Not so impressive result…

I have written a blog in Comsyn Competitor of Emmbi and how emmbi utilizing human resource good than the comsyn have a look

Anyone still tracking this company? Any updates or insights into their B2B and B2C business model and growth prospects would be appreciated. They had an analyst meet with JM Financials few days back. Not sure what materialized in that meeting.

Any new updates on this would be of great help. Thanks!

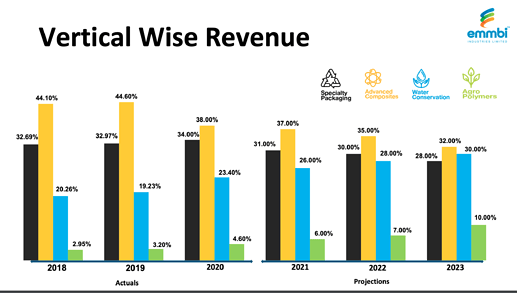

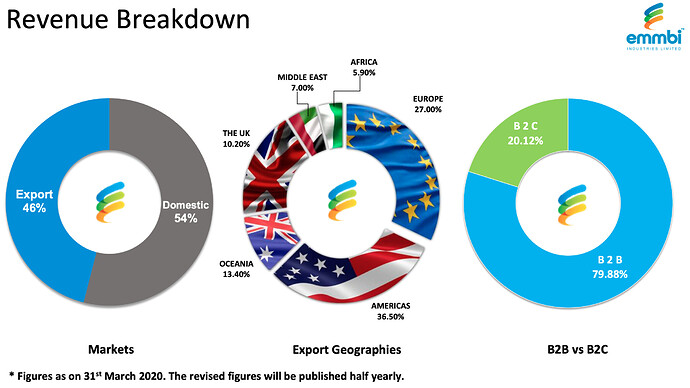

From the latest presentation from the organizational update, we see that the division of the revenue streams are as follows -

Water conversation 20%

Advanced Composites 45%

Speciality Packaging 33%

Agro Polymers 3%

Ref (call transcripts - 1) (call transcripts - 2)

Tailwinds

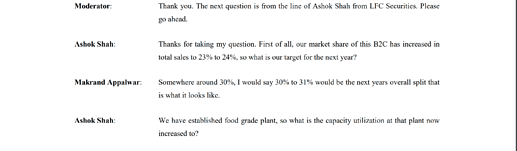

- From the companies own admission, they are happy and expect around 16% overall growth in revenue numbers. And Avana is contributing (presently) around 24% revenue and the company would like to see Avana inch upto 31% revenue. So this clearly states that more focus is in B2C business.

Generally B2C commands better margin control, so we should be able to see better bottom line in next couple of years.

-

With the COVID-19 situation in-place, there are good chances of consolidation in the industry and a very well established player like Emmbi should be able to capture greater market share with current market condition.

-

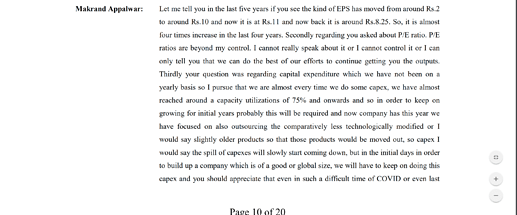

Most of the capex cycle seems to be completed. And also company has started outsourcing lower rudimentary operations to other company - to free both the tangible and non-tangible assets for better utilization. This should aid in margin improvement.

-

Company has also started distributing pond/farming essentials by utilizing existing distribution network - to improve efficiency and sticky-ness of the customer base. These are under the umbrella Avana Create. The product distributed are not manufactured by Emmbi Industries, However, the quality control and assurance is done by the company. Very difficult to guess the contribution from this leg of the operations, however we can atleast expect customer sticky-ness from the initiative.

Headwinds

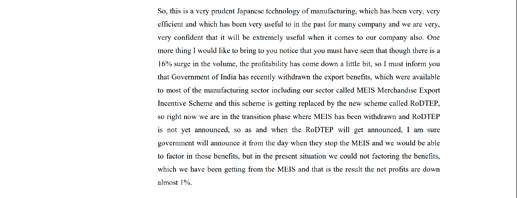

- GOI has withdrawn the tax incentive scheme MEIS and is yet to introduce the new tax incentive scheme. There is no update for the same from the last 2 quarter (we can assume that there is no good news when no news is announced

). So it makes the overall bottom line efficiency metric more worse and company would have to bite the bullet until it is announced.

). So it makes the overall bottom line efficiency metric more worse and company would have to bite the bullet until it is announced.

- There prominent customer base - which are auto sector and food packaging are in a cyclical down cycle (from there own admission in the con-call). So the last 6~8 quarters have been a challenging year for the FIBC sector in general and the company in specific.

