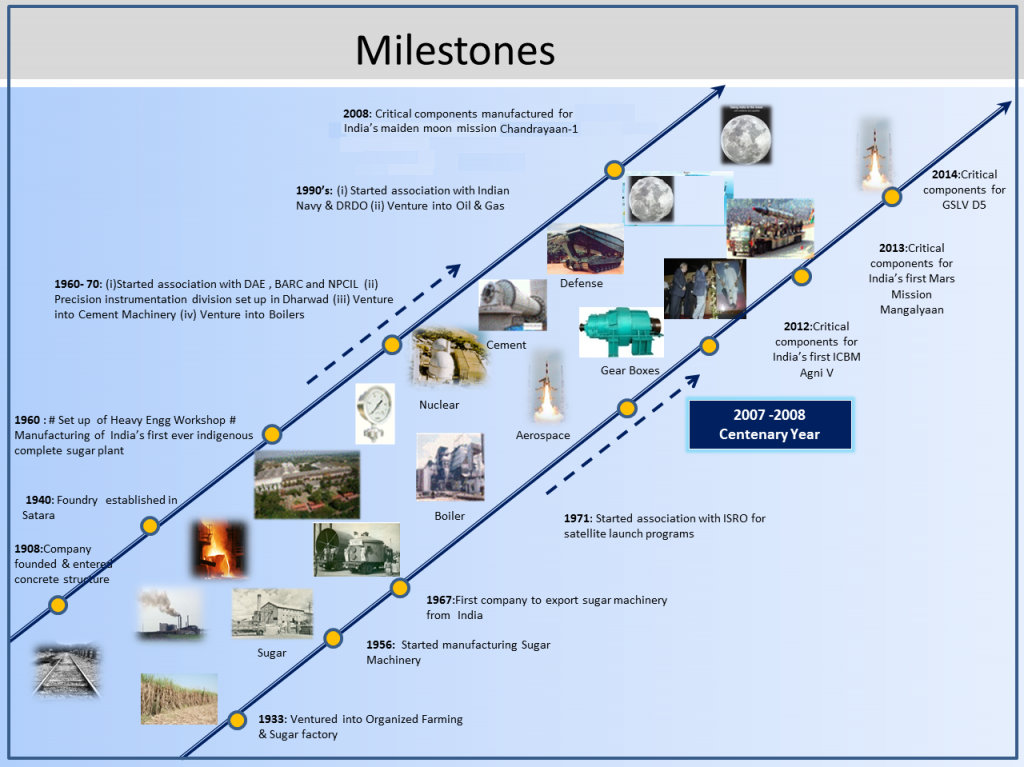

Walchandnagar Industries Ltd.(WIL) , established in 1908 is a Heavy Engineering Company with a presence in Strategic Sectors like Defence, Nuclear & Aerospace and Industrial Products like Gears, Centrifugals, Castings and Gauges. Certified for ISO 9001:2015, WIL also has a presence in Oil & Gas, Railways and in EPC sectors through its offerings for Sugar Plants, Co – Generation Boilers and Cement Plants.

Walchandnagar Industries Limited (WIL) is an ISO 9001: 2015 certified Indian company with global presence and diversified business portfolio in Projects, Products and High-tech Manufacturing. Carrying a legacy of more than 100 years of Engineering Excellence, WIL has established its name as one of the best in its operational areas. WIL is known for pioneering achievements in Indian engineering industry and for its contribution to nation building activities. WIL is a listed company on the BSE and NSE stock exchanges in India.

WIL has a strong engineering, project management and manufacturing infrastructure to undertake projects and supply of machinery and equipments, in the fields of Nuclear Power, Aerospace, Missile, Defence, Oil & Gas, Steam generation plants, Independent power projects, Turnkey Cement and Sugar plants. WIL has a large proven reference list of satisfied customers across the world.

First to Manufacture

* *Critical components for Nuclear Reactor*

* *Main propulsion gear boxes for Indian built Navy Frigates*

* *Components for Satellite launch vehicle for ISRO*

* *Critical components for 235 MW & 500 MW Nuclear Power project*

* *One of the largest Optical Telescope in Asia*

* *Critical components for India’s first Moon mission **“CHANDRAYAAN-I”***

* *Major critical components for India’s Intercontinental ballistic missile (ICBM) program **“Agni V”.***

* *Critical components for India’s first Mars mission **”MANGALYAAN”.***

First ever

- Indigenously built Sugar project

- Company to export Sugar machinery and complete Turnkey project from India

- Export of complete Cement plant with largest ever Kiln manufactured by any Indian company

- Independent Power project based on municipal solid waste in India.

Certifications

- Certified for ISO 45001: 2018

- Certified for ISO 14001: 2015

- Certified for ISO 9001: 2015

- Certified for ISO3824-2

- Certified for IBR

- NABL accreditation for in- house laboratory at WIL

- Works Approval Certificate for Gear Boxes from IRS

- Certified for IATF 16949:2016 and CE Marking (For Instrumentation Unit, Dharwad)

Compliance to Various Codes

- Fabrication of components complying to various codes of conformance such as A.S.M.E, Sec.VIII Div.I & II, A.S.M.E. Sec. III NB, NC, & ND, A.S.M.E. Sec.III NF, I.B.R. Act 1948, ISO, DIN, Customer Codes etc

- Welding procedures and welders are qualified under the various third party inspection surveillances such as I.B.R., N.P.C.I.L, V.S.S.C, E.I.L, L.R.I.S, A.B.S., SSQAG, P.D.I.L, Bax Council, T.E.I.L, B.V., DNV, D.R.DL, Holtec , etc.

