Telecommunication Industry in India

Major Players

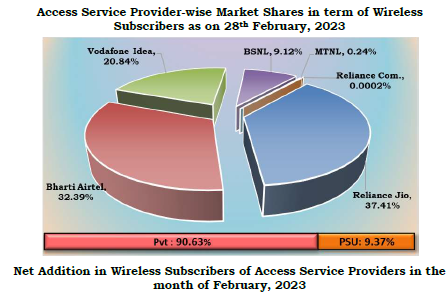

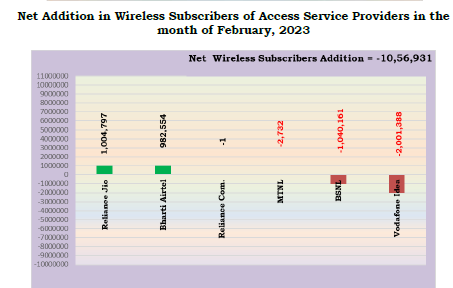

Reliance Jio

Bharti Airtel

Vodafone Idea

BSNL

Revenue share

Jio -31.7%

Airtel-30%

Voda Idea-28%

Remaining-around 10% BSNL

Revenue shares have changed with Dec quarter which will be updated in an upcoming post.

In airtel’s investor presentation Dec 2019 it highlights 30 months of turbulence wherein telecom industry revenue collapsed by 30% from $32 B to $22 B ,capex increased from 22 % -41 % of revenue when usage has increased 10 x. Market has consolidated from 8 players to 4 players where 90 % of subscriber base and revenue with 3 key players. Reliance, Airtel and voda Idea. Reliance is seen growing constantly at the expense of its competitors. Well,the market needs to be analyzed for the next few months to have a clear understanding of whether this shift continues or the current market share will be kept as it is( as the excessive competition has cooled off)

As per TRAI subscription report released on 19/11/2019, the no of subscribers as on 30/09/2019 is 1195.24(wireless -1173.25, wireline-21.49)

Teledensity for Sept 19 is 90.34 % which doesn’t give much room for improvement. Teledensity is seen to be low in states like Bihar (59.72), UP (68.91), MP (70.28) where slight improvement may be seen. Rural teledensity is at 57.28 % where there is some improvement but there are certain urban areas where teledensity is more than 100% with Delhi at 242 %( which may degrow).

But the no of subscribers should grow organically proportional to the growth of Indian population and 20 % of the population is below 15 years giving enough legroom for growth in no of subscribers.

So the increase in revenue/EBITDA of these telecommunication companies should essentially come from growth in arpu. ARPU fell to a low of 68 in June 2018 when Jio started offering voice calls and data free. The ARPU has improved to 100/- in the last quarter as both airtel and Voda Idea introduced minimum recharges instead of lifetime free incoming calls and a lot of inactive customers were also removed from the network.

After intense price battle between the various telecom companies, it is the first time that they have raised the Tariffs in December, Jio has already become a market leader with 30% of total subscribers and the company which earns the most revenue. So now they may very well relent and may start enjoying the fruits of their investment.

Scope and future growth avenues.

Growth in ARPU:

I started looking into telecommunication during a brief stay @ Dubai. Being a developed country I expected mobile internet speed to be pretty high, but the fact was rather surprising and the amount they charged was hefty.So I just went through the telecommunication structue there,Found out that there were two players etisalat and Du (ownership more or less same).Just went through investor presentation Q4 FY 18 and found out that the ARPU is at 98 Dhs(Rs.1600).Obviously not comparable as living status of UAE is totally different and other calling apps being banned in UAE. In voda Idea’s investor presentation there is an arpu comparison of various countries as on Sept 2018 in USD.

