Business Analysis

XPRO India is mainly in the business of creating polymer based plastic films multiple locations & is a leading manufacturer in India of Coextruded Plastic Films (70% market share), thermoformed liners & specialty films (including dielectric films & special purpose BOPP Films)

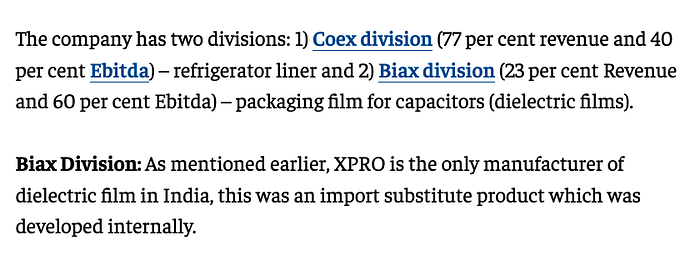

Co has 2 main business divisions, Coax (Coextruded Plastic Sheets film) division, & Biax (Biaxial film) division.

Coex division

These type of plastic films are used to line inside of refrigerators. Co is the dominant player in this industry, enjoys a high market share in supplies to the Indian Refrigerator industry (70%).

this division of the co is a proxy to indian refrigerator industry growth. Any thrust on white goods manufacturing specifically fridge manufacturing with focus on localization is bound to benefit the co.

Refrigerator penetration in India is amongst the least amongst white good categories (<50%), with Euromonitor projecting 14% growth during CY20-25E.

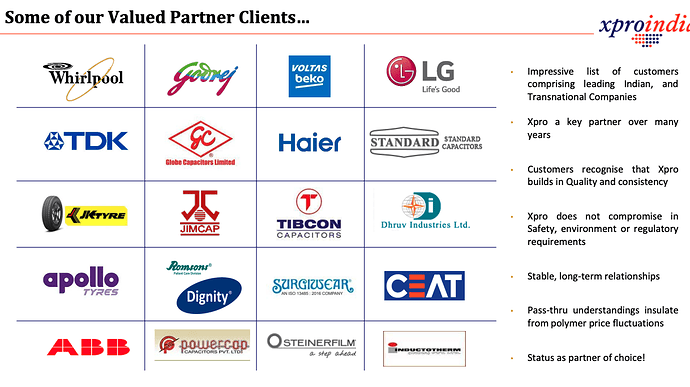

We can see that most refrigerator brands are XPro customers.

While the primary (legacy) uses of coex division has been into refrigerator inner linings, according to company investor presentation coex films also find use in solar panels, other white goods & EVs (we need to better understand HOW).

The coex division forms 77% of revenues but 40% of profits which shows us that the higher profitability lies in the biax division with coex division having lower margins.

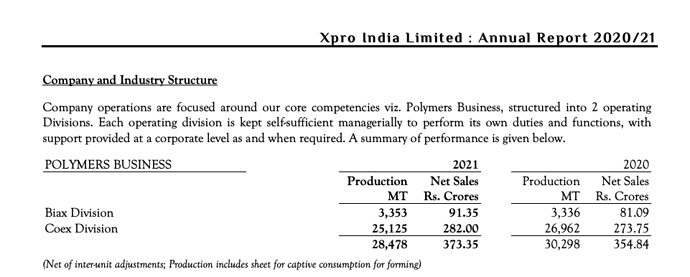

In fact, looking at the annual report, we find the tonnage & revenue split which tells us about the average realization.

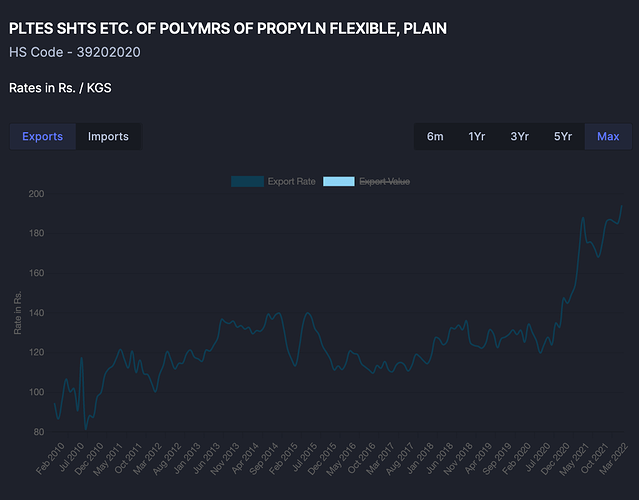

1 lakh rupees per MT realization for coex division. Or. 100 Rs / KG realization.

