Hi guys,

I have gone through the complete annual report and would like to point out my observation.

According to RBI macro stress test for credit risk the GNPA ratio of SCB may go up to 8.1% form 6.9% but if you see YESBANK is confident of having less slippage than FY2022. They had slippage of 5796cr in FY2022 and in FY2023 they have a target of less than 2% on entire advance. Next year their advance might be MAX at 210000cr so 2% of this comes out to be 4200cr.

There are two major reasons for this.

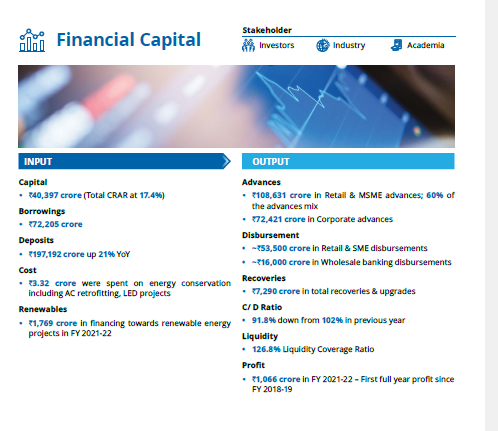

- They have a Retail and corporate mix of 60:40. So they have a granular loan book so, I don’t see any big default here. They have given a guidance of taking this MIX to 64:36. This is the reason they have 24000 employee because the more granular you do the more staff you need and this is also the reason last year they grew advances by 8% only. Because for disbursing 1000cr loan 1 corporate account is more than enough but you need 10000 to 100000 retail account to disburse same loan.

2 They are playing extremally safe. They are growing their advances slowly. Their 61 to 90 days overdue loan was at 4661cr on 31march 2021 and currently at 1264cr on 31march 2022.

My overall point here is last year they did provision of 1667cr from operational profit. this year I feel it is going to be not more than 1400cr from operational profit.

Their balance sheet is going to be above 3.4 lakh cr even after transferring its asset to ARC. So management target of 0.75% ROA comes out to be 2500cr NET profit. They had this target as 1% which they have reduced to 0.75%.

They have opened 52 branches last year and have an employee strength of 24346. They have Provision coverage of 72% but when i include technical write-off it is at 81%.

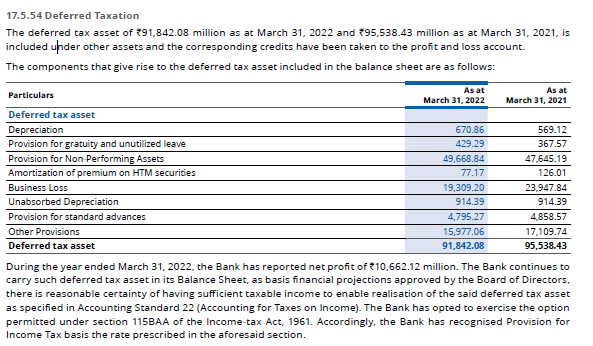

Now I saw an interesting thing. The bank considers its capital as 40397cr but on papers it is at 33730cr. This is because they have differed TAX asset of 9200cr.

The GUIDANCE FOR THIS YEAR IS

1 CASA more than 35%. They are going to achieve this. They are number 1 in UPI and NEFT. Now they don’t make a lot of money here but they get huge Customer DATA which can be converted into CASA. That is why despite having a bad image in market it grew its DEPOSIT by 21% last year.

2 Advance growth of 15%. 25% in retail and 10% in corporate. So this year I am expecting Advances to increase more than 20000cr which is going to Add close to 800 to 1000cr of NET INTREST income. I feel the cost of capital for this 20000cr is going to be low because they are raising equity that is why I took a NIM of 4% to 5%.

3 Recovery above 5000 cr in this cash recovery is going to be around 2500cr now this helps in setting off major part of slippages. and then 0.75% of ROA which is achievable so, EPS of around 0.85.

Overall I feel last year performance was better than expected and bank is on track in achieving all the targets set by management.

I have also posted an article on OPPORTUNITY IN BANKING which further increase my confidence in this stock because I feel it has huge sectoral tail winds. Opportunity in banking industary

Disclosure- Invested and is 85% of my portfolio