USA- 33.6 (Rs.2184)

China -7.8(Rs.507)

Thailand -7.2(Rs.468)

Brazil – 5.5(Rs.357)

Russia -5.1(Rs.331)

Indonesia-2.5(162.5)

Arpu as of Q3 FY19

Jio as-120

Airtei: 128

Voda Idea -107

The above mentioned ARPUs are as of Q3 19 just before the recent tariff increases from December. The direct effect of the increased tariff plans can be seen from the next quarter onwards. On an international comparison ARPU and tariffs have been relatively lower .Tariff was raised for the first time since Sept 2016 after the commercial launch of Jio which paved consolidation of telecom sector into 4 players from close to 8 players. Now that the number of operators have been reduced to 4 and 3 in financial duress the tariff hike seems imminent. Only factor that may play spoil sport is if Jio keeps on with its low prices to raise so that they raise their market share from 30% to 40%,but even in such a situation too the other telecom players especially airtel will also raise leverage and keep at the game.So a further price war may very likely effect everyone negatively. Finances of both voda idea and BSNL are pretty stretched and their ability to raise more funds other than from promoters is pretty doubtful and jio seems to be concentrated on gaining market share in jio Fibre.Also the PSU BSNL may not be able to keep their tariff rates low as one month back there was a very serious doubt that will the company be able to continue as a running concern. Govt recently announced a revival package of 69000 crores for the firm of which around 30000 crores will be used towards VRS package and retirement liability.So it is expected that BSNL will also strongly advocate for a tariff hike.

So it is expected that there will be continuous tariff hikes in the months to come or years.I see this as a multiyear opportunity and already it is an essential commodity as far as a person is considered.

Subscriber growth in Telecommunication

Teledensity for Sept 19 is 90.34 % which doesn’t give much room for improvement. Teledensity is seen to be low in states like Bihar (59.72), UP (68.91), MP (70.28) where slight improvement may be seen. Rural teledensity is at 57.28 % where there is some improvement but there are certain urban areas where teledensity is more than 100% with Delhi at 242 %( which may degrow).

However as per census 2011 the population in the age group 0-9 is around 19.8 % of the population which provides for a pretty good organic growth in the no of subscribers YoY.So there is no imminent threat of subscriber degrowth.

ARPU

ARPU dropped to close to 82 in year 2017 from 115 in 2016 and it has improved to 100 in FY Q2 20.This may be due to a lot of inactive customers deactivated by the incumbents airtel and Vodafone. Also there was introduction of minimum mandatory recharge vouchers by these companies instead of unlimited incoming calls.

ARPU is highest for Jio @ 120 is seen going down continuously from 134.However the trend was seen reversing in Q 3 results with ARPU @ 128 after the recent hike in various recharges from December.

The above status has changed with Q3 20 results with Airtel clocking an ARPU of 135

AGR

AGR really struck a blow to incumbent telecom players who are already finding it hard to stay afloat. As per the SC ruling it stated that all revenue including that of non- telecom services should be accounted for calculation of AGR. As per the terms laid out license fee is 8 % of AGR.As per the ruling the telecoms will face a demand of abount 1.02 L crore towards license fees.

Voda Idea:53000 crores(appx)

Airtel:36000 crores(appx)

Tata Tele:13200 crores

Jio:60 crores.

Jio seems to be the least affected by the AGR issue as they have started operation by 2016. However, there may be some nasty surprises for Jio and Airtel considering their spectrum deals.Jio had a spectrum trading deal with Rcom in 2016.Due to which they may be issued a demand for a part of21000 crores in agr dues that Rcom owes.

As for Airtel they have to pay a part of the dues on the part of aircel and Videocon where Aircel has a demand of 10200 crores and Videocon about 1298 crores. Airtel may have to pay only a small part of the aircel dues.

Any further demand on the part of DOT on these dues may be one of the key risks for both Airtel and Jio.

With SC rejecting the review petition filed by telecoms agr dues have to be paid up by January 23.with Airtel raising enough funds they may be in a good position to clear up the dues,It needs to be seen as to what course of action voda Idea takes. With debt levels already too high it needs to be seen whether any bank will take addl risk of further lending to voda Idea. Also promoter infusing further funds also seems remote with Aditya Birla repeatedly saying that they may have to shut shop if there is no relief from the part of the Govt.