For the biax division: 2.71 lakh / MT or 271 Rs / KG realization. This itself tells us how much higher value added Biax division is.

In Coex division, some future applications are:

Thermoforming capabilities extend to include Automotive interior and exterior trims (e.g. dash boards, door panels, floor panels, etc.); Furniture; Luggage Shells; Sanitary Products (e.g. Bath-tubs, Cabinets); Electrical/electronic housings (Light panels, street lamps and other light fittings); Industrial trays for material handling etc.

Biax division

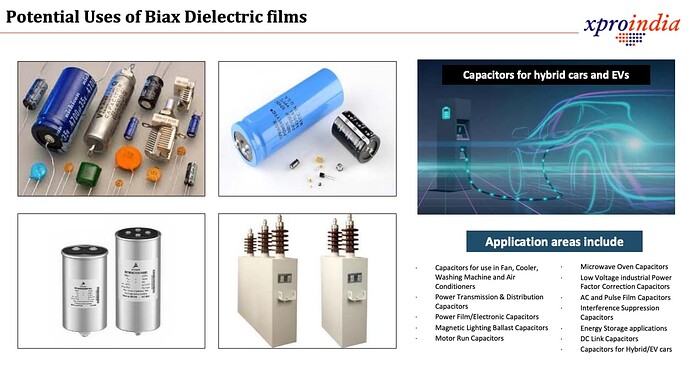

These biaxial dielectric films are used as a critical component of capacitors of all sizes.

Essentially all capacitors consist of electrodes (cathode & anode made up of metals generally) separated by a dielectric medium. Depending on the type of dielectric medium, the capacitor is classified. As: electrolytic capacitors have an electrolyte for dielectric. Film capacitors are one of the

basic types of capacitors.

(To do: What is the industry trend amongst the ceramic, film & electrolytic capacitors. which are preferable in new age applications like solar panels, energy storage, EVs, BMS (battery management system), MCU (motor control unit))).

Xpro’s Biax Dielectric Films are specially designed polypropylene films manufactured by the stenter process on highly specialized equipment in controlled environmental & ultra clean room

conditions for a wide range of applications in the capacitors industry;

Wide Range of products including plain/ smooth films modified for good metallization with Al, Zn or Alloy and winding for normal and high temperature applications, High temperature Super grade, hazy /rough and semi rough films. These Films are available in thickness range of 3µ to15µ (lower thickness

down to 2µ under development) currently

Dielectric films are ideally suited for high performance capacitors, both for normal and high temperature applications, high temperature super grade for AC aging and ripple current condition at elevated temperature, high roughness films for oil impregnated high voltage application capacitors and semi rough films for metallisation and oil impregnation for capacitors for locomotive applications.

The interesting thing is that Xpro is the only manufacturer of these dielectric films in India with 30% market share. 70% of the market consists of imports & xpro is able to gain market share against imports.

The key thing to notice here is a minor detail buried deep in the investor presentations:

