WISE TRAVEL INDIA- WTI CABS

INDUSTRY TRENDS:

The B2B Corporate Mobility Industry can be broken into two segments:

a) Employee Transportation Services (ETS): Employee Transportation Services is a structured corporate mobility system aimed at facilitating convenient and efficient commuting for employees between their residences and workplaces. Organized: Unorganized market share at 15:85 (Calendar Year 2023).

The employee transportation service market, is estimated to have generated a revenue of ₹503.5 billion ($6.1 billion) as of CY2023. It is expected to grow at a CAGR of 11.8% to reach ₹1097.6 billion ($13.2 billion) revenue in CY2030 inline with steady development of corporates such as IT, Global Capability Centers (GCC) segments etc in India. (Report by Frost & Sullivan)

b) Corporate Car Rental (CCR): Corporate car rental services cater to the needs of corporate clients and their employees, offering professional drivers for transportation purposes such as airport transfers, corporate events, conferences and exhibitions, outstation trips and hourly rentals.

Organized: Unorganized market share at 25:75 (Calendar Year 2023). More and more corporate are moving to organized players for advantages of single vendor for across India, transparent billing, better pricing, standardized and reliable services across the country. Organized segment of CCR is expected to increase to more than 30% by CY2030.

The corporate car rental market, estimated at ₹392.4 billion ($4.7 billion) in CY2023, experiences healthy growth fueled by factors like increasing business travel needs, focus on employee well-being, and demand for premium services. It is estimated to grow at a CAGR of 9.3% to reach annual revenue of ₹731.8 billion ($8.8 billion) by CY2030. (Report by Frost & Sullivan)

Consolidation in the Industry ahead?- Over the next few years, as players reach out to more cities and competition intensifies further, leaving low headroom from growth, consolidation is likely to happen with smaller players getting acquired by the larger ones.

Growth at the overall Industry level can be attributed to:

- Transition from remote work to in-office work

- Focus on employee satisfaction and safety to improve retention rates

- Rising corporate air travel and increase in number of airports

- Expansion of office space, new corporates entering India and hiring, particularly in the IT and ITES sectors.

COMPANY OVERVIEW

The company was incorporated in April 22, 2009 as Wise Travel India Private Limited by Mr. Ashok Vashist, Ms. Hema Bisht and Mr. Vivek Laroia. The company took on the responsibility of managing the entire personal ground transportation for the XIX Commonwealth Games in New Delhi in 2010.

From 2013 to 2014, WTI broadened its horizons, bolstering its car rental fleet to over 2500 cabs. This growth was complemented with the strategic acquisition of Wyncabs and Smart Ride, a prominent coach rental company, thereby serving an even broader clientele. In 2021, WTI ventured into tier 2, 3, and 4 cities, ensuring that premium mobility services.

Currently the company has a pan-India presence, more than 200 cities has over 550 customers with 8000+ vehicles with counter presence in 17 airports across the country. As on June 2024- company had 800 employees.

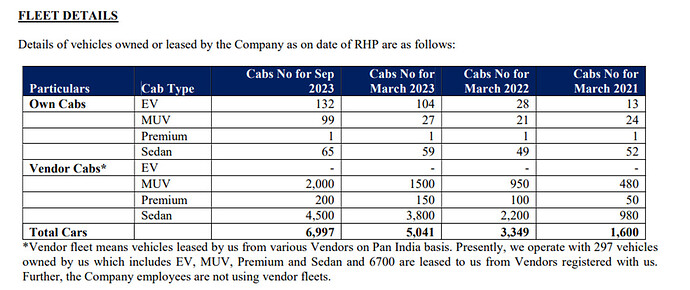

The fleet is structured in an asset light model with over 300 vehicles owned and 7000+ vendor fleet vehicles- leased by them from various Vendors on Pan India basis.