The AGR demand may bring in a drastic change in telecom industry as it may pave way for a duopoly. However this may require addl capex from the part of airtel and Jio to accommodate new customers. And there may be some revenue loss for Airtel as voda Idea is a major customer of Bharati Infratel . But the addition of new customers will more than make up for it.

The chances of voda Idea being able to raise any debt from banks seems remote . The loans made to voda Idea are already stressed and IDFC bank has gone a step further and made a provision of 50 % on the loans. Chairman Mr.Vaidyanathan clearly indicated that they had to make the provisions as the chairman of the company itself was doubting the company’s ability to continue as going concern.

Transition to 5G

The technology transition from 4 G to 5 G will require substantial investment. Already telecom players have started testing 5 G . A reserve price of 5.23 L crore was fixed for 8300 MHz spectrum. The auction is expected to take place in 2020.However with telecom companies under severe debt is not expected to bid aggressively. They may only bid for select circles just to test it so that they may be able to roll it out later on. In addition to spectrum they have to spend on base stations and fibre infrastructure. Jio seems to be most ready for rolling out 5G as they have more 5G ready towers. The telecom players are still to gain any major benefits from the 4 G roll out . They have already requested for postponement of auction as per some reports.

Capex requirement

As per ICRA report moderation in capex intensity is expected until there is a technology upgrade to 5G. Since the industry has achieved a sizeable penetration in 4 G, capex moderation is expected. Capex intensity as measured by capex/sales ratio has been over 50 % compared with around 17-18 % internationally. During FY 19 capex was around 1 L crore which may come down to 65000 crore as per Icra report . Also the capex intensity may come down to 35 % owing to increase in sales and reduction in capex spends. So the next level of major capex will be linked to spectrum auction. As there is not much of immediate business sense for the telecoms in getting 5 G spectrums now and a lttle of their spectrum gets expired by 2021. As far as telecos are concerned , a delay of the next auction till 2021 may augur well for the financial health of the telecom companies. However, it needs to be seen as to what the govt decides. In the upcoming auction R jio may target Rcom’s 800 Mhz spectrum that expires in 2021 and Airtel may bid for 1800 Mhz spectrum that expires in 2021.For voda Idea also 1800 Mhz spectrum in 8 circles are expiring in 2021. It needs to be seen whether voda Idea will bid for even these waves. Spectrum is expected to be sold at base price without much bidding.

Voda Idea as per statement have already a completed a major part of the integration. However, at many places where Vodafone was earlier having good connectivity is facing troubles forcing many customers to port.

It seems like capex requirement will be lowest for Rjio as they are reported to have fairly good connectivity all around.

IUC

IUC charges were slashed from 14 paise to 6 paise from October 2017.It was proposed to be scraped from January 2020.However ,the same was postponed to January 2021 as the incumbents were strongly against scrapping of charges considering the large no of 2g customers they cater to . This would be particularly beneficial for voda Idea and mildly positive for airtel. with the no of subscribers going up for Jio the asymmetry in offnet calls is expected to come down. Also with jio bringing IUC charges of 6 paise/min it is expected that the IUC outgo is expected to go down significantly. However it is to be seen whether there will be any negative effect on subscriber addition due to IUC charges proposed.

As per the Q3 20 results about 20 million call heavy customers have ported out of Jio. Eventhough this has reduced the no of customers , this would considerably reduce the IUC bill paid by Jio to other telecom players and even make them a net earner

A look into individual telecom companies.

