- Vardhman Special Steels Ltd (VSSL), incorporated in 2010, is one of the leading producers of special steel in India. It has a production capacity of 220,000 tonnes of melting and about 200,000 tonnes of rolled (FY21 capacity utilization of 75%) in Ludhiana (Punjab) and supplies steel to engineering, automotive and allied industries

- Toyota subsidiary, Aichi Steel Corp (a subsidiary of Toyota) has an 11.4% equity participation along with technical assistance in specialty steel production which will help in upgrading the quality of specialty steel to global standards

- Further as per the agreement, VSSL will add an additional capacity of 80,000 MTPA (capex of INR 250 cr through internal accruals) for EV and hybrid cars thereby becoming a part of Aichi’s global supply chain.

- VSSL has technology and technical know-how to make steel for global automotive and engineering companies

- Aichi is Toyota’s subsidiary, and this alliance will pave the way for VSSL to seek registration as vendor for more plants of Toyota

- This will bolster VSSL’s export revenue contribution to 25% over the next 4-5 years from the current 5%

- Industry drivers

- PLI scheme in specialty steel & automotive segment: There are very few producers of specialty steel in India, therefore, the order flow would be fairly distributed among them

- PLI Scheme in Specialty Steel: The government has approved INR 6,322 cr for the specialized steel sector to enhance India’s manufacturing capabilities

- PLI Scheme in Automotive Space: Government approved an INR 26,058 cr PLI scheme for auto, auto-components and Drone industries to enhance India’s manufacturing capabilities

- Make in India and China+1: ‘Make in India’ & China+1 is likely to increase the manufacturing of critical components used in the capital goods and automotive sector in India. This is expected to improve demand for specialty steel

- PLI scheme in specialty steel & automotive segment: There are very few producers of specialty steel in India, therefore, the order flow would be fairly distributed among them

- The company aims to be debt-free by FY25 and this is achievable

- The company uses use graphite electrodes over copper electrodes used by its competitors

- Special shapes cannot be manufactured with copper, but graphite is easier to form, and the copper electrode is heavier, which is not suitable for processing large electrodes

- Cost advantage and comparatively environment friendly: VSSL uses scrap steel as a key raw material to produce specialized steel. Compared to sponge iron, specialized steel produced through the recycled route consumes less energy and emits lower carbon

- Risks

- Existing large players - Tata Steel & JSW Steel, could expand in special steel space to diversify

- Demand and pricing in the steel industry (for both raw material and finished products) are volatile and are sensitive to the cyclical nature of the auto industry

- Any change in terms or termination of the alliance could be expected business performance and impact future estimates for VSSL

- Aichi also partnered with Usha Martin in 2014, this agreement was dropped in 2018

- PLI in specialized steel could attract other large players to diversify in this high margin product segment

- Less negotiating power with OEMs as size of OEMs is huge

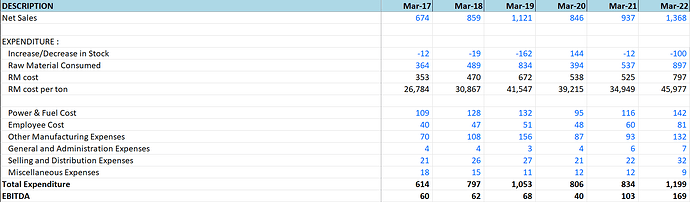

Following are the financials

Disclosure: Invested and my views could be biased