@harsh.beria93 and I were discussing these concepts offline and I thought it would be great to discuss them on the forum so that all the members could add their knowledge and opinions.

The primary questions that we want to talk about are:

What drives asset prices higher? What is money?

My core hypothesis is that net of inflation it is the rise in human productivity that drives asset prices higher thereby creating value for humans and in turn creating wealth.

1,00,000 years ago, a silica rock was simply a piece of rock and humans valued it similar to other rocks, perhaps a well crafted one might have fetched something in return, but it was worthless otherwise. Through the accumulation of knowledge and skills, we learned over millennia to turn that rock into a device called semiconductor. This created value and a market for the processed silica to be traded in. Although the physical substance silica is limited, its applications are practically unlimited. It is hence by adding value on top of existing products and services that newer markets are created, such markets drive existing asset prices higher (a silica mine is worth a lot more now), allowing people to generate wealth with which they then trade in these newer products and services.

The continuous value addition on top of finite resources drives human productivity and the quality of the human experience higher at a rate which is strictly higher than raw asset price inflation. It is the creation of these new markets for these new resources that are the primary source of wealth creation. Until there was no internet, there were no digital ads. Once we learned how to put the physical resources together in a way that adds that value on top of the raw physical resources, we created and facilitated the creation of future downstream markets allowing unlocking of value that we did not even know existed.

A summary:

The following is the virtuous cycle of wealth creation through value addition:

@everyone, @harsh.beria93 please feel free to add your thoughts.

1 Like

What is value really and can we create more of it? Here is my very naive understanding.

The total amount of resources are limited within Earth. With increasing population, the demand for these resources should increase and given that they are not unlimited, should lead to price inflation. This is probably inflation.

Now coming to productivity, Productivity means that we utilize our current assets more efficiently so that we need less of it to fulfill our demands. Ideally, productivity growth should be deflationary in nature as we are better utilizing our current assets. However, productivity growth also leads to newer demand source. An example of this is digital advertising, which not only took market share away from traditional advertising mediums because they offered better value to advertisers, but also grew the overall advertising pie (by creating new demand from small entrepreneurs who suddenly found a new medium to sell their goods). However, this additional demand is at the cost of what? I try to now look at it from a money supply perspective.

What is money? Its a medium of exchange between multiple entites for some services or products. Lets assume that the total amount of money is constant or growing at a very small pace (equivalent to new gold discovery per year in the past), which was the case in the pre-1970s before Nixon delinked gold from currency thus creating fiat money (link). If money is constant in an economy, then its used to buy some services. Now given that the total amount of money is constant, some service being more valuable comes at the cost of some other service. So its capital reallocation rather than value creation.

If I create more money, what does it mean? I dont know the answer but it should lead to inflation somewhere (either in equities or bonds or real-estate or in prices of consumer goods). And because we are creating more of money against constant resources, it should lead to devalution or loss in the value of money. How do I protect against it? Probably by buying something which preserves its value. In my opinion, this can be through businesses with some kind of pricing power or by buying something which is limited in availability (eg: land, precious metals). This is my current though process and I am willing to learn more through this interaction.

3 Likes

Thanks for adding your thoughts, harsh. I am quite excited by this discussion and looking forward to others adding their views and knowledge as well.