Bharati Airtel

This seems to be the best bet in telecommunication sector. They have already raised 3 B $ via QIP and FCCB issuance at a rate of 445 per share. The issue was subscribed 3 times as per reports. It looks like the FIIs are quite interested in the Indian telecommunication story. Bharti Airtel is expected to be a foreign firm with the latest infusion. As per the shareholder analysis Promoters along with institutional investors account for more than 99 % of the holding in the company. Retail shareholding is at 0.66%. So the free float available for trading is very little. FPI holding is high at 22 %. AGR verdict has dealt a financial blow to the company , however the hopes of a duopoly in the sector has sent the share prices higher.

Their African operations has turned around and the company has had double digit revenue growth with margin expansion. The EBITDA margin for the last quarter was @ 44 %. And capex also moderating at their African operations looks good for the company and a having a fairly good dividend policy looks good for the parent company.

As far as I see it Airtel seems to be the one to mostly benefit from the impending turnaround. However , ARPU of Rs.200 immediately and 300 in the long run as required for sustainability as told by Sunil Mittal seems far away. You can see a lot of airtel stores getting opened recently. Also their kiosks are seen in many railway stations.

Another thing that interests me is their Airtel business which caters to corporate customers. One of the main competitors they had was reliance communication. With its operations coming to a standstill airtel may be able to win atleast a good part of their MPLS business.

Reliance Jio

Jio seems to have the best network among the three. With IUC charges coming down owing to them charging 6 paise per offnet call beyond a limit , it seems like Jio may eventually be a net IUC earner. I have recently travelled to Goa and see that they have established a remarkably good network there. Most of the restaurants and Airbnb homes there used JioFi to provide wifi to guests. I feel that their acquisition of Den networks and Hathway cables were quite strategic , which may help them in improving their broadband business further. Also Jio have started providing MPLS connectivity to business customers and they have provided connection in areas where airtel has failed due to feasibility issues. The problem with Jio is you have to own a lot of other reliance businesses if you plan to invest in Reliance industries Ltd like retail, oil exploration and refining etc. Many of this businesses are doing good. The strong parentage is definitely a positive for Jio. However one may not be able to invest in Jio seeing their telecom prospective alone. And in the event of listing of Jio , cant say how much it will be friendly to existing minority investors of reliance. They are largely reported not to be very minority investor friendly. The recent mandatory share swap deal for reliance retail is an example eventhough it was scrapped later on.

Vodafone Idea

As already mentioned the AGR ruling dealt a severe blow to the company. And as promoters have said it is hard to see them emerging out of the crisis. Govt definitely doesn’t want the company to wind up. So we expect some kind of support coming in( Speculative). Even a funding support in AGR may not be enough as they may need good capital for capacity improvement. An AGR demand of 55000 crore is simply too much for the company. With Vodafone cutting india business value to zero its hard to see anymore equity infusion coming up , unless there is some severe relief coming from Govt.

After years of underperformance I feel its the first time they have acted together and raised the prices on December 2019. And all of them are batting together for a floor price. Dont think there will be a floor price but there is room for further hikes maybe a few months down the line. Corona being a major issue maynot affect telecom companies at all. Capex moderation in the immediate future may also aid EBITDA margins.All in all I believe telecom industry may outperform for some time,

I have started writing this report from November onwards. So somethings have changed meanwhile, with another TRAI subscription report coming in for October. Will update once December report is out. There are already existing topics on both Airtel and Idea , but decided to keep it separately as I intend to discuss broadly on many players in the industry not just telecom providers.

I will soon making a subsequent post on 2 important items I have omitted . 1)Debt 2)BSNL/MTNL. I had a small part about debt , but that was insufficient, So will post when I have enough data.

Similarly, BSNL is an important player with more than 10 % share . So it will also be included in the next post.

Invested in Airtel and reliance Industries. Exited out of Voda Idea as I am doubtful of it being able to come out of the AGR crisis and promoters repeatedly raising their doubts regarding ability of company to be a going concern without Gov support. May take a tracking position in Voda Idea. This is a mere study on Telecom industry and not a recommendation to invest in any of the companies mentioned above and Iam not a SEBI registered investment advisor.