these observations they had received and you will understand what I mean).

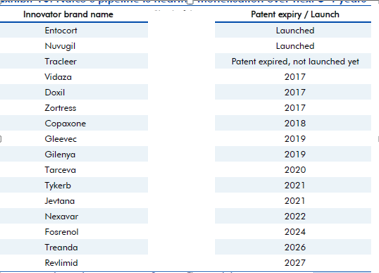

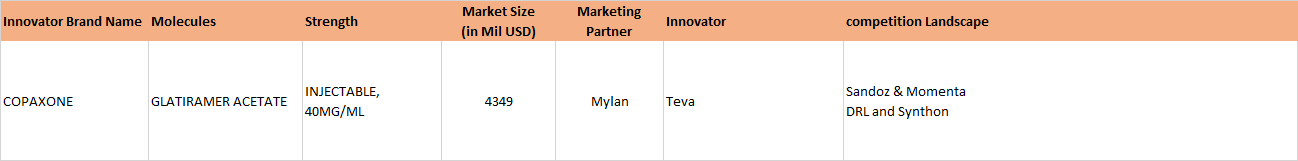

Update 3, Jan 31, 2017: NATCO’s partner Mylan Wins U.S. District Court Ruling Related to Copaxone 40 mg/mL Patents

http://corporates.bseindia.com/xml-data/corpfiling/AttachHis/8F9E30A7_8B05_4A52_B1F6_877DE75C4046_101631.pdf

The clarity on Copaxone 20 mg is still awaited. The Copaxone ruling was long awaited. Copaxone, used in Multiple sclerosis, has a huge market share in the US and had approximate sales on 3.3 billion dollars in the US market, according to IMS Health (as is mentioned in the BSE filing above).

Apart from these three announcements, two more are:

On Jan 02, 2017, Natco launched Velpanat (Sofosbuvir) in Nepal. Sofosbuvir is used in the treatment of Hepatitis C. Drugs for Hepatitis C is, as of now, still a niche play (till more players get into the scene), and Natco has a good market share here.

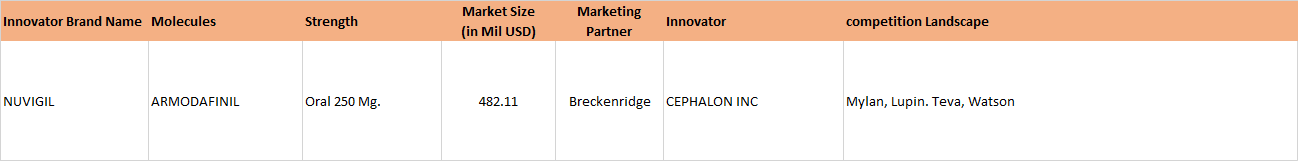

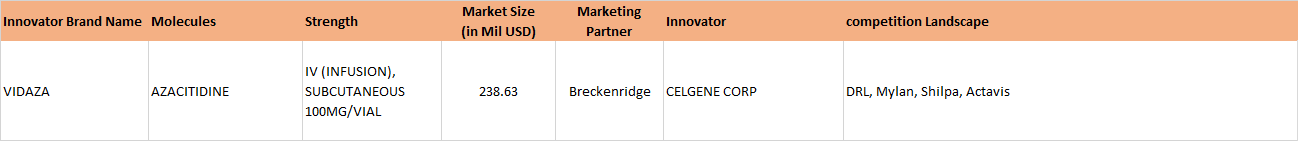

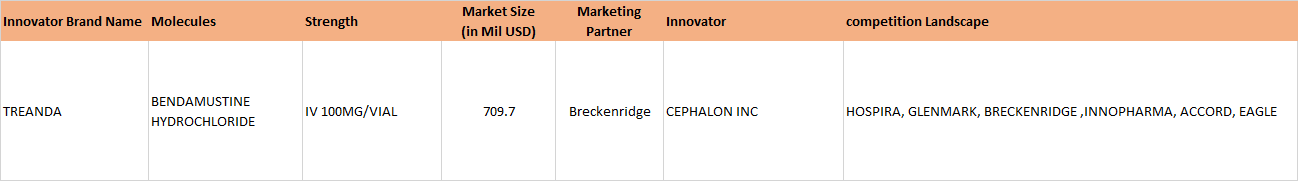

On Jan 06, 2017, Natco received final approval for generic Bendamustine power for the US market, its marketing power being Breckenridge Pharmaceutical Inc. Bendamustine is used in treatment of CLL (Chronic Lymphocytic Leukemia). The original research molecule of Bendamustine - Treanda (presently marketed by Teva, after having acquired Cephalon, which originally manufactured it) has an annual market sales of approximately 133 million dollars.

Now am awaiting results of Natco on 14th Feb, to see how it shapes up.

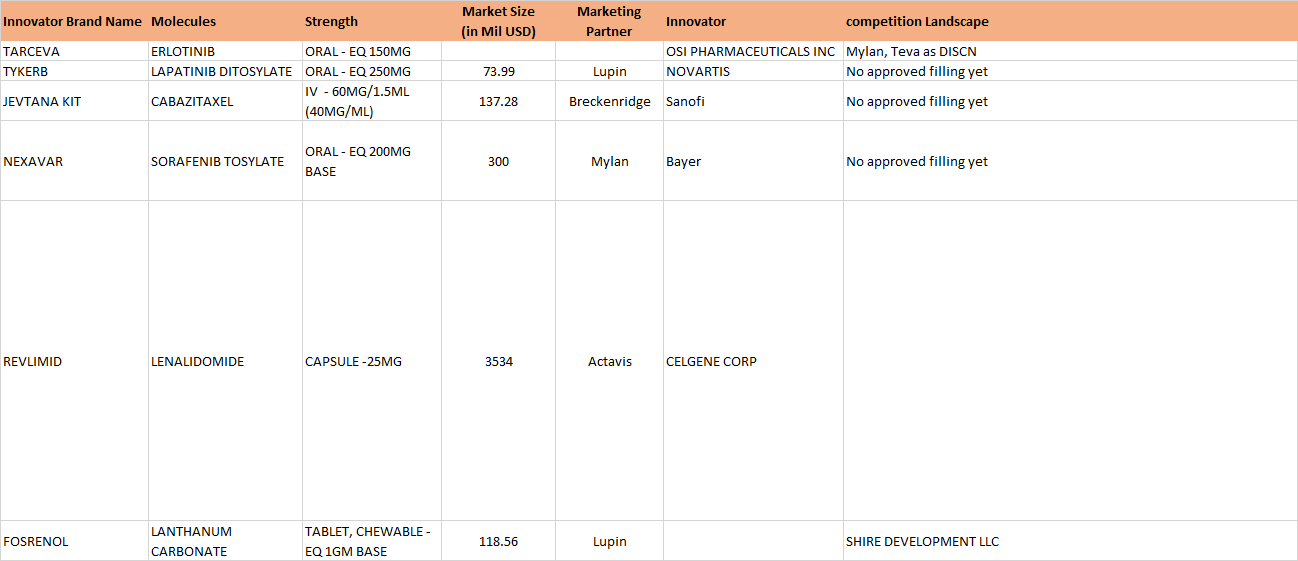

See the issues pharma companies are facing presently, due to FDA, due to Trump and due to market competition, it is amply clear that next ten years belong to Onco Pharma. I intend to share a very detailed discussion on routine pharma versus Onco pharma, as the two will behave differently for the next decade (Onco pharma like Natco, Shilpa, Biocon should not be clubbed with General pharma); I shall do that very soon.

Disclosure: Invested