Venkys india limited

Only listed and largest company in india engaged in poultry, breeding and chicken meat processing

Revenue split

Poultry and poultry products, 39%

Animal health products, 6%

Oil seed segment, 55%

Company is a prominent supplier to many QSRs And International chains Like KFC, Pizza Hut, Burger King, McDonald’s etc

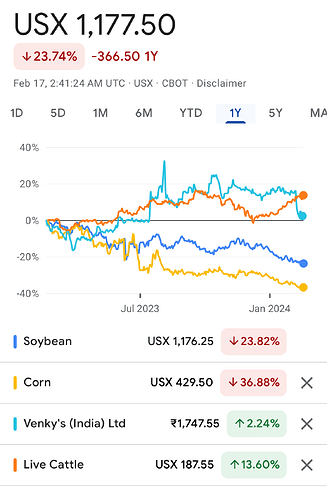

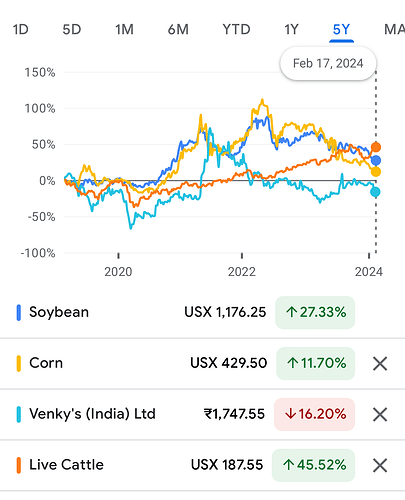

Companies profit margin is dependent upon the price of raw material to poultry feed . In the last 10 years in order to reduce It’s volatile business to non-volatile business Company did backward integration by opening Three. Soya processing plants with a total installed capacity of 5.4 lakh MTPA and Expansion of animal health segment

The Company has announced the setting up of new project for manufacturing of veterinary medicine products under animal health segment and project to be commence from the February 2024 In which company is expecting 30% additional revenue post completion of new projects

Company sales. Margin

2012, 990 crores. 7%

2017, 2400 crores. 11%

2024, 4000 crores. 3%

Currently, due to the inflation or the high cost of raw materials of the feeds company is facing lowest margin and its 12 years of history which is 3% but Sale has been increased from 990 crores to 4000 crores. With addition of new project. It can add further 1000 crores Revenue

When the prices of raw materials like maize And soya falls. The company can achieve its margin back to 6 to 14%

Based on current sales If company achieve 6% margin, current profitability will Increased by 4X

If margin achieve its highest ever 14% Profitability will increases to 10X

Being a commodity play Company has well placed its business from Volatility to non-volatile segment. Considering the economic growth of India from 4 Trillion to 10 Trillion By 2030 With a growth of per capita income We can expect the huge surge in consumption theme

Venkys can be one of the good play under consumption theme