Ajanta came out with their FY21 annual report, here are my observations.

http://www.ajantapharma.com/AdminData/AnnualReports/AjantaPharma_AR2020-21.pdf

Product launches:

- 10 new products in branded generics business (Africa, Rest of Asia excluding India)

- Launched 21 new branded generics product in India out of which 5 were first to market spread across the four key therapies. Have a basket of 300 products

- 9 launches in USA and 12 approvals (including tentative). 36 products on-shelf

- Developed 23 APIs

Branded Generics (68% of revenues; grew @8% to 1’937 cr.):

• Indian branded generics (813 cr.) grew at 6% (IQVIA reported Ajanta growth of 8% vs 4% for IPM). IPM rank improved to 28 from 30 in FY20

• India ophthalmology: Growth of 1% vs industry de-growth of 1% (IPM rank maintained at 2)

• India cardiology: Growth of 14% vs industry growth of 13% (IPM rank at 18 vs FY20 rank of 17)

• India dermatology: Growth of 8% vs industry growth of 6% (IPM rank at 15 vs FY20 rank of 14)

• India pain management: Growth of 18% vs industry de-growth of 1% (IPM rank at 33 vs FY20 rank of 39)

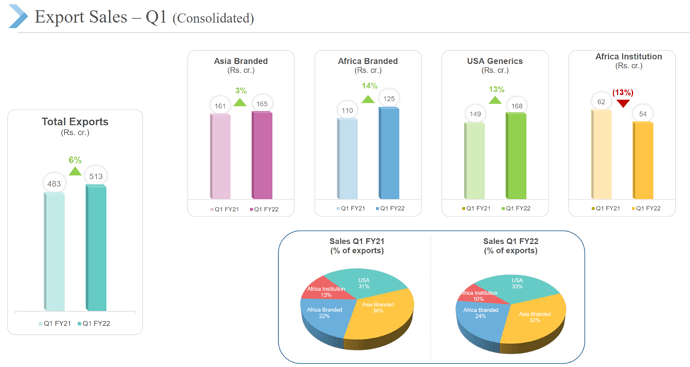

• Emerging market branded generics (1’124 cr.) grew at 9% with launch of 19 new products. Growth was lower than expected due to impact of pandemic in few countries.

Generics and Institutional (32% of revenues; grew @19% to 908 cr.):

- Africa anti-malaria institutional business (271 cr., 10% of revenues) grew at 11%; Have retained market share

- US generics business (637 cr., 22% of revenues) grew at 24%. Could only file 2 ANDAs vs target of 10-12 ANDAs. Expect continued growth momentum in US on the back of new product launches and market share gain in existing products

R&D

• Developed Extended-Release/Delayed-Release oral solid dosage form products using Matrix technology

• Developed products based on solid dispersion technology similar to innovator products

• Total R&D expenses was 5% of revenue (139 cr. vs 164 cr. in FY20) most of which was expensed; R&D activities suffered due to lockdown leading to delays in completion of projects as a result of which Ajanta missed their product filing target across global markets (only 2 ANDAs filed vs target of 10-12 in USA); Next year target is to file 10-12 ANDAs in USA

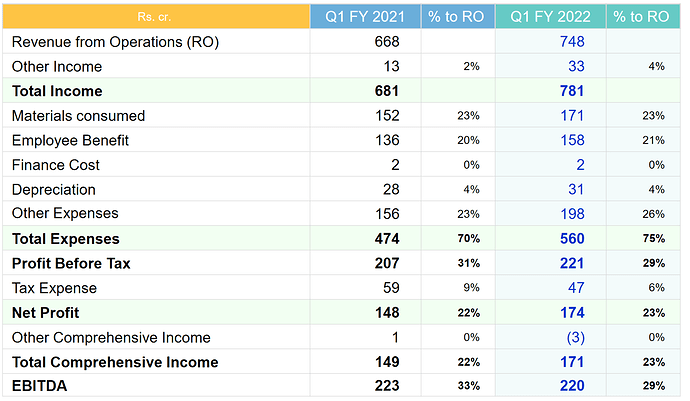

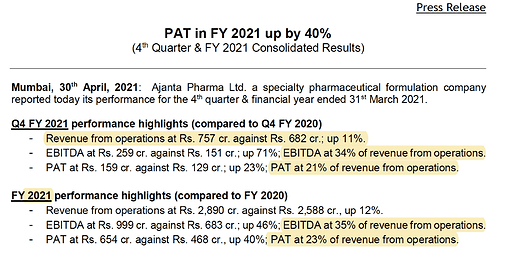

Financial Performance:

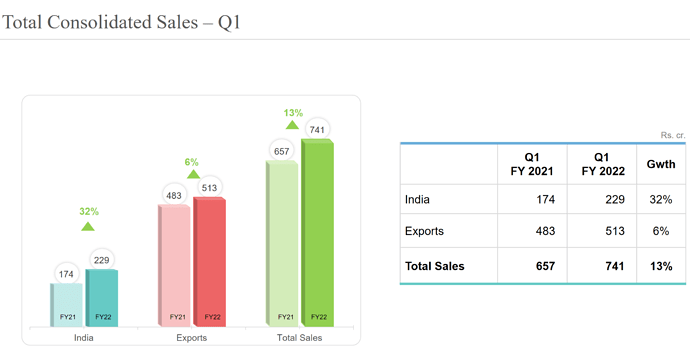

• Consolidated revenue grew by 12% to 2’890 cr.

