Looking forward for buyback actions on February 6th…Good technical set up in charts too…!!

Disc : Invested from lower levels

VRL logistics in top gear to reach buy back price of 300… Eventually chart also suggests same level in very near term

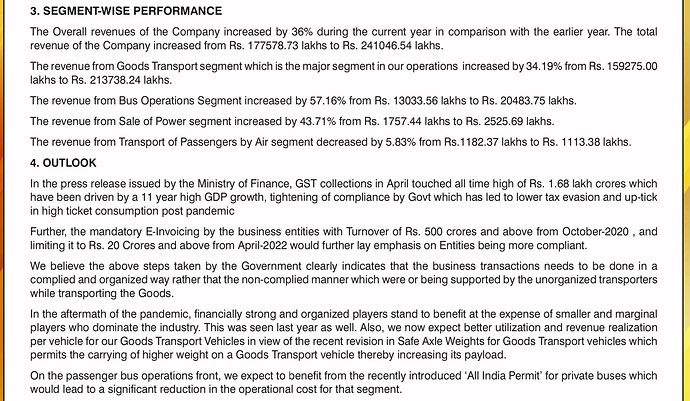

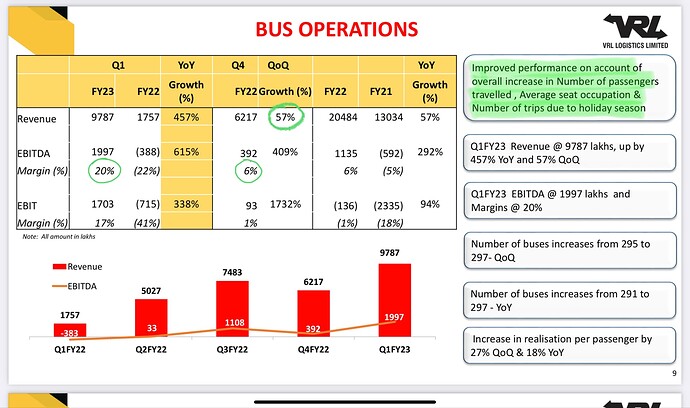

Agree - Goods transport is at its peak and probably will go beyond the peak next year, Buses are turning around and realisation will improve.

Logistics is a key recovery play - and 3rd core part of my portfolio after mid-cap banking / housing / real estate NBFCs and Construction plays

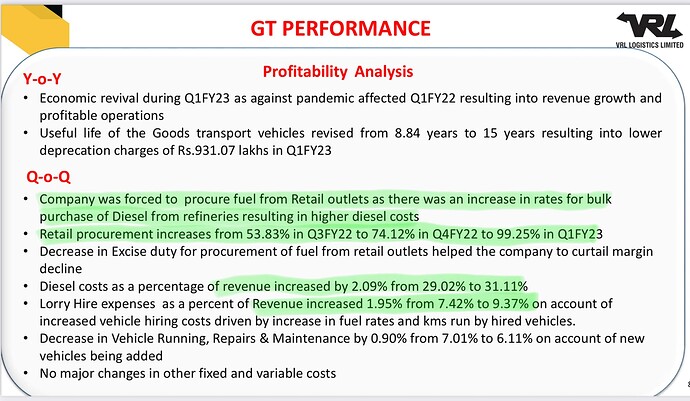

Considering the diesel prices are at roof level, any reduction in price going forward will favour the logistics companies such as VRL which has majority presence is in road transportation and “assuming” they have hiked freight charges as per fuel. Better road conditions and fast tag compulsory will also add bit more to their maintenance cost and margin from fuel point respectively…Any thoughts related to this from other members welcome.

Does anyone have earnings call joining details on 3rd Feb? They havent put up call joining instructions in the communication uploaded on bse .

Q3’22 concall summary:

Margins improvement due to

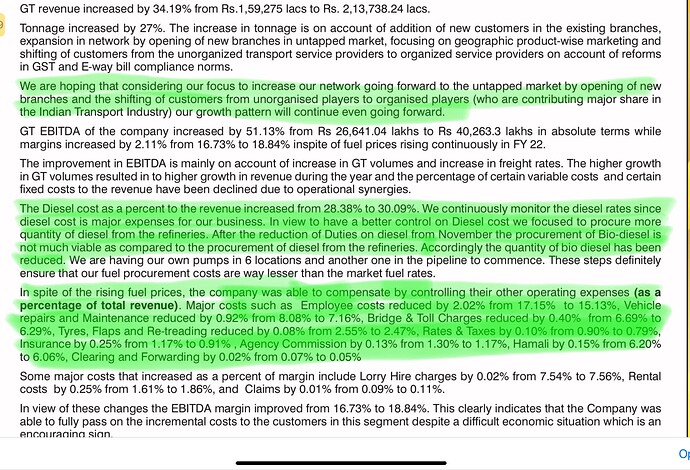

- Volumes improving – 4% increase

- Freight rate improving – 1% increase

Realizations improved due to

- Diesel as % of cost went down to 29.84%(12 rs reduction in diesel prices from October level)

- Tyre cost reduced from 4.3% to 3.28%

- Employee cost reduced to 13.85%

- Vehicle maintenance reduced from 7.48% to 6.55%

- Management said the margins will sustain across next qtr and double digit growth in tonnage.

- Reduction in diesel will be offset by 10% increase in employee cost(hikes given in jan)

Other info provided by management:

- Textile tailwinds helping VRL(tonnage contribution increased from 16%(q2) to 19%(q3)

- Surat hub showed 20% growth YoY. 3lac+ ton

- Tonnage from agri com increased from 8% to 10%

- 400 cr annual cash profit can sustain both capex and dividend policy going further

- Reliance retail added as a customer last year

Looks like the sectoral tailwind is helping VRL along with the asset ownership buss model providing decent operating leverage.

I think VRL will see a very, very sharp cyclical upturn in earnings. The management is sounding upbeat after a long time and are guiding volume growth of 15%. Trucking segment is one where unorganized to organized shift has been real, and the pandemic accelerated it.

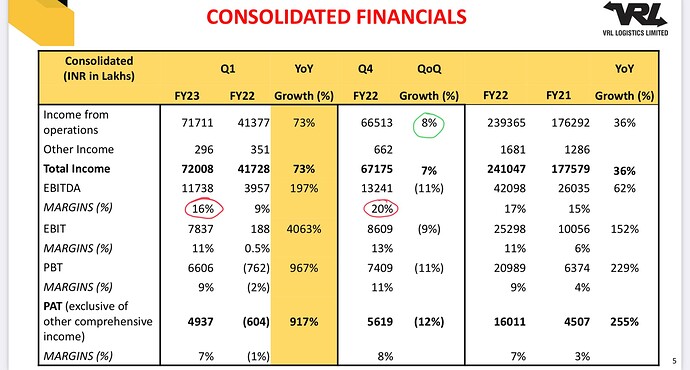

Moreover, after a long time nw tariff rates are being set which are ~15-20% higher than hisorical rates. While at the moment this is just pass through of higher input costs, once the input prices stabilize we will see new cycle of profitability. (VRL used to make 16-18% pre-Ind AS 116 margins, which translates to ~20-22% of post Ind AS 116 margins.)

Last qtr’s result were phenomenal, and comapny achieved qtrly RoE of 38%! So, they are back to 25%+ annual RoE run-rate which will lead to re-rating. I am expecting EPS of Rs. 25.5/34.0 for FY23E and FY24E. You can give your own multiple.

What I like about the company is that it is a cash flow machine

| FY17 | FY18 | FY19 | FY20 | FY21 | |

|---|---|---|---|---|---|

| Cash flow from operations | 198.0 | 205.5 | 192.2 | 257.3 | 271.1 |

| Capex | -62.7 | -47.34 | -211.16 | -122.73 | -38.98 |

| Free cash flow | 135.3 | 158.1 | -19.0 | 134.6 | 232.1 |

| Market Cap | 2,840 | 3,472 | 2,550 | 1,389 | 2,037 |

| Free cash flow yield | 4.8% | 4.6% | -0.7% | 9.7% | 11.4% |

Recent updates:

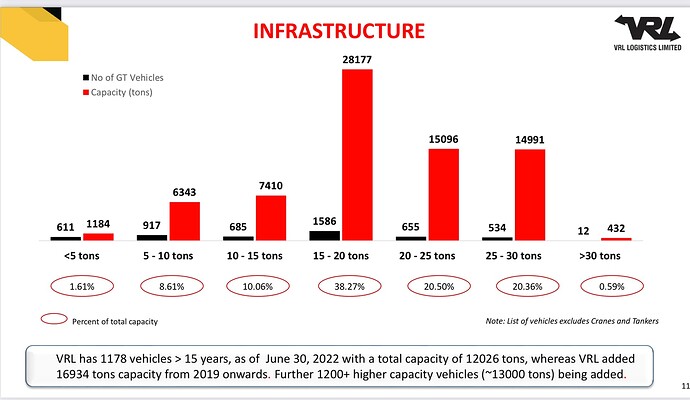

• The company announced capex of Rs. 560 cr over next 8 months which involves scrapping and replacing existing vehicles and addition of pick-up vehicles to capture the demand of short-end cargo.

• Company has ~1200 vehicles (15 years+ with zero book value) which it’ll replace under scrappage policy. It’ll be able to book some profit on scrapping of these vehicles as incentives will be much higher compared to its existing book value.

• Company will also aggressively add 90-100 branches (current branch count 929) every year for next 2 years

• Majority of the capex will be spent from internal accrual as company is expected to generate operating cash flow of ~250-300 cr. And some portion of the capex will be met through debt. Company’s current D/E is comfortable at 0.25X.

Snippets from annual report and conf call:

- Getting volumes from unorganized sectors due to enforcement of compliances like GST, eway bill

- Addition of 91 branches, expansion to east and north eastern part

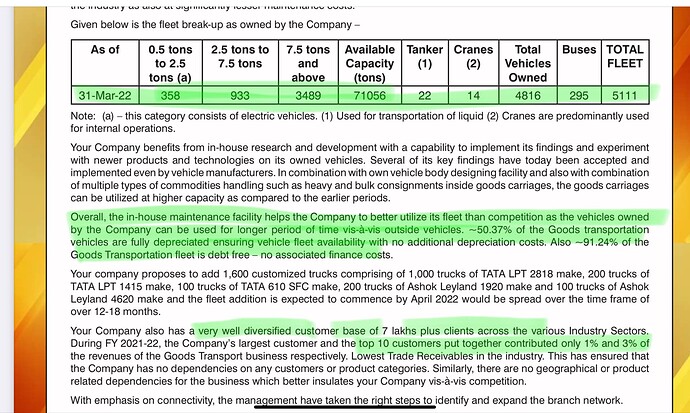

- 1600 vehicle order with Ashok Leyland, Tata motors over 18 month horizon – (1300 – Tata and 300 – ashok)

- No freight hikes after April ‘21 margin compression may happen due to fuel hike

- 141 vehicles scrapped/sold and another 1265 vehicles > 15 years to be assessed for fitment ~ 18% of fleet capacity

- 160 cr capex for the year – 125.5 cr on new vehicles and balance 34.5 cr on maintenance, land building

- 91.24% of vehicles are debt free and 50.37% vehicles fully depreciated

- Well diversified revenue – largest customer 1% and top 10 customer 3% of revenue

- Availability of driver is the biggest problem across industry. VRL retains drivers by offering best in class salaries

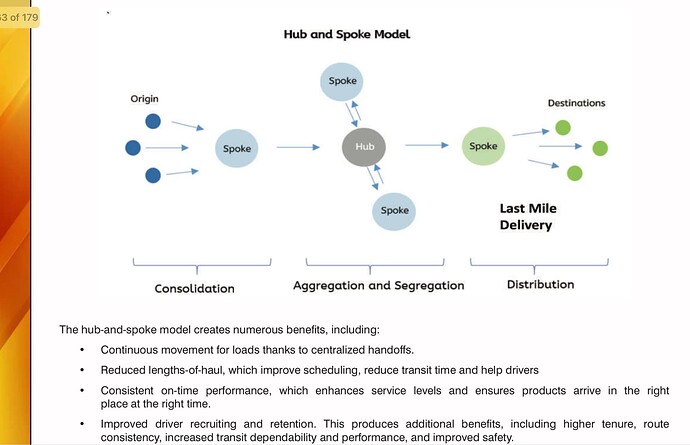

Industry overview: - Road transportation – 110B$ market – Less than truck load(LTL) where VRL is dominant 35% of the market