SEGMENT WISE BREAKUP:

1. Employee Transportation(B2B):

This is the core business segment of the company wherein they service the employee transportation of corporates from Home to Work and back to home. More focused in tier-1 cities, with pricing models varying based on vehicle type, route distance, and service customization. Common models include per-employee, per-trip, and fixed monthly charges.

Pretty impressive clientele- includes marquee names like Indigo, Vedanta, Amazon, Microsoft, Indus Towers, Panasonic, Honda, Coca Cola and others.

The criticality of Employee Transportation increases for certain sectors because of odd shift timings and importance of on time arrivals of their employees. ETS is a direct beneficiary of large global and Indian companies setting up their new office presence in India inline with the boost given by Indian government under the “Make in India” theme.

Key Demand Sectors include:

- IT BPM- includes Captives of other sectors like BFSI, Telecom and Consulting

- Aviation

- Banks

- MNCs and other large corporates

There’s another aspect to the segment as Employee transportation services play a crucial role in enhancing the overall experience, convenience and satisfaction of workforce. An efficient and safe services is essential to ensure lower employees’ attrition.

WTI derives almost 35-40 percent of their revenues from this segment and their large fleets allows them to serve large corporates nationwide and have a PAN India presence.

2. Car Rental Division (CRD- B2B):

In this segment, they cater to corporate clients and their employee transport requirements other than the basic home to work (and back to home) service. Providing chauffeur driven cabs to help them to transport employees, guests or VIPs to airport, conferences, a sales call, intra city travel, hotel pickup & drop, outstation or for their long term or daily car rentals needs.

A very small portion of CRD is also B2C (49 lakhs in FY23) but that’s still largely B2B (62 Crores in FY23). The company is not much inclined towards B2C due to higher cost of customer acquisition.

3. Airport Counters: (B2B) They have a counter presence across 17 large airports. By placing their counters after the security hold areas, the company ensures convenient access for travellers, allowing them to avail their services. They’ve presence in 17 airports a few of which includes:

- Delhi- Indra Gandhi International Airport (3 Counters at T1, T2, T3)

- Bengaluru- Kempegowda International Airport

- Guwahati- Lokpriya Gopinath Bordoloi International Airport

- Varanasi- Lal Bahadur Shastri International Airport

- Gwalior- Rajmata Vijaya Raje Scindia Airport

- Bhopal- Raja Bhoj Airport

- Amritsar- Sri Guru Ram Das Ji International Airport

- Madhurapudi, Andhra Pradesh- Rajahmundry Airport

- Visakkhapatnam Airport

- Jaipur International Airport

- Maduri International Airport

- Jabalpur Airport

4. Managed Services(B2B):

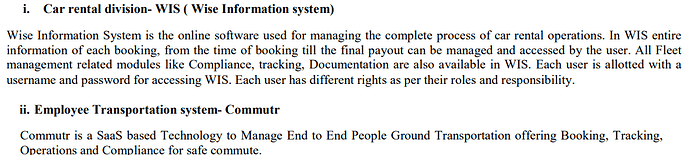

The company started this segment in 2015 and in this segment, they’re managing the complete mobility for any organization. It includes their own technology and own fleet. They provide complete bespoke solutions to the companies on the basis of study, demand and solutions required. The company has their our own in house developed system for Fleet Management.

5. Projects(B2G):

Here they cater to government companies as driving at the ports premise need specialized skills. Working with a lot of govt. companies and providing specialized transport services. The receivables in the balance sheet worth 85 Crores as on March 2024 is largely attributed to Projects and CRD segment.

Key services at company level includes:

- Car Rental Services

- Employee Transportation Services

- End-to-End Employee Transport Solutions (MSP)

- Flexible Fixed/Monthly Rental Plans

- Plans

- Convenient Airport Counters

- Fleet Management Services

- Mobility Services for MICE

- Cutting-Edge Mobility Tech Solutions

- Sustainable Mobility

- Project Mobility Solutions

- Strategic Consulting and Advisory on mobility

- Community commute

Dubai Entry: On September 13, 2023 the Company has established a One-Person Company LLC in the Emirate of Dubai, namely, WTI RENT A CAR L.L.C with the objective of providing car rental services. Started in December 2023, they already have 100 vehicles as of June 24, Breakeven expected in next 4-5 months (June Concall). The management believes that the scale in Dubai have to be large to justify higher operations cost.

