Let’s start with Disclaimer! I am a SEBI Registered Research Analyst running an equity advisory company and holding stake in the company that I am going to discuss. The following stock is not a part of our paid recommendation service so I can able to post about it in public forum. The purpose of this post is to invite views on an unknown high potential stock. (Google Search reveals till date there is no article/post/comment across the internet on the following stock so a healthy discussion might be a fruitful addition)

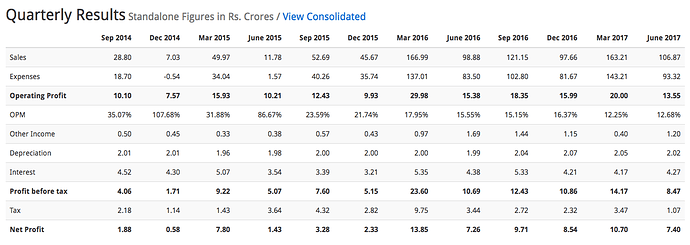

KP Energy - Lotus in muddy water

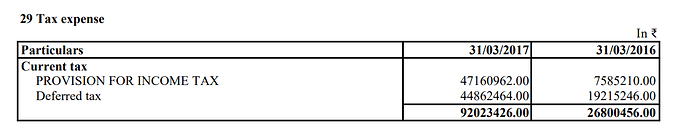

In spite of having a huge potential of renewable energy, over the last two decades, not a single renewable energy player emerged as a wealth creator in the Indian stock market. Rather, well known listed player Suzlon proved as one of the biggest wealth destroyers in the last decade! Another listed player Inox Wind generated huge negative return since its listing in 2015. All wind energy players are struggling with their balance sheet. However, a single less known small company (listed in BSE SME) from the same segment reported 45%+ average ROE over the last 3 years! For a player from Wind Energy segment, the numbers will blow your mind. Last 3 years CAGR sales and profit is growing at more than 50% while maintaining Debt to Equity ratio below 0.55! What’s more, they are generating huge operating cash flow every year. Tax rate stands around 33%! The numbers are interesting enough for digging further. While big players like Suzlon, Inox Wind are bleeding, what makes this small company KP Energy standing apart? Let’s figure it out

How KP Energy is different than peers

Big players like Suzlon, Inox Wind derive maximum revenue from the manufacturing and supplying Wind Turbine to the players those are interested to develop wind power projects. They also have their own wind power generation facility. Due to the manufacturing of wind turbine and other components, their business is capital intensive and requires huge investment and working capital. Thus, it effectively reduces the Return on Equity (ROE). On the other hand, KP Energy doesn’t manufacture Wind Turbines. They simply develop other’s project. Suppose ABC Ltd. is interested in setup a Wind power project worth 200 crores. So, ABC Ltd. directs Suzlon for supplying Wind Turbine Generator (WTG). Now, Suzlon bypasses the order of developing the project to KP Energy. “Developing” includes identification of proper site, land permit, construction work of the site, electrical works, setting up the transmission line and maintenance. In simple terms, suppose you are the owner of a residential house (equivalent to ABC limited in the above example). You are interested in interior development for your house. Although you are purchasing floor tiles from Kajaria Ceramics (consider Suzlon) but you handover the implementation i.e. tiles set up to a 3rd party interior designer (consider KP Energy). Floor tiles manufacturer Kajaria is not interested in setting up tiles on your floor because the revenue potential is minuscule compared to their overall revenue. So, Kajaria (here Suzlon) would be happy if any local interior developer (here KP Energy) set up tiles in your floor. You (ABC Ltd) had already spent around 1 crore for purchasing the house. Most likely you don’t delay the payment of few thousands to the interior developer (here KP Energy) for setting up the floor tiles. Moreover, the interior developer has no liability even if some tiles have a manufacturing defect. So, the interior developer (here KP Energy) has following advantages -

- Almost NIL liability. Manufacturing defects are covered by the manufacturer.

- Timely Payment. As the payment is very less compared to the total amount that the project owner already invested.

- Less working capital required, asset light business that is capable to generate huge operating cash flow as the developer has no significant initial investment.

- Easily scalable. If more and more people construct house then automatically interior design works would increase. Similarly, Government of India set up an ambitious target of installing 60GW Wind Power by 2022. Quantum of auction also increased a lot. So the Wind Power developers like KP Energy has a huge untapped opportunity.

Due to those above points, KP Energy is perhaps the only company across the Wind Energy segment reporting such 50%+ CAGR growth with less debt, 45%+ ROE while generating huge operating cash flow! (It is also a dividend and proper tax paying company)

KP Energy - Notes from Management Meet -

The company is so interesting that I made up my mind to meet with the management in person. I flew from my hometown Kolkata to Surat (Gujarat) and the management didn’t disappoint me. I had a long two hours conversation with the Company Secretary Karmit Sheth and the MD of KP Energy Mr Farukbhai Patel who is the architecture of the success story. Followings are the few points from our two hours long discussion-

