Suzlon - Valuation Update / 8th November 2023

Not all the Glitters is Gold, Not all that stinks is Shit - Somebody

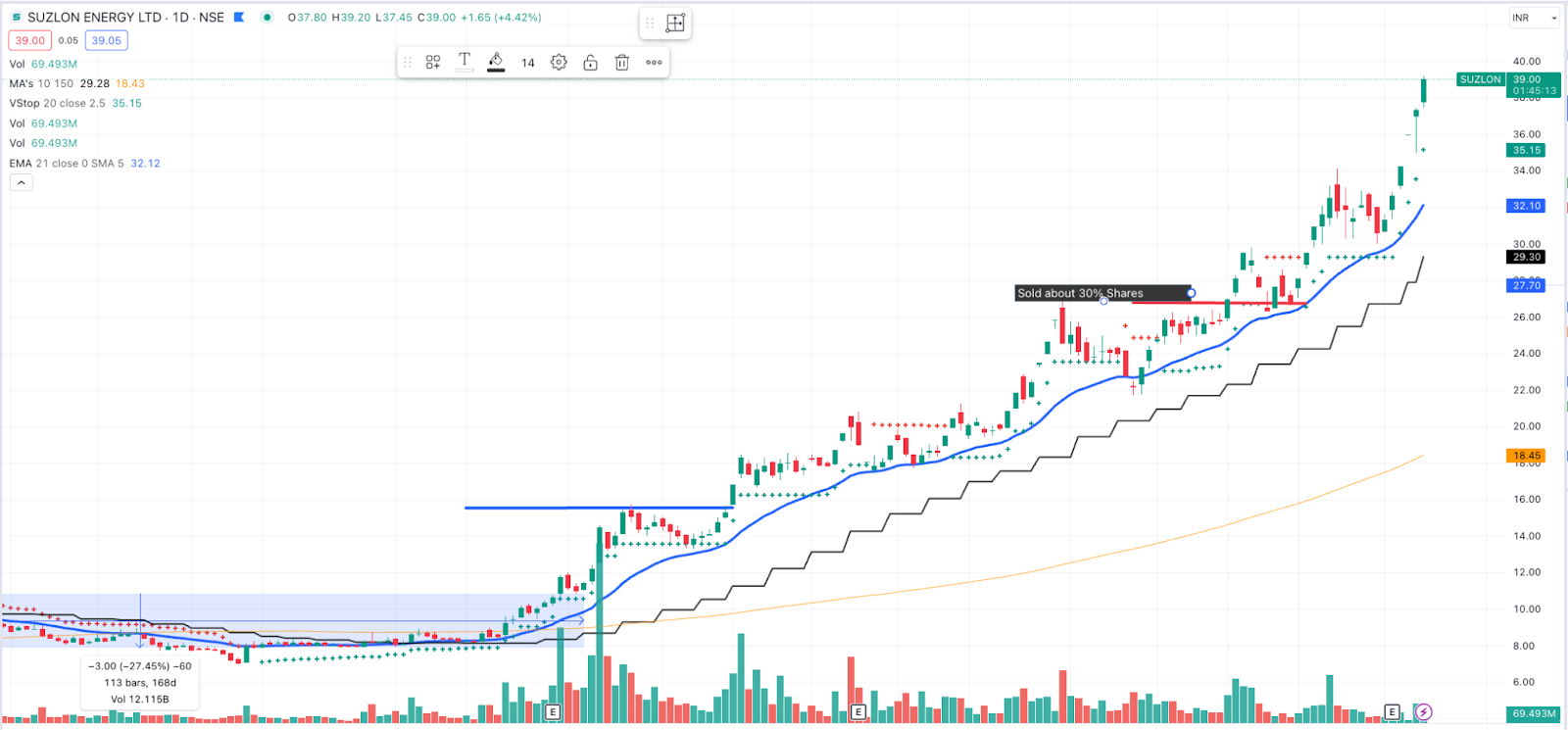

Disclaimer : I am invested in the Co’ & I sold 30% of my holding at Rs. 26 per share worried that the stock had run a little ahead of itself.

This is more of note to self on where we stand in this story and would love to hear your thoughts on the same.

Let’s begin

The Renewable Sector is on the up. Significant changes in the underlying fundamentals have rendered the sector viable & profitable once again.

Wind Auctions have picked up, commissioning of Wind projects has increased and Suzlon & Inox have emerged from the depths of hell (too dramatic ?!), or so it appears.

Between 2017-2020, Suzlon Flirted with Bankruptcy, came close to being Acquired by a Certain large Indian conglomerate and in the process lost the Wind Energy pioneer of India, its founder, Mr Tulsi Tanti to a Heart Attack (RIP)

I’ve made a Short Youtube video about the above changes. If you’re curious you can check it out.

