Hi Is anyone tracking ABC bearings. They have reduced their dependence on commercial vehicles by also catering to other machineries. Their Inventory days, cash conversion cycle, , cash receivables, payment days, debt equity ratio are all improving but their ROCE & ROE is stagnant. Must be due to regular equity dilution and almost muted growth. From long term view it looks good and well positioned to do well with turn around of manufacturing cycle. Do share your feedback on this stock ?

20% up yesterday, Timken acquiring ABC at 77% pc premium

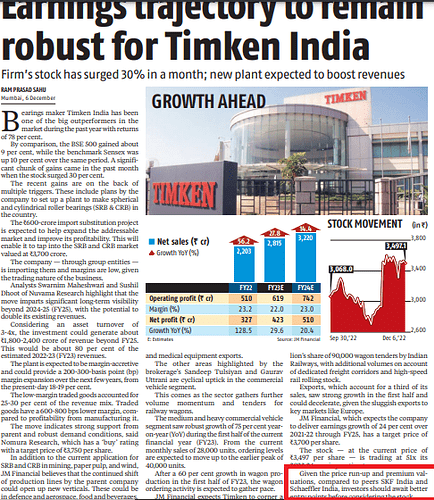

Article on Timken Acquisition of ABC bearing.

Key conference call takeaways (source - Kotak Securities)

Strong performance across segments in FY2019.

Revenues grew by 35% yoy mainly due to

(1) integration of ABC with Timken India in May 2018 (9% of revenues),

(2) 35% yoy growth in process industries mainly led by revival in the wind energy segment (8% of revenues),

(3) strong growth in the mobility segment due to 30% yoy increase in production in the domestic MHCV industry,

(4) 14-16% yoy growth in the railway segment led by a strong order book and (5) strong growth in the industrial distribution business (visible in results of SKF and Schaeffler India as well) due to increase in capacity utilization across segments such as cement, steel, paper processing, etc.

Improvement in capacity utilization in ABC’s Bharuch plant.

Timken’s engineers have been working in ABC’s Bharuch plant over the past 6-9 months to bring

product design and quality up to Timken’s standards. The company has largely achieved its targets and capacity utilization has improved over the past two months (70% in May 2019). We note that Timken was also targeting to start exports of cylindrical and spherical roller bearings (CRBs and SRBs) from this plant—this has not started yet and will aid growth over the next few years.

Outlook for FY2020.

The company highlighted that the railway segment will grow by 8-10% yoy in FY2020 and the company expects growth to pick up in the mobility segment in 2HFY20. The company also highlighted that next year will be soft for the exports segment due to slowdown in global growth and also possibly due to softness in demand for Class 8 trucks in North America (accounts for around 50% of exports). However, the company expects growth to pick up in South African markets mostly led by the mining

segment.

Details on railway segment.

The company won orders worth `400-500 mn from CONCOR for Class K bearings in FY2019. As per the management, Indian Railways have taken certain initiatives, which should drive strong growth for Timken over the medium term. Key initiatives are (1) a shift towards high-end passenger coaches (LHB coaches), which will have significantly higher content of tapered roller bearings compared to

normal coaches and (2) decision to outsource railway workshops, which could drive higher replacement demand for wheel bearings. Apart from this, the technology-driven increase in bearing content (move towards next-generation bearings) in railways also augurs well for the industry. The company has also put in a state-of-the-art facility in Jamshedpur for repairs and refurbishment. The company highlighted that it is qualified to supply bearings to GE locomotive but waiting for their approval to start supplying.

Capex plan.

The company will incur capex of 80-1,00 cr in the Jamshedpur plant to focus on in-house manufacturing of complex parts and localization of parts. Also, the company will invest 35-40 cr for process improvement in the Bharuch plant.

@basumallick Abhishek Dada,

Are you still tracking Timken? Eventhough Q1 results are inline with Covid-19 affected companies, Timken crossed 52 week high few days ago. What is driving this stock to 52 week high as Q2 is also not expected to be great for such companies. Your views please

There is the expectation that once industry / railways start operating, the sales will pickup.

Indian Railways (HBL Timken).pptx (2.7 MB)

PPT on Indian Railways Sector covering TIMKEN and HBL Power

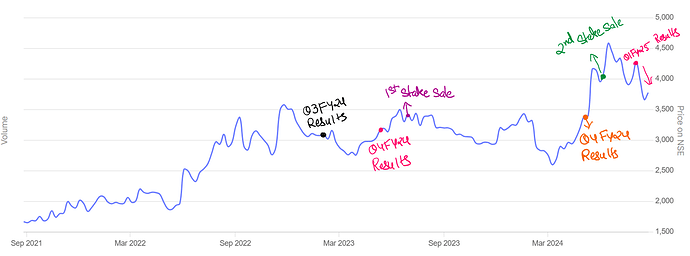

I started working on Timken around August 2020, have closely tracked each and every qtr including the parent company, and made decent money on it. But lately, the actions of both parent and Indian entity have not been shareholder-friendly. The premium these MNCs get just because of ‘good corp governance’ has to be questioned, especially during bull market.

The point of this post is not much deep diving into the business, but I am putting it here hence if anyone is considering investing into the company, can take note of these instances and can accordingly form an opinion. I do believe over long time frame, the business would grow at decent pace given the positioning of Timken globally and having cracked the tapered roller bearings which are used in HCV, railway and machines.

Below I am sharing 1 instance where I found mgmt giving wrong numbers over concall, and 2 instances for how I believe the parent entity smartly reported previous qtr numbers in a way that created optimism about the company:

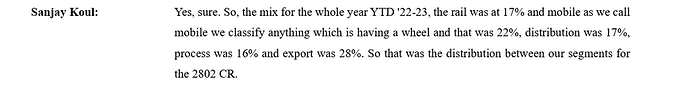

1st Instance:

1st Stake sale: June 2023 - 10.1% stake for 2,361 Crs.

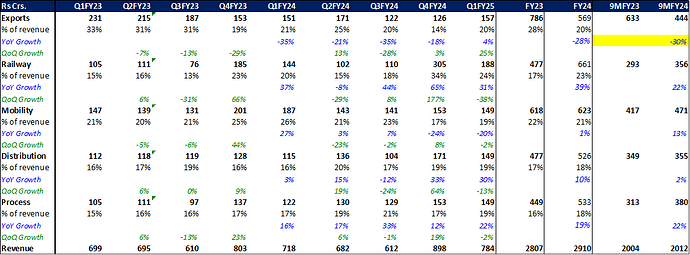

During the first stake sell, the company was reporting a good set of numbers, and the street was surprised that why would the parent entity cash out when the business was good, the demand in all the sectors the company is catering to are in structural tailwind, hence few eyebrows were raised. And post that, Timken delivered bad qtrs back and back and especially the weakness in exports was very much evident (refer figure 2).

Whereas there has always been talk about making the Indian entity as the manufacturing hub for the Timken Global, it seems more like in the past qtrs mgmt jacked up the inventories and reported very healthy numbers for the Exports for Timken. Since then, they have been struggling for more than 1.5 yrs for the same (refer figure 2).

Below the attached image (refer Figure 1) is my notes from the stake sale concall held by Timken India. The reason given over the call was funny, the mgmt said to ‘look at other MNCs, they have even lesser stake than what Timken India has in the Indian entity, hence nothing major - just move on with life.’

Interestingly, if you compare Q4 concall notes and stake sale call, the mgmt tone for exports changed sharply, earlier they were expecting a revival and then suddenly called out and said that they believed exports for going to be weak.

Figure 1 – Takeaways of Concall on stake sell

Figure 2 - Qtr trends for Timken

2nd Instance

2nd Stake Sale: 29th May, 2024 - 6.65% stake for ~2000 Crs.

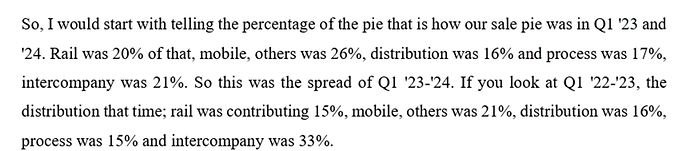

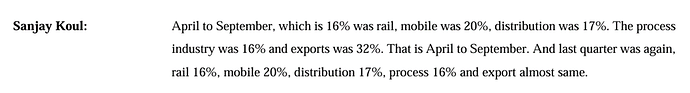

If you will read through concall note, a clear question was asked about is railway a lumpy business for them, because if the past if you will observe, it was always in the range of 100-185, but in Q4 it was 305 Crs.(refer Image 2) But the mgmt said they feel there is no one off and quoting the same that it is about structural trends and what not.

Q4FY24 was something which was an exceptionally good for the company, and they sounded so confident over a call with exports bottoming out (which always has been a key trigger for the company).

Q1 numbers although the mgmt made it sounds like some phenomenal numbers they have published, but I would term it as weak given the kind of commentary they had in Q4 (refer figure 2). You might have a different opinion and I might be reading too much in Q-o-Q numbers, but given the timing of the stake sell, I am putting more emphasis on this.

3rd Instance

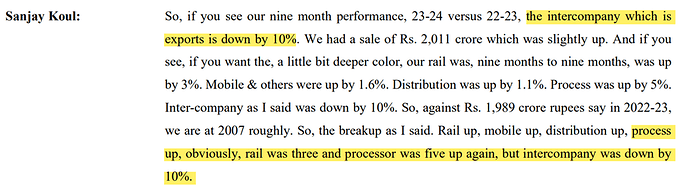

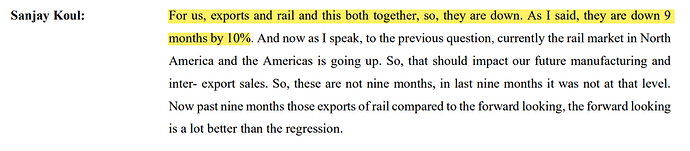

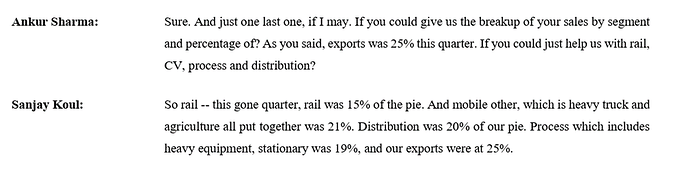

Incorrect numbers over concall:

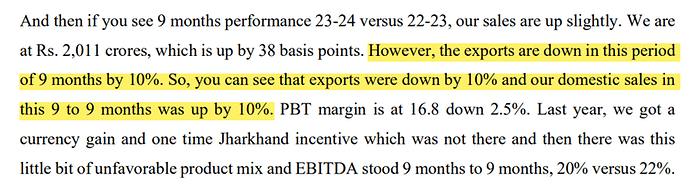

In the Q3FY24 concall, the mgmt said over 4 times that their exports over the 9MFY24 period were down 10% compared to 9MFY23 (refer figure 3,4,5), but according to the previous numbers given in the past concalls, if you combine them, the exports were 30% down!

I had a word about this from Kotak Institutional Analyst (since they have been tracking the company since a very long), and Spark Analyst (since they host concall for the company), and guess what? They also agreed that the numbers mentioned over concall were wrong and they are also seeking further information from the company. I dropped a mail to the company, even parent entity, for obvious reasons it went unanswered.

I am putting snippets from past concall (Refer fig 3,4,5,6,7,8,9 & 10) where you can see and match the numbers from qtr number sheet (refer figure 2)

However, in Q4FY24 when giving full year numbers, it matched with the breakup of Q3FY24 they gave for exports with the overall year.

I don’t wanna explain this or put more emphasis over this point anymore, you can make whatever you want from this. All I am saying is, it is not possible that the company didn’t see the email or the analyst who literally hosts the company’s concall wouldn’t have pointed it out to the mgmt.

Figure 3 - Q3FY24 snippet 1

**

Figure 4 - Q3FY24 snippet 2

**

Figure 5 - Q3FY24 snippet 3

**

Figure 6 - Q2FY24 Snippet

**

Figure 7 - Q1FY24 Snippet (which also has reference of Q1FY23 numbers)

**

Figure 8 - FY23 numbers

Figure 9 - H1FY23 and Q2FY23

Figure 10 - Q4FY23 numbers

To sum it all up throught price chart, you can just refer to below image:

Happy to be corrected if there is any flaw in the argument. Timken leads at the global level and I certainly believe it will continue to do so. But it is high time to question the companies around these stuff. I think other MNCs atleast have been transparent that they are getting good valuation and hence selling off stake.

What is your views. In general Railways projects are picking up. las session the price also went up by >8%