Here are my notes on the company. Some of the points are already covered.

Story

Business

Capacit’e Infra is a construction company focused on Residential, Commercial and Institutional buildings. It provides end-to-end construction services for residential buildings, multi level car parks, corporate office buildings, buildings for commercial purposes and buildings for educational, hospitality and healthcare purposes. Company’s capabilities include constructing concrete building structures as well as composite steel structures. Company also provides mechanical, electrical and plumbing (“MEP”) and finishing works. Company predominantly operate in the Mumbai metropolitan region which accounts for 63% of its revenues. Rest of the revenue comes from Chennai, NCR and Bengluru. Company works for some of the reputed real estate developers like Kalpataru, Oberoi Constructions Limited, The Wadhwa Group, Saifee Burhani Upliftment Trust, Lodha Group, Rustomjee, Godrej Properties Limited, Brigade Enterprises Limited and Prestige Estates Projects Limited.

Clients

History

Company was founded by Rahul Katyal along with Subir Malhotra in 2012. Rohit Katyal joined in 2014. Katyal Brothers previously worked for Pratibha Industries. PE funds Paragon Partners promoted by Siddharth Parekh (son of HDFC chairman Deepak Parekh) and Hong Kong based NewQuest Asia invested in the company in 2015. Along with Paragon Partners, Infina Finance jointly owned by Kotak Mahindra Bank and Kotak Family has invested in the company. PE funds invested through compulsorily convertible preference shares, which were converted to common shares on June 30 2017. PE funds have invested at an average price of Rs 132 / share. Promoters currently own 57% while PE funds own 43% of the company. Post IPO, promoter holdings will drop to 47%.

Key Strengths

- **1. Exclusive focus on construction of buildings in major cities -** Company has growth rapidly since its incorporation in 2012 by focusing only on construction of residential, commercial and institutional buildings without engaging in any other activities such as land development or infrastructure development. Such a focus has enabled the company to acquire specialized construction technology, which allows it gain competitive advantage over smaller construction companies in a highly competitive and fragmented industry.

- **2. Large Order Book with marquee client base and repeat orders –** Current order book is about 4,600 Cr, which is 4 times FY 17 revenue across 50 different projects. Company has secured repeat orders from some of the clients, namely the Lodha Group, The Wadhwa Group, Godrej Properties Limited, Transcon Developers Private Limited, Ahuja Constructions and Puravankara Projects Limited, since the date of first contract with each of them. Ongoing execution of certain redevelopment projects, such as the Saifee Burhani Upliftment Project – Sub cluster 03 and Rustomjee Seasons, will allow company to qualify for and to bid for mass housing projects in the future.

- **3. Ownership of modern system formworks and other Core Assets -** Company has the capabilities to undertake building construction projects using modern technologies including temperature-controlled concrete for mass pours, self-compacting free flow concrete for heavily reinforced pours and special concrete for vertical pumping in Super High Rise Buildings and High Rise Buildings. Investment in Core Assets has helped the company expand execution capabilities, along with a corresponding growth of Order Book.

Strategies for future growth

- **1. Continue to remain focused on building construction. –** Company’s plan to stay focused on construction of buildings will allow it to increase productivity and maximize asset utilization.

- **2. Expand in mass housing project –** Mss housing is a growth area. Company’s experience with Saifee Burhani Upliftment Project – Sub cluster 03 and Rustomjee Seasons, as well as the projects in Gated Communities such as Kalpataru Immensa and Godrej Central will provide appropriate qualification credentials for undertaking redevelopment and mass housing projects.

- **3. Expand in cities with high growth potential –** Company has ongoing projects in MMR, NCR, Bengaluru, Chennai, Hyderabad and Pune. Company intend to increase presence in these locations by bidding for and securing new projects, including securing repeat orders from existing clients.

- **4. Undertake projects on a design-build basis –** Company plans to take projects on a design-build basis, wherein scope of work includes designing elements of the project in addition to construction and finishing services. This will increase revenue potential by increasing the scope of services and will relatively limited competition.