The first question I asked myself was what’s a reasonably flexible range of PE ratio a co’ such as Suzlon should trade at given that we know the sector is turning around.

Maybe 25-50x of Earnings would be a reasonable range. Maybe ! Let’s find out

Whether it’s 25 or 50 (Focus on the range not so much the absolute numbers) Would largely depend on 2-3 fundamental factors

- Current & Expected growth rate of profits

- Longevity of profitability

- Visibility/Certainty of Profitability

To see and understand a connection between Current PE & future profit growth, we can invoke the PEG ratio (PE / PAT Growth) which many growth investors like to use in evaluating Growth companies.

A PEG of 1.5 or under is considered reasonable/undervalued when the growth itself is good (20-25%+) to begin with

Which means that a co’ that can grow at 25%, may reasonably be expected to trade (under normal/positive market conditions) at 25*1.5x = 37.5X

| Year |

2019 |

2020 |

2021 |

2022 |

2023 |

| Net profit after tax (PAT) |

(1,527) |

(2,642) |

104 |

(200) |

2,849 |

| Adjusted PAT |

(1,527) |

(2,642) |

104 |

(200) |

130 |

In 2023, the co reported a PAT of 130 Cr (adjusted for Exceptional item from Sales of Stake & Conversion of Debt into Equity).

This 130 Cr was a big jump of ~25% from 2021 Profits & well, infinitely higher than the loss incurred in FY22 of -200 Cr.

Still considering the 25% PAT Growth, maybe, a reasonable valuation could be ~ 37.5X on a trailing earnings basis

The fact that Current PEx is 142x means that TRAILING PAT growth is NOT the the key factor driving Suzlon’s valuations

Therefore, we must obviously assume that there are ‘other factors’ included in this price of 142X PE

As we just discussed above, the ‘other factors’ are most likely :

- Longevity - PAT growth will continue to be high in the coming years too !

- Certainty - We are also quite certain that this “Robust” growth will continue into the future

Basically by pegging Suzlon’s valuations at 142X we are saying this :

> “Profits will grow fast, they will grow for a long period and we are quite sure they will continue to grow fast for a long period”

The next question which I’m sure all of us are wondering is, what the hell does fast growth, long period and quite sure really mean for Suzlon.

Let’s explore that in a little more detail.

For this part of the note, I will invoke my genie - the “Model”

It’ll only take a few minutes of fiddling with it to realize how ridiculous it can get. You end up making a lot of estimations which in combination render the outcome (PAT) to be widely distributed