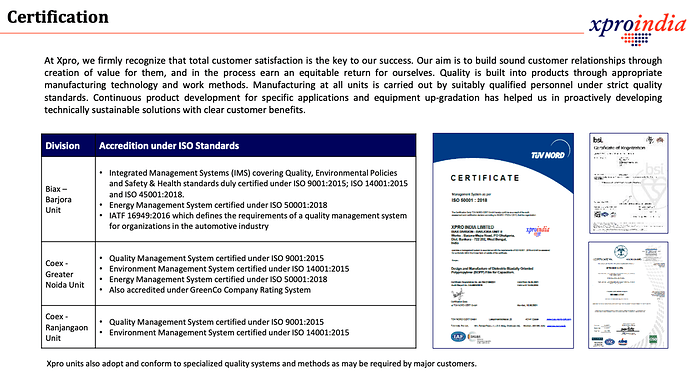

These IATF 16949:2016 are difficult to get & generally only required when a co has to become tier-K supplier to Auto OEMs. In fact this was one key trigger for some investors to study shivalik bimetals. This certification shows that Xpro is serious about putting their biax films into capacitors which go into EV. Thus, while this market might be small, it can be expected to grow rapidly with EV growth of 70%.

Key to do: Find out which specific components in EV require film capacitors, substitution threat/risk, value per EV & project how large this market can be in 2025 or 2030.

For a plastic film maker to get IATF certification should itself be a trigger for us to study it more.

Industry structure/Barriers to entry

What we know currently: XPro is only manufacturer in India. Has 30% market share. 70% import. Can easily invert. In addition they are already exporting to Germany & US. One of largest American customers is STEINERFILM INC. Xpro is exporting 20 MT per month to this firm right now (data from importgenius, details here)

320 MT runrate. Did 3100 MT last year. So significant export volumes with 1 customer.

In terms of barriers to entry, we know of a few things:

- This requires expensive german machines. There is a small capital barrier to entry.

- It requires expertise to operate the machines. Thus there is a learning curve barrier to entry as well.

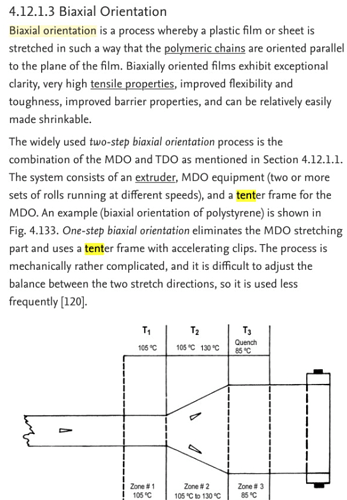

Here is a screenshot from a paper on biaxial orientation showing us that the tetner process to manufactur biaxially oriented films are difficult to manufacture: Biaxial Orientation - an overview | ScienceDirect Topics - The IATF certification itself acts as a barrier to entry. It takes many years to get then lot of due diligence, constant testing, quality control to maintain the certification.

- In general in Auto OEM space, first mover advantage is a huge barrier to entry. Specially for critical application components, auto ancillaries are not very eager to shift or move their suppliers easily because the testing & qualification process is rigorous, time consuming & acts as a barrier to entry. See shivalik bimetals, see racl, see tatva chintan, all of them demonstrate in one way or another how hard it is to break into auto OEM supply chains. The EV is only as robust as the weakest component in it. If the plastic film inside the capacitor inside the MCU breaks or gives in, it causes a car that OEM would have promised 10 years of reliability to fail soon. This is why an OEM or tier-K would not change its venders just because of pricing.

Key todo: Understand the technical expertise or learning curve moat better through the concall to be held on friday

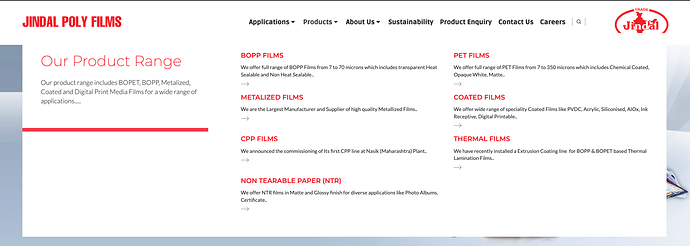

Jindal poly has been talking about dielectric films since 2018: https://www.newprojectstracker.com/iem/iem-projects-by-jindal-poly-films-ltd-jb26002

Have they been able to? At least i have not been able to find any product to do with capacitor films or dielectric films on their website:

No mention of dielectric or capacitor films. No mention in annual report either:

^ Have a look for yourself

We need to spend more time to understand whether jindal has been able to crack dielectric films or not. And if not, why not. And that itself would indicate the extent or depth of the moat.