Unique business model with a moat -

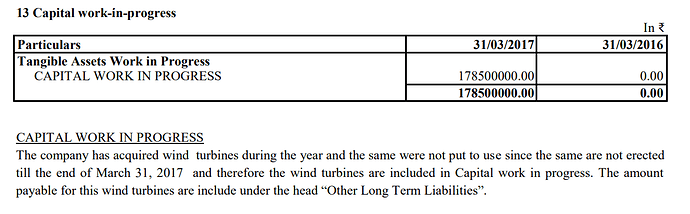

The unique asset light business model is the result of careful market study for the last two decades. Farukbhai Patel (first generation entrepreneur) is in various business since 1994. The present business model is crafted after closely studying the Wind Energy sector and big companies like Suzlon. I asked about the “moat” or “competitive advantage” of the company as it seems another company can easily replicate the same business model. The management answered that they have the land bank (all in Gujarat) capable of installing 800 MW Wind Power in the coming years. 800 MW is big enough while considering the fact that last year in FY17 they did 81 MW. (Already a 10X opportunity) Those lands are mostly unused and located very remote parts of Gujarat. So, those are leased at very cheap rate. The huge land bank capable of setting up Wind Project will act as “Competitive Advantage”. Further, from my understanding, many complex procedures are involved in developing a Wind Power project as sites are located in the remote village having very less population. They also did a project in hilly terrain where there is no commercial road connectivity. Thus, for a new entrant, it is not that much easy to copy the business model of KP Energy. Big companies like Suzlon, Inox Wind etc are also executing large projects but their primary revenue generator is the manufacturing of Wind Turbine. So, they are not direct competitors of KP Energy. In fact, over the last 3 years, KP Energy received almost all business from Suzlon itself!

Huge Scale up opportunity -

From Feed in Tariff (FIT) regime to the auction based tariff, the Wind Energy segment changed a lot. The Government of India set up an ambitious target of installing 60GW wind energy within 2022. The latest auction resulted in huge fall of wind power cost at only Rs. 3.46 KWhr. Lowering price means, the economics of scale would come into the picture. Going forward, only cash rich entities can set-up Wind Power projects. The critical mass for viable auction is around 250 MW. During FY17 KP energy did 81MW. Going forward, for their own survival they have to projects ranging from 250-500 MW as small scale projects would no more remain financially viable. So, over the next 2-3 years, they must have to scale up their operation by 5-7 times than the present scale. Otherwise, survival would be difficult. While asking about the capability of scaling up the management replied that it is difficult going from zero to hundred but once you reach hundred you can easily replicate it for making 2X, 3X and all. The statement is true indeed. Myself being a business owner realised the same. It is always difficult for the first paddle in bicycle but once it starts moving paddling becomes smooth and doesn’t require that much pressure as it was required in the first.

Preferential Allotment -

As on August 2016, KP Energy has very low liquidity (not traded every day) in BSE SME segment. Moreover, investors can’t buy a single quantity. As on current date, minimum investment lot is 3 Lacs+ (approx). Thus the stock is out of reach for maximum retail investors. To address the issue, the management is coming out with the Preferential allotment. After equity dilution, the paid up capital would be increased to more than 10 crores which is one criteria for shifting to the BSE main board (exchange). After March 2018 the company can apply for shifting to BSE main exchange. So, after few months from March 2018, KP Energy might be traded on BSE main exchange. Thus low liquidity and high investment lot related issues would be resolved. So, the stock might attract a higher number of retail investor’s interest during 2018.

Honest, Spiritual management -

Interestingly the MD Farukbhai Patel (Follower of Islam) is non-veg while the CEO who overlooks the entire Wind Energy operation, Ashish Mithani (Jain) is purely Veg. In spite of the contrast, both of them are spiritual and share a strong bonding. Farukbhai Patel was also talking about ESOP so that all of his employees can also take a part in the wealth creation journey from their own company. Many employees are associated with Farukbhai for the last few decades! On a side note, I noticed a huge number of books in the office room of Farukbhai Patel. As all of them are written in Hindi/Urdu (maybe) so I didn’t get the idea about the content. I also forget to ask about it!

Overall, I had a nice two hours long interaction with the management of KP Energy. The office visit increased my confidence about the company and business prospects! If everything goes well then the business has potential to grow by 10 times within 2020.

Risk-

Frankly speaking, I was struggling with finding out Risk. So the “Risk” part is edited later due to few requests from community members. So, here it goes -

- If the company fails for getting enough project development order or if they fail in scaling up then the survival itself would be difficult in the new auction based regime.

- Liquidity Risk - The stock is not traded every day, listed only in BSE SME. If something goes wrong, then one may not find enough buyers for selling it!

Disclaimer -

The author is a SEBI Registered Research Analyst. He has personal investment in KP Energy. So the views can be biased. The above is not a stock recommendation as there is no mention of valuation and stock price target. The author has a separate equity advisory service. KP Energy is not a part of the stock recommendation service. The primary reason is very low liquidity (stock is not traded every day) and the huge minimum required investment. One can’t purchase a single unit of the stock. As on August 2017, minimum investment lot is worth 3 Lacs+ (approx). Thus it is out of reach for the maximum retail investors and can’t be a part of the stock recommendation service.

As KP Energy is not a stock recommendation, so the author can’t be involved in the discussion of stock price valuation, target and all.

The article was first published on https://www.paulasset.com/articles/kp-energy-multibagger/