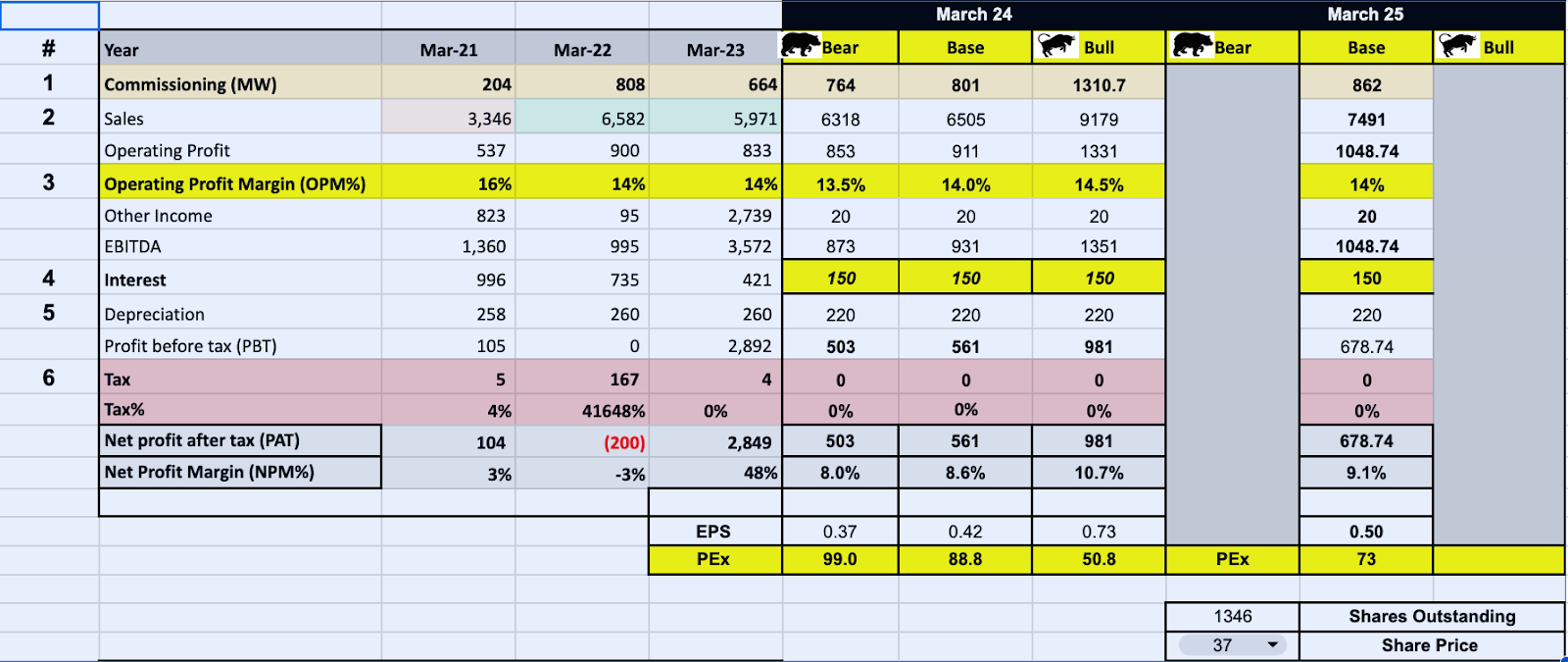

Meaning, my base case shows PAT of ~ 500 Cr and my Bull case of ~950 Cr.

That’s a fairly wide number !!

BUT I convince myself it’s worth it because we can get a good sense of the key number driving the PAT, that alone may be useful to some.

The following Key metrics are driving the financials in the model

| # |

Key Metric |

Comments |

Risks |

| 1 |

Order Book (MW) |

Current Order Book of ~1663 is mostly executable over the next 2 years up to March 2025 - September 2025. Current commentary from Management suggests ~750-800 MW will Commissioned this Year |

Evacuation Infrastructure in Karnataka since ~50% of Book is in Karnataka. |

| 2 |

Per MW Realization = Sales |

Historical numbers suggest ~5.5 Cr / MW. However, since S144 Turbine makes up 62% of Order the per MW might be higher since this is a new Turbine with higher efficiencies and it is being suggested that margins may be higher here. |

Suzlon has really minimal negotiating power with customer (IPPs) and my layman opinion is margins are not likely to be materially different from Current. If you’re an industry insider please feel free to educate on this. |

| 3 |

Operating Profit Margins (%) |

Here’s another leap of faith where we’re assuming Margins are likely to remain between 14-15%. Industry is kind of expecting higher on the back of 3MW+ turbine commissioning |

Steel costs, which make up for 65-80% of the total material (weight wise) are pass through but other costs are not which can mess with the margins |

| 4 |

Interest Cost |

While Debt has been reduced to 0 and the company has net cash of ~550 Cr, working capital debt remains and In FY23 it was 36% of Sales. WC has been the achilles heel for the Wind Turbine business. We have annualized the H1F24 Interest cost in the model. If it is lower, it will add straight to the bottomline. |

Management has said they’ve made adjustments to WC and its likely to improve but we’ll have to see. |

| 5 |

Depreciation |

Annualized for H1F24 and assumed to be 220 Cr |

|

| 6 |

Taxation |

No Taxes given Tax Loss Carry forwards. |

|

Which lead to the results looking something like this

Without getting into the details of the model, checkout the commissioning estimates, OPM, PAT and PEx justified by the expected PAT across the Bear, Base & Bull case

If our reasoning that “37.5X PE justified by 30% PAT growth “ is reasonable to begin with, the only scenario in which on a 1 year forward basis PEx is even close (50X) is the March 24 Bull case where we assume ~ 1300 MW of commissioning happens.

I think it’s damn near unlikely !

For one, it means that the company will commission in H2 of FY24, 4X of what it commissioned in H1F24.

While the second half of the year is expected to be better, that’s a long shot. (Any Industry insiders? Feel Free to enlighten us please)

Even management said in latest concall that H2 is likely to be 2X of H1 commissioning which brings total commissioning for F24 close to 800 MW (Base case)

So, one thing appears to be very likely.

Market is discounting much further than just the next year and with much certainty !!

This means that :

-

From the perspective of trailing PAT growth - 1.5X of 25% = 37.5X PE - Things look overvalued

-

From the perspective of FY24 PAT growth, which is likely to be 5X (400% YOY) so on a 1 year forward basis (w/ 500 Cr PAT), PEx is ~ 88.8x which again seems ridiculous in silos but maybe is being justified by the PAT growth of ~ 400%.

-

Market is discounting the profitability of the entire outstanding order book of 1650 MW and assuming with high certainty that it will be executed by March - September 2025.

