According to Grant Thornton that the logistics sector is already growing steadily at a rate of 10–12% YoY, contributing 14.4% to India’s GDP and employing more than 20 million people. The warehousing storage sector is growing even more rapidly, projecting a CAGR of 15.64% and a market size of USD 35 billion by 2027.

This is the only listed company which is purely a warehousing business. Warehousing business becomes more attractive because they have real assets which have really high value and can be liquidated easily because of their real estate value has they are located in prime locations.

Details of the company:

Market Cap: ₹ 1,367 Cr.

Current Price: ₹ 55.7

Stock P/E: 51.6

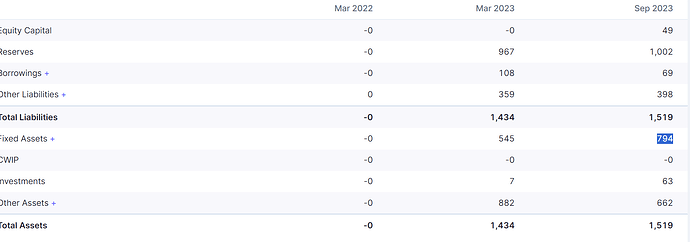

Debt: ₹ 68.7

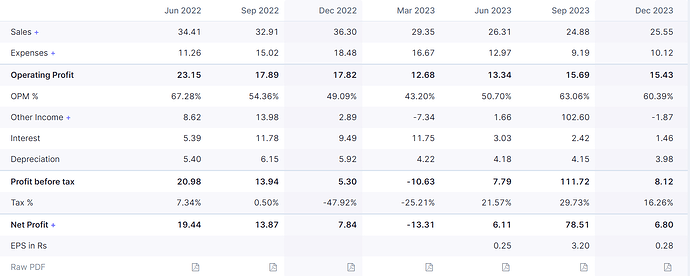

OPM%: 50% (Approx)

Fixed Assets: 794crs

Pursuant to demerger, Transindia Real Estate Limited (“the Company”),

resulting company of Allcargo Logistics Limited, has signed a definitive agreement to sell its logistics park at Jhajjar in Haryana at an enterprise value of approximately ₹ 636.71 crore. The deal consummation will help Transindia Real Estate Limited (TREL) realize substantial value from this divestment and continue to have zero debt.

Additionally, the Company has also divested its 10% stake held in Malur Logistics & Industrial Parks Private Limited, Venkatapura Logistics & Industrial Parks Private Limited, Kalina Warehousing Private Limited, Panvel Warehousing Private Limited, and Allcargo Logistics & Industrial Park Private Limited, for an equity consideration of near ₹ 4.55 Crores.

As a result of this divestment, Transindia Real Estate Limited, will receive over ₹433.37 crore as cash proceeds. The company will deploy the capital to fuel its growth plans and expand its operations in various locations. The deal will also boost the company’s financial capabilities, paving the way for fresh investments in emerging business growth opportunities.

There is a good opportunity for investors to grab in a company with Mcap of Rs. 1300 crores will have a cash balance of Rs.450 crores and other assets(warehouses), this seems to be attractive has the company will come at a valuation of 1:1 when compared to assets.

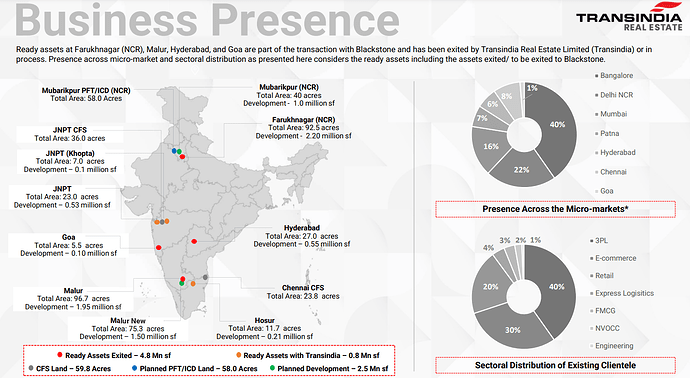

At present company gets a Rental income of Rs. 100 to 120 crores per year where in many of the warehouses are still in development by the company.

This company shall be one of the most exciting companies in this sector and i have gradually started accumulating this share, it maybe a pre matured accumulation but it can work well.

Not a Recommendation do your own research

Image is attached relating to their warehouses in India.

Uploading: image.png…