- Less than 5 trucks owner have a major share showing the fragmented market – more than 50% market share

- VRL is the biggest player with owned asset model with a capacity of 4816 vehicles and 71056 tons

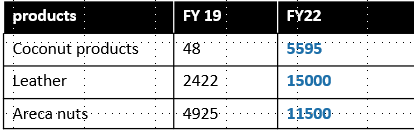

Example of getting volumes from unorg sector like coconut, leather goods

Dear Mr Zaki_Ahmad,

What is the source of above graphics ? VRL placed a half page ad in Business Line recently wherein conspicuously projected only YOY figures and not the QoQ . QoQ speaks a lot . IMHO, Q4 must be traditionally best quarter for VRL as most of the government transfers takes place that time . Right ?!.

Q3’22 management concall:

- Company is net debt free. Invested 15cr in mut funds for tax purpose

- Net debt was 46 cr as on Dec 31 and 134 cr as start of year. Net debt will not cross 50-60cr after capex

- Increase in tonnage 10,10,000 tons growth of 15% over last year nos. Daily tonnage was 10,900 tons

- Few sectors below have shown tremendous growth over last year

| Sector | Growth over last year |

|---|---|

| Agri products, equipment | 47% |

| Automobile | 25% |

| Education | 31% |

| FMCG | 23% |

| Footwear | 36% |

| Metals, hardware | 28% |

- 5% rate increase for non-contractual tonnage ~ 65%( if costs are constant, this is 300 bps margin accretive)

- Started bulk fuel procurement mid-dec, 2rs cheaper than retail

- Lorry hire will not go beyond 10-12% if revenue.

- Not taking price hikes in new markets to gain market share

- 12% of volume was from branch addition in last 2 years

- Capex of 1600 vehicles out of which received delivery of 800 vehicles and other 800 by September

- Promoter will participate in buyback

- Unorganized sector like dryfruits, leather, coconut will lead the 15-20% annual growth

VRL Logistics Q4FY23 Concall Summary

20% plus tonnage growth which usually never exceeds mid single digits after a long time. Is something changing?

Any one tracking this company? What’s the reason of the recent sellof?

VRL Logistics Limited Q1 FY25 Analysis: Key takeaways!!

Business Outlook:

- VRL Logistics faced several operational challenges in Q1 FY’25 due to labor absenteeism during elections and extreme heatwaves, which impacted efficiency and resulted in service delays. However, the company has since resolved these issues and expects a return to efficient operations.

- The company maintained revenue growth of around 9% year-on-year, driven by an 8% increase in volumes and a 1% improvement in price realization. This was aided by the expansion of the branch network and increased contributions from existing customers.

Strategic Initiatives:

- VRL Logistics has accelerated its branch network expansion, adding 36 new branches in Q1 and targeting around 100 new branches for the full fiscal year. This is expected to support further growth in tonnage.

- The company has taken a 5-6% price hike across all revenue segments to offset the increase in costs, including higher diesel rates, toll charges, and employee costs. This has led to a 6% improvement in realizations in July.

Trends and Themes:

- The logistics industry is seeing a recovery in demand, particularly in commodities that underperformed in FY’24, with the support of a good monsoon season.

- VRL Logistics is focused on improving operational efficiency and cost control to maintain its margins, even as it invests in expanding its branch network and fleet.

Industry Tailwinds:

- The revival of economic activity and the gradual recovery in key sectors like textile and agriculture are expected to drive demand for logistics services.

- Improved infrastructure, such as the increasing number of toll booths, can benefit organized players like VRL Logistics.

Industry Headwinds:

- Volatility in fuel prices and the potential for further increases in driver costs and other operational expenses pose challenges to maintaining margins.