Actually, taking the THIRD perspective simplifies things a lot :

If Suzlon was to execute the entire order book of ~ 1650 MW, how much profit can it generate?

As we have discussed above, it’s not easy to pinpoint the exact number and the numbers can vary widely BUT…

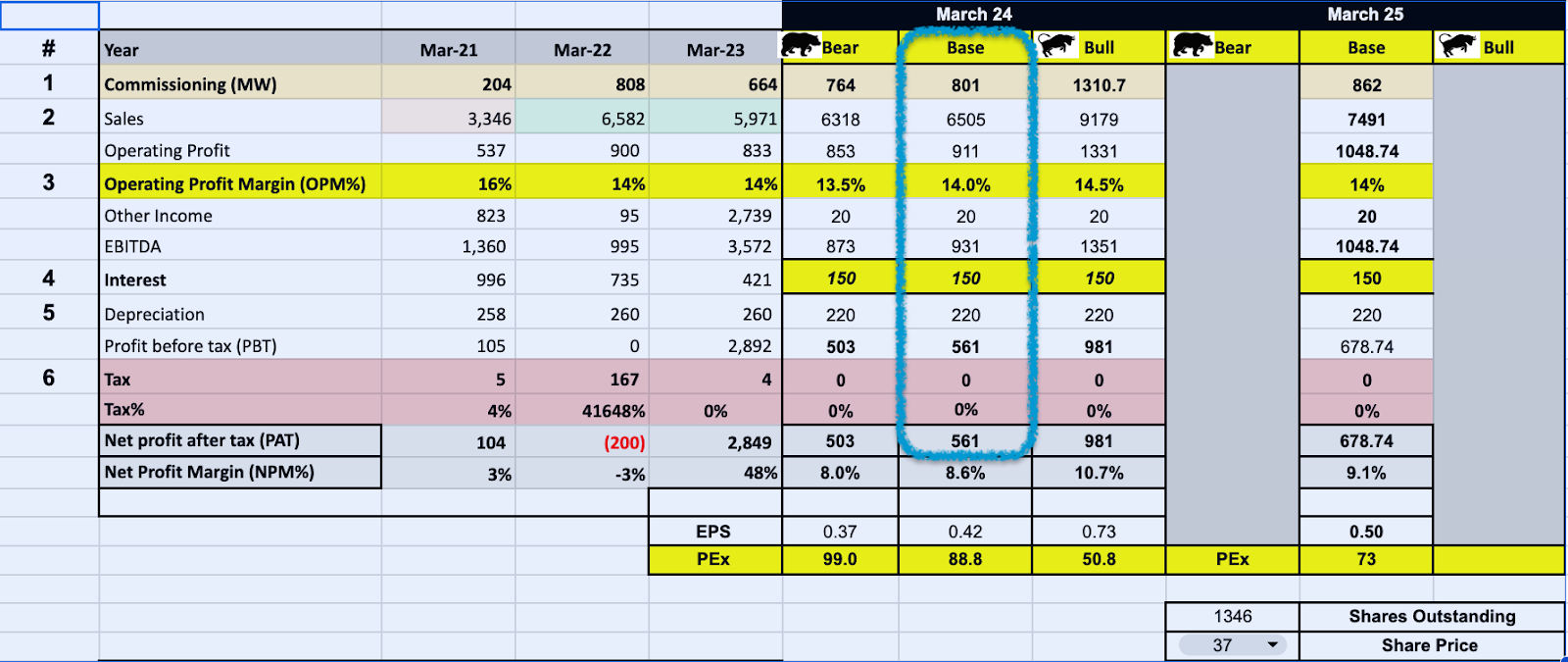

If we say per MW realization, OPM and all the other expenses are going to look something like March 24 Base Case (Highlighted in blue Pic below)

It would mean that the co’ would earn a PAT of ~1100 Cr which on the Current Market cap of Rs. 52,500 means co’ is actually trading at 47.7X on a 2 year Forward basis.

This means that the current prices imply not only that the order book will be executed in the given time frame (2 years) but that OPM will be ~15% and PAT around ~1100 and the degree of certainty of all the above happening is fairly high.

Even if the above were true, a 47.7X further implies (my personal opinion) that the order book will keep growing, and things are likely to remain bullish for the sector.

Meaning, current prices have already factored in 2 years of future earnings + an additional multiple(s) for profitability 2+ years into the future.

I love the confidence these prices seem to display but it appears things have moved much ahead of a reasonable buying range.

But then again, I sold 30% of my holdings at 26/share so who am I to say what is reasonable?

All I’m saying is, it seems that Suzlon Investors are flirting with the future as if it was the present, and leaving little room for any Execution risks.

Apologies for any errors and would love to hear your thoughts on the above.

Thank you

Rahul

.

.