Clearly they are working on it:

https://www.linkedin.com/in/sameer-gite-54b72619/?originalSubdomain=in

Tailwinds

Coex division can grow at 10-15% due to deeper penetration of white goods like refrigerators. If white goods manufacturing (PLI for electronics) & exports out of india pick up, rate of growth can accelerate.

Key todo: Understand plans of various cos to export refrigerators made in india.

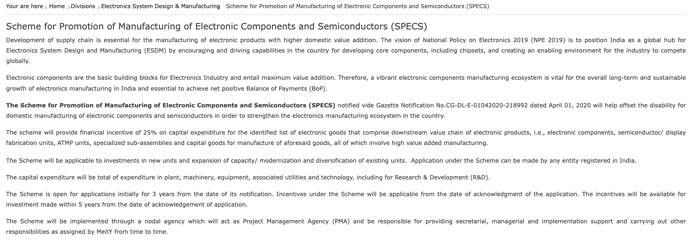

The biax division has stronger tailwinds. Dielectric films going into capacitors can be a secular trend for many years to come depending on execution of electronics PLI:

https://www.meity.gov.in/esdm/pli

https://www.meity.gov.in/esdm/SPECS

If semicon manufacturing picks up could be very interesting.

We already know that xpro has taken IATF certification so they intend to provide to capacitor makers who intend to provide to EVs. Component per vehicle is what we need to figure out. Growth rates here would be easily north of 50% for at least 1 decade. The concentrated industry structure helps us take advantage of the tailwinds.

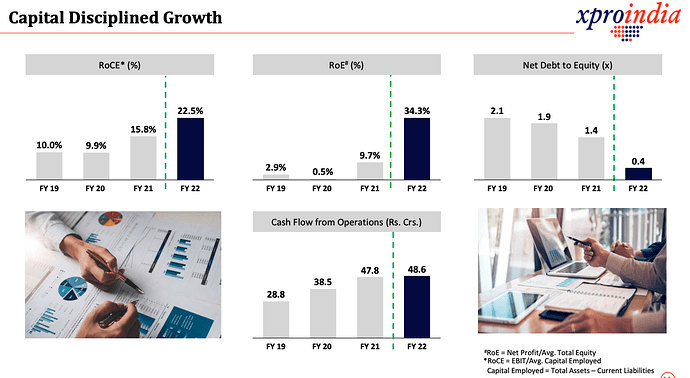

Capital efficiency & Return ratios

Co has maintained great & improving return ratios. With much higher margins in biax division, these return ratios can easily improve even from here as value added biax part changes in product mix. Co has also managed to grow its operating cashflows YoY while reducing debt both of which are encouraging signs.

Risks

- At 32 times earnings the valuations dont provide tremendous comfort. Having said that depending on exact nature of industry structure, the pace of execution (do their biax films already make it to EVs in india?), i am happy to pay up for a secular growth sunrise company.

- Co will do 1st ever concall on Friday 10 june. Generally when cos start opening up it is not to give any bad news. We must take whatever info they share, claims they make around competitive advantages with a skeptical mindset & do our own due diligence to verify cos claims rather than relying on them blindly.

- Stock has run up quite a lot in last 2 years, there can probabilistically be instances of profit booking, forced selling etc depressing returns testing patience at least for a few years.

- If Jindal poly cracks capacitor films, this goes from being a monopoly to duopoly. I am less comfortable owning a large position in a duopoly than monopoly. COmpetitive intensity heating up is 1 key risk.

- Liquidity in stock is limited: 3000 stocks traded per day. This poses its own risks with regard to entry & exit.

- if electronics manufacturing ecosystem does not take off, it poses an IRR risk depending on entry valuations.

- Need to figure out how sustainable the realisations are. Export realisation have gone up in recent past possibly due to electronic component shortage.

Disc: Have a small position, studying eagerly, looking forward to 10 june concall.

Link to register for concall: