#WELSPUNCORP

Starting a new thread since there was no thread for the Said company. These notes are not mine sharing only for educational discussion :

- Crude from a high of $60 in Jan, 20 crashed to $20 in May, 20. As a result, Welspun Corp lost 40% of its FY20 order book.

However the company still has 8-9 months of #revenue visibility and can easily service its #fixedcost & employee expenses for FY21.

Soon out of the Woods

#CMP - 81

#MarketCap - 1,565 cr

#Industry - Pipes & Plates

In the last month, crude oil has recovered around 50% from the bottom, as a result Welspun Corp won 90KMT #order in its US facility last week indicating normalcy once global trade & economy resets.

However, feel Welspun Corp’s strong cash & investment position in the #balancesheet and very low #longtermdebt will help the company withstand the current turmoil and bounce back stronger.

- Interesting Case Study- #MohnishPabrai - effective way of buying distressed companies in bad times, buys at what he calls PE ratios of 1. He looks at unfavourable industries, (car industry in 2012) finds companies that will not go bust & have potential to deliver high earnings

For example, in 2012, he was buying Fiat-Chrysler (FCAU) at an average price of $4. The current EPS is $2.22. If we deduct 40% of the 2012 purchase price as the value gotten from Ferrari, we get to a PE ratio close to 1.

#WelCorp #Valuations- WelCorp is at distressed valuations and won’t go bust. On a steady state and normalized environment post COVID19, the company can do a 1000 cr EBIDTA in FY22 against an EV of 1,600 cr. At an #EVEBIDTA of 1.6 times, Welspun Corp at CMP is priced to extinction

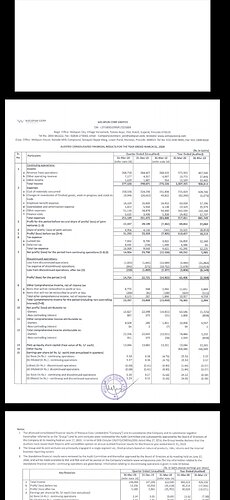

- Strong Financials & ability to withstand loss of revenues in FY21- As of Q3FY20, Cash & Cash Equivalent in the balance stands at 920 cr. Welspun Corp has a #debt to equity below 0.5 times, absolute number of debt is around 1,000 cr.

Biggest #COVID19 casualty

Post Jan2020, the #crudeoil prices collapsed 60-70%. The company has major dependence on global oil & gas players for its order book. https://t.co/M4Kgek399p

#Interestcoverageratio for FY20 would be around at 5 times (approx.) which provides huge comfort towards the management’s ability to service the debt. Last 5 years average #CashFlow from Operations is around 600 cr

- Management quality+

Consistent Cash Flow generation+

ROCE+

Cheap Valuations

is perfect recipe for a multibagger

#ManagementQuality- Zero Pledge by promoters, Consistent dividend payout for last 10 years, No cross holdings in other group companies.

#CashFlow from Operations- Last 10 years, accumulated CFO at 6,000 cr and current market price is at 10years low.

#ROCE- Return on Capital Employed for FY20 at 25% (approx.), vs FY17 at 6.5% indicating a clear turnaround in operations.

Cheap #Valuations - Welspun Corp at FY22 is valued at 1.6 times EV/EBIDTA is giving the company a shutdown valuations.

Therefore, the management of the company took the strategic decision to divest plate and coil mill division & the 43 MW power division.The sale of assets will result in the cashinflow of Rs. 900 crore which will help the mgmt to reach its target of zero netdebt by the end of FY20

Prudent #ManagementStrategies during PreCOVID19 era led to significant turnaround

Turnaround in Saudi’s Joint Venture’s Operations

The Company has a JV in Saudi Arabia. The loss making operations from this geography was weighing down on the bottom line of the company till FY19

However, due to bidding discipline and margin focused orders, the Saudi division witnessed a turnaround from Q4 FY 2019 and it posted positive #operatingprofits. The share #SAUDIJV increased from a loss of Rs. 60 crore in H1FY19 to a operating profit of Rs. 75 crore in H1FY20.

However, due to COVID19 impact on businesses, this decision has been deferred to March, 21 and so far only 20 cr has been received by the management. But the management’s intent focus towards asset light model & focus on core business is clear.

Company Overview

The company is engaged in manufacturing of welded line pipes and has a diversified product portfolio which includes #HSAW line pipes, #LSAW line #pipes, and #ERW/#HFIW line pipes. It is one of the largest players in the global line pipe business

#CrudeOil bounce - However, #brentcrude bounced 40% from lows due to which company recently won projects worth 102KMT, out of which 90KMT is from US.

Focus on Core Business

The management had planned to make the business model of the company into #assetlight model. They identified some assets which were weighing the capital employed, but were not contributing to the company’s profits.

The group has maintained relationships with reputed overseas customers, which include Saudi Aramco, TOTAL, Qatar Petroleum, Exxon Mobil and Kuwait Oil Company. It also supplies line pipes to all major players in domestic market, such as BPCL, IOC, GAIL, RIL, GSPL, and L&T.

#CurrentOutlook

#Orderbook as of Q3FY20 was 1,305KMT. Oil & Gas players globally being main clients, Post COVID19 company lost 40% (approx.) of its order book. Current order book stands at 765KMT valued at 6,200 cr giving the company #revenuevisibility for atleast 8-9 months.

Disclosure : Invested from lower levels. Please, do not take this as an investment advice. Do your own due diligence before taking any discussion. Notes are not mine and credit will be given to said writer. Posted only for discussion and educational purposes.