In addition, if management had some definite clarifications with evidence, but there has just been a rebuttal without any detailed statement.while I am hoping this does not become another satyam saga, we need to be cautious

Disc:not invested but was feeling missed out & planning to seeing the growth.

I never said it’s normal I said needed as price was going up one way in

last 2 years

Also if u see Prakash Ind it came in SEBI shell co list it dragged down so

much n see the price now

Correction was due due to very high valuation but reason of correction was not known !

Before purchase I did some field verification in my district area where such Kendra are in operation and was impressed by their services to customer without any premium. Multiple service roll-out at single point is the key for the operation leverage for this business. If Amazon want to penetrate in rural area, this was the best point. Because in rural area people are still fear to buy directly online but they need some shop who can buy for them without any additional cost.

Now onwards government priority is to focus on rural, chain of 45000 Kendra and expanding at very high rate (franchise based) Vakaragee is set to gain momentum to get commission from other business who want to roll out their services in rural area without much capital spending.

I recommend to go through last conf call which resolve many queries raised by group members.

Buffet - If you know business, volatility is the best friend. See’s was many times corrected 30-40% but adding more only proved right…yes but it need conviction to swim opposite to flow of river !

If you come to know that Dolly /other well-known tweeter followed investor buy Vakrangee, I think many will post good research data / favorable point in this forum !

Disc - invested …willing to add

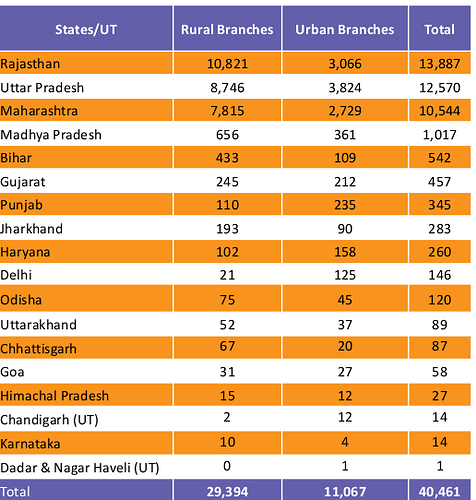

Which states these VKs work and do we have a state wide breakup ? I like to do a scuttlebutt in a Vakrangee Kendra if possible.

Disc: not invested. Looked at due to high reported growth rates of revenue and profit.

You take district head (Business coordinator’s) number from Vakrangee website and ask contact of VK in your area. Do sample of minimum 10 VKs and u will come to know reality. If VK owner is not willing to do business / not following ethical practice they are closing the VKs also. Their closure rate is 3% on yearly basis.

I request to go through last conf call …to know working of their business model.

Do they publish con call transcripts ?

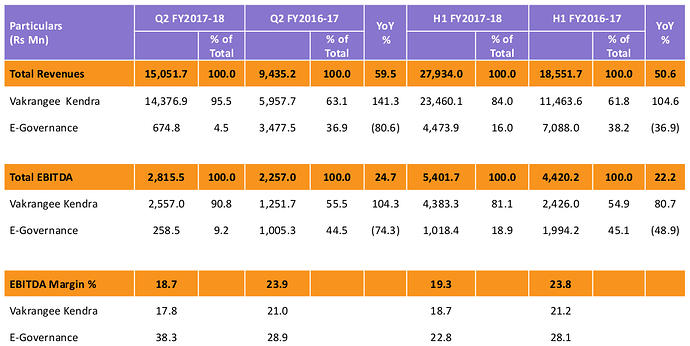

From the Q2 Investor presentation

Then segment revenue

35206 was the VK count end of FY17. Now If I use a random mid figure 38K, I can see 3.78 Lakh as per VK revenue for Q2 2017. Per month this would mean 1.25 Lakh on an average revenue for company. Now if division is 70-30 ratio, then actual revenue should be 4.2 Lakhs (4.1 to 4.4 lakhs ) as these figures not in Inv presentation.

for Q3 2017, it is said 44286 are VKs and revenue is 16837. So for averaging if I use 43000 Vks to get per VK revenue per month, I would get close to 4.3 Lakhs (reg Q3 presentation - http://www.bseindia.com/xml-data/corpfiling/AttachHis/21e536d7-d200-46ac-a6fa-1359b3b2e768.pdf)