- **5. Undertake projects on a lock and key basis –** Company plans to bid for MEP (mechanical, electrical and plumbing) work, finishing and interiors in addition to construction activities. This will be cost effective for the company as indirect costs will be spread over a larger revenue base.

- **6. Bid for projects in public sector. –** As the size of the company grow, it will be eligible to bid for bigger projects in public sector boosting its revenue but it may create a cashflow problems.

##Financial Ratio Analysis

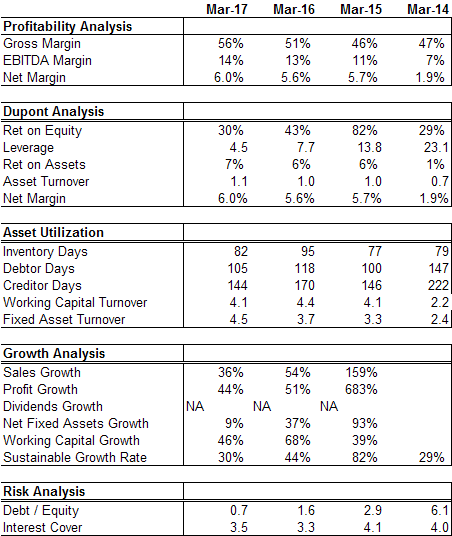

Profitability Analysis

Company’s gross margin has steadily improved over the last 4 years indicating increasing value addition. Ebitda margins have increased along with gross margins. Net margins have not improved along with EDITDA margins because of increasing interest costs. However, interest costs should peak out as debt to equity ratio is dropping. Other income, which includes interest income, is also dropping as company is putting surplus cash raised from funding to use.

Dupont Analysis

Company has generated a high ROE over the last 4 years despite raising additional capital in last 2 years and dropping leverage. This is because of rising return on assets which in-turn is driven by rising asset turnover and net margins. Company can be expected to generate about 25% ROE over next few years.

Asset Utilization

Construction business is working capital intensive. This can be seen by higher inventory days and receivable days. Company has been able to partially fund this with credit from vendors and advances from customers and remaining working capital is funded with short term borrowing from banks. After funding working capital, company has money left to buy fixed assets (which are mainly formwork) that allow company to raise productivity, gain competitive advantage and increase its order book. Fixed asset turnover is increasing indicating that company is able to generate sales faster than growth in fixed assets. Working capital turnover is steady at 4.

Risk Analysis

Debt to equity ratio has been dropping over last 4 years mainly because of additional equity capital raising. Post IPO, this ratio will drop further. Company however, will need to regularly borrow money to fund working capital. Interest Cover is trending down inspite of lower debt to equity ratio. At 3.5, it also at a low value. Value higher than 5 is safe. This indicates that company’s cost of borrowing is rising and that may be the reason company is raising additional equity from PE funds and IPO route.

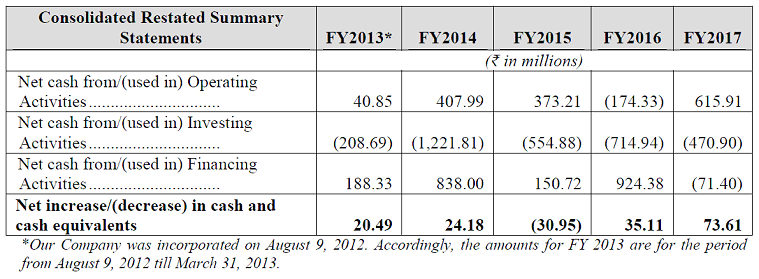

Cashflow Analysis

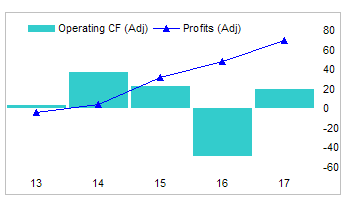

Company has generated negative cashflow from operations in FY 16 mainly due to build up of receivables and inventory.

