Superb…

Well done. This is a lesson in funding pump and dump

Creative accounting is one of biggest challenge coming forward. Not necessarily this case, unfortunately hard nut to crack based on information available on public domain. Media and associated companies is a sitting time bomb! With all forms new fads accountant’s are not ready to tackle treatments. That would mean far far more job for ordinary shareholders.

@The_Confused_Consult thanks for putting up some valid points. but I’m not sure it’s book cooking. if it is then why would moneycontrol and BoB will recommend a buy with longterm perspective. that’s beyond my capacity. if anyone can highlight some points about these recommendations, it would really help.

Fiberweb in AR mentioned that it’s approved supplier to Lowe (amongst leading & reputed Company in USA) leading to being approved supplier to Walmart in USA. it also supplies to J&J. if Fiberweb management is lying about these supplies then corresponding companies would condemn the claims of Fiberweb.

Regarding Gayatri selling, if they have to recover 100cr they have to pump the price to above 400. and they were selling since 150 levels, which makes it more difficult to recover 100cr even at 400.

in another forum @phreakv6 was mentioning about circular trade in open market. I could see same thin happen on friday in Amarraja Batteries where 7,50,000 were traded in open market and take for delivery, which is unusual considering the 2W avg volume is just 96000. same thing observe in BlueStar . I can few more example like Dena Bank, Container Corporation of India etc., all of them have high delivery around 98%. is it not the samething for big companies like these? Amarraja and Bluestar would just hit the Lower Circuit if it’s open market sale. it’s same as Fiberweb like circular trade?

@sravanind thanks for asking questions and expressing apprehensions. I think we are bit over reacting to the extent cooking of books or circular trading. These are forensic subjects and can be unearthed by appropriate agencies. Because on information available from public domain very difficult to perform a forensic activity, you need support from management. So let’s not go that far.

Your point on: research recommendations

Research analyst provides assessment of his views just like you and me. Yes we can argue they have better resources or man of superior intelligence but no one takes accountability. All I can do is ignore their voices and try by myself whatever I can do.

Customer information

The notifications to stock exchange does not mention about customer name etc. I am afraid in 2016 and 2015 AR company does not specify either. In case I have missed out you have to guide us with specific page and reference. That will give me better understanding further.

Unfortunately announcement to stock exchanges are not audited as per statute. In past a good number of companies were caught lying. Personally I would not rely much unless specific information are provided.

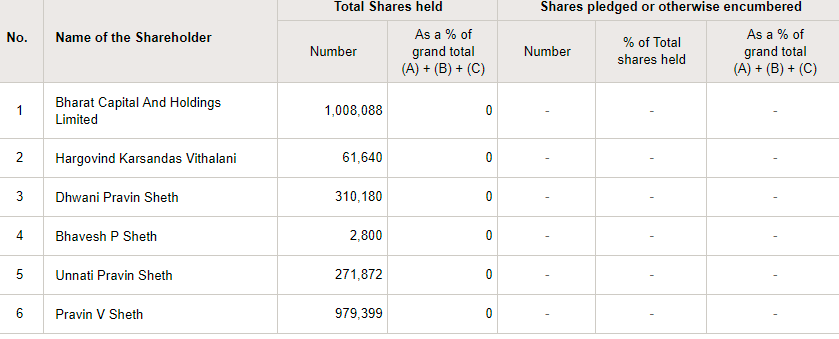

Gayatri Selling

I am not sure whether they want to recover 100 Cr or not. Not even aware if they are pumping price. All I exhibited is inconsistent communication, unusual transactions related party transactions. Plus shares distributed at higher price to retail shareholders, you can see the table.

But the debate is somewhere else, it’s not accusing anyone of a treachery.

- Inconsistent financials with little support from cash flow. few points raised above.

- Extremely unusual communication style of management, at least I am not acquainted. Like PE ratio, using sir/sir, hyper sensitive positive affirmations. Few examples given above.

- Unavailability of second level of information to do further studies. Like customer details, product name, competitive advantage if you are claiming to be superior, growth forecasting to do a business valuation etc.

- Questionable transactions in past which is making difficult to connect current state of affairs. I pointed out some old loan above.

- Catalyst- when we speak about growth drivers it has to be super specific. Why order book is not reflecting in revenue? Where from capex of 100 Cr will come?

I am leaving with few notes for you to ponder over:

- What is stopping Supreme Industries or big guys entering into this business if the structure of industries is so superior? I mean huge demand supply gap, high margin.

- Does anything state of the art protected by regulation? Or else anyone can buy any plant and start doing business.

- Why would a customer pay higher price when end user pricing is influenced by intermediary brand not Fiberweb?

- I have struggled basically where from competitive advantage comes? Regulatory pricing? Branding? Cost advantage? I don’t see any of them. How would I be happy with durability of forecasting if I can not spot the source.

- Why not declassify Gayatri Pipes to public category and announce to stock exchange that part of financial dealing shares will be offloaded?

- Where is consolidated financial statements if you have subsidiary companies?

- Where is a cost auditor when you have manufacturing facilities?

- If you have internal audit system where is the name of auditor or in house? Why not mention.

- Huge cash balance with respect to working capital requirement? Why the cash was not working for company?

Honestly I have not spend a great deal of time for this company as I abandoned the idea. If you are happy with investment thesis you have every right to invest and make money.

In fact it’s possible your investment thesis may come true. I wish you best of luck.

Regards

I forgot, if you want me to focus on specific area to focus I can try if it helps you. Perhaps October 1st week. Please let me know, but just in case you want.

Small companies make tall claims all the time. Sometimes they might be telling the truth but not the whole truth. For eg. A 3d printing company I know once had a small one-time rapid prototyping order from Volvo. The value of the order was so small but the company to this day continues to list Volvo as the first Customer under clients. It conveys a different meaning to the uninformed. These things happen all the time when companies want to elevate themselves by association. It may even be a lie but the big company may not even know or be aware of the existence of the small fry that this can go on for years until a bigger controversy builds up out of it and then the bigger company issues a clarification that they have never worked with the one claiming it to be the Customer. These things have to be taken with a pinch of salt.

Regarding Gayatri Pipes selling - The FY17 AR clearly lists Gayatri Pipes as a related party on Page 83 and the relation being “Common Director- Pravin V Sheth Gayatri Pipes & Fittings Pvt. Ltd.”. Despite this the promoter continues to claim this company is not a promoter company and is unrelated although its present right there in the AR. Now what if the company had been siphoning off funds which is what lead to the BIFR situation? They could then dilute stake to related parties at filthy cheap valuations and then pay off the debt using siphoned funds and also sell the stake issued via pref allotment as a bonus at elevated valuations. The promoter is a CA after all and has clearly been unethical on multiple occasions. Got to assume the worst.

Large volumes like that if they are one-off, they are most probably reshuffling of holding within different holding companies. A lot of this happened to avail tax benefits in the last FY. It may also be a large stake being offloaded to another buyer at a pre-agreed price. What matters is the disclosures. If you don’t see anything in the disclosures related to promoter selling, then it may not be anything to worry about. In Fiberweb, these large transactions happen almost on a day to day basis at fixed prices but the prices do follow a downtrend in the longer timeframe. This gives the impression that the promoter company Gayatri pipes is offloading to an intermediary who can then dispose this stake off without the burden of disclosures.

As for research recommendations, I can find research reports on Shilpi Cables and quite a few other stocks which have met a sad fate. Better to take them with another pinch of salt.

My 20 cents on this company… I had a small holding in this company which I sold off. I read through BSE filings of the company and found them to be too immature and I got the impression that the same was with an eye on the stock price. … For instance they kept declaring that a particular machine which was supposed to make high margin products has been ordered, and they made a big splash news when the equipment arrived. They claimed that it arrived one month in advance of the schedule … in any corporate these are daily events and there is an adequate buffer in project timelines … and there are many such announcements which smirk of single minded pursuit of appeasing the stock price ,… these are purely my views.

My 2 cents on Customers

Walmart - They supply to a Walmart supplier. So technically Walmart is not a direct customer. A friend of mine checked Walmart shelves & could not find any reference to Fiberweb. (It’s possible that the Tier 1 supplier name is mentioned and not Fiberweb)

Lowe’s - Not sure if the Lowe’s referenced is the same as the Fortune 500 retail company in USA. Per one of the company communication, they had mentioned supplying to Walmart through Lowe’s. AFAIK Lowe’s compete with Walmart in many product lines (including Fiberweb’s end products). So the Lowe’s mentioned herein may be a different company than the Fortune 500 retail giant.

J&J - Per company communications J&J and Unichem are domestic customers

Trading by the middle east subsidiary accounts for 25%. And they scaled up such volumes in 1 quarter. Given the kind of companies they claim to have as customers, unlikely that they depend on a 3rd party company to source to them from China & have their hefty mark ups.