• EBITDA margin was at 35% (vs 26% in FY20) on account of savings in marketing, R&D and other costs due to lockdown in H1FY21 which are one-time in nature. These expenses normalized in H2FY21.

• PAT grew by 40% to 654 cr.

• Cash ~ 375 cr., Paid back 250 cr. (buyback + dividend) and generated operating free cashflow of 284 cr.

• ROCE was up from 26% in FY20 to 30% in FY21

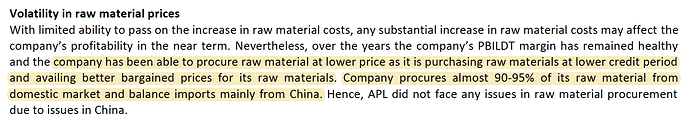

• Material cost went down from 25% to 22% due to rupee depreciation + positive product mix

• Employee cost remained at 19% of sales and other expenses came down from 29% of sales to 24%

Strategy:

- Be a niche player in global pharma space and enhance value for all stakeholders

- Customized market specific product portfolio

- Focus on 1st to market products

- Leverage brand power of key products

- US: launch of limited competition products and have an impeccable service record thus becoming a preferred partner for customers

- Inventory levels were strategically increased to 98 days vs 71 days in FY20 to hedge against any supply chain disruptions due to pandemic conditions. The absolute amount stood at 766 cr. in FY21 against 496 cr. in FY20

- Management monitors the return (EBIT) on capital, as well as the level of dividends to equity shareholders. Group’s target is to achieve a return on capital above 30% in 2020-21 the return was 30% and in 2019-20 the return was 26%.

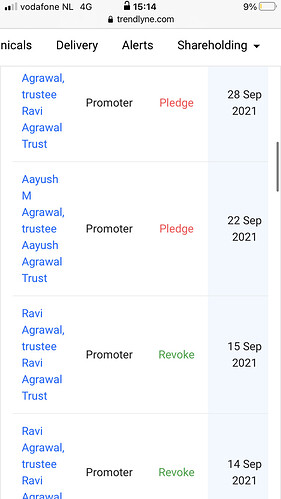

Share issuances:

- ESOP: During the year, 5’500 shares were issued against the options exercised and 3’000 new options were granted under the SBIP 2019 to employees of overseas subsidiary

- Bought back 735’000 shares at 1’850 price

Miscellaneous:

• Commissioned first production line for sterile ophthalmic products at Guwahati facility

• Spent 145 cr. on CAPEX

• Receivable days improved to 95 days vs 111 days in FY20

• Auditor remuneration at 0.99 cr. (vs 0.83 cr. in FY20)

• Hedging policy: ~70% of company’s income via exports with major currency exposure being in USD, the company generally does currency hedging up to a maximum period of 6 to 12 months and up to the extent of 50% to 75% of its net foreign exchange earnings.

• No major contingent liability other than financial guarantee of 73.11 cr.

• Employee count: 7’035 (vs 7’167 in FY20) (median salary increase: 8.8%)

• Non managerial remuneration hike was 8.8% and managerial remuneration hike was 20% (in-line with performance)

• CSR: Spent 12.78 cr. vs obligation of 10.49 cr. (no unspent amount)

• Share price high: 1884.55, low: 1235.2

• Number of shareholders: 45’826 (vs 40’090 in FY20)

• The Company had entered into a Joint Venture (‘JV’) with JV Turkmenderman Ajanta Pharma Limited (TDAPL) where it had management control during the first 10 years of this contractual arrangement. However, in terms of the JV agreement, the Company subsequently surrendered the management control in favor of the local partner and since then ceased to have any control on the operations of the JV. Further, TDAPL operates under severe restrictions that significantly impairs its ability to transfer the funds. Consequently, the Company had impaired its entire investment in TDAPL and considers this as an unrelated party. The Company is also unable to obtain reliable and accurate financial information in respect of the said JV

• Planning to add renewable energy sources for captive consumption

• During the year, Company’s step-down subsidiary, Ajanta Pharma Mauritius (International) Limited has applied for de-registration as part of reorganizing the business operations in Mauritius due to rationalization of tax structure

• The Company has also implemented an Internal Financial Control (IFC) framework to ensure proper internal controls over financial reporting. These controls ensure that transactions are authorized, recorded and reported on time. They ensure that assets are safeguarded and protected against loss or unauthorized disposal. It is also designed for effectiveness and efficiency of operations, compliance or regulations backed by strong audit framework at all the locations.

Global trends:

• As per Global Medicines & Usage Trends to 2025 report by IQVIA in April 2021, the total cumulative spending on Covid-19 vaccine through 2025 is projected to be USD 157 billion, largely focused on the initial wave of vaccinations to be completed by 2022

• In 2016-2020 period, growth was 3.8%, 7.4% and 3.9% for developed, pharmerging and ROW markets. 2020 invoice was $960bn, $291bn and $15bn for developed, pharmerging and ROW markets (total spends: $1.265 trillion)

• Global pharma invoice spending is expected to reach $1.6 trillion (3-6% CAGR growth) by 2025 with developed markets projected to grow at 1.5-4.5%, pharmerging market at 7-10%, and ROW at 3-6%.

• Among pharmerging markets, China, Brazil, India, Russian Federation and other markets had 2020 sales of $134bn, $29bn, $21bn, $18bn and $89bn, with growth (FY16-20) of 4.9%, 10.7%, 9.5%, 10.8% and 9.6% respectively.

Disclosure: Invested

” / Twitter

” / Twitter