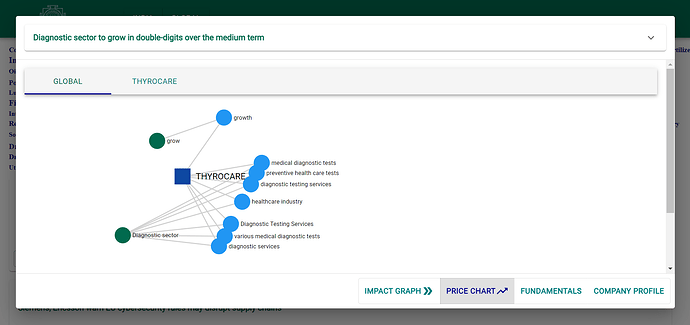

Thyrocare – A business analysis, 26th Dec 2023

Background

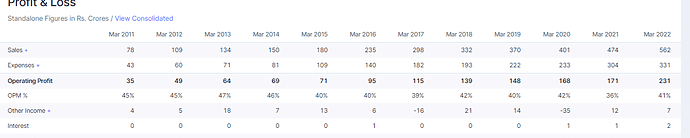

Thyrocare is largely in the business of blood tests. It is heavily tilted towards testing for disorders (blood constituents, hormones, electrolytes) rather than disease. Its business model is more B2B focused than B2C. Here B2B refers to hospitals, clinics, local collection centers that send their business to Thyrocare (often via franchisees). Typically, these other businesses collect the blood samples and Thyrocare processes it. See Figure 1 for revenue mix.

Figure 1: Most of Thyrocare’s revenue is from B2B, only 6% from B2C. Quarterly report, Oct 2023.

With PharmEasy acquiring a 70% stake in Thyrocare in 2021, the opportunity for exploiting synergies and getting more B2C business via PharmEasy portals does arise and this can be without much spending on customer acquisition and advertisement.

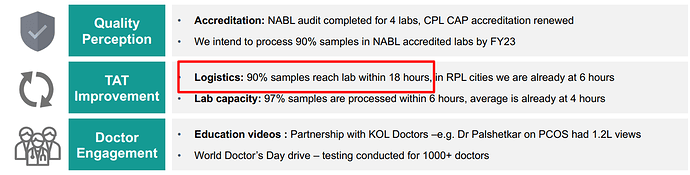

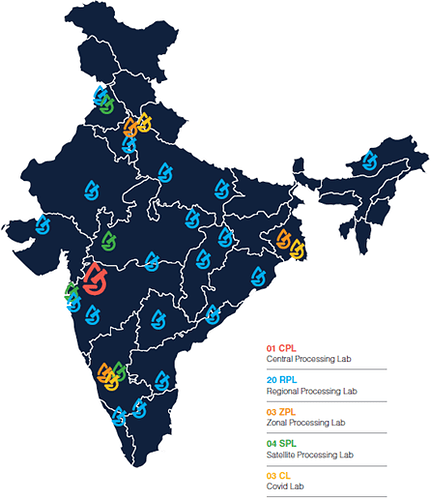

The business model is of the hub and spoke kind as shown in Figure 2. Samples are collected in 570 of the 779 districts in India. Samples requiring more complex tests are sent to the central and zonal labs, the others to proximal regional labs. This way equipment costs are centralized and utilization rates are high.

Figure 2: The hub and spoke model of Thyrocare.

If opportunities for growth are available, it can be done in a capital-light manner. All equipment is leased from the vendors and the lease costs go into opex. All reagents are purchased from the vendors but that does not require capex. Lab space can also be leased. So effectively this is a capital light business.

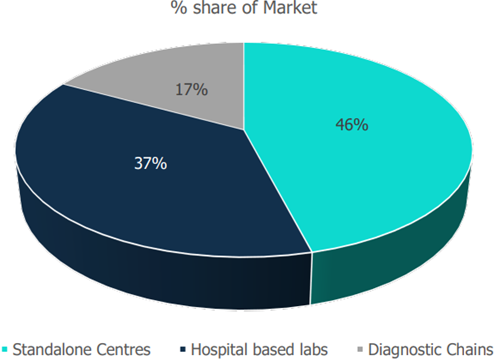

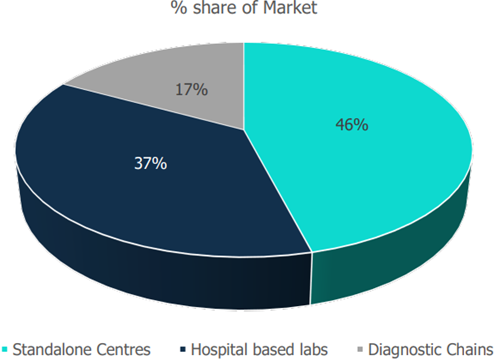

A good overview of the sector is given by HDFC securities in 2021 and Care Ratings in 2023. As shown in Figure 2, the market share of the organized diagnostics labs is only 17% of which the large pan-Indian entities only have a 6% market share. Like the other large organized players, Thyrocare has NABL certified labs (only 2% of the nation’s labs have this certification). Do note that there might be other certifications that still lend credibility and perhaps some of the other labs have such alternative ones. Long story short, amongst the organized players, accreditation is not a competitive advantage.

Figure 3: Market share of diagnostics providers

Thyrocare is also involved in providing PET-CT imaging labs but that’s only a small part of the business (7% revenue, 2023).

Business drivers

The most obvious business driver is that the entire sector will grow as GDP/capita increases. Add to it the fact that India will be the global epicenter of lifestyle diseases owing to poor diets and lack of exercise, sector growth is inevitable.

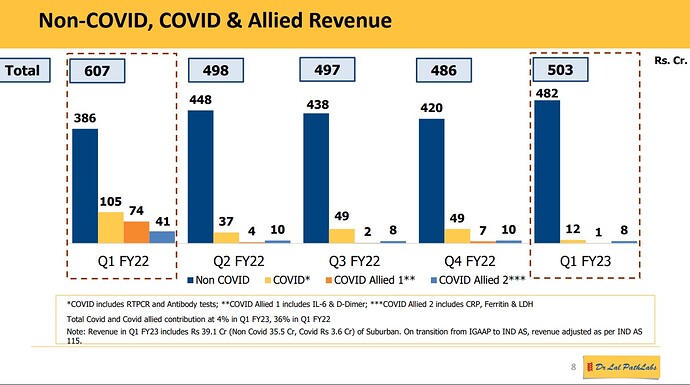

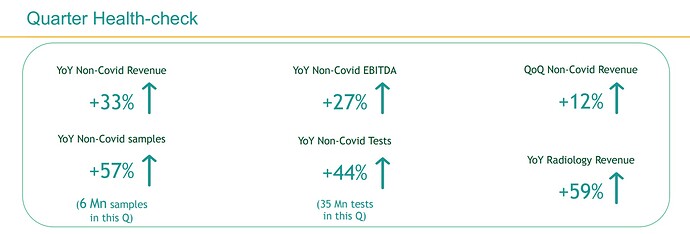

This entire business might go the way of retail, with margins and ROCE contracting due to competitive intensity owing to lack of entry barriers. This is excellent for the populace as costs go down, but identifying winners in the sector becomes very difficult. After all they are all using the same machines, doing the same tests and by and large offering similar services. Certainly, there are niches, such as Thyrocare being more into testing for disorders while Dr Lal’s Pathlabs offering more complex tests including disease testing.

Winners will be decided by good managerial practices. That’s what separates the Walmarts and Costcos from the rest. While the business is a value-add to society, nothing prevents commoditization of the diagnostics market. The unorganized sector will likely shrink, but amongst the big organized players, whether there will be a few dominant ones 10 years from now is hard to estimate.

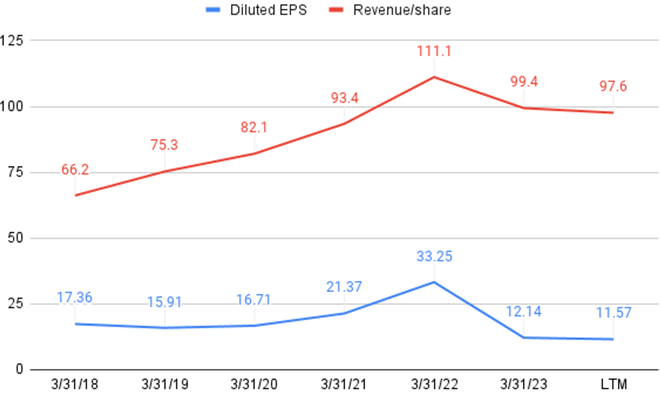

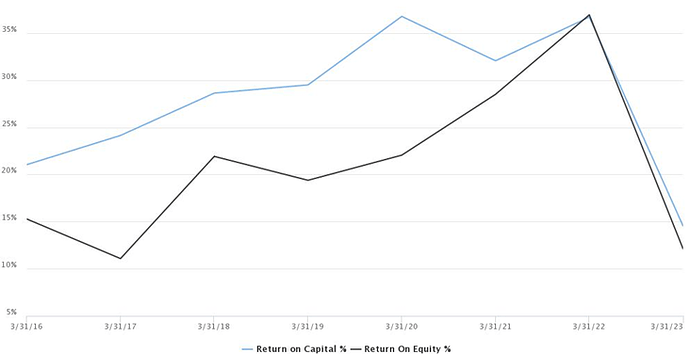

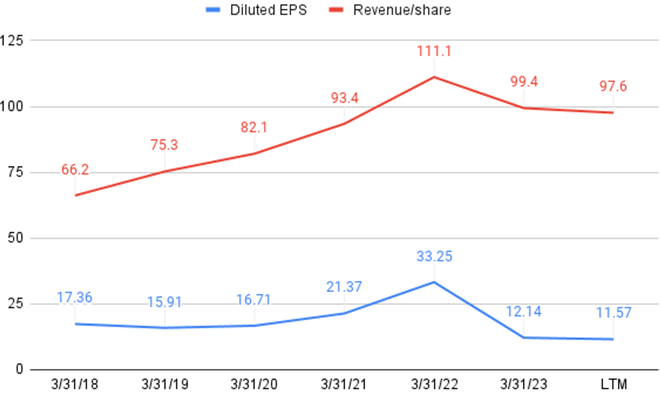

To me Figure 4 tells Thyrocare’s recent story. While revenue per share has shown decent growth (ignore the Covid pop), earnings have not grown proportionally. In fact, in the last 18 months, they are going down quite dramatically. This is a clear picture of a company without pricing power and without being able to leverage economies of scale.

Figure 4: Revenue and earnings per share over the past 5 years.

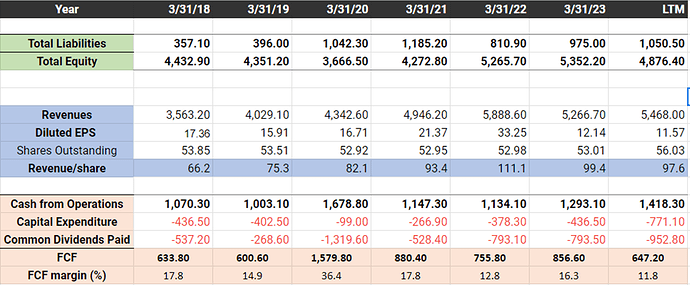

Analysis of Financial Statements

Two things stand out from Table 1 – all growth rates are anemic and practically all the FCF is being returned to shareholders as dividend. The average capex over the last 5 years is INR 400 million, of which 70% is maintenance (depreciation and amortization) while only 30% is being put into growth despite capital metrics being decent (Figure 5). And that’s the crux of the problem, they are unable to grow without destroying margins. For a cash rich company like Thyrocare, I find it surprising that they lease machines (don’t know the exact percentage) – unless you are growing rapidly, buying would be cheaper in the long run.

The recent increase in share count (approx. 6%) is something to keep an eye on. I don’t particularly care why they are doing it but shareholders should know that their stake is reduced by 6%.

Table 1: Key metrics from financial statements in millions INR over the past five years.

Figure 5: ROCE and ROE trend.

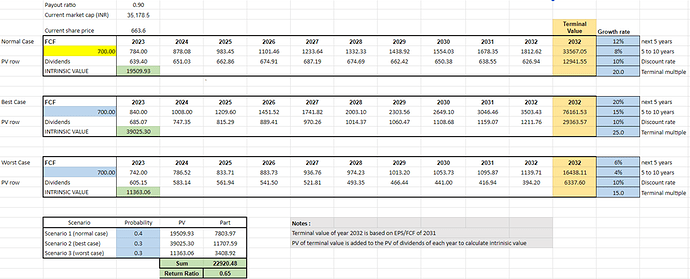

For valuation, I just use Thyrocare as a FCF engine. INR 700 million seems like a reasonable FCF number. 10 years out, the PE should contract. Given these assumptions the most likely case is that Thyrocare is priced at 6.5% return. Only with the most optimistic assumptions is it firmly valued for a 10% return.

Table 2: A DCF valuation for normal, best case and worst-case scenarios using FCF as input.

Investment thesis

This is a decent company in a growing market. Competitive forces will likely make ROCE and margins go down, but nothing stops Thyrocare from being a reliable FCF engine. To me this would be more of a dividend buy with a modest 10% FCF growth. That being said, its priced to be a high growth company while the data does not support it. Astute management practices might prove me wrong and the business might meaningfully improve, the data over the last years only shows deteriorating business metrics. Not surprisingly, while the business makes 2.5 higher revenue today (in 2023), than in 2015-16, the stock price has not budged! A 50% decrease from here wont surprise me too much. Wake me up if the price goes down by half and the dividend approaches 5%.

Company news

A few minor developments on business expansion:

Thyrocare has also entered into government partnerships for the like of TB and infections, but this would only be a percentage or two of revenue (Concall Transcript, Oct 2023).

Also, Thyrocare has entered a JV in Tanzania and expressed interest to expand into East Africa and the Middle East.

Catalyst

The PharmEasy acquisition could have been a catalyst but that does not seem to have emerged. On the contrary, PharmEasy is so heavily in debt, they may just think of Thyrocare as a cash cow to service their debt. And if they struggle to service their debt, who knows what happens to the stock price if they unload their shares or sell it someone else. Either way, unless the business gets materially better, I don’t see a sustainable catalyst. Price action is of course unpredictable.

Disclosure: I had bought it relatively cheap as a hedge against further covid outbreaks (Thyrocare goes up, rest of the portfolio goes down). I sold out at a reasonable profit. Probably I had paid too much to buy it in the first place (even as a hedge) but Mr. Market was kind and absolved me of my sins.