The revenue split between segments: (H1FY24)

- ETS(B2B): 36%

- CRD(B2B): 27%

- Managed Services(B2B): 17%

- Projects(B2G): 10%

- Airport(B2C): 7%

Financial Analysis::

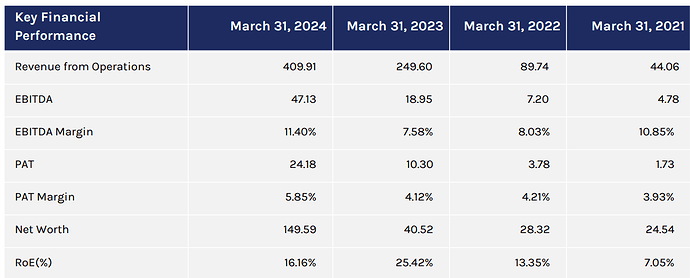

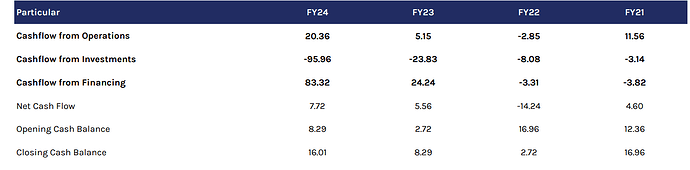

Financials appear impressive overall- They have been able to scale the business quite well from 89 crores in 2022 to 411 Crores in FY24. EBITDA margins crossed 10% in FY24. The company is among the top five organized players in terms of fleet size. The company also has 102 Crores of cash as on April 2024.

The business generated a positive cash flow from operations in 2024 worth 19 Crores. (ROE looks depressed due to recent IPO)

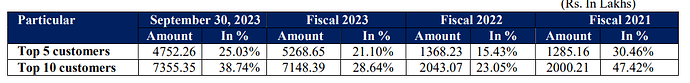

Client Concentration: Fairly diversified client concentration for a small company with Top 10 customers attributing to only 38% revenues.

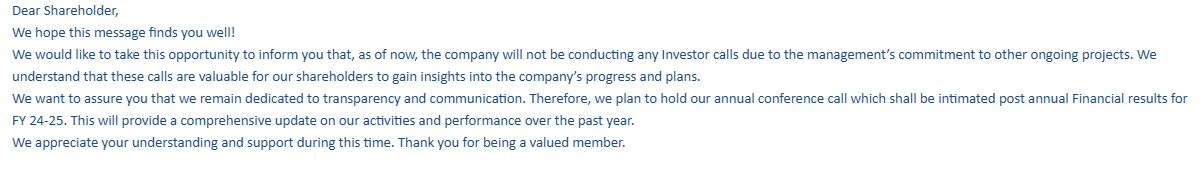

Management Information:: Based on Mr. Ashok Vashisht’s TV interviews (Only promoter that’s visible in interviews) and Concalls, it appears he has a thorough understanding of the cab industry and has a vision to drive this company to a great scale. The company has recently started doing concalls and the execution history is impressive although limited being a recent IPO.

WTI CABS ASHOK VASHIST INTERVIEW- Targetting 2000 Crore Revenue by FY30?