I normally reclassify interest expense as operating activity instead of financing activity. Cashflow looks even worse when interest expense is subtracted from CFO especially when compared to net profits.

However, earnings quality of construction businesses cannot be judged by comparing CFO with net profits. This is because construction businesses are working capital heavy and working capital investment is treated as operating cashflow (as per GAAP) instead of investing cashflow. As long as a construction company is able to fund working capital and still able to generate positive CFO, it will not get into a debt trap. To that extent Capacit’e has done well given its high growth rate. However, it has been able to raise easy money from PE funds and now IPO so it hasn’t faced a credit crunch since its existence. Equity funding has been used for buying fixed assets. Company will be tested when credit dries out.

Corporate Governance

I consider following factors as corporate governance indicators:

- 1. Executive compensation – MD and other executive directors are drawing a salary of close to 1 Cr per year, which is fair given the size of the company.

- 2. Debt Repayments – Company is a net borrower in every year except 2017 as it is a growing company. In 2017 company used equity funding to retire some debt.

- 3. Dividend Payments – Company has paid dividends only in 2016 since incorporation.

- 4. Related Party Transactions – No significant RTP red flags.

- 5. Tax Payments – Tax rate of the company is 33% over last 3 years so it is paying taxes. However, actual taxes paid is lower than tax expenses and deferred tax liability is growing.

##IPO & Valuation

Company is raising 400 Cr of fresh capital by issuing 1.6 Cr shares at 250 rs/share at top end of range. This will take outstanding shares to 6.8 Cr post issue and IPO accounts for 24% of post issue capital. IPO proceeds are used for buying formwork (50 Cr), working capital (250 Cr) and general corporate purposes (100 Cr). IPO is valuing the company at Rs 1700 Cr on a post issue basis. Company generated PAT of 69 Cr in FY 2017. Shares are issued at a PE ratio 24, which is high given the fundamentals of the company.

IPO prospectus states that company generated EPS of 17 for FY17 but that was before CCPS were converted into common shares and on a pre IPO share count of 4 Cr shares. That gives a wrong impression that shares are offered at PE of 14 (250/17).

##Risk Factors

- 1. Business is manpower intensive. Company is mainly a labor contractor. It has 1700 employees and over 10,000 contract labor.

- 2. Company is subject to liability claims for any defect in construction work. Company has to make good any defects for upto 72 months past the construction completion date.

- 3. Company relies on sub-contractors for raw materials and some non-core assets and relies on timely delivery of quality materials.

- 4. Company depends on third party providers for MEP services.

- 5. Top 5 clients account for 39% of order book and top 10 clients account for 60% of order book.

- 6. Mumbai region account for 62% of total order book.

- 7. Business is working capital intensive. Company in the past has raised additional capital by issuing equity to fund working capital needs. However, in this business, working capital is the major capital needed as fixed capital is small part of total assets.

- 8. Industry is highly competitive and fragmented. Lowest bidder generally get the contracts. Outside Mumbai area, company may not have adequate information about the projects and customers and local contractors may have an edge.

- 9. Company has generated negative cashflow from operations and its adjusted cashflow from operations (after subtracting interest expense from reported CFO) has consistently lagged reported profits.

- 10. Low entry barriers in this industry keep competition high and make the industry fragmented.

- 11. Possibility of payment delays heighten working capital intensity

- 12. Promoter is diluting stake to below 50% to fund growth of the company.

- 13. Company has not paid a dividend in the past and given the cashflow situation, company may not pay dividends in future.

- 14. Shares are offered at a high PE of 25 when peers are selling at 18-22 times earnings.

- 15. As per the IPO prospectus, MD Rahul Katyal holds only a higher secondary certificate from the Maharashtra State Board of Secondary and Higher Secondary Education Divisional Board.

Disc: Applying for IPO.