I did my research and gave up when things did not add up.

I attended the AGM of the company at Daman and also interacted with the management to clarify some of the issues. These are summarised below:

-

Expansion plans of spun bond non woven and melt blown fabrics. Due to the complexities involved in the installation of melt blown machinery, the installation is likely to be completed by mid Oct 2017, followed by trial run, submission of sample fabric to potential clients and commercial production from early Nov 2017. With regard to further expansion of 10000 MT spun bond non woven machinery, a technical committee has been set up and is expected to submit their report shortly. My inference is that since spun bond non woven fabric has comparatively lesser margins and there would be increased competition going forward due to presence of other suppliers of this fabric that could further reduce the margins, the company may go in for a different product that has higher profit margins and lesser competition (akin to melt blown fabric).

-

Funding for expansion. Out of 30 crores raised by issuing convertible equity warrants, 20 crores was utilised for melt blown machinery and about 7 crores for the factory building and installation expenses. Additional funding that would be required for further expansion recommended by technical committee would be decided by the fund raising committee/Board.

-

Promoter selling of shares in open market (Gayatri Pipes, Sulochana Devi and Abhishek Agarwal). The selling of shares by these who are clubbed under the category of promoters was mainly to raise funds for their respective companies. Going forward, the chairman mentioned that he would be increasing promoter stake and would also consider buying the remaining shares held with Gayatri pipes.

-

Details of companies to whom fabric is supplied. In addition to Johnson & Johnson (domestic) and Lowe( international) for which communications in the form of press release was sent to exchanges, there are about 10 other US based clients to whom the fabric is supplied. Due to the existing confidentiality agreement, the names of these clients cannot be revealed at this stage.

-

Value added items. Instead of supplying the entire roll of fabric to the clients, the fabric was cut to the required size as required by the customers mainly for crop and fruit covers with the required colour pattern and printing. Other items which is also mentioned on their website includes hospital related items such as bed covers, pillow covers, curtains, shoe covers, disposable face masks etc.

-

Corporate Tax. The company would be required to pay tax from next FY onwards as the exemption including MAT is limited till current FY.

-

NSE listing. The existing criteria for listing stipulate a minimum positive net worth of Rs.50 crores for the preceding 3 years. However, management clarified that post this AGM, they would be submitting the required documents required for listing and expects the same to be completed within 3 months.

Disclosures:1. Invested, views may be biased

2. Some of the discussion points which are not yet finalised/made public have not been

included.

When it was disclosed/discussed in AGM it is as good as making it public, I suppose.

Disclosure: exited recently, no holdings.

You are saying 2. Some of the discussion points which are not yet finalised/made public have not been included.

Are you trying to tell us that you have access to information which public do not have? In case yes, don’t you think it’s not normal interaction and disclosure is insufficient. Not sure, @adminph2 may have to guide.

Point No 1: Expansion Plans

Due to complexities involved- I spoke to someone associated to technical textiles. He says there are different type of machines, but it’s input to output machine unlike in an industry you need a web of requirement before final out put comes. Second what I understood these machines can be low as 4 to 5 cr in cost and can be installed in any premises. Third which is most important to me, seems to be a business so far operated either mostly by China or SME (Small or Medium) sector in India. So not sure whether company’s claim being pioneer is true. If at all SME is true without a cookie cutter model how would one company fend of competition, more so less capital intensive. Further no regulatory protection on technology, machines are easily available all over world. Unless you are giving specifics of what this machine is which others do not have.

I am afraid there would be any margin play if a lot of guys are involved. The only way you can punch them through cost advantage or offer something which others do not have. Like value added products you have mentioned. What I was told by this guy, single machine can easily produce 5000 MT to 6000MT a year even with a very low investment of 4 Crs. I am not a subject matter expert of this industry, but if management claims 10000MT is a gigantic quantity produced we need to back it up with details.

Point no 2: funding for expansion

I am finding bit akward for a high margin product what is stopping company to approach a lending institution like bank? Every percentage of financial leverage will add to Return on Equity. Is it Banks are refusing the loan?

Convertible equity warrants gives choice to management exercise right but not obligation to convert. Where we can see further details on this? Why not use a convertible security where promoters are obliged to bring additional money. Warrants are meaningless till you purchase the stock. You are just buying a underlying asset. Good for investors but why a promoter would use own company as underlying asset.

Point no 3: Promoter selling in Gayatri Pipes

I will be conservative here assuming Agarwal’s are selling for their own need. Lot of related information are tangled.

