Uniparts India Limited

OVERVIEW

Uniparts is the global manufacturer of precision parts and systems for off highway vehicles. The off highway vehicles include tractors, ultra terrain vehicles etc, construction and forest machinery (CFM) etc. The company primarily manufactures 3 point linkage systems, precision machine parts and adjacent product verticals like power take offs, hydraulic cylinders etc. These parts are structural and load bearing parts and hence subjected to strict specifications and load tolerances checks.

The company was incorporated in 1994 by first generation entrepreneur Mr. Gurdeep Soni in Ludhiana as a supplier to OEM’s to European players. By 2000, it established its manufacturing facility in Noida. By the mid 2000’s, the company was the major supplier to John Deere. Currently the company has 5 production facilities: 2 in Noida, 2 in Ludhiana & 1 in Vizag. Besides this, the company has 2 warehousing facilities: Augusta & Eldridge.

Business Details

The image attached below is of 3 point linkage. It gets attached to the tractor and carries different equipments like ploughs.

The power take off is an additional attachment which transfers the power from the main machine to the equipment which does not have any power source

Uniparts has an approximately 17% global market share in 3PL systems and 6% global market share in precision machine parts of the CFM industry. Besides this, the company also caters to the aftermarket segment for 3 PL range. Aftermarket means that the company supplies to players like O’Reilley Auto parts so that the customers can come for their requirements post the purchase

Uniparts offer fully integrated engineering solutions from conceptualization, development and validation to implementation and manufacturing of our products. The conceptualization stage involves acquiring market intelligence, assessing customer requirements and formulating customized strategy for individual customers. The development phase includes product designing, material procurement and processing. This is followed by the validation phase, which involves prototyping, testing and feasibility analysis. Revenue from the agricultural segment contributed 70% while CFM contributed 25% of the total revenues.

The clientele is extremely long term with contacts running for 15+years. The company is having the various capabilities under its wing namely forging, machining, welding etc. This enables the OEM’s to get the products designed and developed in house. This is the major competitive advantages where Uniparts is not just the component manufacturer but engages with the client from designing to development phase to offer a high level of customization. As a result, they have over the years introduced several products to product portfolio including rear hitch, front hitch, hydraulic lift arms, PTOs and trailer hitch which allows them to offer integrated system solutions to meet customer requirements and move up the value chain. The major raw material for all the manufactured parts is steel.

UIL follows a global delivery service model with manufacturing facilities and warehouses across geographies. This helps it provide multiple delivery options to its customers, wherein they can either opt for premium priced local delivery (for products manufactured in a nearby plant or stored in a nearby warehouse) and benefit from lower lead time, or for competitively priced offshore delivery (from a relatively low cost manufacturing location, such as India) that entails a higher lead time.

However there are few concerns. There is a big revenue concentration from the top 5 clients. While this sounds a big concern, these clients have been existing with UIL for a long time.