Personal Opinion:

- B2C would be the major driver to look forward. With greater net margin from B2C and larger percentage of the revenue share from B2C we should expect bottom line to improve going forward. This should be a secular growth story for the company for next few years.

- All other segments does not call for any shout-out case of improvement. Though, very commendable job by the company in having a good growth curve in top-line.

Disc : Have invested in recent market meltdown.

Not a registered security advisor and this post does not suggest for anyone to either buy/sell/hold the investment in the company.

Further to the above content (about headwinds), I also gather information (here) which states that GOI may not continue either with MEIS or RoDTEP scheme on immediate basis. There seems to be a strategic rethink and also a look into the sectors which can avail any export benefit.

Looks to be a long haul before which GOI would approve an export scheme. Shareholders must be content with margin - Export incentive % for some more time.

These are really good insights into the business of Emmbi. Basically company operated in 4 different verticals. So where does Avana fit into this? Is it a separate entity or is it part of the Agro polymers business and is Avana completely B2C or some part of it is B2B as well. Also it seems like they are not looking to grow their packaging and composites segment. Their main focus is around Avana now. Like they have specified in their concall that they are very happy with their growth over the last 5 years and their EPS has grown 5 times from 2 to 10. All this looks rosy looking in retrospect but given the flat growth over the last 4-5 quarters is there any insights on the road map ahead? When will this EPS become 20-25 from 8 and things like that.

Please let us know if you have any details on these. Thanks!

Disclaimer: Invested and looking to average at cmp

Avana logically is classified under the water conversation vertical. It is mostly a B2C business AFAIK.

Focus on Avana does not mean that other divisions are not focused for growth. On the contrary, we should also not assume that other verticals are focused at equal intensity. One of the pitfalls in understanding business, is that we should not derive our own conclusion - unless stated explicitly.

Only concrete understanding is that Avana would be a significant growth driver for the company.

I wouldn’t hazard a guess into the future EPS (where exactly it would be) and project it on the forum. Projecting the future EPS shouldn’t boil down to a mathematical problem where we throw in some numbers and get an output.

All that can be re-iterated (based on management commentary) is “One of the vertical is poised for a good run in the next 3~5 years”. If the management sticks to the plan, and the future roadmap pans out, it would be poised for a good growth - both in top line and bottom line.

I would ideally focus on (a) Is there a story to play (b) Is the story playing as expected. Finally where exactly does EPS stands would be at the end of 3~5 years is futile exercise according to me.

Businesses whose majority of the income are derived from exports would see an impact in the next couple of quarter due to significant impact in the freight cost increase.

Article with a quote from Makrand Appalwar, MD - Emmbi Industries.

As 46% of the revenue are derived from the export market, company would continue to face challenging times - unless the cost increase of freight charges are passed on to the end customer - for which we have very little indication about.

Personally, I am happy to see company facing multiple head-winds from past 8~10 Quarters. The mettle and the depth in the management capability would be tested in these challenging times and would define the company of the future.

Disc : Have invested in recent market meltdown.

Not a registered security advisor and this post does not suggest for anyone to either buy/sell/hold the investment in the company.

Analysis of company prospects presented by MC.

Disc : Have invested in recent market meltdown.

Not a registered security advisor and this post does not suggest for anyone to either buy/sell/hold the investment in the company.

Anybody still tracking it ? Q4 Revenue seems to have gone up quite a bit. Though the OPM has taken a hit. Borrowings have also gone up because of heavy working capital requirements. Any insights on future prospects of the company from anybody would be helpful !

Exports will face margin pressure because of freight rates which are still high and are expected to remain at elevated levels throughout this year. if we don’t have another covid wave additional expenses wouldn’t be der and they can still catch up to a 10.5 margin which is still far off from the 14 percent margin which they used to have a couple of years back.

Avana looked promising before the covid but it looks like it might take at least 8 to 10 months to gauge how it’s gonna shape up and I personally do not like the FIBC business which doesn’t have the pricing power

The use of technologies like salesforce and Shopify seems interesting and might work well if the business scales up as expected, but at the moment it’s still a waiting game for another 8 to 10 months.

Kanpur Plastipack, a competitor of Emmbi in the FIBC business has been doing quite well. It’s showing good growth all round. Emmbi has been lagging behind not only in the FIBC space but also in the Avana space. Avana being in the B2C space should have much better margins and it has been a drag to be honest.

Management has looked incapable till now to walk the talk. Every concall they come up with a new reason to justify their underperformance but the forecasts are always amazing. Obviously those forecasts go for a toss. They have been using Covid to shield their underperformance.

Any guidance on the quality and integrity of the management would help. The only glimmer of hope to stay invested right is the good Revenue growth in Q4 results. May be they will be able to scale up the margins once they capture a good share of the market. But for that is the management capable and sincere and honest enough to do that ?