You can get call from researchbyte website

Apart from LIC, Edelweiss Mid and Small Cap Fund is also invested in this company. (increased shares into Vakrangee in dec quarter.) I am really confused after a veteran like Yogeshji posted his analysis and I cannot objectively decide if I like this management or not. I would rather wait till a clear picture emerges.

largest network of last mile retail touch pointto deliver real time banking, ATM and financial services, insurance, e-governance, ecommerceand logistics services to the un-served, underserved rural and urban markets. business model has evolved as aggregator and emerge as a one stop convenience store forvarious kind of products and services under one roof. They cater to jan dhan and aadhar account linkage, DBTs, Amazon, Redbus, Irctc, Jio mobile, Logistics delivery, Life and non life insurance businesses and Jan Dhan microinsurance too. Focus shifting away from capital intensive e gov businesses. Low incremental capex requirement due to reliance on frachise model and operating leverage from adding more services.

Verticals- 1.E gov-its legacy business which involved high capex and working capital intensive business, 2.Banking, 3.Insurance, 4. Ecom and 5. Logistics. DBT has been a game changer as it excludes middle man and lot of DBT happens these days due to various state and central govt subsidies directly credited to the account. Also because of network effect kicking in they are able to have very good negotiating power with the partners so that frachise becomes highly profitable. Their revenue sharing will be 77-78(franchise): 23-22(Vakrangee). Also the franchise will do majority capex which is approx 1.2-1.5 lacs in rural and 6-9 lacs in urban area and vakrangee needs to spend only 5-20K per centre for establishing. Vakrangee will do the infra setup, training and access services. Since not many are well versed with net transactions, Vakrangee serves as the last mile connectivity for those customers.

Given themselves a target of 75k kendras by 2020 and for that they have tied up with IOC to open up 26K outlets will lead to faster rollout. Currently they generate 7.2 lakh revenue per kendra. The commisions they are getting on services are 0.48% for banking, 5-15% for GMV of amazon, 10-20% for insurance. Though E Gov businesses have higher margins at 28%, vakrangee has consciously decided to scale down this business as its has high DSO of close to 120 days and go for businesses from other verticals though it has lower margins due to less working capital requirements. Vakrangee has also relieved themselves of all long and short term debts from may 2017. Also all their assets are fully depreciated and hence it will ensure most of their margins will go to the bottom line and they expect their margin to 20% at franchise level and 1.5-2% employee and other expenses leading to the stable margins of 17-18% for long term.

vakrangee kendras are very much in demand as Business correspondent for various banks due to the govt initiaitive to setup rural banks and vakrangee with their brick and mortar model fits all the requirements of the rbi. Banking contributes 35% of its total revenues and Banks encourage BC as the cost invoved is only rs5/ 1000 transaction whereas traditional banks need 60-90/1000rs transaction. Also Vakrangee selects francise on strict selection criteria with adquate qualifications and certifications. Demonetisation has been a blessing as it has increased banking culture among the rural population. they also have license for white label atms which have lower working cost and are profitable at 35-45 transactions per day against conventional which require 100 transactions

Vakrangee is betting big on ecom services and they have got exclusive 5 yr tie up with amazon with 5-15% commision on GMV. Amazon benefits this by increasing its offline presence by UDAAN scheme and it eliminates logistics and reverse logistics cost.

Their working capital has shown tremendous improvement due to this shift from legacy to Kendra business model

It seems they have knocked off most if their fixed assets in PPE and converted into cash it seems.

They have disposed off 948 crores worth of computers last yr

Got to dig deeper at the balance sheet as there are too many big changes. They also have 577 crores of cash In the books

In addition to increase in investments worth 17 crores.

Coz they had so much cash after disposing close to 100 crores of fixed assets, they have cleared off all their debts including working capital debts. This is reflscted in increasing NFATs.