| Uniparts India Limited |

2020 |

2021 |

2022 |

2023 |

| Top Client |

36.87% |

34.15% |

32.78% |

35.21% |

| Top 5 Clients |

61.18% |

58.32% |

56.10% |

56.45% |

| Top 10 Clients |

74.62% |

73.08% |

70.42% |

71.30% |

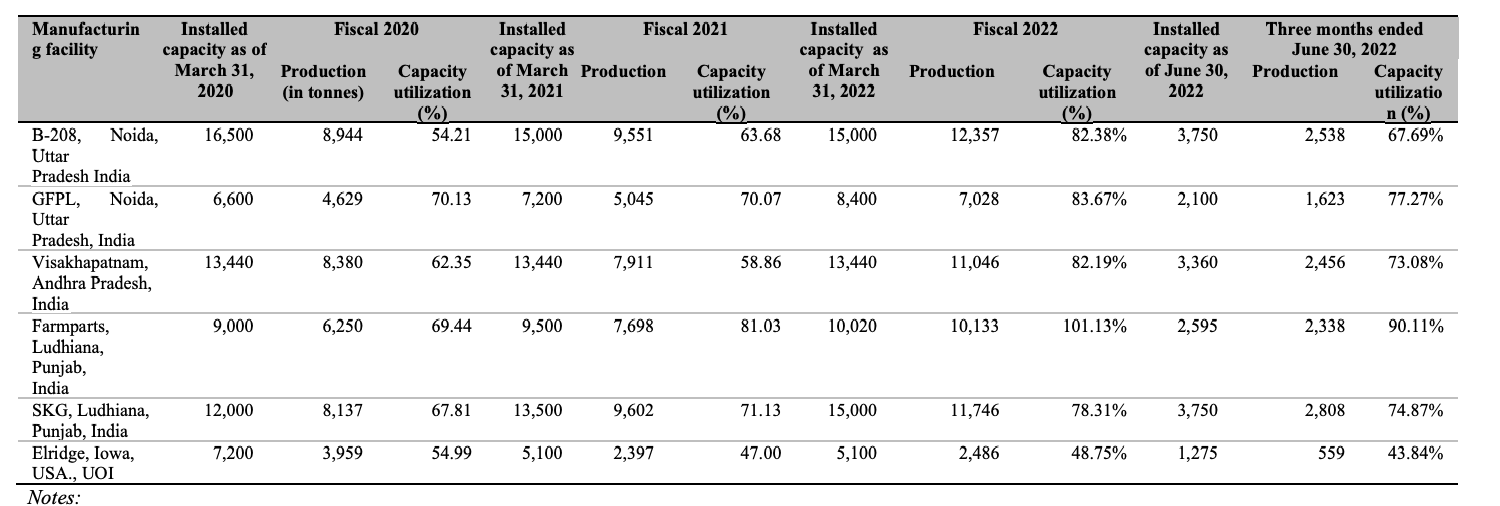

Let’s look at the capacity utilization in their manufacturing units:

Sum total capacity utilization is 76.6% which is pretty high. Now keeping these 2 contexts together, it might be possible that the company has strategically chosen smaller short tail clients so that their capacity utilization remains optimal. Had they started onboarding larger clients, they might have had to undertake the capex. But having said that, the client concentration poses a significant risk at the company level.

One interesting piece to note about this business is that the company used to enter the long term contracts with OHV OEM’s earlier. However with the increasing competition, the OEM’s have to frequently introduce new models or make modifications to existing models. Hence they provide the estimated demand to UIL which further plans its production schedule as per the data which is received. However any unforeseen disruption at OEM operations (like strikes, lockdowns etc.) can have adverse impact at UIL.

The company is cyclical where the sales of its parts depend on the agriculture sector which is further driven by a lot of factors like climate, cost of fertilizers etc. On the other hand the construction segment is driven a lot by macroeconomic policies, interest rates etc.

Financial Details

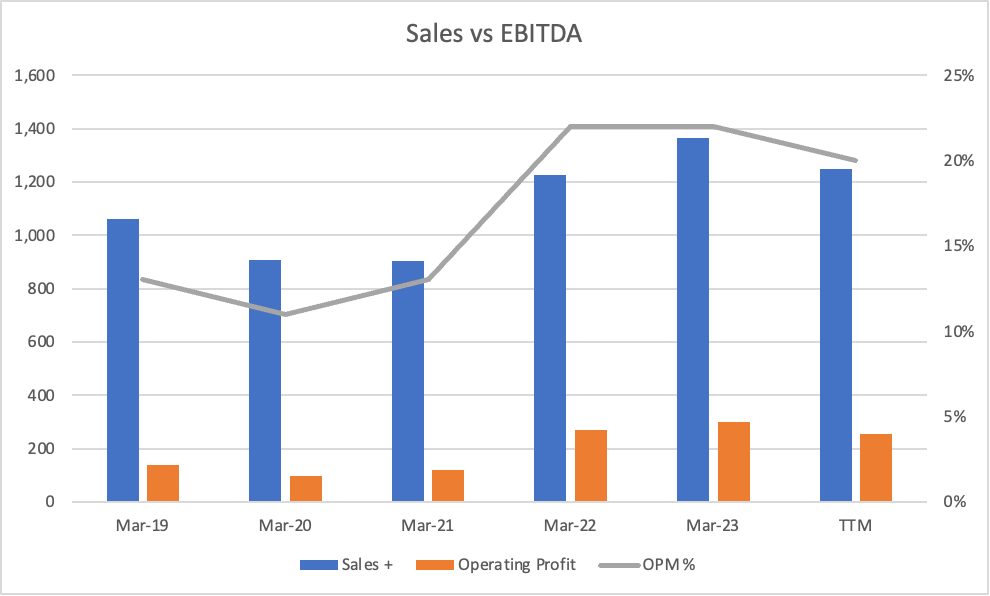

As outlined earlier, the sales are highly cyclical which is seen in the following graph:

