What made me look at this company at first sight?

Recent B2B SAAS Fintech Platform IPO

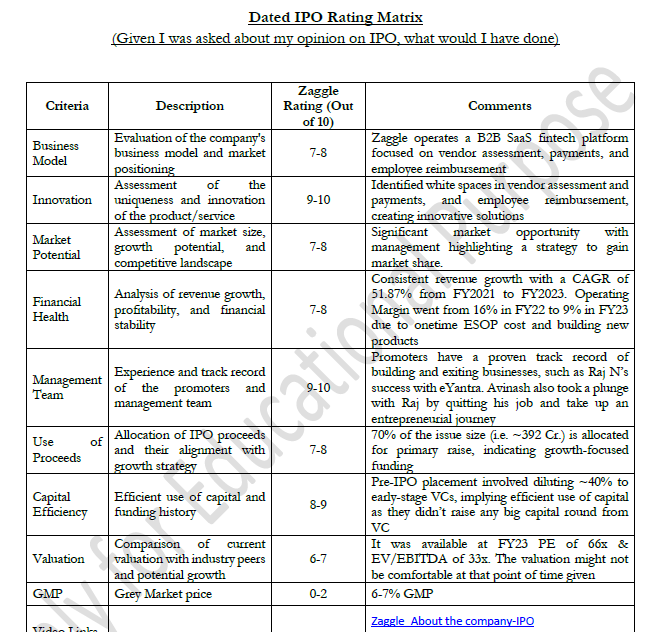

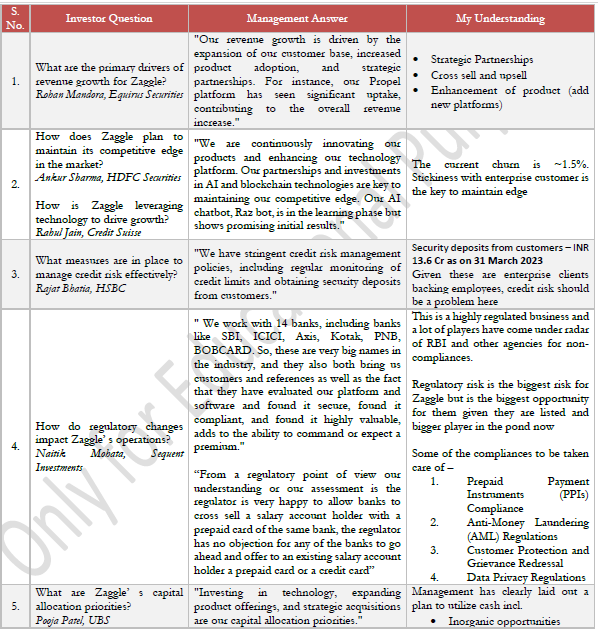

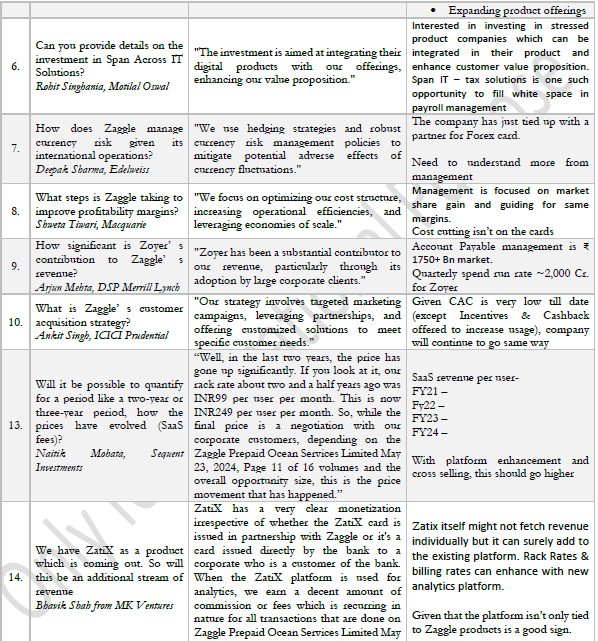

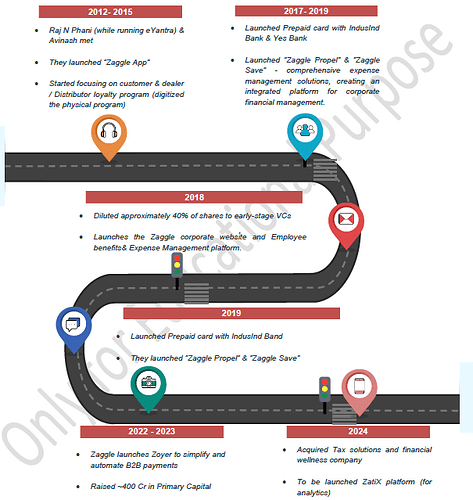

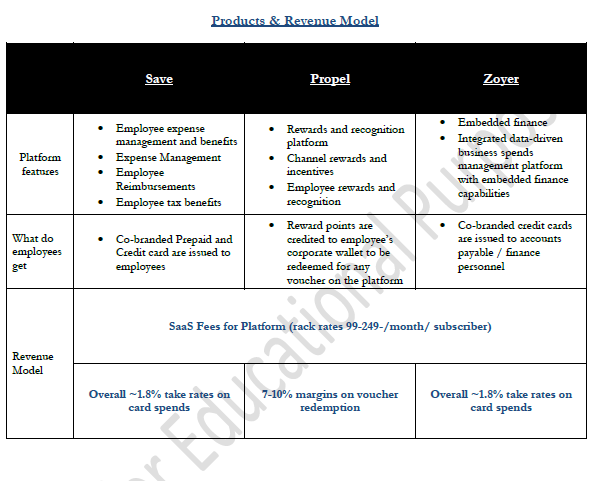

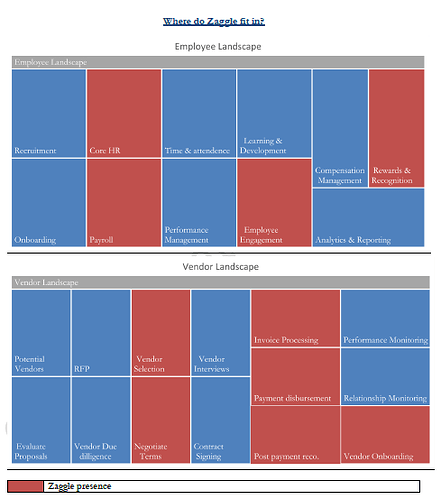