I just went thru last 2 concalls- nice ones- it takes 4-6 months for new kendras to stabilise and the franchise recover the cost In 2 yrs. we can expect 1.25-1.5 lac in urban centres and 60-80k from rural centres. Most of the urban Kendra will come up in iocl outlets

They say they can give annual guidance but a target for 2020. They expect a growth of 6-8% in banking and egov business(stable ones) and 10-12% growth in ecom and logistics business.

Vakrangee:

By looking at shareholding pattern & the trend I could not identify any red flags .

-

Credit Suisse (Singapore bought 1.96 crores shares during 2016), -

LIC has 3.23 crores shares -

Edelweiss 2.25 lac shares -

Promoter is chartered accountant turned Entrepreneur, Promoters holdings remains same at 41.61% (from FY 15-16 to FY 16-17) -

Institutional investors stake up by 11% from 18% to 29% during FY 16-17. -

LIC has a nominee director -

The chairman of corporate governance committee is Mr.Ramesh Joshi retired ED of SEBI. -

Some companies provide date wise buy & sell details of promoters & Major institutional holders. In this AR report there’s no such break up. For example: Same quantity bought & sold several times during the year that will not be shown in the AR. -

There is comment under promises made where in CEO mentions- As promised, the Board has appointed a new Statutory Auditor, Price Waterhouse & Co., as our new Statutory Auditor from the year FY2018, subject to regulatory approvals. -

Unable to understand how the revenue comes to company by acting as intermediately to various institutions (govt ,Insurance companies ,banks ,Online sellers,busticketing ,IRCTC) ,a % on the value transacted ,fixed fee .Whether this will be charged to consumer or compensated by Institution. -

Someone should visit the center, get the feedback from the native residents about the level of satisfaction & convenience offered. -

The risk assessment & mitigation available in the AR is not so detailed or in depth. -

Have three 100% owned subsidiaries ,e-solutions inc in Philippines engaged in digitalizing the land records for Philippines government ,finserv & logistics pvt ltd

These are my thoughts after going through the AR

On some queries

Image 1 shows the majority of holding is by corporate body of vakrangee.

There is very little promoter holding - like Dinesh Nandwada holds around 5.3% with not much change and none others have much holdings to speak off except for the remuneration which is also well under the ceiling prescribed.

Also though the date of transaction is not given, most institutional investors have either upped or pruned their stakes.

I could not see any promoters/ directors having shareholding and hence skeptical of the news of circular trading- but can’t be ruled as same quantity could have been bought and sold to tug the prices.

Regarding the mode of revenue, it’s been paid by the institution whose services are delivered like amazon or banks and not from the customers.

In the bulk deals yesterday, there are two deals of around 1.9 cr shares each.Naturally some of these institutional investors must have off loaded.Is there any site, wherein one can see as to who sold in these bulk deals?

It is surprise that at lower circuit also there are many buyers - today almost 1.2 cr shares have changed hands at lower circuit. Yesterday also huge volume with 52% delivery based. Are promotors or institutional investors are buying …I don’t think retail investor buying can lead such huge volume.

Normally, at lower circuit difficult to find buyers and volume stuck once LC activated

Some serious dissection on Vakarangee was done few years back at the following : Forensics and the art of triangulation

It’s equity is 100 crores shares of which aprx 45 cr with promoters

Major fund houses holding too

Small investors selling that’s y 50lacs seller

That was well written by Amit Mantri long back…I hope he is not wrong…Given that he is a PMS fund manager at 2point2capital now

But it will need to be relied considering 2-3 years elapsed, claims and figures changed drastically due to ‘claimed’ furious growth. Also inv presentation talks about tons of partnerships post 2015. @Yogesh_s sir how many months/years before you looked this up last ?

it is a manipulated scrip. Chor promoters.The rise itself was suspicious. Now if the skeletons starts tumbling down it can keep crashing. But this is India -so let us wait and see.

I looked up last 8 annual reports and latest presentation. I lost interest after that since I could not get my basic questions answered.

Phew! Thank you @Yogesh_s. That reminds how much I need to increased my learning efforts! Your insights helps us to learn more and encourages too.

PC Jwellar down 50% intraday…Vakrangee down almost 40-50% in this week…is thier any connection. Few days back Vakrangee bought .5% stake in PCJ.

Any one have any idea on this