The EBITDA margins are shown to be in the cyclical range in the above graph. However, the company is able to pass the raw material and freight rate increase to the customers due to highly specialized ancillary partnership

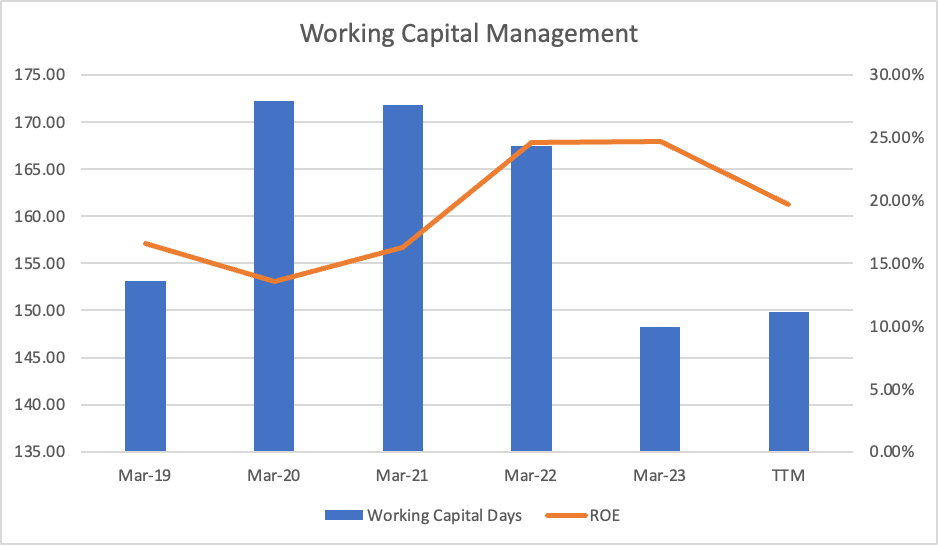

The company is having a working capital cycle of ~150 days which is quite high considering the high dependance on Europe & USA (74%) markets. However, the ROE has been consistently above 20%.

There are net profits of 598 cr from 2019 to 2023 and the net cash flows from operations of 620 cr in the same period indicating a good cashflow conversion situation for the company

Management & Related Party Transactions

The company is led by Mr Gurdeep Soni and Mr Paramjit Soni both of which were paid the salary of Rs 5cr each. The sitting fee amounted to Rs 30 lacs for all the directors in the company. Besides this, there were 3 Key Management Personnels (KMP’s) which were paid Rs 1,82,00,000 as average. The total remuneration comes out to be Rs 15.76 cr (31.82 cr+25cr+30 lacs). This is pretty under the radar considering the net profit of 176 cr.

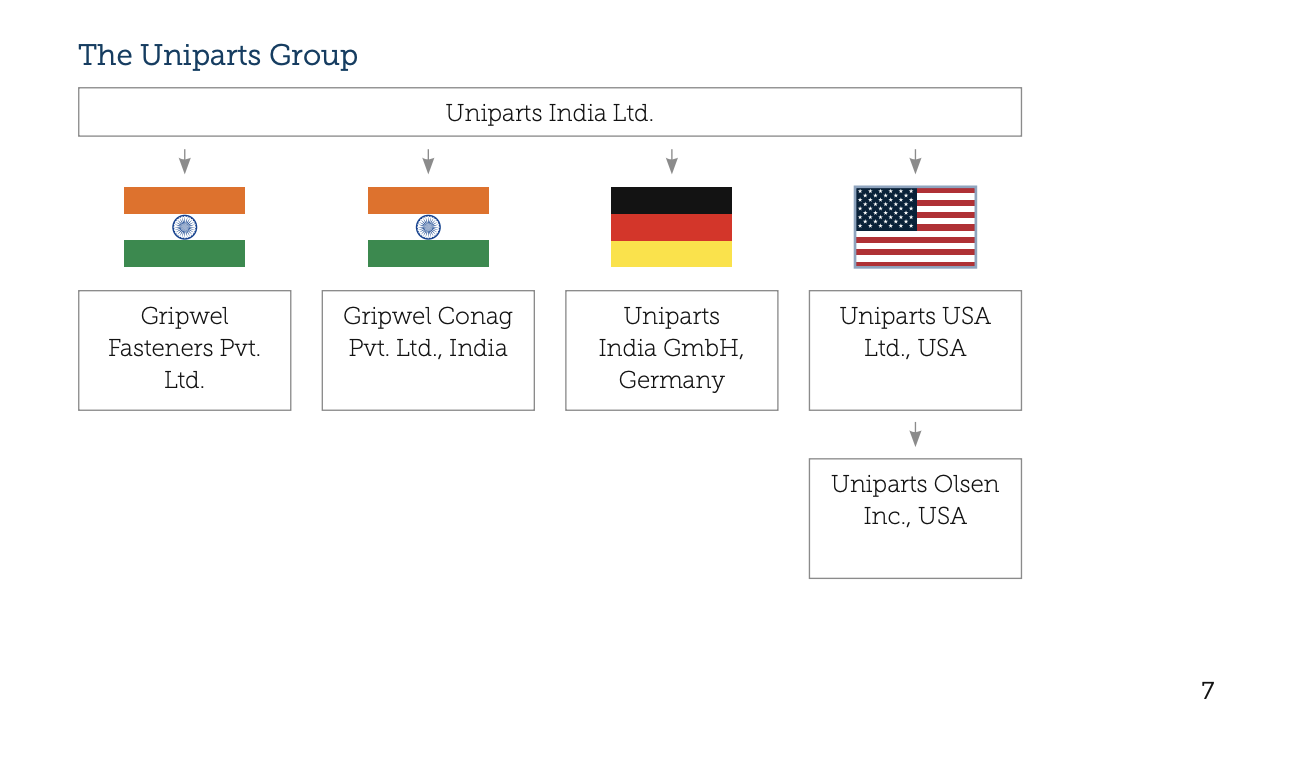

The company’s structure is as follows:

UIL is having 4 subsidiaries which are 100% owned:

- Gripwel Fastners Pvt. Ltd.

- Gripwel Conag Pvt. Ltd.

- Uniparts India GmbH

- Uniparts USA Ltd.

Uniparts USA Ltd. is having a 100% owned subsidiary Uniparts Olsen Inc. The job work of UIL is contracted to Gripwel Fastners and Gripwel Conag which is minute and amounts to 71 lacs. A loan of 5.25 cr was given to Gripwel Conag for working capital against which 3.9 lacs as interest was charged. Other related party transactions look relatively clean

Thesis

- Niche manufacturing and a full scale solutions provider rather than just an ancillary vendor

- Top 5 OHV companies in the USA are the clients of UIL indicating technical expertise (Bobcat, Caterpillar, Case New Holland etc.)

- Focus of the company on ancillary segments like UTV (utility terrain vehicles) and tractors with >70 HP

- Conservative Management, focus on free cash flows, ability to pass hike in raw materials & freight to end customer

- China+1 factor to power the sales of this company

- Revival of US farming sector from 2024 onwards (Link). This is due to the fact that the inflation had eaten into the incomes in 2023 since there was a large stocking which happened in 2022. 2023 was the year of de-stocking for farming sector

- With the China dumping of agrochemicals, the prices are at lower end which is expected to benefit farmers to modernize their equipments

Anti-Thesis

- Cyclicality in both agriculture & CFM sector

- Client Concentration risk where top 5 clients derive 55% of topline

- Short term contracts with OEM’s which can lead to overproduction/underproduction thus leading to adverse impact on bottomline

Valuation & Conclusion:

Since their margins are not impacted owing to the cyclicality of the business, assuming the modest current price to book of 2,8 and price to earnings of 14, there is a lot of room to re-rate. Globally auto ancillaries in the heavy equipment space trade at 5 times book value. With the moat of precision manufacturing, I believe the company has a bandwidth to deliver a fairly decent returns (20%+) CAGR for the next few years to get in line with the global competitors trading metrics.

Credits: @bharatbetpf for the recommendation

![]()