Walchand Peoplefirst Ltd is listed on BSE (BSE Code 501370). They have a market cap of Rs.64 crores. CMP Rs.221.

Their website is https://www.walchandpeoplefirst.com/.

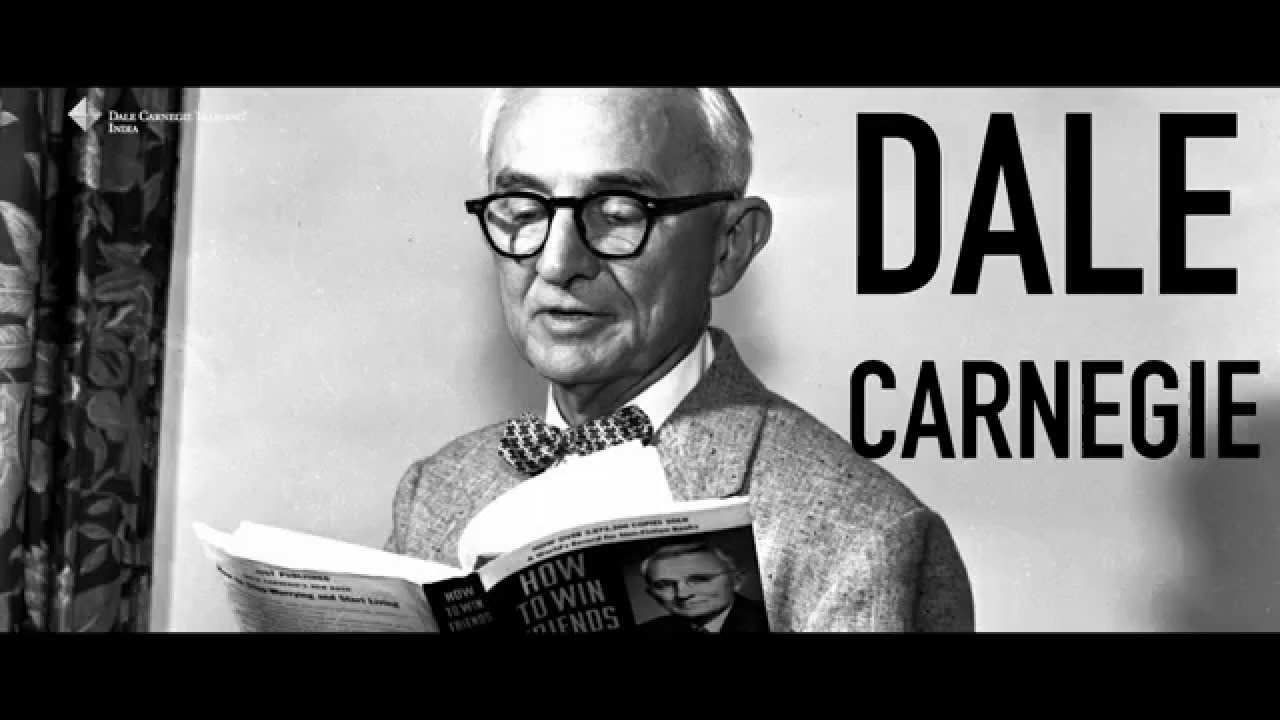

Walchand Peoplefirst is a corporate training company. They are master franchisees of Dale Carnegie Institute. They recruit other franchisees in tier 2 and tier 3 cities. Dale Carnegie was the author of ‘How to win friends and influence people’, a bestselling book which has a cult following. In 2022 they became master franchisees of Dale Carnegie Institute and will now be recruiting franchisees themselves. As per the 2023 AR, they have taken Rs.10 lakhs as franchise fee.

They opened a Franchise in Pune recently:

They are expanding.

I found a video about them. Start watching from 3:05 because till then they are talking of Dale Carnegie and not Dale Carnegie India.

On their website they claim to have ‘8,500 + clients including top Government, Corporate, Education and Social sectors.’ and claim thave trained over

650,000 people.

They teach soft skills, which I think are going to be in demand even after a lot of other areas are automated by AI.

They have two independent directors who have a good profile - H. N Shrinivas and Jehangir Ardeshir. Both have worked with the Tata Group in senior positions.

Their sales have been stagnant for the last decade. From Rs.17.18 crores in FY13 to Rs.17.81 crores in 2023. In FY21, they reported losses.This seems to have been because of Covid and the lock down. Their training was mainly in person. Now their training is also online and they are profitable.

They own a building on Ballard Pier, South Mumbai named Construction House. The parent company is Walchand & Co Pvt Ltd. The land (806 square metres) on which the building is built is leased from Mumbai Port Trust is in the name of the listed company.

Mumbai Port Trust:

See serial no 516. Land admeasuring 806.86 square metres in name of Walchand Capital Ltd (old name of Walchand Peoplefirst Ltd).

This company was incorporated on 1920-07-06.

This is the building, specs and picture:

https://property.jll.co.in/office-lease/mumbai/ballard-estate/construction-house-ind-p-001akg

As of March 31, 2023, they had cash and investments of over Rs.25 crores and debt of less than Rs.6 crores. So net Rs.19 crores cash. Their net profit so far this year has been Rs.2.4 crores. I do not know their current cash position.

The concerns:

Their company secretary quit recently.

Management remuneration has been higher in recent years. The two main directors themselves take about Rs.3 crores as their salary.

They spent on buying an expensive car in FY23.

In recent years, even in FY23, a lot of their profit is from ‘other income’. Without this, they would be in losses.

What is the value of their land and building at Ballard Pier? Can they monetize this?

When will they become profitable?

Why are they into losses despite being the master franchise of a world known brand and being a service company?

Disclosure: I have invested in the stock of this company. This is not a recommendation.