Case study – Will future be more consistent?

When I discussed Vishnu Chemicals with my investor friends, a very important question cropped up in many discussions.

Vishnu Chemicals’ performance till FY21 was subdued & inconsistent for past so many years and it improved only from FY22. Is something wrong with the company’s business or execution capabilities/integrity of the management? Is the company riding on only favourable external factors and improvement is temporary? Should one buy such stock for very long term?

Deep dive into the valuepickr forum and various other public information suggest that while management had hunger & dedication to grow; high debt level with high interest rates and fund crunch were big constraint in earlier years.

I appreciate that the management did not stop making efforts to change the things, despite fund crunch. Investment in Carbon Di-oxide recovery plant became a game changer move. It was delayed but when it became operational it changed the fortunes as cost of production came down. The company also gradually diversified into value-add products and added new user industries. The company set-up barium business (in JV earlier which was acquired by Vishnu later on) but high quality raw material availability was an issue. Not only raw material availability eased out later on, VCL recently acquired Ramadas Minerals Pvt Ltd, through which it can convert low-grade barytes into a superior-grade.

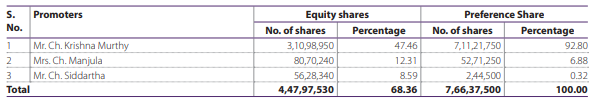

These efforts along with favourable industry scenario helped the company in changing its orbit. With the cash accruals in last few years along with QIP issue, gearing level is at comfortable level now. Improved balance sheet and credit rating will help in reducing interest rates. There seems to be further efforts on expanding capacity, adding derivative products, improve barium business and bring down costs on continuous basis. All this make me believe that past is behind, major issue is resolved and company should do well in future more consistently.

In my view, CFO/EBITDA, end result of capex, management remuneration, related party transactions are few important parameters to check fund leakage. In last 10 years, cumulative CFO/EBITDA is 0.62x despite 3x increase in revenue (which results in incremental working capital requirement), capex of Rs.600 cr in this period seems to be fruitful and management remuneration is reasonable. In terms of related party transactions, the company partly outsources transportation to a group company but amount is less than 0.3% of revenue per annum. Also, promoters have given interest free unsecured loans and also forgone part of interest on preference shares. Overall, the company looks clean on these parameters.

While I generally avoid companies with inconsistent performance for a prolonged period and use past performance as an important benchmark for future, here I have taken deviation due to above mentioned reasons. I believe that one should have some flexibility in his investment framework, particularly when there is strong logic to do that. Only time will tell if my logic & analysis is right and I will use the outcome as a learning for future.

Disc: Invested. I am not SEBI registered Advisor/Analyst. My view may be positively biased. I am not suggesting any investment action. The information provided above is for education purpose only.