- Labor availability and productivity issues, as witnessed in Q1, could impact service levels and growth if not managed effectively.

Analyst Concerns and Management Response:

- Analysts were concerned about the impact of the operational challenges on volumes and profitability in Q1. The management acknowledged the issues but expressed confidence in resolving them and maintaining a healthy growth trajectory going forward.

- The management reiterated its focus on cost control measures, including the recent price hike, to offset the increase in operational expenses.

Competitive Landscape:

- VRL Logistics competes with local and regional players, particularly for business from smaller customers. The company’s ability to offer consistent service quality and its pan-India network provide it with a competitive edge.

Guidance and Outlook:

- The company expects to maintain a volume growth of around 12-14% in the coming years, supported by the expansion of its branch network and recovery in key sectors.

- The management aims to improve EBITDA margins to around 15-16% in the future, driven by the price hike and continued focus on operational efficiency.

Capital Allocation Strategy:

- VRL Logistics has slowed down its capital expenditure in the near term, with plans to invest around ₹200 crore annually, primarily for vehicle additions.

- The company’s debt levels remain under control, with the debt-to-equity ratio staying low despite the recent capital investments.

Opportunities and Risks:

- Opportunities: Expansion into untapped markets, increasing penetration in existing geographies, and leveraging the recovery in key sectors like textiles and agriculture.

- Risks: Continued volatility in fuel and other input costs, labor availability and productivity issues, and potential delays in the implementation of the branch network expansion plan.

Customer Sentiment:

- The company’s ability to pass on the price hike to its customers, including contractual clients, suggests that the demand for its services remains relatively inelastic.

- However, the management acknowledged that some smaller customers may temporarily shift to other service providers due to the price increase, but they are expected to return over time.

Top 3 Takeaways:

- Operational challenges in Q1 FY’25 impacted profitability, but the company has taken corrective measures and expects a return to efficient operations.

- VRL Logistics is accelerating its branch network expansion and implementing price hikes to offset cost pressures, aiming to improve its EBITDA margins.

- The company remains optimistic about the industry’s growth prospects and its ability to capitalize on

the recovery in key sectors, supported by its pan-India presence and focus on operational efficiency.

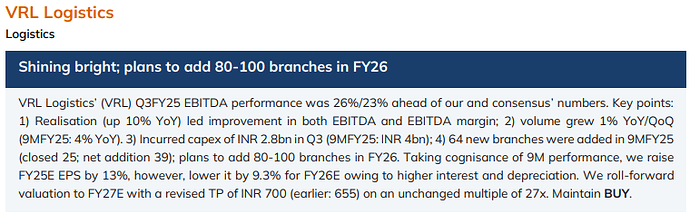

Source: ICICI Securities report https://images.moneycontrol.com/static-mcnews/2025/02/20250209151420_VRL-Logistics_09022025_ICICI-Securities.pdf

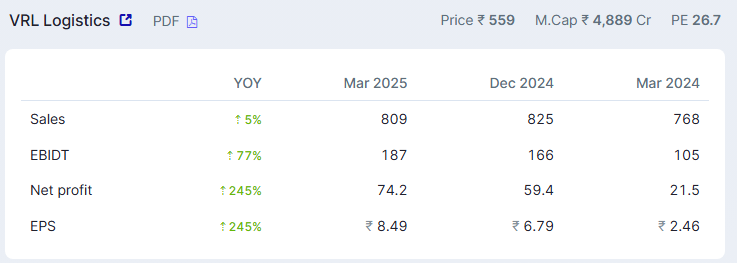

Earning should grow > 25% CAGR over next 2 years on the back of price hike & operational efficiencies. Available at 31x trailing P/E compared to average P/E of 35x in last 5 years

Surprisingly no activity on this thread. Q3 and Q4 are breakout on numbers. Volume was flat due to price increase taken by the co. However, price increase seems sustainable now, and doing 20% odd EBITDA margins is no mean feat. Its trading at 25 TTM pe now and with 600 odd annual ebitda trades at an EVebitda below 10. Volume growth will come by branch expansion, they have guided for 12% volume growth for FY 26.