- One the sale is taking place at a much higher value than acquired. That establishes a monetary benefit has happened to seller, in fact significant.

- Gayatri pipe share the same address, phone number, directorship etc. What makes us to think these companies does not have business interest with each other. It’s actually contrary.

- There is another listed company Kunststffe Industries run by Sheth family with Gayatri Pipe being a significant shareholder.

Here is one more management statement from your post:

Going forward, the chairman mentioned that he would be increasing promoter stake and would also consider buying the remaining shares held with Gayatri pipes.

Is management disclosing insider information such sensitive as increase in promoter holding to retail shareholder like us? How many promoters talks about creeping acquisition in advance?

Point No 4: Customers

BSE announcements are not audited piece of material. Director’s report has to say very clearly about customer. I checked again, it keeps saying buying agent.

Another statement from management from your post:

Due to the existing confidentiality agreement, the names of these clients cannot be revealed at this stage.

Wondering what would be confidentiality in disclosing customer name unless you are not a direct supplier. It would be like Infosys denying my firm to claim that I do consulting work for them. (example, I am not giving any consulting to Infosys).

Point no 5: Value added products

By cutting a bigger size to smaller size, how can we believe it’s a value add than normal processing. I have a company called Maithan Alloys which operates in a terrible industries like alloy. But what management deed is provide different mixture of alloys customised to customer need. But what is significant customisation comes from integrated activities like manufacturing, addition of catalysts etc not simple cutting and packing. This type of competitive advantage will be smashed off in 2 days by others.

Lastly before someone asks me to deal with management, I am not going to do that. Simple reason is when so many questions hitting me by talking to a friend and looking at bare financials why should even I talk to management. And how many cases retail shareholders talk to management? Or else VG Bangur would have been my mentor, I am holding his shares for 22 years now.

Disclaimer- not invested, unlikely to invest.

These communications are for those guys in forum who wants to have ‘value added’ eye before putting their money. I know a bunch of them here, will throw my ideas and receive from them ongoing basis. That’s a corner stone behind valuepickr. Those who are invested or want to invest of course they have absolute freedom.

The points mentioned by me include those which do not form part of AGM. These were discussed separately with the management after the AGM.

@the_confused_consult…Appreciate your point of view. While I’m no expert on technical textiles, will try and answer some of the queries raised. But before that, would like to clarify that my post was intended to share the information gathered from the management for the benefit of valuepickr members and is not meant to be any kind of recommendation.

Firstly, complexities involved. Management stated that the time taken for installation was more than anticipated due to extensive piping, cabling and welding work involved for which they are dependent on German technical staff and each of these fields have different specialists.

Secondly, type of spun bond machines available in the market could mainly be either local, chinese or German. In this case, the machines are imported from Reifenhauser Gmbh, which as I understand has better quality and hence end product is more acceptable to export markets.

As per my understanding, it is not the size but the expected margins going forward that has resulted in rethink. If you go through the last conference call wherein it was stated that the production cost being similar for both spun bond and melt blown fabric (marginal difference of 3-4%), the product sale price is 2.1/kg and 3.5/kg(both in USD) respectively.

I do not think this is the case. If you go through the proceedings of the Board meeting held on 21 Sep 2017, wherein it is mentioned that they would explore all possible options for financing the project. “preferential issue of equity shares including convertible bonds/debentures, private placements, QIP, and/ or depository receipts and /or any other mode including loan from Banks/financial institutions”.

http://www.bseindia.com/xml-data/corpfiling/AttachHis/62645efb-531b-436e-abbc-1980735bd288.pdf

there may be several reasons why management do not want to reveal the names of suppliers but at this point to conclude that these are false would be speculation. Several IT companies too do not reveal the names of the clients they added during the quarter (8K miles, Kellton are few examples).

while we can debate on the definition of value added products, as per the company, these products fetch them higher value and margins and hence they term it as value added product.

I can understand you being invested, appreciate your views and more importantly the pain you are taking to gather information.

But somewhere it doesn’t gel again, I may be offshoot. I think our job is to bring points of view , investors have their own liberty to decide.

As a general point it’s all about ‘Management Said’. Well I will not vouch an investment proposition with too much ‘Management Saying’, there should be cross verification from multiple sources. Saying that let’s focus on what management is saying:

Secondly, type of spun bond machines available in the market could mainly be either local, chinese or German. In this case, the machines are imported from Reifenhauser Gmbh, which as I understand has better quality and hence end product is more acceptable to export markets.