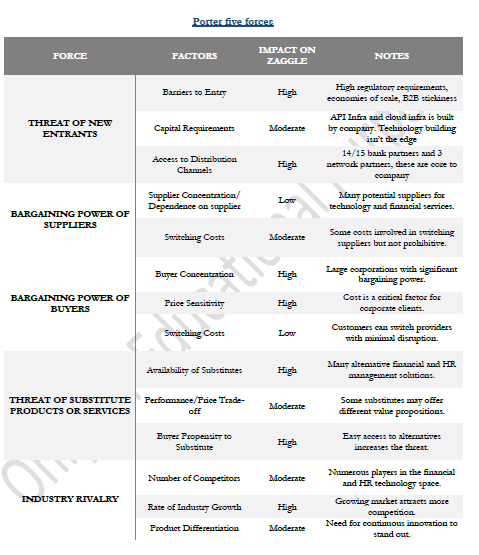

- Innovative fintech platform which has identified white spaces in Vendor assessment and payments and Employee reimbursements.

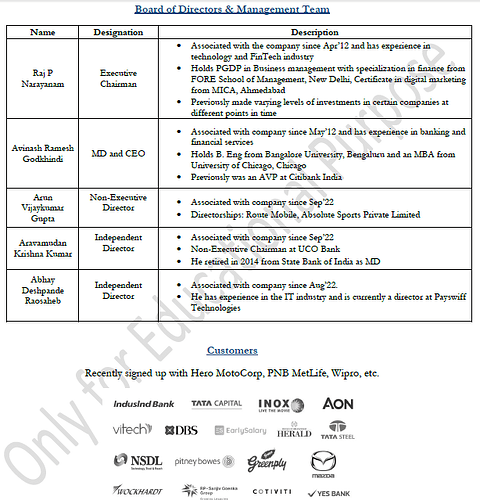

First-Generation Professional Entrepreneurs

- Promoters with proven track records in building and exiting businesses.

