What does the company do?

Updater Services supports medium and large enterprises by handling operational and compliance-heavy tasks that most companies either don’t want to manage internally or can’t do efficiently. Think of everything behind the scenes that keeps an office or commercial site running—from hiring and supervising security guards to maintaining air conditioning systems, processing payroll, and conducting background checks.

They operate in two core areas:

- Facility Management – This includes cleaning, pest control, security personnel, plumbing, electrical services, and other infrastructure-related services needed to keep a physical site functional. For example, they manage complete site services for large IT campuses, logistics hubs, and airport terminals.

- Business Support Services – This is a higher-value segment and includes employee verification, audit assistance, payroll services, sales support staffing, and airport passenger services. These are often more tech-enabled, recurring, and margin-rich. Clients may use Updater to manage their entire backend onboarding process or third-party audit trails.

This broad portfolio allows them to cater to a mix of sectors like IT parks, warehouses, logistics, airports, banks, and hospitals, offering bundled services across physical and operational layers.

Company background

- Started in 1990 in Chennai

- Has grown alongside India’s infrastructure and IT boom

- Employs over 65,000 people today

- Works across sectors: IT, BFSI, healthcare, logistics, public spaces

- Conducted an IPO in 2023, raising ₹640 crore

- Used the funds to clear debt and build reserves

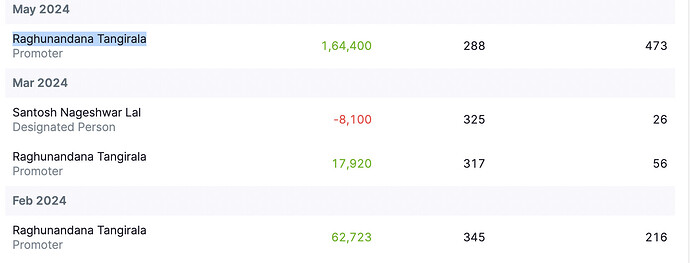

Who runs it?

- Founder: Raghunandan Tantry, who still leads the company.

- Known for staying out of the spotlight but focused on execution

- Prompters own 58.88%

- FIIs 2.74% DIIs 15.35% and Public owns 23.05%

This kind of promoter-led continuity often helps in service businesses.

Why do customers stick around?

Clients work with Updater because it takes away operational pain.

- Managing hundreds of frontline workers in-house is time-consuming and risky

- Labour laws in India are strict—outsourcing to a compliant vendor reduces risk

- Updater has systems and trained teams in place across the country

- They’ve built trust: a 93%+ client retention rate tells the story

Long-term contracts and sticky relationships form a strong foundation.

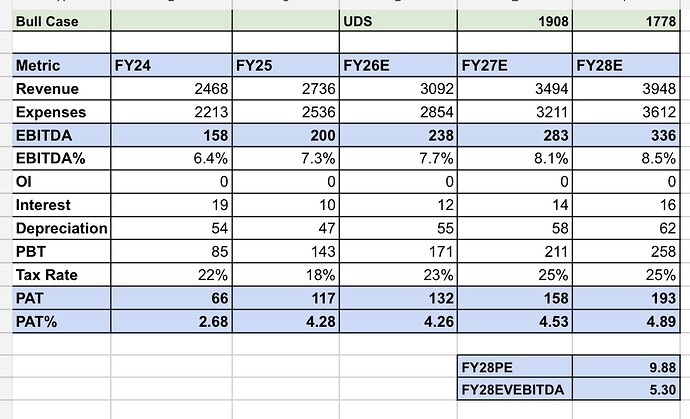

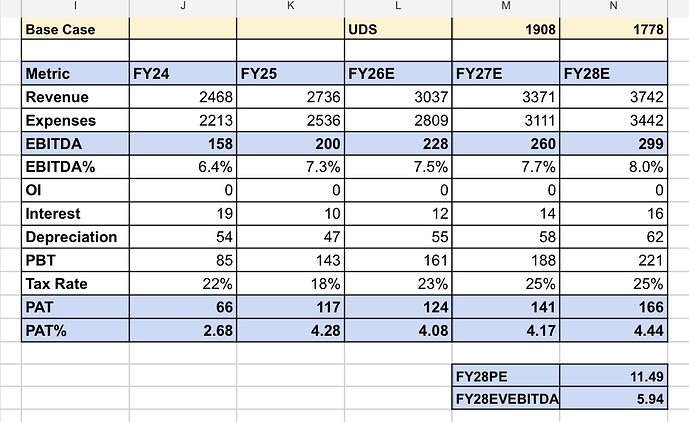

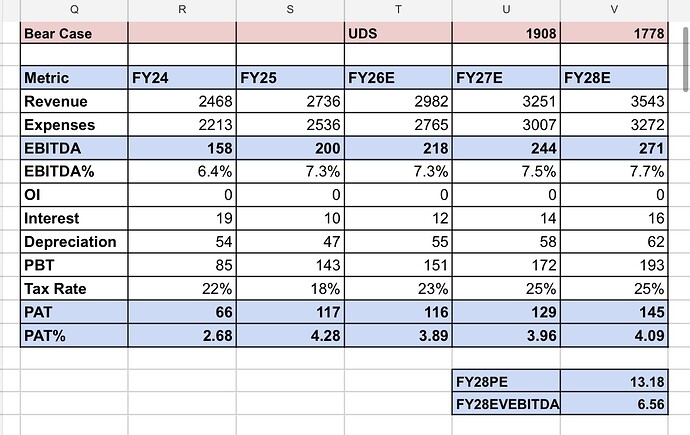

Key numbers (TTP)

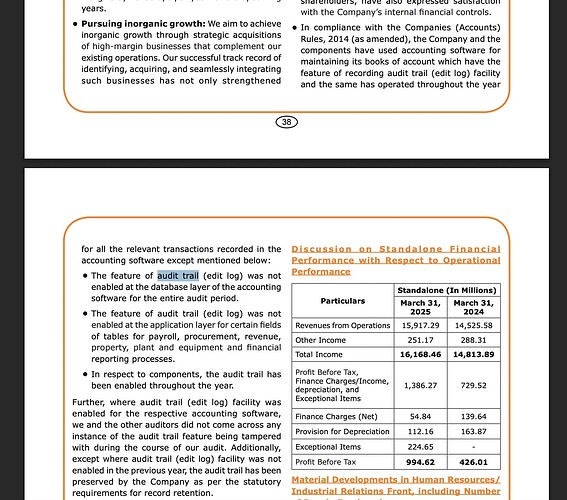

- Revenue: ~₹2,500 crore

- Net Profit: ~₹65 crore

- Operating Margin: ~9%

- Market Cap (May 2025): ₹2,290 crore

- P/E Ratio: ~20x

The revenue mix is improving, and they’re now cash-rich post-IPO.

Peer comparison

| Company | Area of Work | Market Cap | P/E | Screener Link |

|---|---|---|---|---|

| Updater Services | Facility + support | ₹2,290 cr | 20x | Link |

| Quess Corp | Staffing + multiple areas | ₹5,400 cr | 24x | Link |

| SIS Ltd | Security, cash handling | ₹4,800 cr | 18x | Link |

| Krystal Integrated | Government facilities | ₹930 cr | 16x | Link |

Competitor details

Quess Corp

Quess is the giant in this space with over ₹15,000 crore in annual revenues. It offers a broad mix of services—staffing, payroll, HR tech, facility management, and IT support. While this gives it scale and stability, facility management is just a small part of its overall mix. Its margins are thin, and its large size makes it slower to shift focus compared to more nimble players. The company has a habit of acquiring multiple businesses, which adds complexity.

SIS Ltd

SIS started off as a security services provider and still derives a large portion of its revenue from guarding services. It also operates in cash logistics and some facility management. The business is heavily reliant on manpower, and while it has solid recurring revenues, pricing power is limited. They’re well-positioned in government and industrial contracts but have struggled to enter higher-margin B2B corporate services.

Krystal Integrated

Krystal thrives on government infrastructure contracts—railways, public hospitals, waste management services. These are long-term and high-volume, which gives them visibility. However, delayed payments, fixed-rate contracts, and low innovation mean margins are tight. It’s a stable player in the public sector, but growth is limited.

Updater Services

Updater is smaller, but more focused and strategically aligned. Their shift toward business support services—especially in private sector accounts—offers a better margin profile. They’ve been successful in bundling services at client sites (e.g. a logistics hub using both facility and audit support from them). The challenge will be in maintaining quality and culture as they scale.

Industry tailwinds

- Industry size: Over ₹1 lakh crore (CBRE)

- Outsourced share: 39% in FY23, expected to hit 45% by FY28 (Colliers)

- Outsourced FM segment to grow from ₹39,000 crore to ₹86,000 crore (17% CAGR)

- Business support services expected to grow over 20% annually (EY)

- Drivers: Formalisation, rising infrastructure, and compliance needs

The overall trend is clearly favourable for organised players.

Growth triggers

- More companies choosing to outsource non-core operations

- Indian labour laws pushing firms to go with compliant vendors

- Growth in infrastructure and commercial real estate = more service opportunities

- Business support services are more profitable and sticky

- Potential to cross-sell across existing accounts

- Cash-rich position enables strategic acquisitions

What I like about it

- It’s a real, useful, everyday business

- High client stickiness

- Strong financial discipline

- Improving margin profile through better service mix

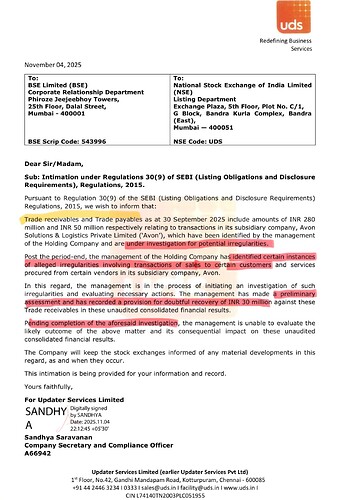

What can go wrong

- Scaling issues – managing 65,000+ workers is not easy

- Competitive pricing pressure – low barriers to entry

- Client concentration risk – over-reliance on a few clients

- High employee turnover – affects delivery and costs

- Tech disruption in support services – risk of automation

- Regulatory compliance – one big miss can hurt reputation

- M&A integration risk – poorly integrated acquisitions can drag performance

Theme, Value, Growth

- Theme: The sector is moving from unorganised to organised. Compliance, cost pressure, and a growing service economy support this shift.

- Value: At 20x P/E, valuation looks fair for a clean, cash-generating company that is slowly improving its margins.

- Growth: The opportunity is large. The industry is expanding, and Updater is trying to ride that wave by offering deeper services to the same clients.

What I’m tracking

- Are client relationships getting deeper or wider?

- Are they able to retain people and scale up hiring without hurting service quality?

- How fast is the support services segment growing?

- Is profit growing faster than revenue (thanks to better mix)?

These are key to margin improvement and long-term value creation.

Final thoughts

Updater isn’t trying to be a headline-grabber. It’s quietly doing the work that most companies don’t want to handle themselves.

If it keeps growing its business support services, maintains client relationships, and executes well at scale, it could turn into a steady compounder.

Risks are there, but so is a long tailwind.

Would love to hear more views, especially from those who’ve seen the company’s work firsthand.

Note: This is a personal research note intended for discussion, not investment advice. Please do your own checks before taking any position. I have a tracking position in this business.