BUSINESS AREAS

- Aerospace

- Cement Plant Machinery

- Defence

- Foundry

- Gear Boxes

- Instrumentation

- Centrifugal Machines

- Nuclear Power

- CoGeneration Power Plants

- Missiles

- Sugar Plant Machinery

- Walchandnagar Technology Group (WTG)

–

WTG

Walchand Technology Group (WTG) is Technology & Engineering Solutions Group of Walchandnagar Industries Limited (WIL) powered by a dynamic and dedicated team of qualified and trained engineering professionals, with a judicious mix of domain and discipline experts. WTG has harnessed in-house knowledge and ability garnered from over 100 years of engineering achievements and experience, to provide a complete range of consulting engineering services in the following sectors

A. Energy – Nuclear, Thermal Plants

B. Oil and Gas – Eg. Distillation Column for Oil India

C. Defence – Submarines & Ships

D. Design Engineering and Execution of Complex Projects – Eg. Sodium Coolant System for 500 MW FBR at Kalpakkam Bhavini

E. Special Purpose machine and R & D Projects

Availability of Software and hardware tools at WTG and access to expert panels of agencies and consultants with specific domain expertise in nuclear, electrical engineering, as well as controls and instrumentation give a distinct advantage.

Prominent Clients list include Nuclear Power Corporation of India limited (NPCIL), BHAVINI, BARC, IGCAR.

Stock Price History

Walchandnagar has been a premium company in critical area manufacturing for aerospace & nuclear sectors. The company has gone through a very tough time but is now looking at a full swing turnaround, backed my massive sectoral tailwinds.

What do I like?

Company founded by a freedom fighter. Has tremendous strength the aerospace, defence, missile, and nuclear sectors.

These are very high-tech areas were only specialised players with the manufacturing capabilities, technical know-how, and historical quality delivery strength, can survive.

It is not easy for a new company to setup & establish itself as a credible supplier of these components, that too for the government, ISRO, NPCIL, etc.

Our Government is pushing on every business area that Walchandnagar Ind is involved in. There is and will continue to be growing demand for products that they manufacture.

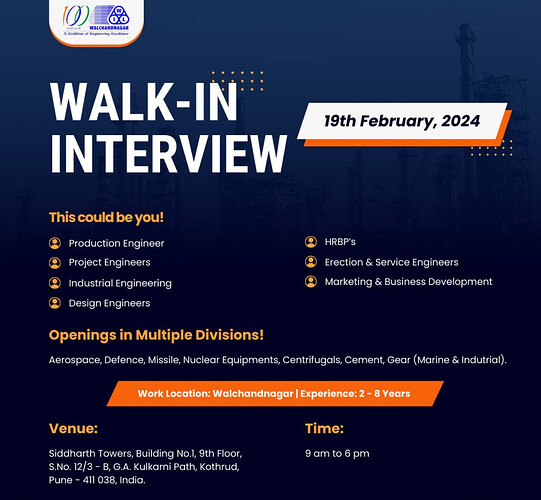

Company is undergoing debt restructuring. In the process, they have raised preferential from a few astute & marquee investors - 233CR

- Ajay Upadhyaya made an entry in June 2023 quarter, currently holds 1.63%

- Ashish Kacholia 17.5lac shares 2.59%

- Jagdish Master - 4.3lac shares 0.65%

*Some are via warrants at Rs 114/share - I believe 33.33% paid, 66.67% to be paid

Funds to be used for

- Purchase of large assets to enhance defence, nuclear, and aerospace programs. gearbox business

- Reduce debt on books.

- General working capital

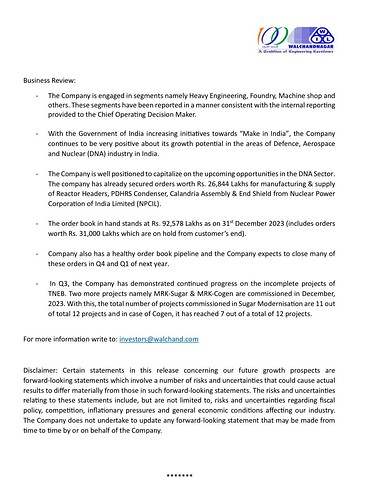

Q3FY24 Results - poor, and expected. There was a strike which caused some loss, and they are still in the turnaround process.

Management is bullish, confident, and hungry to turnaround the entire business.

“This is truly an opportunity for Walchandnagar to rebuild its brand & legacy, to what it was two decades ago. Next ten years will define Walchandnagar, the engineering & aerospace, defence business, as we stand for it. I think we are very ambitions, very hungry, as a management team. This inflow of capital, and faith, that people have put in us, needs to be repaid in the next 5-10 years. We are very bullish about all that we do, and we are very hungry, that’s they key.” ~ Chirag Doshi, MD

Yesterday’s Press Release

My View

The worst is behind them.

I see honesty, patriotism, and hunger, in Chirag Doshi. These 3 values, when mixed with nation building initiatives by the government, and when the business has an edge due to the highly specialised & technical nature of the product mix (barrier to entry), the resulting recipe is one for imminent success.

Invested, position built slowly across the last several months.

*Disclaimer: I invest on management depth, market leadership, sector growth & demand. My holding periods are long, and I’m alright with drawdowns, as long as corporate & business hygiene is intact. NOT an expert, just a dreamer