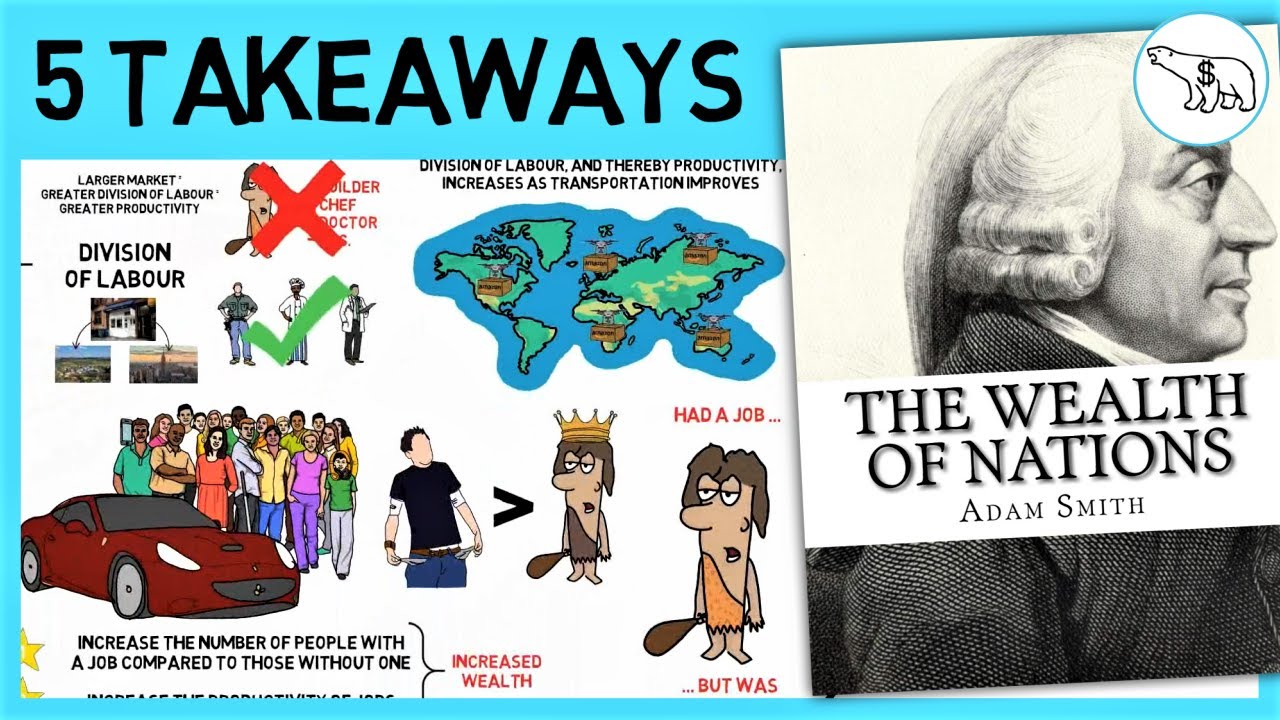

In the mean while I do want to add a couple of videos that I believe are much related to the topic at hand:

These are by “the Swedish investor” who reviews “the wealth of nations” and talks about the concept of wealth and how increase in productivity causes value creation via the market creation. Coincidentally I had not heard about this book and only finished seeing the videos 10 minutes ago. I do feel quite excited to read the book as soon as time permits.

PS: I have chosen a biased summary of the video based on the facts which appealed to me the most. The video actually goes into much more depth about the concept of money and value and wealth.

1 Like

My $0.02

Increase in productivity is 1 of the factors which can increase wealth. We talk about companies like Google (due to search engine), Amazon (due to comfort of e-retail and AWS), Roomba (reduces menial manual effort) which have definitely increased productivity.

However do all companies that are successful increase productivity? Netflix, Facebook, Amazon Prime Video etc are some companies where we can debate whether they increased productivity or just filled the vacuum that was created by all the increase in productivity.

But my opinion is, fundamentally, at the core of Wealth Creation is Customer Obsession (I work at Amazon and this is the foundational tenet for us). All the companies that I mentioned above created products which helped customers. The help can be increase in productivity, better connectivity (Whatsapp, LinkedIn, Facebook, Gmail), or even keeping us occupied (Netflix, Hotstar, Amazon Prime). Even the example given in the 1st post in this thread of silica to semiconductor journey was because semiconductor created products which customers wanted. We may argue that iPad or iPod didn’t increase productivity. But these products were selling a dream to the customers.

So, in summary, if you are able to create a product which either

- Solves an existing problem for the customer - AWS, Kindle

- Takes an existing good thing and makes it great for the customer - iPod, iPhone, iPad, McDonalds

- Creates something that a customer doesn’t know he wants until he sees the product - UPI, Google Search, CocaCola

then you are definitely creating wealth.

Your subject of the thread and the subsequent first post explanation is very different

Asset prices are driven higher or lower by the amount of money chasing it and the value of money itself however in your explanation you seem keen to discuss why economy, production, value of resources expand/increase

Arguably this was best addressed by Mises in his theory of production/Austrian economics

His basic argument is a roundabout way of making a product increases economic output for all

To give an example, iron tools can be made by an ironsmith using traditional furnace. A roundabout (More complex) way of doing it is to install industrial scale furnace and robots.

A factory to do that requires a lot more resources but over longer period is more efficient And/Or makes better products

Every advantage and gradual improvement in all sectors has been because of someone adopting a more roundabout way of doing things which meant better than the previous ones

It also sometimes leads to waste as two companies might both introduce a more roundabout way and only one might come out a winner but this is the way free market economy works

When an asset price begins rising at a rate appreciably higher than the broader market, opportunistic investors and speculators jump in and bid the price up even more.The resulting flood of investment dollars into the asset pushes the price up to even more

inflated levels.

Stock prices are slaves of earnings. Returns are chiefly attributed to three types of yields:

- Speculative yield (or hope rally): returns in anticipation of earning recovery

- Earnings yield: earnings recovery phase

- Inflationary yield: post earnings recovery phase when inflation act as a catalyst leading to earnings acceleration.

At broad level, type 1 is visible in stock returns during last few years. However, 2 and 3 are increasingly becoming visible in select large/mid/small cap names showing signs of market share gains.

Good luck.

1 Like