Every product Sony sells is not OLED or cost billions, similarly a reputed manufacturer has variety of product lines.Yes, management may be right here, the friend who told me may be right here. No specific data to ponder over, that’s the point.

As per my understanding, it is not the size but the expected margins going forward that has resulted in rethink. If you go through the last conference call wherein it was stated that the production cost being similar for both spun bond and melt blown fabric (marginal difference of 3-4%), the product sale price is 2.1/kg and 3.5/kg(both in USD) respectively.

It would be really helpful for reader here if we know what is the quantity sold, no independent way of verifying these claims.

I do not think this is the case. If you go through the proceedings of the Board meeting held on 21 Sep 2017, wherein it is mentioned that they would explore all possible options for financing the project. “preferential issue of equity shares including convertible bonds/debentures, private placements, QIP, and/ or depository receipts and /or any other mode including loan from Banks/financial institutions”.

http://www.bseindia.com/xml-data/corpfiling/AttachHis/62645efb-531b-436e-abbc-1980735bd288.pdf1

This is a standard circular passed by most of companies. It does not answer why one would go ahead and issue an warrant without taking obligations. Or why the cost of funding is so terrible if taken from bank?

there may be several reasons why management do not want to reveal the names of suppliers but at this point to conclude that these are false would be speculation. Several IT companies too do not reveal the names of the clients they added during the quarter (8K miles, Kellton are few examples).

Yes, agree there may be several reasons. The companies we are referring here , have they refused being asked? I can understand every company like size of 8k adds hundreds of customers every quarter. It’s technically not possible for them to disclose. Here we are talking about a company who keeps saying about buying agent, nothing short of discussed in director’s report. I guess 8K miles dont do such things!

while we can debate on the definition of value added products, as per the company, these products fetch them higher value and margins and hence they term it as value added product.

Apologies, but this is not a debate between you and me. In fact I think we have same objective, to put up a justified case study for bull and bear. Value addition is embedded to value chain of company, don’t you think we need specific answers than generalized statements.

Still dozens of questions unanswered more in the area of shareholding, funding and financial analytics. A lot of them have been listed by not only me, few others.

But good point is enough discussion materials for an reader to take a call appropriate to his risk appetite.

Simply said,

When we are right – we earn,

When we are wrong – we learn.

Only pun intended nothing about Fiberweb.

please don’t take to heart.

My question to ponder is that do we recognise Fiberweb is the only great story?

If not move on. My intention is not to hurt anyone.

Prasad.

No one is taking into heart. In fact I am not invested here, I can simply close my eyes and walk on. A lot of people assembled in this forum not only to benefit themselves but others as well. You can see voluntary selfless efforts for hours by many many guys including founder. Let that spirit not die.

With advent of information explosion it’s becoming more important we manage our decisions well. That brings to , we need a strong bear case for every stock.

The amount of wealth destroyed from certain stocks has wiped out people, they never come back to invest. Those who were propagating vanished, some still selling services shamelessly.

This has nothing to do with this company, in fact this company may turn out to be a industry leader or competitor. But having criticism will make Fiberweb stronger not weaker!

agree 100%. this is what i also wish to convey.

This is not funny anymore, Moneylife scathing article on Kunstestoffe Industries. I have highlighted this earlier, same management, same office address also Gayatri Pipes is a major shareholder.

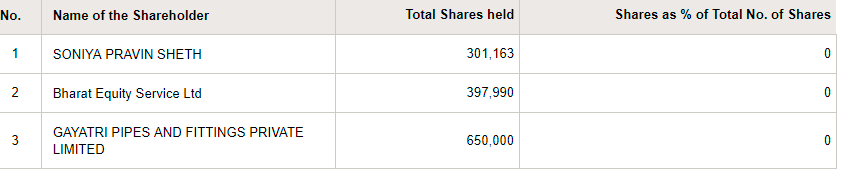

Promoter details of Kunststoffe

Public shareholding details of Kunststoffe- Soniya Sheth is taged as public!

Fiberweb was actually a well known U.K. listed company in non woven fabric that got acquired by world leader Polymer Group in 2013.

Good name this company has chosen for itself!

Thank you very much to all who contributed to this thread. I cant express my gratitude enough in words as to how much you guys have helped me in figuring out what’s going on with this scrip. Though I took 20% loss, many lessons were learnt.

I also would like to share my observation that many members who wrote in support of this ‘turnaround story’ have either joined this forum recently or have been here for long, but did not post in other topics. Not accusing anybody, but I find it very strange.