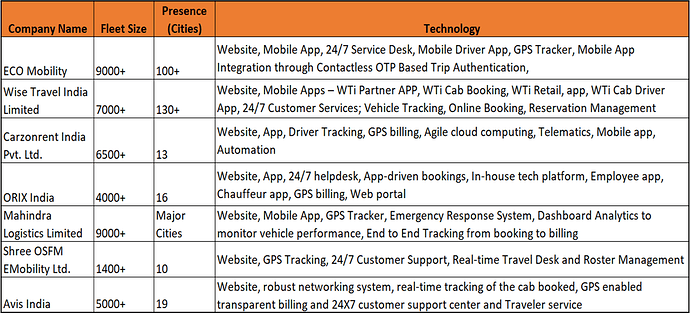

Competition:

The market is highly fragmented, with many regional players succeeding in smaller areas. In the organized sector, a few large PAN India companies dominate, a few managing substantial fleet.

This data is a as of Feb 2024, now WTI has over 8000 vehicles as per their recent presentation and other players may also have added fleet since then.

Key Triggers:

- The upcoming IPO of Ecos Mobility could lead to a market re-evaluation of listed players like WTI Cabs and Shree OSFM (Ashish Kacholia recently invested).

- The company plans to establish partnerships with leading global car rental brands (as outlined in the June presentation), which could enhance scale and help them expand into more cities across India.

- Projected growth of 30-35% over the next few years, coupled with the addition of a new EV fleets and other optionalities such as International expansion and State Govt business.

- Industry still very fragmented and unorganized- Industry may see some M&A activities going ahead.

- Rise Of India’s Aviation Sector and Increased Airport Traffic: 14 New and Upcoming Airports Including Jewar & Lakshadweep. With the addition of new airports and expansion of existing ones, there will be a surge in airport traffic, including both domestic and international passengers. Increased Airport Connectivity Fuels Demand for Chauffeur Driven Mobility.

. Risks:

- Highly competitive space with cut throat competition both PAN India basis and with regional players located in every state. Competition includes the likes of Mahindra Logistics, Ecos India Mobility, Carzonrent, Shree OSFM etc.,

- The inherent nature of industry is such that the pricing power among the players is low.

- The company doesn’t have long term contracts with most of their customers.

- Disruption due to change in government regulations(Covid alike) and activities such as economic, political and other prevailing conditions in India.

Management Guidance and Outlook:

- Aiming to grow at 30-35% per annum on topline and bottomline with sustainable margins.

- Adding EV fleet of 1000+ going ahead in a phased manner and flexible on it being asset light and owned vehicles. (Added 400+ Vehicles already, will be focusing on Bio-CNG also moving ahead)

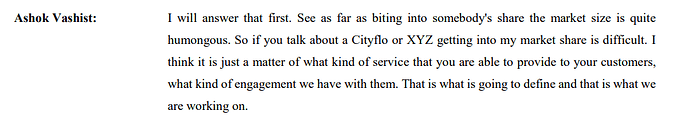

- Small Fish in big pond?: Management believes that the market size and opportunity is large for all the players to grow multifold from current scale. Here’s what the management believes:

- Also targeting bus services and taking parts in tenders in Delhi, MP, UP- State Government projects.

Valuations and P2P:

WTI is trading at a market cap of 651 Cr (Cash of 102 Crores as on March 2024) a FY24 PE of 28 and P/S of 1.38

vs listed peer Shree OSFM trading at a FY24 PE of 35 and P/S of 2.42

vs Ecos Mobility placed at a 32x FY24 PE and P/S of 3.5 (higher EBITDA margins-15-16% and size-12000 fleet).

Overall the company appears to be the least valued among the peers with a large TAM and good promoter backing with 30-35% growth guidance in coming years. In an Industry where competition is stiff, pricing power is limited and entry barriers are low - operational excellence becomes the cornerstone of success.

The key question is: Can the company manage efficient operations, allocate capital wisely, and scale sustainably from this point forward?

DISCLOSURE:

- Not invested. Not a SEBI Registered advisor, please do your own due dilligence.

- Have taken a lot of information from Ecos DRHP and WTI DRHP that includes third party reports.

- First thread, Please highlight any changes or additional info if required as per forum rules.

References: