Hello readers!

First and foremost, I want to express my sincere appreciation to the esteemed members of the ValuePickr community. I’ve been reading and following company threads on ValuePickr for about a year now and all the invaluable insights have played a pivotal role in shaping my thought process about trading/investing.

In this thread, I want to disclose my holdings and the rationale behind each of them.

Ugro Capital

This is by far my largest and highest conviction bet. The company aims to gather 1% of the addressable credit gap in the MSME sector, which roughly translates to 20,000Cr. The idea is that, as the comapny keeps on increasing its off book AUM % (target is 50% by FY25), the RoEs keep incing up and should reach in the range of 15-18%. I believe the stock can command a multiple of 3-4x book after the asset quality concerns are addressed (with time, ofcourse)

While the execution has been flawless so far on the topline, it does not yet refelect in the bottomline, as well as the share price. The reason for topline growth not refecting the bottmline was the heavy opex into new branch openeings and omboarding employees, which has been eating into the profits. As of now, the company is done with its first phase of expansion and we should be good for atleast a year or two before they begin again.

I believe that there are a few reasons for the underperformance of price, first and foremost being the untested asset quality, which can only be proved over the years to come. Second would be the constant selling pressure from one of their early investors named “DBZ Limited”, they are down from owning 19% of the company, to close to a percent or two now. Third would be the PAT growth, which should be addressed going forward and it is projected that Ugro would do close to 200cr in FY24.

I have not decided on an exit price for Ugro. I am happy to hold it and see how the story unfolds in the years going forward.

Infrastructre Stocks

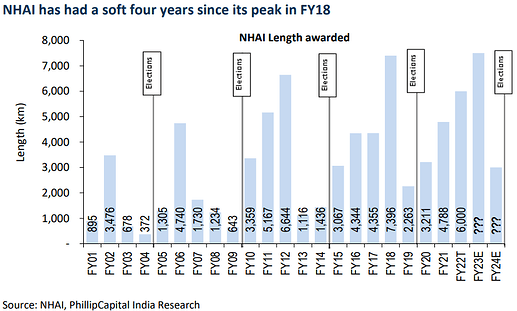

I started looking into infra stocks after I came across an amazing report by Vibhor Singhal of Phillip Capital during march 2022. The thesis was very pretty straight forward and simple, as per NHAI’s order award trends, it is almost certain that FY23 will be the year of peak awards (in the FY19-24 cycle) and FY24, being an election year, will see a sharp drop (unless this historically recurring

trend breaks). Observe the snippet below

The next step was to identify stocks with high orderbook visibility, tight working cycle, and resonable return ratios. HG Infra, PNC Infratech and NCC were picked.

So far, HG and NCC have delivered amazing returns. I have infact sold off my position at NCC as I am not comfortable with the risk reward anymore at this level, plan was to sell it at 8-10x FY24 EPS which yields a price of 110+. I started trailing my position after the stock breached 110 and sold it all off at 118. NCC gave me a 63% return on a position of roughly 8%

I have started trailing my position in HG infra, as my valuation comfort is breached after it crosses 10x FY25 EPS, yielding a price of 940, I still have close to 60% of my original position and will probably sell it all at 1000 and above, a new thing I am trying to do is ride the momentum as far as possible using technicall analysis and fetch maximum value. So far, in the 40% postition that has been sold off, HG Infra has delivered a 51% return, much satisfied.

I am still holding onto PNC infratech, and infact have topped off my existing position, taking it to 10% of my portfolio. The goal is to start selling it once it crosses 12x FY25 EPS, a target price of 380.

Banks

Currently I hold HDFC Bank, ICICI, CUB, DCB and CSB bank. Almost all of these banks were bought for mean reversion in the next 2 years .The thesis for banking stocks is in-fact very surface level due to my very limited knowledge on the sector, so pardon me for this one.

HDFC Bank - I picked it up in July when it was trading at 3x book (or equal to its covid valuations) so the play here is of pure mean reversion. Bank’s 10 year mean p/b is 4.5x and even if it takes 2 years to get there, I am happy with the returns.

ICICI Bank - Picked it up at 700, on borrowed conviction, and sold it at roughly 900 in August 2022. As the metrics of the bank kept improving, I re-purchased this during the recent correction and I hope to sell it above 3x FY25 ABVPS of 368, translating a share price of Rs.1104

CUB Bank and DCB Bank- Yet again, bought for a mean reversion play. I am aware of the scare CUB has created due to the divergence in its NPAs, as I’ve read, something similar happened in 2018 but market eventually got ahead of it and gave it 3x book. I will be happy to sell CUB above 2x book, and DCB bank at 1.5-1.8x book.

CSB Bank - Bought because of its fast growing gold loan portfolio, which makes it an interesting re-rating candidate going forward. When I bought it in November, it was cheaper than most PSU banks. Plan is to sell it post 2x FY24E BV around 180, valuing it at 360/share

Welspun India

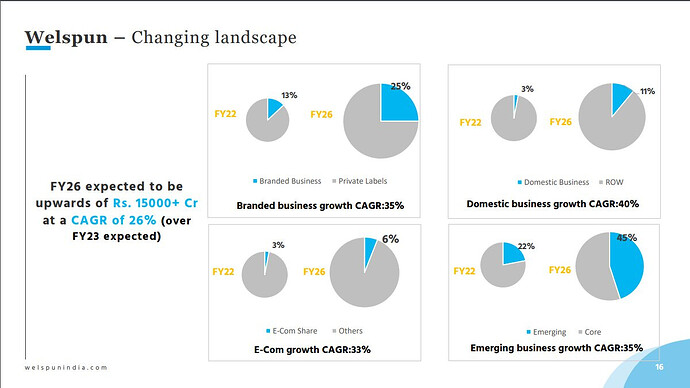

Things got interesting with welspun when everything that could go wrong, went wrong in 2021. Cotton candy and shipping costs through the roof and talks of US recession crashed the price from highs of 170 to sub 60s. I was aware that the company did a buyback in 2021 at 120/share, and that prompted me to look into the story even more. One thing I was sure of was that cotton candy prices and shipping costs were abnormally high, and they cannot sustain these prices for long, eventually margins would revert to its long averages and money would be made. The margins have infact reverted from 6% in Q2FY23 to 13% in Q4FY23, the stock has rebounded sharply after the company announced a buyback worth 2% of their Mcap at 120/share. Also attaching a snippet from one of their investor concalls. My FY26E PAT is roughly 960Cr.

I am currently looking into Sudarshan Chemical and Ultramarine pigments. Starting thesis is that both of them are currently near all time low margins, and as crude cools off, their margins would also start to improve. I will write a detailed thesis if I do end up buying a 5% stake or more in my portfolio.

I also hold Aegis Logistics, Avanti feeds, Piramal enterprise, Himatsingka seide, Shriram Finance, and Mangalam cement in my portfolio, I will try to add on a short thesis to these as time progresses and I gain a better understanding of the underlying businesses.

My current learning sources - ValuePickr, My small investment circle, Kumar Saurabh (scientific investing), SOIC finance and Sahil Kapoor of DSP Mutual fund (especially his Netra series, do check it out incase you haven’t!). Please feel free to suggest additional sources I could use to enhance my knowledge base.

Thankyou for your time! I welcome your thoughts on anything and everything.