Primary Raise Proportion in IPO

- 70% of the issue size for primary raise, indicating growth-focused funding.

Market Opportunity and Share

- Management highlighting a significant market opportunity and strategy to gain market share.

Capital Efficient Business Model

-

Pre-IPO placement, they have diluted ~40% to GKFF ventures and Veantureast. Both the investors are early-stage VCs implying that the company haven’t raised significant money in the past.

-

They raised Venture Debt of ~50 Cr. from Vivriti (Source: Crunchbase) which was paid Pre IPO.

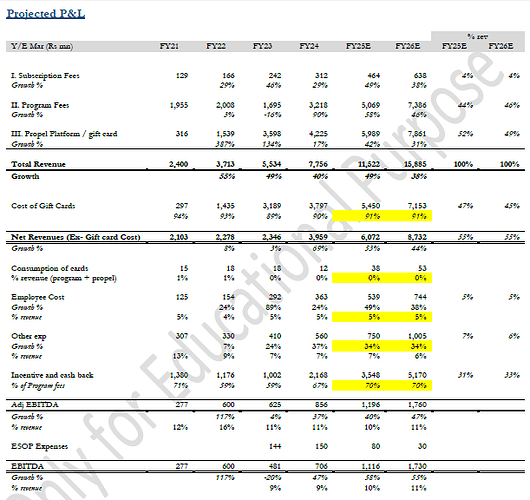

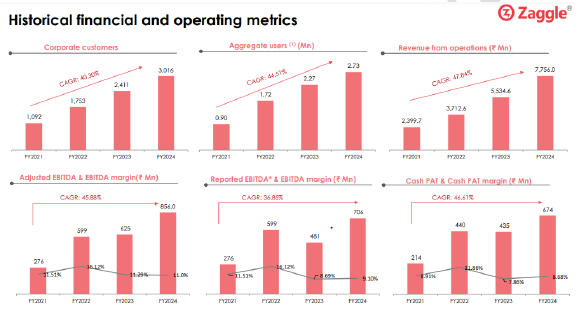

Historical & Projected Growth Rates

-

The company doubled revenue in the last 2 years to reach INR 775 Cr.

-

Management is guiding for stable margins and organically doubling revenue in the next 2 years.

-

Inorganic growth on the cards in H2 FY24 with acquisition size of ~500 Cr topline

Venture Capital Backing

- Raised money from reputable VC funds and grown profitably, showing strong product-market fit.

Customer Success Stories

-

Demonstrated positive impact on businesses through real-life success stories.

-

Big enterprise clients incl. IT services companies

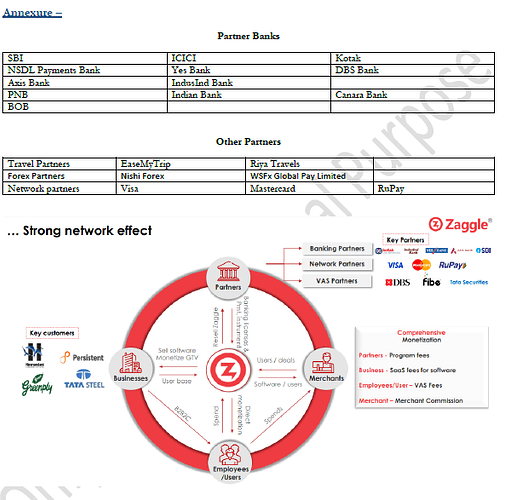

Strategic Partnerships

- Formation of key alliances with Banks to issue prepaid and credit cards.

Primary Raise Proportion in IPO

- 70% of the issue size for primary raise, indicating growth-focused funding.

Market Opportunity and Share

- Management highlighting a significant market opportunity and strategy to gain market share.

Capital Efficient BusinList itemess Model

Video Links: Video Link - Management interview

(https://www.youtube.com/watch?v=wFKgigIF3LM)